Market Overview

The India Air Ambulance Service market is valued at approximately USD ~ million in 2026This growth is primarily driven by the increasing demand for medical transportation services, particularly in remote and underserved regions where ground ambulances face limitations. The rising occurrence of medical emergencies, including accidents and critical health conditions, alongside government efforts to improve healthcare infrastructure, has significantly contributed to the market expansion. Air ambulance services are essential for providing life-saving treatment during transport, particularly for patients in rural or isolated areas where timely access to hospitals is critical.

India’s major cities like Delhi, Mumbai, Bangalore, and Hyderabad dominate the air ambulance market. These cities have advanced healthcare infrastructure and serve as hubs for major hospitals, making them key locations for air ambulance services. The high population density in these cities, along with the demand for timely medical services, has led to a stronger presence of air ambulance operators. Moreover, the proximity of these cities to international borders, and their role as medical tourism destinations, further boosts demand for both domestic and international air ambulance services.

Market Segmentation

By Service Type (In Value%)

The India air ambulance service market is segmented by service type into emergency and non-emergency air ambulance services. Emergency air ambulance services dominate the market due to the critical need for rapid medical transportation in life-threatening situations. The rise in road accidents, heart attacks, and other emergency medical conditions necessitates swift and efficient transportation to the nearest medical facility. These services are especially prevalent in rural areas, where medical infrastructure is limited. The growth of health insurance coverage for emergency evacuation services is also a contributing factor to the dominance of emergency services

By Aircraft Type (In Value%)

The market is also segmented by aircraft type into fixed-wing aircraft and rotor-wing (helicopter) services. Rotor-wing services, particularly helicopters, have gained significant traction in India due to their ability to access remote and congested areas that fixed-wing aircraft cannot. Helicopters are faster and more agile in reaching accident sites or critical care centers, which has made them a preferred choice for emergency medical evacuations. Their ability to operate from smaller landing sites, like helipads or open fields, gives them a distinct advantage in India’s urban and rural landscapes, where infrastructure for fixed-wing aircraft is often lacking.

Competitive Landscape

The India Air Ambulance Service market is dominated by both domestic players and a few global operators. The major local players include Care India Air Ambulance, Jet Airways Air Ambulance, and Apollo Air Ambulance, which have established their presence due to their extensive healthcare networks and specialized services. Global players such as Medanta Air Ambulance and Air India Air Ambulance contribute significantly to the market, leveraging their strong brand reputation and international medical transport networks. This competition is intensifying as both public and private sector collaborations are driving infrastructure improvements, with the Indian government also supporting air ambulance services through regulatory reforms and public-private partnerships.

| Company Name | Year of Establishment | Headquarters | Fleet Size | Key Services | Geographical Coverage | Partnerships |

| Care India Air Ambulance | 2005 | New Delhi, India | ~ | ~ | ~ | ~ |

| Jet Airways Air Ambulance | 1993 | Mumbai, India | ~ | ~ | ~ | ~ |

| Apollo Air Ambulance | 1983 | Chennai, India | ~ | ~ | ~ | ~ |

| Medanta Air Ambulance | 2004 | Gurgaon, India | ~ | ~ | ~ | ~ |

| Air India Air Ambulance | 1953 | New Delhi, India | ~ | ~ | ~ | ~ |

India air ambulance service Market Analysis

Growth Drivers

Urbanization

Indonesia’s rapid urbanization is a key growth driver for the air quality monitoring system market. In 2024, more than ~ of the country’s population resides in urban areas, which contributes to higher levels of air pollution due to traffic congestion, industrial activities, and construction. Jakarta, Surabaya, and Bandung are among the cities with the highest air pollution levels, driving the demand for air quality monitoring systems. As urban populations grow, air quality monitoring becomes increasingly critical for managing pollution and safeguarding public health.

Industrialization

Indonesia’s industrial sector has grown significantly, contributing approximately 20% to the country’s GDP in 2024. This growth is primarily driven by the expansion of the manufacturing, mining, and energy industries, which have significantly impacted air quality. Industrial zones like Batam and Surabaya experience high levels of pollution due to the emissions from factories, power plants, and transportation. The government has implemented stricter regulations to monitor and reduce industrial emissions, further driving the demand for air quality monitoring systems in these areas.

