Market Overview

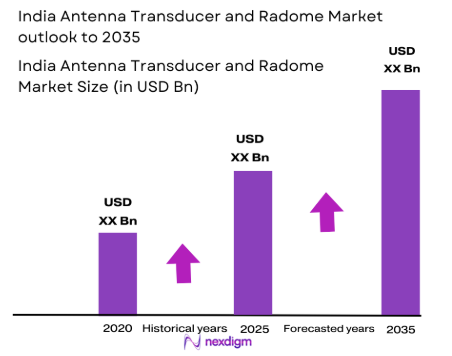

The global antenna transducer and radome market was valued at USD ~ billion based on a recent historical assessment, driven by rising demand for advanced communication systems, radar technologies, and satellite infrastructure. Growth is propelled by expanding 5G networks, defense modernization programs, and increasing investments in aerospace electronics. Manufacturers are enhancing product capabilities to support higher frequency requirements, improved signal integrity, and ruggedized components across commercial and defense applications, reflecting strong expenditure across these sectors.

India’s antenna transducer and radome market benefits from concentrated industrial activity in major urban and technological hubs, supported by government-led defense and telecommunications initiatives. Cities such as New Delhi, Mumbai, and Bengaluru host key manufacturing centers, R&D facilities, and integration operations for communication and radar systems, fostering a conducive environment for market growth. International partnerships and local infrastructure investments further reinforce these regions as focal points for adoption and deployment of high-performance antenna and radome technologies.

Market Segmentation

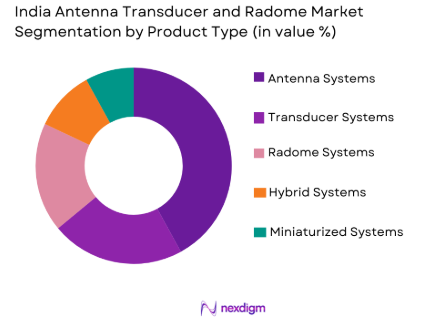

By Product Type

The India antenna transducer and radome market is segmented by product type into antenna systems, transducer systems, radome systems, hybrid systems, and miniaturized systems. Recently, antenna systems have dominated the market due to increasing demand for wireless communication, satellite systems, and defense radar systems. These systems have become indispensable for high-speed internet connectivity and secure communications, particularly in urban and remote regions. Furthermore, technological advancements in antenna design, such as the miniaturization and optimization for higher frequencies, have led to enhanced performance, enabling widespread adoption across industries like defense, telecommunications, and aerospace. The large-scale implementation of 5G technology has also spurred demand for advanced antenna systems, further reinforcing their market leadership.

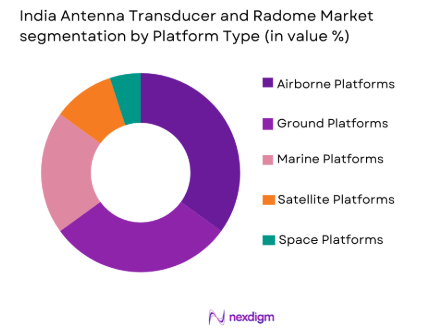

By Platform Type

The market is segmented by platform type into ground platforms, airborne platforms, marine platforms, satellite platforms, and space platforms. Recently, airborne platforms have taken the lead in terms of market share, driven by the increasing adoption of drones, unmanned aerial vehicles (UAVs), and aircraft communications. These platforms require high-performance antenna and transducer systems to ensure optimal communication, radar, and navigation. With the surge in both military and commercial applications of drones and other airborne systems, manufacturers are focusing on providing lightweight and efficient radomes and antenna solutions. Moreover, the continuous expansion of aerospace and defense technologies has created a strong demand for such platform-specific solutions, positioning airborne platforms as the dominant sub-segment.

