Market Overview

The India Air Cargo Screening Systems Market is valued at approximately USD ~million, driven by increasing demand for air freight and strict regulatory requirements for cargo security. The growth of e-commerce and air cargo volumes has resulted in a greater emphasis on enhanced security measures in airports and cargo terminals. Additionally, the rise in terrorist threats and the need for stringent security protocols have led to the adoption of advanced screening technologies such as X-ray machines and Explosive Detection Systems .

India’s major air cargo hubs such as Delhi, Mumbai, and Bengaluru lead the market due to their strategic locations and infrastructural capabilities. These cities serve as key international gateways, handling large volumes of goods and necessitating robust air cargo security systems. The dominance of these cities can be attributed to their status as economic centers, high volumes of international trade, and the presence of key transportation and logistics networks that drive the demand for air cargo screening systems.

Market Segmentation

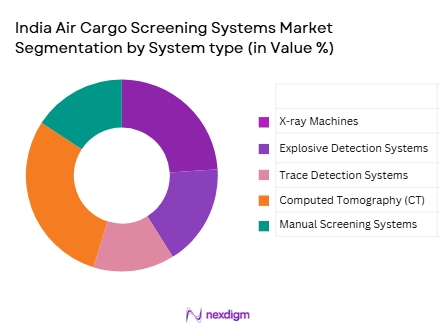

By System Type

India Air Cargo Screening Systems market is segmented by system type into X-ray machines, Explosive Detection Systems (EDS), Trace Detection Systems, Computed Tomography (CT) Scanners, and Manual Screening Systems. Among these, X-ray machines hold the dominant market share due to their widespread use in airports and cargo terminals for routine security checks. X-ray machines offer a cost-effective, efficient, and quick method for screening cargo. Additionally, their ability to detect a wide range of threats, including explosives and illegal substances, makes them an essential part of cargo security. The demand for automated X-ray systems has been rising due to their ability to process large volumes of cargo quickly, reducing delays and increasing efficiency in air cargo operations.

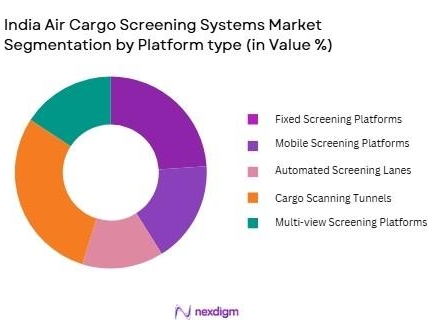

By Platform Type

The market is also segmented by platform type, which includes fixed screening platforms, mobile screening platforms, automated screening lanes, cargo scanning tunnels, and multi-view screening platforms. Fixed screening platforms dominate the market, as they are permanently installed in major cargo terminals and airports. These platforms provide consistent, high-capacity screening and are often used for bulk screening of large volumes of air cargo. Mobile screening platforms, though smaller in market share, are becoming increasingly popular in airports with limited space or those requiring flexibility. The demand for automated screening lanes is also on the rise due to their ability to streamline security processes and reduce human intervention.

Competitive Landscape

The India Air Cargo Screening Systems market is dominated by a few major players, including both international and domestic manufacturers. The presence of global brands such as Smiths Detection and Rapiscan Systems, along with local players like Bharat Electronics, contributes to a consolidated competitive environment. These companies focus on innovation, cost-effectiveness, and regulatory compliance to stay competitive.

| Company Name | Establishment Year | Headquarters | Technology Focus | Major Clients | Regional Market Focus | Revenue Estimate (2024) |

| Smiths Detection | 1980 | UK | ~ | ~ | ~ | ~ |

| Rapiscan Systems | 1993 | USA | ~ | ~ | ~ | ~ |

| Bharat Electronics Limited | 1954 | India | ~ | ~ | ~ | ~ |

| Nuctech Company Limited | 1997 | China | ~ | ~ | ~ | ~ |

| L3 Technologies | 1997 | USA | ~ | ~ | ~ | ~ |

India Air Cargo Screening Systems Market Analysis

Grow Drivers

Urbanization

Urbanization in Indonesia is accelerating rapidly, with more than ~of the population living in urban areas as of 2024, a figure that is expected to rise steadily. This rapid urban growth is contributing to an increase in air pollution levels, making air quality monitoring systems a necessity for managing urban air pollution. Cities like Jakarta, Surabaya, and Bandung are experiencing high levels of traffic congestion, industrial emissions, and other pollutants, thereby driving the need for comprehensive air quality monitoring. According to the World Bank, urbanization is linked to rising pollution levels, making urban centers a prime driver for increased demand for air quality monitoring systems.

Industrialization

Indonesia’s industrial sector is a key contributor to the nation’s economic growth, with the industrial output accounting for over ~of its GDP in 2024. However, rapid industrial growth, particularly in manufacturing, mining, and energy sectors, has led to an increase in airborne pollutants, such as particulate matter ~ and sulfur dioxide (SO2). As industrialization continues to expand, air quality monitoring becomes critical to assess the impact of emissions from factories, power plants, and other industrial operations. With a steady rise in factory outputs and energy demands, monitoring pollution levels in industrial hubs is becoming increasingly essential to mitigate health risks associated with air quality degradation.

Restraints

High Initial Costs

The high initial costs associated with air quality monitoring systems remain one of the primary barriers to widespread adoption in Indonesia. While the technology is improving, the capital investment required for setting up advanced monitoring infrastructure can be prohibitive, especially for smaller cities and rural areas. Many municipalities face budgetary constraints that prevent them from deploying high-end monitoring systems. As of 2024, the average cost of installing air quality monitoring stations in urban regions can range from IDR ~million to IDR ~ billion per unit, depending on the sophistication of the system. These costs limit the ability of local governments and businesses to invest in comprehensive air quality monitoring networks.

