Market Overview

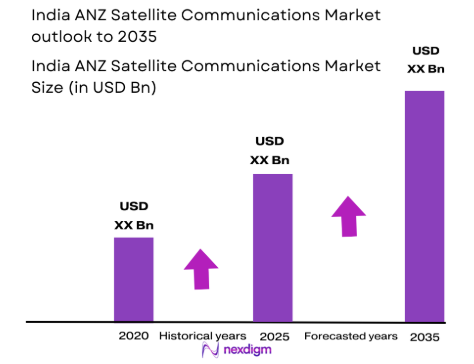

The India ANZ Satellite Communications market has experienced steady growth, reaching a market value of approximately USD ~ billion in 2025. This growth is driven by the increasing demand for connectivity in remote and underserved regions, the expansion of mobile broadband infrastructure, and the rising adoption of satellite-based communication solutions by both government and commercial sectors. The sector is also supported by the growing investments in defense, broadcasting, and telecommunications industries, driving the deployment of satellite communication technologies across various platforms and use cases.

India, along with Australia and New Zealand, leads the satellite communications market in the region due to their robust telecommunications infrastructure and significant investments in space technology. India dominates the market due to its vast geographical coverage, increasing internet penetration, and government-backed initiatives such as the Indian Space Research Organisation (ISRO). Australia and New Zealand benefit from a favorable regulatory environment, which promotes the expansion of satellite communication networks, including the use of satellite constellations to improve connectivity in remote areas. These factors contribute to their leading positions in the market.

Market Segmentation

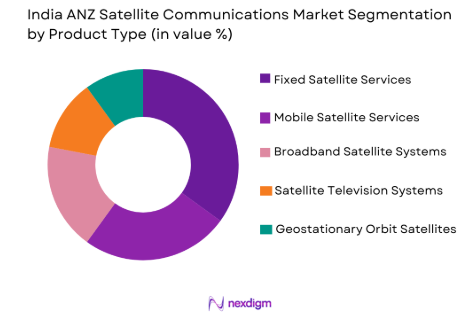

By Product Type

India ANZ Satellite Communications market is segmented by product type into fixed satellite services, mobile satellite services, broadband satellite systems, satellite television systems, and geostationary orbit satellites. Recently, fixed satellite services have dominated the market share due to the increasing demand for reliable communication channels in remote areas. The demand for fixed satellite services is largely driven by both government and commercial sectors that require stable connectivity for mission-critical communications. The widespread adoption of satellite television and broadband systems also supports the market share of fixed services, which are widely used for broadcast and internet services.

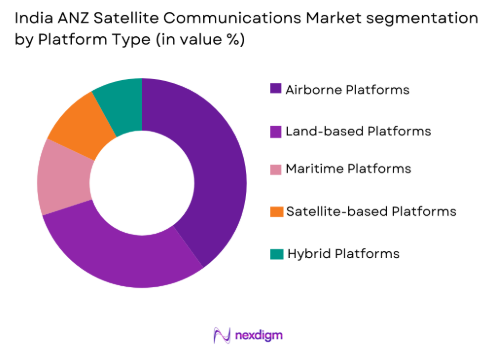

By Platform Type

The India ANZ Satellite Communications market is segmented by platform type into airborne platforms, land-based platforms, maritime platforms, satellite-based platforms, and hybrid platforms. Recently, airborne platforms have seen significant growth in market share due to the increasing demand for high-speed data transmission, especially in the aerospace and defense sectors. Airborne platforms are being utilized for both commercial and military applications, providing enhanced coverage and reliability in remote areas. The advancement of satellite constellations in low earth orbit (LEO) has further enhanced the potential of airborne platforms, thus contributing to their dominance in the market.

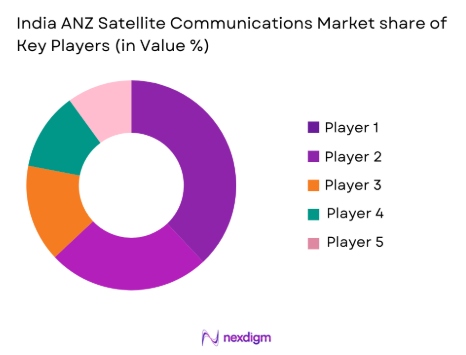

Competitive Landscape

The India ANZ Satellite Communications market is highly competitive, with major players continuously innovating to meet the rising demand for high-quality satellite communication services. The market is characterized by a significant number of consolidation efforts and strategic alliances to expand service coverage, particularly in underserved regions. Key players in the industry focus on technological advancements in satellite constellation deployments, which provide more affordable and reliable connectivity. The influence of these major players is strong, and they continue to shape the competitive dynamics through partnerships and technology licensing agreements.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Market-specific Parameter |