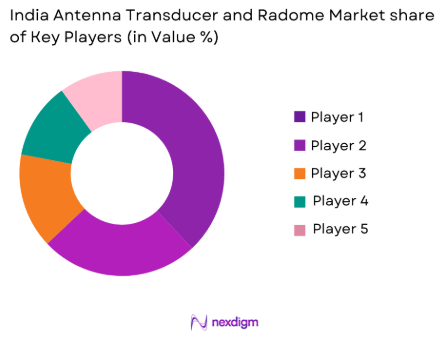

Competitive Landscape

The competitive landscape of the India antenna transducer and radome market is marked by a mix of large multinational corporations and smaller regional players. Consolidation trends are evident as major companies continue to expand their market presence through acquisitions, partnerships, and technological advancements. The dominance of large players is influenced by their technological expertise, extensive R&D resources, and established distribution networks, while smaller companies focus on providing specialized solutions. Leading players are focusing on strategic initiatives, such as collaborating with defense and telecommunications sectors, to leverage emerging opportunities and maintain market leadership.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Market-Specific Parameter |

| L3 Technologies | 2002 | New York, USA | ~ | ~ | ~ | ~ | ~ |

| Honeywell Aerospace | 1999 | Phoenix, USA | ~

|

~

|

~

|

~

|

~

|

| Cobham Limited | 1934 | Dorset, UK | ~

|

~

|

~

|

~

|

~

|

| Viasat Inc. | 1986 | Carlsbad, USA | ~

|

~

|

~

|

~

|

~

|

| Rockwell Collins | 1933 | Cedar Rapids, USA | ~

|

~

|

~

|

~

|

~

|

India Antenna Transducer and Radome Market Analysis

Growth Drivers

Technological Advancements

The continuous evolution of communication technologies has been a major growth driver in the antenna transducer and radome market. Advancements in mobile networks, especially the rollout of 5G technology, have spurred the demand for high-performance antennas and transducers to ensure uninterrupted and efficient data transmission. With the push towards more sophisticated aerospace, defense, and telecommunication applications, the requirement for cutting-edge antenna systems has intensified. For instance, the integration of AI-driven systems and the adoption of millimeter-wave frequencies in antenna design have elevated performance standards, enabling more reliable communication in highly demanding environments. The increasing use of satellite systems in both commercial and defense applications has also necessitated the development of robust, efficient radomes, which protect antennas from harsh environmental conditions while maintaining signal integrity. In addition, miniaturization technologies have led to lighter, more compact systems that are being widely adopted in mobile and portable applications. As these technologies continue to advance, their influence on market growth will be substantial, driving both product innovation and demand in various sectors.

Military and Defense Expenditure

The increasing military and defense expenditure in India has been another significant growth driver for the antenna transducer and radome market. The country’s growing defense budget, along with the expansion of its defense capabilities, has resulted in a surge in demand for advanced communication and radar systems. These systems rely heavily on high-quality antenna and radome technologies to function efficiently in modern warfare. In particular, India’s defense forces are investing in satellite communication systems, radar applications, and unmanned aerial vehicles (UAVs), all of which require sophisticated antennas and transducers. Additionally, the growing geopolitical tensions in the region have prompted the Indian government to prioritize strengthening its defense infrastructure, further boosting demand for these systems. Moreover, India’s space program, with its increasing number of satellite launches, is contributing to a steady demand for reliable radomes to protect antennas in space applications. With India’s defense sector poised for continued growth, this trend is expected to provide a sustained demand for high-performance antenna systems and radomes.

Market Challenges

High Initial Capital Costs

One of the major challenges facing the India antenna transducer and radome market is the high initial capital investment required for manufacturing and deploying advanced systems. The cost of developing cutting-edge antenna and radome technologies, along with the associated infrastructure, remains a significant barrier for many players in the market. These systems require advanced materials, such as high-grade composites and metals, which can increase production costs. Furthermore, the integration of these components into military, aerospace, and telecommunications applications involves complex processes that demand significant financial outlay. The cost factor often deters smaller companies from entering the market or scaling their operations, thereby limiting competition and innovation in certain segments. In addition, government and regulatory approvals for defense contracts and aerospace applications add further layers of complexity and cost, making it difficult for new entrants to navigate the market. The substantial investment required for R&D to develop next-generation systems also presents a challenge, particularly for firms without access to adequate funding or resources. The cost structure poses a constraint on the widespread adoption of these systems across all sectors and regions, especially in emerging markets.