Restraints

High Initial Costs

The high initial costs associated with air quality monitoring systems present a major barrier to widespread adoption in Indonesia. In 2024, the cost of advanced monitoring equipment, including sensors and data management systems, remains a significant investment for both government bodies and private sector entities. Small businesses and local governments in less-developed regions find it particularly difficult to afford these technologies. Additionally, the high cost of maintenance and calibration adds to the financial burden, limiting the market’s potential reach.

Technical Challenges

Technical challenges, such as calibration, data accuracy, and integration with existing environmental management systems, pose a significant obstacle to the growth of the air quality monitoring system market in Indonesia. In 2024, many regions still face issues with inadequate technical expertise to manage these systems effectively. The lack of standardized protocols for data collection also hampers the consistency and reliability of air quality data across the country. These technical challenges need to be addressed to improve the effectiveness of monitoring efforts.

Opportunities

Technological Advancements

Technological advancements offer significant opportunities for growth in Indonesia’s air quality monitoring market. In 2024, there has been a notable increase in the adoption of low-cost, IoT-enabled air quality sensors. These sensors provide real-time data and can be easily deployed in remote areas with limited infrastructure. Moreover, advancements in artificial intelligence and machine learning are enabling more accurate data analysis and predictions. These technologies present opportunities to expand air quality monitoring coverage, making it more affordable and accessible to a broader range of users.

International Collaborations

International collaborations offer a significant opportunity to enhance air quality monitoring systems in Indonesia. The country has been working with global organizations such as the World Health Organization (WHO) and the United Nations Environment Programme (UNEP) to improve air quality management. These collaborations help Indonesia access financial resources, technical expertise, and advanced monitoring technologies. The support from international agencies will accelerate the deployment of state-of-the-art air quality monitoring systems, especially in regions with limited infrastructure.

Future Outlook

The India Air Ambulance Service market is poised for significant growth over the next decade. This growth is expected to be driven by the increasing number of medical emergencies, the growing number of hospitals in rural and semi-urban regions, and advancements in air transport technology. Additionally, government initiatives to improve healthcare access, particularly in remote regions, will fuel demand for air ambulance services. The rising adoption of telemedicine and medical technologies that support remote diagnosis during transport will also be key factors driving the market forward. Moreover, increasing health insurance coverage, particularly for emergency medical evacuations, is expected to enhance market accessibility and affordability for a broader range of consumers.

Major Players

- Care India Air Ambulance

- Jet Airways Air Ambulance

- Apollo Air Ambulance

- Medanta Air Ambulance

- Air India Air Ambulance

- Vistara Air Ambulance

- Deccan Air Ambulance

- Shree Air Ambulance

- King Air Ambulance

- Air Rescue India

- Reliance Air Ambulance

- Gujarat Air Ambulance

- KIMS Air Ambulance

- Paramount Air Ambulance

- Life Air Ambulance

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Air ambulance service operators

- Healthcare providers

- Insurance companies

- Emergency services providers

- ircraft manufacturers and fleet leasing companies

- Regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

In this phase, the focus is on mapping the ecosystem of the India Air Ambulance Service market by identifying key variables such as demand drivers, customer segments, and infrastructure capabilities. This involves extensive desk research, utilizing government reports and secondary databases, and conducting preliminary interviews with industry experts.

Step 2: Market Analysis and Construction

This step involves the analysis of historical data pertaining to the market’s growth, service availability, and technological advancements. Key metrics such as fleet size, number of air ambulances, and regional coverage are examined to understand market trends. Financial performance and government regulations are also assessed to identify potential growth patterns.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be validated through interviews with key stakeholders, including air ambulance operators, healthcare providers, and policymakers. These consultations will provide insights into operational challenges, customer demand, and future expectations, helping to validate assumptions and refine the market model.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing the data gathered from secondary research, primary consultations, and market analysis. This step ensures that all relevant market factors are considered, providing an accurate and comprehensive overview of the India Air Ambulance Service market. The final output will include detailed market forecasts, segmentation, and strategic insights.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing demand for emergency medical transportation