| Inmarsat | 1979 | UK | ~

|

~ | ~ | ~ | ~ |

| SES S.A. | 1985 | Luxembourg | ~

|

~

|

~

|

~

|

~

|

| Intelsat | 1964 | Luxembourg | ~ | ~ | ~ | ~ | ~ |

| Telesat | 1969 | Canada | ~

|

~

|

~

|

~

|

~

|

| Viasat | 1986 | USA | ~

|

~

|

~

|

~

|

~

|

India ANZ Satellite Communications Market Analysis

Growth Drivers

Technological Advancements

The India ANZ Satellite Communications market is witnessing significant growth due to the rapid advancements in satellite technology, particularly with the deployment of low-earth orbit (LEO) satellites. These innovations are transforming the landscape of satellite communications by offering more efficient and lower-latency connectivity. The development of small satellite constellations has enabled better coverage in remote and underserved regions, thus driving the demand for satellite services in both commercial and defense sectors. Additionally, the increasing miniaturization of satellites has reduced costs, making it more accessible for companies and governments to deploy satellites for communication purposes. As more countries and businesses prioritize connectivity, the integration of LEO satellites into existing communication networks is expected to drive further growth in the sector. Technological advancements are enabling providers to deliver higher-quality data transfer and enhance reliability in the services they offer, fostering an expansion of satellite usage in a variety of industries.

Regulatory Support

The growing regulatory support for satellite communication in India, Australia, and New Zealand is another key growth driver. Governments in these regions are implementing policies to encourage satellite communication systems, especially for rural and remote connectivity. In India, the government’s emphasis on bridging the digital divide through initiatives like the Digital India campaign has spurred investments in satellite communications. Similarly, Australia and New Zealand are focusing on space exploration and satellite technology to improve their telecommunications infrastructure. Such government-backed regulatory initiatives are providing an enabling environment for the growth of satellite services, especially in areas where terrestrial connectivity options are limited. The focus on regulatory frameworks also helps in the standardization of services, which boosts consumer confidence and facilitates smoother market penetration for satellite communication providers. As these regulations continue to evolve, the market is expected to see sustained growth, backed by favorable policies and public-private partnerships.

Market Challenges

Infrastructure Limitations

Despite the growth in demand for satellite communication services, infrastructure limitations continue to pose significant challenges to the India ANZ Satellite Communications market. The need for robust ground stations and satellite uplinks to provide high-speed connectivity in remote areas remains a critical barrier. These infrastructure requirements can be costly and time-consuming to establish, particularly in rural and mountainous regions of India, as well as remote parts of Australia and New Zealand. Additionally, there is a lack of specialized knowledge and resources to build and maintain such infrastructure, further hindering expansion efforts. The complexity of integrating satellite communication systems with terrestrial networks adds to the infrastructure challenges, slowing down the deployment of large-scale services. Without addressing these infrastructure issues, satellite communication providers may face difficulties in meeting the growing demand, especially for applications that require high-bandwidth and real-time communication capabilities.

Spectrum Scarcity

Another pressing challenge for the satellite communications industry in India, Australia, and New Zealand is the growing scarcity of radio frequency spectrum. As more satellite services are deployed, there is an increasing demand for spectrum allocation, which is a finite resource. The process of spectrum licensing is highly regulated, and there is often competition for access to these frequencies, especially in densely populated regions. The regulatory bodies in each country have limited capacity to grant additional spectrum licenses, which can delay satellite system rollouts and hinder their scalability. Furthermore, the risk of interference from other communication services sharing the same frequency bands could disrupt satellite communication systems, leading to service outages and reliability concerns. To overcome this challenge, satellite service providers need to work closely with regulatory authorities to ensure that adequate spectrum is made available for their operations, while minimizing the risk of interference with other services.

Opportunities

Satellite Internet for Rural Areas:

One of the most promising opportunities in the India ANZ Satellite Communications market lies in providing satellite-based internet services to rural and underserved areas. In India, millions of people in remote regions still lack reliable internet access, which is crucial for education, healthcare, and economic development. Satellite communications offer a viable solution to this issue by providing high-speed internet where terrestrial infrastructure is absent or not cost-effective. Both the Indian government and private players are investing heavily in satellite communication technologies to bridge this gap and extend broadband access to remote villages. Similarly, Australia and New Zealand are looking at satellite networks to expand connectivity in their rural and isolated communities. The expansion of satellite internet networks in these areas will not only address the digital divide but also create opportunities for businesses to tap into new markets and offer new services.

Satellite-based IoT Solutions

Another significant opportunity in the market is the use of satellite-based IoT (Internet of Things) solutions, which are revolutionizing industries such as agriculture, logistics, and transportation. In regions like India, where infrastructure can be unreliable, satellite IoT provides a reliable communication channel for remote monitoring and management of assets, including livestock, crops, and fleet vehicles. The rise of connected devices across industries is driving the need for satellite IoT solutions, as these services offer global coverage and can be deployed in areas where cellular networks are unavailable. Additionally, the increasing adoption of 5G technology in satellite communications is expected to accelerate the growth of satellite IoT, providing higher speeds and greater bandwidth for real-time data transmission. As industries embrace digitalization, the demand for satellite-based IoT services is expected to rise, creating new opportunities for satellite communication providers to expand their portfolios.

