Market Overview

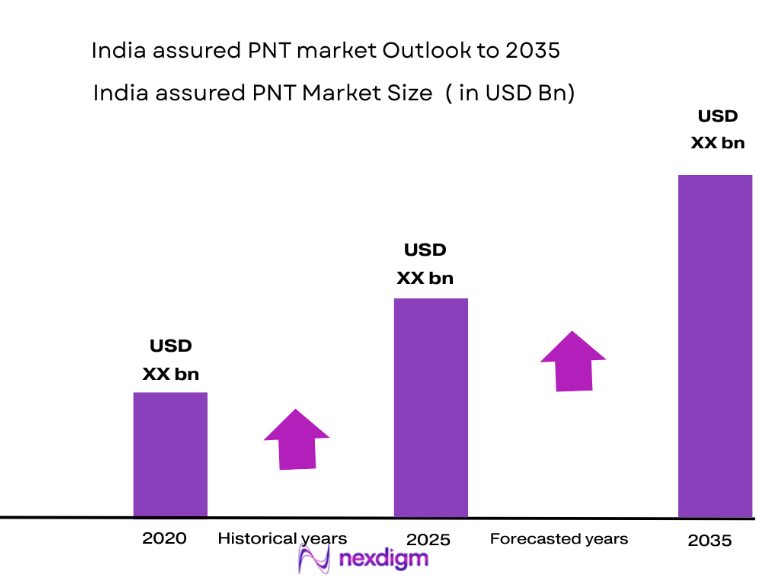

The India Assured PNT Market is experiencing robust growth, driven by the increasing demand for precision navigation and timing solutions across sectors like defense, aerospace, and telecommunications. Based on a recent historical assessment, the market size is valued at USD~ billion, fueled by advancements in satellite-based systems and growing reliance on GPS and other satellite services. The key drivers of this growth include enhanced infrastructure and adoption of location-based services for commercial and military applications.

Dominant cities like Delhi, Mumbai, and Bengaluru are leading the market due to their strategic importance in the defense, aerospace, and technology sectors. The dominance of these cities can be attributed to their well-established infrastructure, presence of leading aerospace and defense companies, and governmental support for technological advancements in navigation systems. This concentration fosters innovation, enhances connectivity, and supports the development of high-precision PNT systems.

Market Segmentation

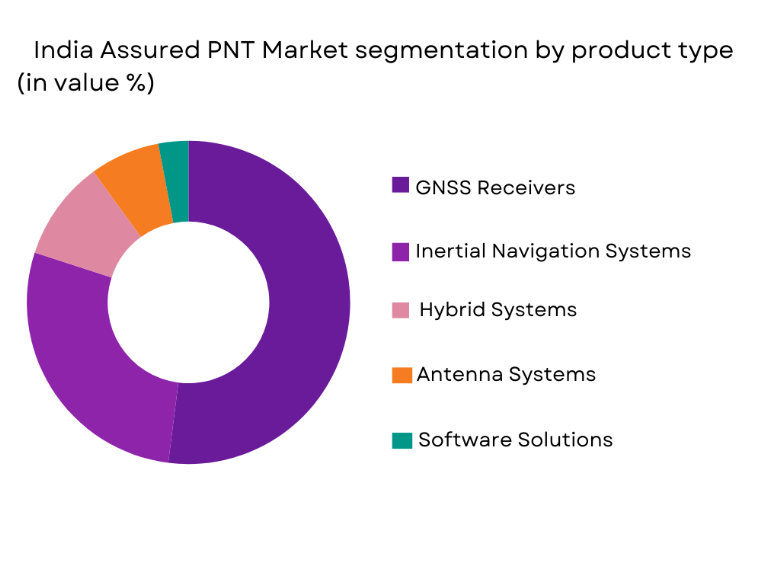

By Product Type

The India Assured PNT market is segmented by product type into GNSS receivers, inertial navigation systems (INS), hybrid systems, antenna systems, and software solutions. GNSS receivers are currently dominating the market due to their wide application in defense, aviation, and transportation sectors. They offer high reliability, are cost-effective, and provide real-time positioning data essential for both military and commercial use. The growth of autonomous vehicles, drones, and smart city infrastructure has further driven the demand for GNSS receivers, making them a key sub-segment.

