Market Overview

The India Air-to-Air Refueling (AAR) System market is a critical segment of the country’s defense infrastructure, with the market valued at approximately USD ~ billion. This market’s growth is primarily driven by the increasing demand for advanced defense technologies, strategic air power projections, and defense modernization initiatives. India’s expanding defense budget, which reached USD ~ billion in 2025, coupled with the necessity to extend operational reach in regional military engagements, provides a solid foundation for the growth of AAR systems. In addition, the transition towards indigenous manufacturing in defense systems under initiatives like “Make in India” has spurred the market’s growth, particularly in the AAR technology sector.

The dominance of India’s Air-to-Air Refueling market is largely concentrated in key military hubs like New Delhi, Bangalore, and Hyderabad. New Delhi serves as the nation’s defense and strategic operations headquarters, influencing decisions on defense procurement and modernization. Bangalore, known as the aerospace capital of India, is home to several defense contractors, including Hindustan Aeronautics Limited (HAL), which plays a significant role in the integration of AAR systems. Hyderabad’s contribution comes from several technological and defense R&D centers, contributing to innovation in AAR platforms. Additionally, key suppliers, contractors, and regulatory bodies like the Ministry of Defence (MoD) and the Indian Air Force (IAF) are pivotal in shaping the market landscape.

Market Segmentation

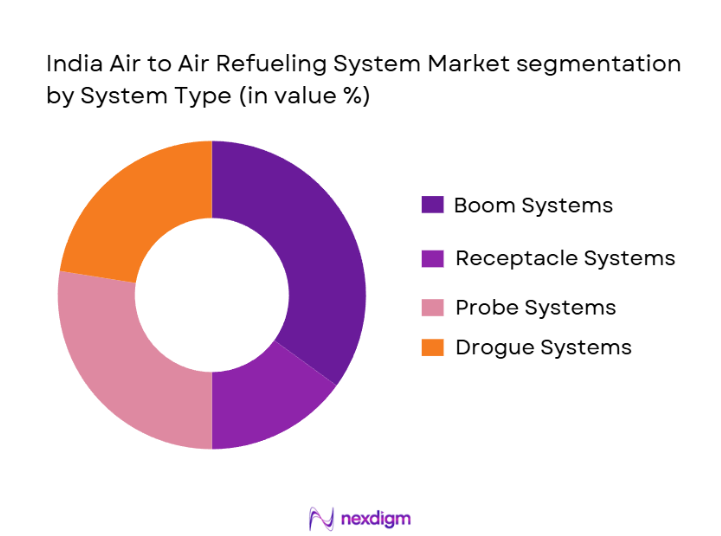

By System Type

India’s Air-to-Air Refueling System market is segmented into two primary system types: Boom & Receptacle and Probe & Drogue systems. The Boom & Receptacle system, which has a higher fuel transfer rate, is largely favored for larger aircraft such as the Boeing KC-135 and Airbus A330 MRTT. It is particularly useful for long-range military operations requiring quick and efficient refueling during combat missions. On the other hand, the Probe & Drogue system is used for smaller aircraft, particularly naval vessels, and provides greater flexibility in refueling under less-controlled environments. The dominance of the Boom & Receptacle system in the Indian military stems from its adaptability to large military aircraft and its alignment with the Indian Air Force’s long-range mission objectives.

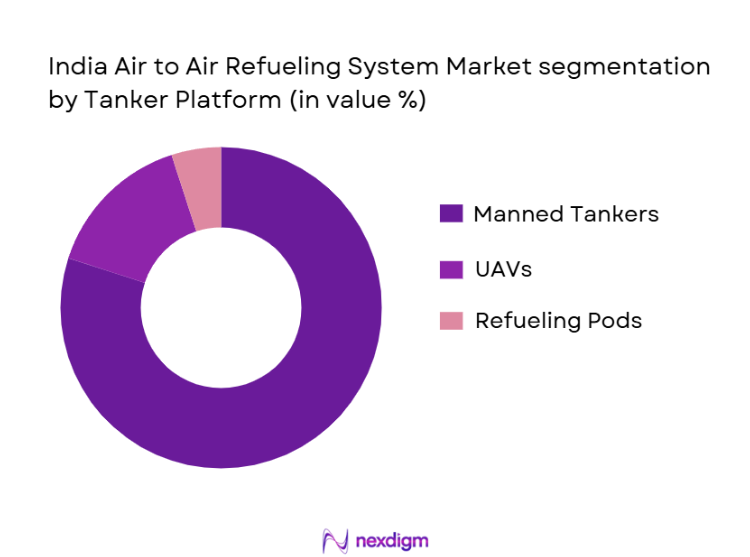

By Tanker Platform

India’s tanker platform segment is split between manned tankers, unmanned aerial refueling vehicles (UAVs), and refueling pods. Manned tankers, such as the Boeing KC-135 and Airbus A330 MRTT, dominate the market due to their robust capacity, versatility, and operational range. These platforms are essential for extending the operational range of fighter jets, bombers, and surveillance aircraft. However, the growing demand for UAVs in modern warfare has given rise to UAV-based refueling systems, which offer lower operational costs and higher operational endurance. The Indian Air Force’s investment in unmanned systems as part of its modernization initiatives contributes to the growing interest in this category.

