Market Overview

The India airspace and procedure design market is valued at approximately USD ~ million in 2025, with significant growth expected as air traffic in the country continues to rise. The market is driven by an increasing need for efficient air traffic management and optimization of airspace. With India’s aviation sector growing rapidly, driven by government initiatives like the National Civil Aviation Policy, the demand for modern airspace design and management systems is escalating. Moreover, India’s growing air traffic management capabilities are supported by technological advancements in radar systems, satellite navigation, and real-time monitoring tools.

India’s airspace and procedure design market is predominantly driven by its major aviation hubs, including New Delhi, Mumbai, Bangalore, and Chennai. These cities host the country’s busiest airports and are at the forefront of infrastructure upgrades. The government’s focus on modernizing air traffic control systems in these cities, along with the increasing number of domestic and international flights, drives the adoption of advanced airspace management solutions. India’s large geographical area and complex air traffic patterns also contribute to the dominance of these cities in the airspace management domain.

Market Segmentation

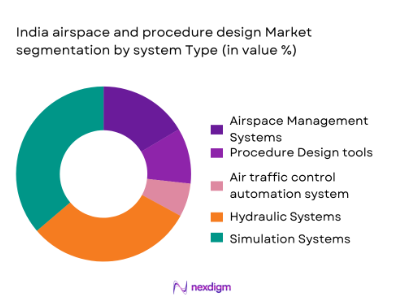

By System Type

The India airspace and procedure design market is segmented into airspace management systems, procedure design tools, air traffic control automation systems, safety and compliance systems, and simulation systems. The airspace management systems segment dominates the market due to the increasing demand for efficient management of the country’s expanding airspace. As air traffic volumes soar, systems that provide real-time data and optimize air traffic flow have become critical. These systems ensure that aircraft movements are coordinated efficiently, reducing delays and enhancing safety, which is particularly important for busy hubs like New Delhi and Mumbai.

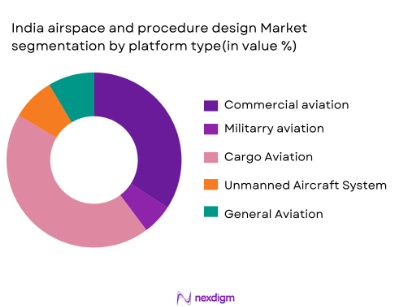

By Platform Type

The market is also segmented by platform type, which includes commercial aviation, military aviation, cargo aviation, unmanned aircraft systems (UAS), and general aviation. Commercial aviation is the dominant segment, driven by the growing number of domestic and international flights in India. With the expansion of the aviation sector, especially under initiatives like the UDAN scheme, the need for improved airspace management in the commercial aviation sector has increased. This growth is fueling the adoption of advanced procedure design tools and airspace management systems, particularly in airports serving major cities like New Delhi and Mumbai.

Competitive Landscape

The India airspace and procedure design market is dominated by a mix of local and international players offering advanced air traffic management systems. Companies like Thales Group, Honeywell Aerospace, Indra Sistemas, and Bharat Electronics Limited (BEL) have established a strong foothold in the market, delivering solutions tailored to India’s air traffic management needs. These companies play a critical role in modernizing India’s airspace management infrastructure, ensuring safe and efficient air traffic flow across the country’s increasingly busy skies.

| Company Name | Establishment Year | Headquarters | Product Offering | Market Reach | Innovation Focus | Major Partnerships | Revenue | Product Quality | R&D Investment | Certifications |

| Thales Group | 1893 | France | – | – | – | – | – | – | – | – |

| Honeywell Aerospace | 1906 | United States | – | – | – | – | – | – | – | – |

| Indra Sistemas | 1986 | Spain | – | – | – | – | – | – | – | – |

| Bharat Electronics Limited (BEL) | 1954 | India | – | – | – | – | – | – | – | – |

| L3Harris Technologies | 2019 | United States | – | – | – | – | – | – | – | – |

India Airspace and Procedure Design Market Dynamics

Growth Drivers

Expanding Air Traffic in India Driving the Need for Efficient Airspace Management and Procedure Design Solutions

India has witnessed significant growth in air traffic, which is expected to continue rising, driven by increased domestic and international travel. In 2023, India’s air traffic rose by 18%, with over 140 million passengers handled at major airports such as New Delhi’s Indira Gandhi International Airport. The surge in air traffic necessitates more efficient airspace management systems to ensure smooth operations and reduce congestion. Additionally, the country’s rapidly expanding airport infrastructure and the increasing fleet size of domestic airlines like IndiGo and Air India further amplify the demand for sophisticated airspace management solutions to optimize flight paths and procedures.