Regulatory Compliance and Certification

The regulatory landscape for antenna transducer and radome systems is highly complex, with various certifications and compliance requirements that manufacturers must adhere to. The stringent regulations imposed by the aerospace and defense sectors, as well as government bodies, are crucial for ensuring the safety and reliability of these systems. However, navigating these regulatory requirements can be a daunting task for manufacturers, particularly for those unfamiliar with the specific standards and processes involved. The complexity of compliance processes, combined with the ever-evolving nature of regulatory frameworks, makes it difficult for companies to stay updated and in full compliance. Moreover, obtaining certification for products such as radomes and transducers often requires extensive testing and approval from multiple authorities, which can be time-consuming and costly. In addition, international markets may have differing regulatory standards, creating challenges for companies seeking to expand their reach beyond India. The rigorous certification processes can delay product launches and increase operational costs, limiting the speed at which companies can introduce new innovations into the market. This regulatory burden is a key challenge for companies striving to remain competitive in the rapidly evolving antenna systems market.

Opportunities

Integration of IoT in Antenna Systems

One of the most significant opportunities in the India antenna transducer and radome market lies in the integration of Internet of Things (IoT) technologies with antenna systems. As IoT adoption increases across industries such as smart cities, manufacturing, and healthcare, the need for efficient, reliable communication systems has grown exponentially. Antennas and transducers designed for IoT applications must be capable of handling large volumes of data while maintaining minimal energy consumption. This presents a promising opportunity for companies in the antenna market to develop specialized products tailored to the specific needs of IoT devices. The demand for low-power, long-range communication systems that are compatible with IoT devices is driving innovation in antenna design. Additionally, IoT-enabled antennas can facilitate the development of smart grids, automated factories, and connected healthcare devices, further expanding the market potential. As India continues to roll out smart city projects and invest in IoT infrastructure, the market for antenna systems that cater to IoT will grow significantly, offering manufacturers a wide range of opportunities for expansion and growth.

Growing Space Industry

The burgeoning space industry in India presents an exciting opportunity for the antenna transducer and radome market. With the Indian Space Research Organisation (ISRO) continuing to push the boundaries of space exploration and satellite communication, there is an increasing demand for high-performance antenna systems that can withstand the harsh conditions of space. Radomes and antenna systems are critical for satellite communication, radar systems, and space exploration missions, where reliability and durability are paramount. As India’s space capabilities continue to expand, both in terms of satellite launches and deep space missions, the need for advanced antenna systems will grow. Moreover, the rise of private space companies in India, along with increasing international collaboration in space research, is expected to drive further demand for antenna and radome technologies. The Indian government’s push for a self-reliant space sector, coupled with the increasing interest in space tourism and satellite broadband services, will contribute to sustained growth in the space-related antenna market. This presents a significant opportunity for manufacturers to develop innovative products that meet the unique challenges of space communication.

Future Outlook

The India antenna transducer and radome market is poised for substantial growth, with significant technological advancements and strong demand from the aerospace, telecommunications, and defense sectors. Over the next five years, the market will witness the continued expansion of 5G infrastructure, which will drive demand for high-performance antenna systems. Moreover, the growing focus on defense and aerospace technologies will contribute to increased demand for radomes and transducers that ensure reliable communication in harsh environments. Additionally, the rise of the IoT and the expanding space industry will offer new opportunities for market participants to innovate and capitalize on emerging trends. With government support for defense and space infrastructure, the market outlook remains positive, with continued growth expected across key application areas.

Major Players

- L3 Technologies

- Honeywell Aerospace

- Cobham Limited

- ViasatInc.