Future Outlook

The India ANZ Satellite Communications market is expected to witness significant growth in the next five years, driven by technological innovations, increasing demand for broadband in remote areas, and supportive government policies. Advancements in satellite constellations, particularly in low earth orbit (LEO), are expected to improve service coverage and reduce latency, while boosting demand across sectors like agriculture, defense, and telecommunications. Increased investments in satellite infrastructure will also fuel expansion, offering greater opportunities for satellite-based services to meet growing connectivity demands in underserved regions.

Major Players

- Inmarsat

- SES S.A.

- Intelsat

- Telesat

- Viasat

- Hughes Network Systems

- Global Eagle

- Iridium Communications

- Speedcast

- O3b Networks

- Eutelsat Communications

- Globalstar

- ViaSat

- OneWeb

- Telenor Satellite

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Satellite communication service providers

- Telecommunications companies

- Aerospace and defense companies

- Broadcasting networks

- Research and development organizations

- IoT solution providers

- Research Methodology

Step 1: Identification of Key Variables

This step involves identifying the key variables that influence the satellite communications market, including technological trends, regulatory frameworks, and market demand. The research team collaborates with industry experts to determine the most relevant variables that impact market growth. Once the key variables are identified, they are used to guide the overall research process, helping to shape the scope and objectives of the study. This step is essential for ensuring that the research remains focused on the factors most critical to understanding market dynamics.

Step 2: Market Analysis and Construction

In this phase, the research team conducts a detailed market analysis by examining current trends, historical data, and future projections. Market segmentation is performed based on product type, platform type, end-user segment, and geographic region. The data collected is used to construct market models that predict future growth. These models are then validated through expert consultations and feedback from industry stakeholders to ensure their accuracy. This process allows the research team to understand the broader market dynamics and provides a foundation for the next steps in the research.

Step 3: Hypothesis Validation and Expert Consultation

At this stage, the research hypotheses are tested against real-world data and validated by consulting with industry experts, market leaders, and key players in the satellite communications space. Expert consultations provide valuable insights into emerging trends, challenges, and opportunities. This phase also involves refining the market models to incorporate new information gathered from consultations. By gathering expert opinions, the research ensures that the findings are credible and aligned with industry expectations, providing a robust basis for the final analysis.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing all the data and insights collected during the research process to produce the final output. The research findings are consolidated into comprehensive reports, highlighting key trends, growth drivers, challenges, and opportunities. This report is structured to provide actionable insights for businesses, investors, and policymakers. After reviewing and finalizing the report, it is presented to stakeholders for review and feedback before being officially published. The final output provides a complete market analysis that helps guide decision-making in the satellite communications industry.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Demand for Broadband Connectivity

Government Initiatives in Satellite Communication

Growth in Defense and Aerospace Applications

Technological Advancements in Satellite Systems

Expansion of Telecom Networks in Rural Areas - Market Challenges

High Initial Infrastructure Costs

Regulatory Hurdles and Licensing Issues

Limited Spectrum Availability

Geopolitical Risks and Space Debris

Technological Constraints in Remote Areas - Market Opportunities

Satellite Internet for Remote Locations

Growth in Telemedicine and Education via Satellite

Advancements in Satellite Constellations - Trends

Shift Towards Low Earth Orbit Satellites

Rising Investment in Satellite Communication Startups

Satellite Network Integration with 5G

Increased Use of Satellite-based IoT Solutions

Growth of Small Satellite Launch Services - Government Regulations & Defense Policy

National Space Policy Guidelines

Satellite Licensing and Spectrum Allocation

Security Measures for Defense Satellites

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Fixed Satellite Services

Mobile Satellite Services

Broadband Satellite Systems

Satellite Television Systems

Geostationary Orbit Satellites - By Platform Type (In Value%)

Airborne Platforms

Land-based Platforms

Maritime Platforms

Satellite-based Platforms

Hybrid Platforms - By Fitment Type (In Value%)

Standalone Systems

Integrated Systems

Modular Systems

Custom-built Systems

Pre-installed Systems - By End User Segment (In Value%)

Government & Defense

Telecom Providers

Broadcasting

Commercial Enterprises

Research Institutions - By Procurement Channel (In Value%)

Direct Sales

Reseller Networks

Government Contracts

Online Platforms

Distributors & Retailers - By Material / Technology (In Value%)

Fiber Optic Technology

Solid-State Electronics

Plasma Technology

Microelectronics

Hybrid Radio Frequency (RF) Technology

- Market share snapshot of major players

- Cross Comparison Parameters (Market Share, Product Innovation, Distribution Channels, Pricing Strategies, Customer Base)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Inmarsat

SES S.A.

Intelsat S.A.

Eutelsat Communications

Telesat

Thaicom

Hughes Network Systems

Viasat

OneWeb

SpaceX

Iridium Communications

Speedcast

O3b Networks

Gilat Satellite Networks

Global Eagle

- Growing Telecom Demand in Rural Regions

- Government Initiatives for Satellite Communications

- Expanding Use of Satellite in Broadcasting

- Increasing Adoption of Satellite Internet by Enterprises

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035