Government Initiatives like the National Civil Aviation Policy Focusing on Modernization of Air Traffic Management

The Indian government’s National Civil Aviation Policy (2016) and the recent National Airspace Management Plan (2022) prioritize the modernization of air traffic management to accommodate increasing air traffic. In the 2023 budget, the Indian government allocated INR 15,000 crore for upgrading and modernizing air traffic management systems. This funding is dedicated to enhancing airspace procedures, improving efficiency, and ensuring safety. These government efforts are designed to streamline air traffic control procedures and implement next-generation airspace management technologies, such as radar systems, satellite navigation, and airspace design tools.

Market Challenges

High Cost of Advanced Systems for Smaller Airports and Regional Airspace Management

Smaller airports in India face challenges related to the high upfront cost of implementing advanced airspace management systems. While large airports in major cities can afford these systems, smaller regional airports struggle with limited budgets. For example, thermal surveillance, radar systems, and automated control systems come with high initial costs, which are prohibitive for airports with lower passenger traffic. The financial burden of upgrading air traffic control infrastructure limits the implementation of state-of-the-art airspace management technologies at regional airports, leading to uneven system adoption across the country.

Complexity of Integrating New Systems with Existing Air Traffic Control Infrastructure

India’s existing air traffic control infrastructure, established decades ago, poses significant challenges when integrating new airspace management technologies. Many systems at older airports are not compatible with modern technologies, such as satellite-based navigation or new radar systems. For example, the integration of Automated Dependent Surveillance–Broadcast (ADS-B) and satellite-based navigation into India’s existing network of air traffic systems is a complex and expensive process. These integration complexities delay the modernization of airspace procedures and impede the effective use of advanced technologies in some regions.

Market Opportunities

Growing Demand for Drone and UAS Management Systems Due to the Rise in Unmanned Air Traffic

India’s expanding use of unmanned aerial systems (UAS) and drones presents a significant opportunity for the airspace and procedure design market. As of 2023, India has issued over 100,000 drone licenses for both commercial and recreational use, and the government is actively working on policies to regulate and integrate UAS into the national airspace. To accommodate this rise in unmanned traffic, there is growing demand for advanced drone management systems and airspace design tools that can safely integrate drones with manned aircraft in shared airspace.

Government Investments in Modernizing the Air Traffic Control Infrastructure, Creating Demand for Advanced Systems

The Indian government continues to invest heavily in modernizing the air traffic control infrastructure. In 2023, the government approved an additional INR 10,000 crore for the implementation of modern surveillance and airspace management systems. This includes the installation of advanced radar systems, the expansion of air traffic control centers, and the adoption of satellite-based navigation systems. These efforts create a substantial market for new airspace management technologies, further driving demand for procedure design systems that can optimize air traffic flow and improve operational efficiency across the country’s airspace.

Future Outlook

The India airspace and procedure design market is poised for significant growth in the coming years, driven by the expansion of air traffic, government initiatives to modernize airport infrastructure, and advancements in air traffic management technology. The increasing demand for more efficient, automated airspace and air traffic control systems will continue to propel the market forward. Additionally, the rise in UAS (unmanned aerial systems) operations and the government’s focus on making air traffic management safer and more efficient are expected to be key drivers for innovation and investment in the airspace sector in India.