- Rockwell Collins

- Raytheon Technologies

- Thales Group

- General Dynamics

- Airbus Defense and Space

- Northrop Grumman

- Safran Electronics & Defense

- BAE Systems

- Garmin Ltd.

- ViasatInc.

- TTM Technologies

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Aerospace and defense companies

- Telecommunication service providers

- Satellite communication companies

- Automotive companies

- Smart city developers

- Space agencies

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying the key factors that drive the market. This includes understanding consumer behavior, technological advancements, and regulatory factors that influence market demand. Additionally, the competitive landscape and the influence of key players are analyzed to provide insights into market trends. This step is crucial for establishing a foundation for data collection.

Step 2: Market Analysis and Construction

Market data is gathered through secondary research and primary interviews with industry experts. This data is then analyzed to understand market dynamics, growth drivers, challenges, and opportunities. A model is constructed to quantify the market potential and develop accurate forecasts. The analysis incorporates macroeconomic factors such as government spending and technology adoption trends.

Step 3: Hypothesis Validation and Expert Consultation

The hypotheses generated from the initial market analysis are validated by consulting with industry experts. Interviews with key stakeholders, such as manufacturers and industry analysts, help refine market assumptions and ensure the accuracy of the findings. Expert feedback is incorporated into the market model to adjust for any discrepancies or emerging trends.

Step 4: Research Synthesis and Final Output

After validating the hypotheses, the research findings are synthesized into a comprehensive market report. The final output includes a detailed analysis of market size, trends, growth drivers, challenges, and opportunities. This information is presented with clear recommendations for market participants to help them make informed strategic decisions. The report also includes projections for future market growth based on the most reliable data available.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increase in Military & Defense Applications

Advances in Satellite Communications

Rising Demand for High-Speed Data Networks

Adoption of Advanced Aerospace Technologies

Government Investments in Space Infrastructure - Market Challenges

High Initial Capital Investment

Technological Complexity and Innovation Demand

Supply Chain Vulnerabilities

Regulatory and Compliance Challenges

Environmental Impact and Sustainability Concerns - Market Opportunities

Expansion in Emerging Markets

Adoption of 5G and Next-Gen Communication Systems

Integration with Smart City & IoT Solutions - Trends

Miniaturization of Antenna Systems

Integration of AI in Transducer Systems

Increasing Use of Radomes in Civil Aviation

Demand for Lightweight & High-Performance Materials

Shift Towards 3D Printing & Additive Manufacturing - Government Regulations & Defense Policy

Space Policy and Regulation Enhancements

Emission Control Regulations for Aerospace

Defense Procurement Policies and Funding

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Antenna Systems

Transducer Systems

Radome Systems

Hybrid Systems

Miniaturized Systems - By Platform Type (In Value%)

Ground Platforms

Airborne Platforms

Marine Platforms

Satellite Platforms

Space Platforms - By Fitment Type (In Value%)

OEM (Original Equipment Manufacturer)

Aftermarket

Customized Solutions

Integrated Solutions

Upgraded Systems - By End User Segment (In Value%)

Military & Defense

Commercial Communications

Aerospace & Aviation

Marine & Offshore

Space & Satellite - By Procurement Channel (In Value%)

Direct Procurement

Distributors & Resellers

Online Marketplaces

Government Tenders

Third-Party Integrators - By Material / Technology (In Value%)

Polymer-Based Materials

Metal Composite Materials

Carbon Fiber Materials

Advanced Dielectric Materials

Ceramic-Based Materials

- Market share snapshot of major players

- Cross Comparison Parameters (Technology Adoption, Product Innovation, Pricing Strategies, Market Reach, Distribution Channels)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Antenna Technologies

L3 Technologies

Honeywell International

Cobham Limited

Viasat, Inc.

Airbus Defense and Space

Rockwell Collins

General Electric Company

Northrop Grumman

Rohde & Schwarz

TE Connectivity

Molex

Satcom Direct

Radiall

Harris Corporation

- Military Agencies and Contractors

- Satellite Operators and Providers

- Commercial Aviation Companies

- Telecommunication Providers

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035