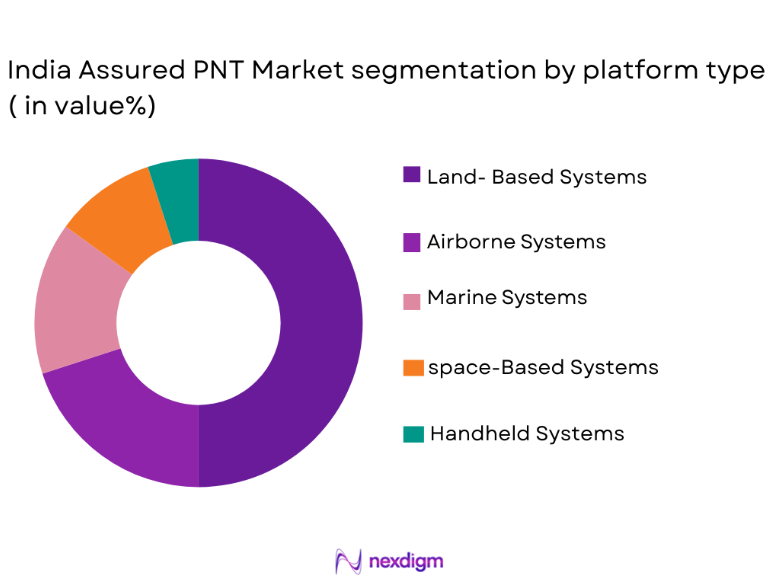

By Platform Type

The India Assured PNT market is also segmented by platform type into land-based systems, airborne systems, marine systems, space-based systems, and handheld systems. Land-based systems hold a significant share due to their widespread use in applications such as transportation, logistics, and defense. These systems are integrated into various vehicles, including autonomous cars and military vehicles, to enhance operational efficiency. The continuous advancements in technology and the adoption of assured PNT solutions across different land-based platforms have contributed to this dominance.

Competitive Landscape

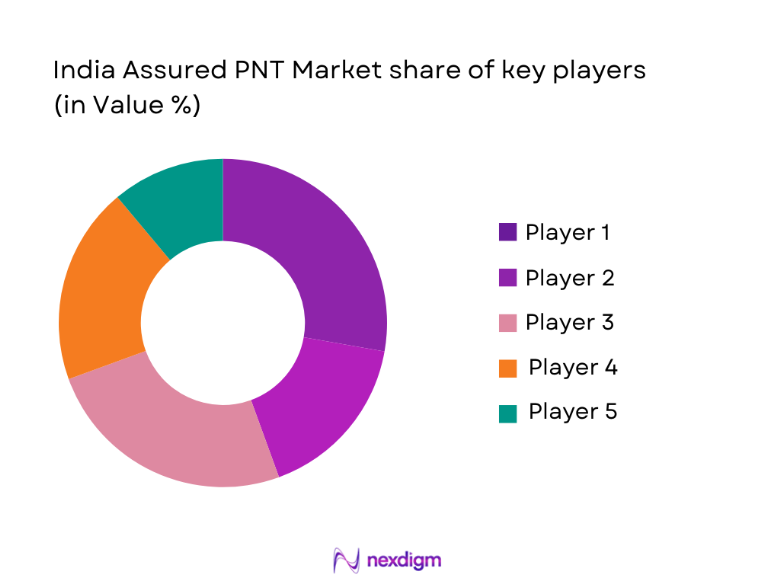

The India Assured PNT market is competitive, with both international and local players striving to dominate the sector. The market is marked by consolidation as larger players form strategic alliances with government bodies to gain access to high-value contracts, particularly in defense and satellite navigation systems. Major players in the market influence trends through technological advancements and by catering to both civilian and military requirements. The growing demand for reliable positioning data, along with government support for indigenous production, has led to increasing investments and market innovations.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Parameter |

| GPS Aided Navigation | 2002 | New Delhi | ~ | ~ | ~ | ~ | ~ |

| NavIndia Systems | 2007 | Bengaluru | ~ | ~ | ~ | ~ | ~ |

| Stellar Positioning | 2010 | Mumbai | ~ | ~ | ~ | ~ | ~ |

| SmartNav Solutions | 2005 | Chennai | ~ | ~ | ~ | ~ | ~ |

| INDO Nav Systems | 2012 | New Delhi | ~ | ~ | ~ | ~ | ~ |

India Assured PNT Market Analysis

Growth Drivers

Government Investments in Infrastructure Development

Government initiatives such as “Make in India” and “Smart Cities” have greatly enhanced the demand for assured PNT solutions. These programs aim to modernize infrastructure, particularly in transportation, where precision navigation is critical for autonomous vehicles, drones, and urban mobility solutions. Additionally, defense sector modernization, especially the adoption of advanced navigation and targeting systems, has fueled further investments in assured PNT systems. The Indian government’s increasing focus on indigenizing satellite navigation systems and increasing military spending has created a favorable environment for the market to grow. The demand for precise, reliable, and robust navigation systems is further reinforced by India’s desire to secure technological independence and reduce dependence on foreign systems. As more infrastructure projects are initiated, the need for assured PNT systems is expected to rise, driving market growth.

Rising Demand for Navigation Solutions in Commercial Aviation and Autonomous Vehicles

The rapid expansion of the aviation sector and the introduction of autonomous vehicles have significantly increased the demand for assured PNT solutions. The aviation industry requires highly accurate and reliable navigation data to ensure safety, particularly for urban air mobility (UAM) systems and drone deliveries. Similarly, the autonomous vehicle market is becoming one of the most significant drivers of assured PNT technologies. Autonomous systems rely heavily on accurate navigation data for operations in real-time, and assured PNT solutions offer the precision needed for safe and efficient autonomous operations. As both industries continue to expand, the demand for assured PNT systems will increase, benefiting the market significantly.