Technical Challenges

Indonesia faces several technical challenges related to the deployment and operation of air quality monitoring systems. These include the lack of standardized methodologies for air quality monitoring and the maintenance of a large network of sensors in different regions. For instance, monitoring equipment often suffers from inaccuracies in remote and rural areas where data calibration is difficult. Additionally, data integration from different monitoring stations is often fragmented, creating challenges in providing a unified, national air quality report. With more than ~ air quality monitoring stations across the country as of 2024, Indonesia continues to face issues regarding data consistency and quality.

Opportunities

Technological Advancements

Advancements in sensor technology and data analytics are creating significant opportunities for the growth of the air quality monitoring system market in Indonesia. Low-cost, high-precision sensors and IoT-enabled devices are becoming more accessible, making it possible for both government agencies and private businesses to invest in monitoring systems. The integration of Artificial Intelligence (AI) and machine learning into air quality monitoring systems allows for real-time data processing and predictive analytics, improving decision-making. As these technological innovations continue to evolve, they present a significant opportunity to enhance Indonesia’s air quality monitoring capabilities.

International Collaborations

International collaborations between Indonesia and other countries with advanced air quality monitoring technologies can drive market growth. For example, partnerships with organizations like the World Health Organization (WHO) and the United Nations Environment Programme (UNEP) provide access to cutting-edge monitoring solutions and frameworks for data sharing. Indonesia’s government has expressed interest in collaborating with foreign agencies to strengthen air quality management efforts, particularly in major cities like Jakarta, where pollution is a severe issue. These international partnerships open doors for knowledge exchange, technological transfer, and funding, further fueling market growth.

Future Outlook

Over the next decade, the India Air Cargo Screening Systems market is poised to experience significant growth. This growth is expected to be fueled by ongoing investments in airport infrastructure, the increasing volume of air freight, and the government’s commitment to enhancing cargo security. Additionally, advancements in technology, such as AI-driven screening systems and IoT-enabled monitoring devices, will play a crucial role in driving demand for more efficient and effective cargo screening solutions. The need for compliance with global security standards will also contribute to the market’s expansion.

Major Players

- Smiths Detection

- Rapiscan Systems

- Bharat Electronics Limited

- Nuctech Company Limited

- L3 Technologies

- Thermo Fisher Scientific

- Leidos

- Autoclear

- OSI Systems

- Vanderlande Industries

- Kastle Systems

- G4S

- Dematic

- Adani Group

- Saab AB

Key Target Audience

- Government and regulatory bodies

- Airports and airport operators

- Cargo and logistics companies

- Freight forwarders

- Airlines and cargo carriers

- Investments and venture capitalist firms

- Customs and security agencies

- Large-scale industrial manufacturers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the India Air Cargo Screening Systems Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the India Air Cargo Screening Systems Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIS) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple air cargo screening system manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the India Air Cargo Screening Systems Market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increase in air cargo traffic

Stringent security regulations and policies

Technological advancements in screening systems - Market Challenges

High cost of advanced screening systems

Integration complexities with existing infrastructure

Regulatory compliance hurdles - Market Opportunities

Emerging markets with increasing cargo volume

Growing demand for automated screening solutions

Government investments in airport security infrastructure - Trends

Shift towards AI-driven screening technologies

Adoption of IoT-enabled devices for real-time monitoring

Increasing emphasis on cybersecurity in screening systems

- Government regulations

Aviation security regulations by the Bureau of Civil Aviation Security (BCAS)

International Civil Aviation Organization (ICAO) standards

Compliance with Indian Customs regulations for cargo screening - SWOT analysis

Strength: Strong government focus on air cargo security

Weakness: High installation and maintenance costs

Opportunity: Expanding international trade increasing demand for air cargo

Threat: Regulatory and compliance challenges with international standards - Porters 5 forces

Threat of new entrants: Moderate

Bargaining power of suppliers: Moderate

Bargaining power of buyers: High

Threat of substitute products: Low

Industry rivalry: High

- By Market Value ,2020-2025

- By Installed Units ,2020-2025

- By Average System Price ,2020-2025

- By System Complexity Tier ,2020-2025

- By System Type (In Value%)

X-ray machines

Explosive detection systems

Trace detection systems

Computed tomography scanners

Manual screening systems - By Platform Type (In Value%)

Fixed screening platforms

Mobile screening platforms

Automated screening lanes

Cargo scanning tunnels

Multi-view screening platforms - By Fitment Type (In Value%)

Retrofit solutions

New installations

Modular systems

Turnkey solutions

Hybrid fitment types - By EndUser Segment (In Value%)

Airports

Cargo terminals

Logistics service providers

Freight forwarders

Customs authorities

- Cross Comparison Parameters(Market penetration, Technological innovation, Pricing strategy, Customer service, Product differentiation)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Smiths Detection

Rapiscan Systems

Nuctech Company Limited

L3 Technologie

Autoclear

Kastle Systems

Vanderlande Industries

Saab AB

OSI Systems

Thermo Fisher Scientific

Leidos

Dematic

G4S

Adani Group

Bharat Electronics Limited

- Airports are increasingly investing in automated screening technologies

- Customs authorities are prioritizing advanced threat detection systems

- Freight forwarders are exploring efficient screening for quicker cargo clearance

- Logistics providers are focusing on optimizing security processes without delays

- By Market Value ,2020-2025

- By Installed Units ,2020-2025

- By Average System Price ,2020-2025

- By System Complexity Tier ,2020-2025