Expansion of medical tourism and cross-border medical services

Government and healthcare sector investments in emergency healthcare services - Market Challenges

High operational and maintenance costs for air ambulance services

Limited availability of trained medical personnel in remote areas

Regulatory constraints on air ambulance operations - Market Opportunities

Technological advancements in aircraft and medical equipment

Rising demand for non-emergency air ambulance services

Collaborations and partnerships between private and public sectors - Trends

Increasing use of drones for medical supply transportation

Integration of telemedicine in air ambulance services

Shift towards environmentally sustainable air ambulance operations - Government regulations

Aviation safety and medical transport standards

Insurance coverage for air ambulance services

Government initiatives to improve emergency medical services - SWOT analysis

Strength: Growing awareness and demand for emergency air services

Weakness: High cost of air ambulance services

Opportunity: Expanding private-sector participation in air ambulance services

Threat: Regulatory challenges and operational costs - Porters 5 forces

Threat of new entrants: Low

Bargaining power of suppliers: Moderate

Bargaining power of buyers: High

Threat of substitute products: Low

Industry rivalry: High

- By Market Value ,2020-2025

- By Installed Units ,2020-2025

- By Average System Price ,2020-2025

- By System Complexity Tier ,2020-2025

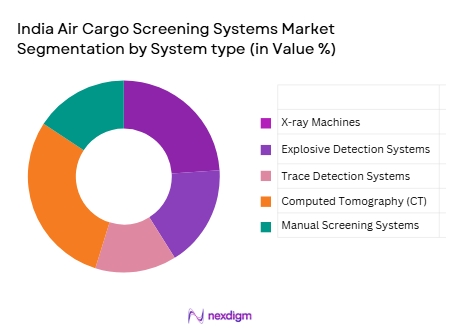

- By System Type (In Value%)

Emergency Air Ambulance Services

Non-Emergency Air Ambulance Services

Fixed-Wing Air Ambulance

Rotor-Wing Air Ambulance

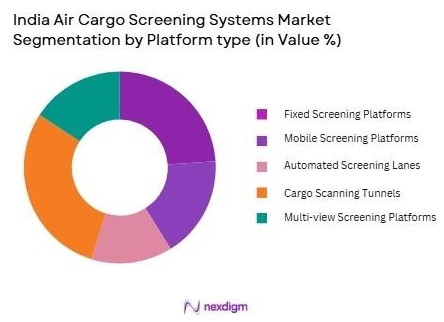

Hybrid Air Ambulance Services - By Platform Type (In Value%)

Single Engine Aircraft

Multi Engine Aircraft

Helicopters

Fixed-Wing Aircraft

Specialized Air Ambulance Platforms - By Fitment Type (In Value%)

Aircraft Mounted Medical Equipment

Mobile Medical Units

Helicopter Medical Equipment

Fixed Wing Medical Equipment

Modular Medical Systems - By EndUser Segment (In Value%)

Private Patients

Government & Public Sector

Insurance Companies

Healthcare Providers

Air Ambulance Service Operators - By Procurement Channel (In Value%)

Direct Procurement from Manufacturers

Procurement via Government Contracts

Private Sector Procurement

Leasing Providers

Insurance-Based Procurement

- Cross Comparison Parameters(Market Share, Service Type, Technology Adoption, Geographic Presence, Customer Base)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

CareIndia Air Ambulance

Sankara Air Ambulance

Medanta Air Ambulance

Air India Air Ambulance

Jet Airways Air Ambulance

Apollo Air Ambulance

Vistara Air Ambulance

Deccan Air Ambulance

Shree Air Ambulance

King Air Ambulance

Air Rescue India

Reliance Air Ambulance

Gujarat Air Ambulance

KIMS Air Ambulance

Paramount Air Ambulance

- Private patients seeking immediate medical care

- Government agencies expanding air ambulance networks

- Insurance companies driving demand for air evacuation services

- Healthcare providers adopting air ambulance solutions for rural areas

- Forecast Market Value, 2026-2035

- Forecast Installed Units ,2026-2035

- Price Forecast by System Tier ,2026-2035

- Future Demand by Platform ,2026-2035