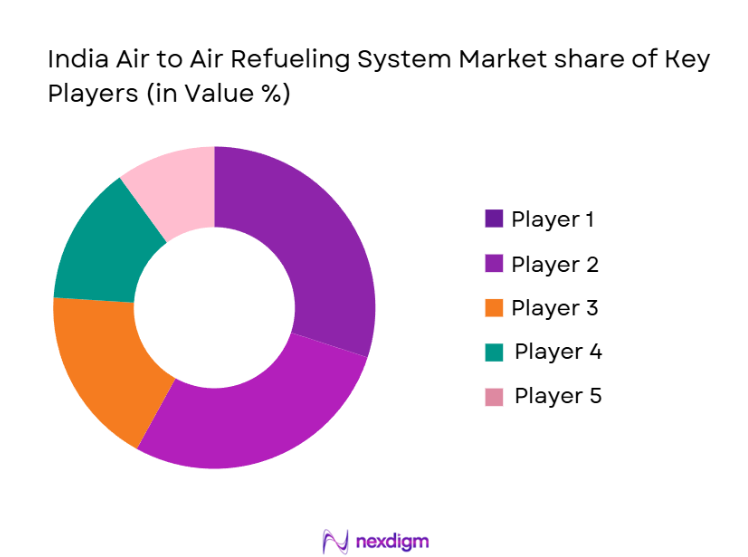

Competitive Landscape

The India Air-to-Air Refueling market is dominated by a few key players, with both global defense giants and local aerospace manufacturers playing pivotal roles. Global players such as Boeing, Airbus, and Lockheed Martin lead the market due to their established expertise in AAR systems and their ability to meet the high standards set by the Indian Ministry of Defence. Local players, including Hindustan Aeronautics Limited (HAL) and Bharat Dynamics Limited (BDL), contribute to the AAR ecosystem by focusing on indigenous development and integration of AAR systems.

| Company | Establishment Year | Headquarters | System Type Expertise | Tanker Platform | R&D Focus | Product Portfolio | Key Partnerships |

| Boeing Defense | 1916 | Chicago, USA | ~ | ~ | ~ | ~ | ~ |

| Airbus Defence & Space | 1970 | Toulouse, France | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1995 | Bethesda, USA | ~ | ~ | ~ | ~ | ~ |

| Hindustan Aeronautics | 1940 | Bangalore, India | ~ | ~ | ~ | ~ | ~ |

| Bharat Dynamics Limited | 1970 | Hyderabad, India | ~ | ~ | ~ | ~ | ~ |

India Air-to-Air Refueling Systems Market Analysis

Growth Drivers

Increased Defense Budget Allocation

India’s defense budget, which continues to rise annually, plays a pivotal role in boosting the demand for Air-to-Air Refueling (AAR) systems. The Indian government’s focus on modernizing military capabilities, especially in air power, is significantly driving the AAR market. This includes the procurement of new refueling aircraft and upgrading existing platforms to enhance operational readiness.

Strategic Operational Requirements

As India’s geopolitical positioning demands greater military reach, AAR systems are becoming essential for extending the operational range of fighter jets, bombers, and surveillance aircraft. This is particularly important for India’s engagements in the Indo-Pacific region, where air superiority and long-range operations are vital.

Market Challenges

High Procurement and Maintenance Costs

The high upfront procurement costs and expensive maintenance requirements for AAR systems pose significant challenges. In addition, AAR system components, including tankers and refueling equipment, require specialized parts and support, driving up lifecycle costs.

Interoperability with Global Defense Systems

As India operates a mix of indigenous and foreign military platforms, ensuring interoperability between AAR systems and a wide range of aircraft presents technical and logistical challenges. Achieving seamless integration across diverse platforms is critical for maximizing AAR system performance.

Opportunities

Indigenous Development and “Make in India” Initiatives

The push for indigenous manufacturing and self-reliance under the “Make in India” campaign presents significant opportunities for local manufacturers like Hindustan Aeronautics and Bharat Dynamics. This allows India to not only reduce reliance on foreign suppliers but also to build a strong domestic AAR system ecosystem.

Unmanned Aerial Refueling (UAR) Systems

With the rise of drone technologies, there is increasing interest in the development of unmanned aerial refueling systems. These systems promise reduced operational costs, increased endurance, and safer refueling operations, presenting a growing market for both military and civilian applications.

Future Outlook

Over the next five years, the India Air-to-Air Refueling market is poised for significant growth, propelled by continuous modernization of India’s air force, the increasing adoption of indigenous defense systems, and the growing role of unmanned refueling technologies. The government’s defense budget, which has seen consistent annual increases, will continue to support the procurement of advanced AAR systems. Additionally, the Indian Air Force’s focus on increasing its operational readiness and combat efficiency will drive investments in next-generation refueling platforms, both manned and unmanned. Advances in autonomous refueling systems will further shape the market dynamics.