Major Players

- Thales Group

- Honeywell Aerospace

- Indra Sistemas

- Bharat Electronics Limited (BEL)

- L3Harris Technologies

- Raytheon Technologies

- Saab Group

- Northrop Grumman

- Collins Aerospace

- Lockheed Martin

- Airservices Australia

- SITA

- NavCanada

- Boeing

- Airbus

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Airports and Air Navigation Service Providers

- Airlines and Aviation Operators

- Aerospace Manufacturers

- Military and Defense Contractors (e.g., Indian Air Force, Defense Research and Development Organisation – DRDO)

- Air Traffic Management Solution Providers

- System Integrators and MRO Providers

Research Methodology

Step 1: Identification of Key Variables

This phase involves identifying the key variables and stakeholders involved in India’s airspace and procedure design market, including government agencies, private sector players, and end users. This step is essential to understand the regulatory landscape, operational demands, and technological advancements shaping the market.

Step 2: Market Analysis and Construction

This phase involves compiling and analyzing historical data, such as air traffic growth, technological adoption, and government policies affecting airspace management in India. The aim is to understand the current market structure and identify key trends driving growth in airspace and procedure design.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be validated through consultations with key industry stakeholders, including air traffic controllers, airlines, airport authorities, and technology providers. These consultations will help refine the assumptions used in the market model and provide insights into the challenges and opportunities within the industry.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing all gathered data into a comprehensive report on India’s airspace and procedure design market. This includes a detailed analysis of market growth drivers, challenges, opportunities, and a competitive landscape, along with forecasts for future growth and technological advancements.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Expanding air traffic in India driving the need for efficient airspace management and procedure design solutions.

Government initiatives like the National Civil Aviation Policy focusing on modernization of air traffic management.

Technological advancements in air traffic control and procedure design systems, enhancing operational efficiency. - Market Challenges

High cost of advanced systems for smaller airports and regional airspace management.

Complexity of integrating new systems with existing air traffic control infrastructure.

Regulatory challenges related to the certification of new airspace management technologies and procedures. - Market Opportunities

Growing demand for drone and UAS management systems due to the rise in unmanned air traffic.

Government investments in modernizing the air traffic control infrastructure, creating demand for advanced systems.

Development of smart airports and advanced airspace systems as part of India’s “Digital India” initiative. - Trends

Increasing use of artificial intelligence and machine learning in airspace management systems.

Automation of air traffic control systems to optimize airspace usage and reduce human error.

Rising focus on sustainability and green aviation solutions within airspace and procedure design processes.

By Market Value 2020-2025

By Installed Units 2020-2025

By Average System Price 2020-2025

By System Complexity Tier 2020-2025

- By System Type (In Value%)

Airspace Management Systems

Procedure Design Tools

Air Traffic Control Automation Systems

Safety and Compliance Systems

Simulation Systems - By Platform Type (In Value%)

Commercial Aviation

Military Aviation

Cargo Aviation

Unmanned Aircraft Systems (UAS)

General Aviation - By Fitment Type (In Value%)

OEM Installations

Retrofit Solutions

Aftermarket Systems

Upgrades and Maintenance

Custom Solutions - By End User Segment (In Value%)

Government and Regulatory Bodies (e.g., DGCA)

Airlines

Airports and Air Traffic Management Agencies

Aerospace Manufacturers

Air Navigation Service Providers (ANSPs) - By Procurement Channel (In Value%)

Direct Procurement from Manufacturers

Government Procurement Tenders

Private Sector Contracts

Integrated Solutions Providers

Online and Distributor Networks

- Market Share Analysis

- Cross Comparison Parameters (Product Innovation, Market Reach, Technological Advancements, Regulatory Compliance, Client Base)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Detailed Company Profiles

Thales Group

Honeywell Aerospace

Raytheon Technologies

Indra Sistemas

L3Harris Technologies

Saab Group

Northrop Grumman

Collins Aerospace

Aireon

Lockheed Martin

Indra

Boeing

Bharat Electronics Ltd. (BEL)

Tata Consultancy Services (TCS)

Hindustan Aeronautics Ltd. (HAL)

- Airlines looking for more efficient airspace utilization to reduce costs and improve operational efficiency.

- Government bodies and regulatory authorities focused on safety and compliance in airspace management.

- Airports seeking to modernize their infrastructure to handle growing air traffic volumes.

- Aerospace manufacturers investing in innovative solutions to optimize air traffic and procedure management.

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035