Major Players

- Boeing Defense

- Airbus Defence & Space

- Lockheed Martin

- Hindustan Aeronautics Limited

- Bharat Dynamics Limited

- Safran

- GE Aviation

- Eaton Aerospace

- Raytheon Technologies

- Northrop Grumman

- L3 Technologies

- Thales Group

- Israel Aerospace Industries

- Saab AB

- United Technologies Corporation

Key Target Audience

- Indian Air Force (IAF)

- Indian Ministry of Defence (MoD)

- Indian Navy

- Defence Equipment Manufacturers

- Defense OEMs

- Government Defense Procurement Agencies

- Investments and Venture Capitalist Firms

- Private Aerospace Contractors

Research Methodology

Step 1: Identification of Key Variables

The research begins by identifying critical factors that influence the Air-to-Air Refueling market in India. This step includes understanding the geopolitical climate, defense budget allocation trends, and technological advancements. The identification of stakeholders such as defense suppliers, manufacturers, and regulatory bodies is crucial.

Step 2: Market Analysis and Construction

This phase involves gathering and analyzing historical data from reliable sources, including the Indian Ministry of Defence and defense contractors. The analysis includes understanding procurement patterns, air force expansion programs, and the shift towards indigenous manufacturing under the “Make in India” initiative.

Step 3: Hypothesis Validation and Expert Consultation

We validate initial hypotheses by conducting expert consultations through interviews with industry leaders, government defense agencies, and military experts. These consultations provide insights into current and future market trends.

Step 4: Research Synthesis and Final Output

The final phase consolidates the gathered data and insights to create a comprehensive market report. This includes a detailed forecast of the AAR market in India, an evaluation of the competitive landscape, and the identification of growth opportunities.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions; Defence Procurement Cycle Mapping; Data Sources & Validation; SupplyChain Primary Interviews; Market Modelling & Forecasting Logic; Limitations; Validation with Defence OEM and User Data)

- Definition and Scope

- Market Genesis & Policy Evolution

- Historical / Technological Timeline

- Air-to-Air Refueling Value Chain Analysis

- Regulatory & Standards Framework

- Growth Drivers

Extended Strategic Reach & Power Projection Imperatives

India Defence Budget Allocation Trends

MultiDomain Operations & IndoPacific Strategic Partnerships - Market Challenges

High Procure & Lifecycle Support Cost

Interoperability & Certification Complexity

Legacy Fleet AAR Retrofit Barriers - Opportunities

Indigenous Systems & MakeinIndia Defense Initiatives

UAV & Autonomous Refueling Expansion

Regional AAR Service & Aftermarket Ecosystem - Technology & Innovation Trends

Autonomous Refueling Systems

Digital Twin Reliability Engineering

Hybrid Boom / Probe Systems - Regulatory & Defence Standards

MoD / DRDO Certification Matrices

NATO / Global Interoperability Benchmarks - SWOT Analysis

- Porter’s Five Forces

- By Value 2020-2025

- By Volume 2020-2025

- By Installed Base 2020-2025

- By System Type (In Value%)

Probe & Drogue

Boom & Receptacle

Autonomous / Hybrid Systems - By Tanker Platform (In Value%)

Manned Tanker Aircraft

Unmanned Aerial Refueling Vehicles

Buddy Refueling Pods - By End User (In Value%)

Air Force

Naval Aviation

Defence Export Customers - By Component Type (In Value%)

Boom Assemblies

Probes & Drogues

Hoses, Valves & Pumps

Fuel Tanks & Pods - By Integration Type (In Value%)

OEM New Platform Integrations

Retrofit / Upgrade Kits

Aftermarket Support & Spares

- CrossComparison Parameters (System Integration Capability, Global Contract / Supply Footprint, Platform Compatibility, MoD / International Certifications, R&D Intensity, Production & Maintenance Ecosystem, Aftermarket Support Network, Strategic Alliances & Offset Contributions)

- SWOT Analysis of Major Competitors

- Major Players

Boeing Defense

Airbus Defence & Space

Cobham plc

Eaton Aerospace

Parker Aerospace

GE Aviation

Lockheed Martin

Safran SA

BAE Systems

Israel Aerospace Industries

Hindustan Aeronautics Limited

Adani Defence & Aerospace

Tata Advanced Systems

Samtel Avionics

Local Tier1 Component Manufacturers

- Air Force Operational Demand and Mission Set

- Naval Aviation Requirements (Carrier Ops)

- Budget Allocations & Procurement Cycles

- Strategic Pain Points (Capability Gaps)

- Defence Acquisition Process & Decision Flow

- By Value 2026-2035

- By Fleet Adoption Metrics 2026-2035

- By Technology Share 2026-2035