Market Challenges

Challenges in Infrastructure Development

One of the significant challenges for the India Assured PNT market is the slow pace of infrastructure development, particularly in rural and remote areas. Despite government investments, India’s vast geographical expanse and lack of seamless coverage in certain regions present difficulties in the efficient deployment of assured PNT systems. Inadequate infrastructure, such as the absence of necessary supporting facilities for satellite navigation and communication, hampers the full potential of these technologies. While urban centers are quickly adopting these systems, remote areas remain underserved, slowing the overall market growth. Addressing this issue requires substantial investment in improving infrastructure and creating an enabling environment for the widespread adoption of assured PNT systems.

Technological and Regulatory Challenges

The rapid advancement of technology poses a dual challenge for the India Assured PNT market. As new technologies emerge, companies must ensure their systems remain compatible with evolving standards, creating a constant need for upgrades and investment. Regulatory challenges, particularly those concerning data privacy, cybersecurity, and international cooperation in satellite navigation systems, further complicated market operations. The absence of a standardized regulatory framework for assured PNT systems in India means that companies must navigate complex compliance landscapes, slowing down the adoption and integration of new technologies. Overcoming these technological and regulatory hurdles is crucial for sustaining long-term market growth.

Opportunities

Growth of Smart Cities and IoT Applications

The growing development of smart cities in India presents a significant opportunity for the Assured PNT market. These cities require advanced navigation solutions to optimize traffic management, improve urban mobility, and support autonomous systems. The integration of assured PNT systems into the Internet of Things (IoT) ecosystem will further enhance the efficiency of smart city infrastructures. Real-time data from assured PNT systems will support applications such as smart transportation, logistics, and public safety, creating substantial demand for reliable positioning solutions. The government’s push to establish smart city projects provides a promising growth avenue for the market.

Expansion of the Defense Sector and Indigenous Systems

The Indian defense sector presents another key opportunity for the Assured PNT market. With a strong focus on self-reliance and the indigenization of military technologies, India’s defense forces are increasingly turning to domestic solutions for navigation and positioning. The growing demand for advanced systems in military operations, such as drones, unmanned aerial vehicles (UAVs), and precision-guided munitions, is creating opportunities for assured PNT system providers. Furthermore, the government’s increased defense spending and emphasis on technological advancements in defense will provide the necessary support for the development and deployment of advanced navigation solutions in the defense sector.

Future Outlook

The India Assured PNT market is poised for strong growth over the next five years, driven by technological advancements, increasing government support, and rising demand for precision navigation systems across defense, transportation, and telecommunications sectors. Emerging trends such as the integration of autonomous systems, smart city initiatives, and the development of indigenous technologies will fuel market expansion. The government’s strategic focus on ensuring technological self-sufficiency and infrastructure modernization will play a crucial role in supporting the continued growth of the market. Technological innovations, regulatory support, and demand-side factors will propel India as a global leader in the assured PNT sector.

Major Players

- GPS Aided Navigation

- NavIndia Systems

- Stellar Positioning

- SmartNav Solutions

- INDO Nav Systems

- Indian Nav Technologies

- L&T Navigation Solutions

- Rockwell Collins India

- Cobham India

- Honeywell Aerospace India

- Trimble Navigation India

- Thales India

- Raytheon India

- GPS Systems International

- BAE Systems India

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense contractors

- Aerospace manufacturers

- Public safety agencies

- Autonomous vehicle manufacturers

- Transportation infrastructure companies

- Technology and communication firms

Research Methodology

Step 1: Identification of Key Variables

The key variables affecting the market are identified through a combination of primary and secondary research sources. These include market demand, technology trends, and regulatory policies.

Step 2: Market Analysis and Construction

Analyzing current market conditions, trends, and competitive dynamics to construct a comprehensive market model.

Step 3: Hypothesis Validation and Expert Consultation

Validating the market hypothesis through expert consultations, interviews, and market feedback.

Step 4: Research Synthesis and Final Output

Compiling findings and insights into a structured report, supported by data-driven analysis.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Demand for Reliable Navigation Systems

Technological Advancements in GNSS and Hybrid PNT Systems

Growing Investment in National Security & Infrastructure

Rise in Autonomous Systems Adoption

Development of Smart Cities and IoT Integration - Market Challenges

High Initial Investment in PNT Infrastructure

Limited Availability of High-Precision Systems

Vulnerability to Jamming and Interference

Regulatory and Certification Hurdles

Challenges in Integrating New Technologies with Existing Infrastructure - Market Opportunities

Expansion of Hybrid and Multi-constellation Systems

Collaborations between Private Players and Government Agencies

Integration of Advanced PNT in Consumer Electronics - Trends

Shift Towards Resilient and Secure PNT Solutions

Increased Demand for PNT in Autonomous Vehicles

Growing Role of Quantum Technologies in PNT

Adoption of Multi-modal PNT Systems

Increase in Government and Military Investments - Government Regulations & Defense Policy

Standardization of PNT in Defense Applications

Policies Supporting Smart City Infrastructure

Regulatory Framework for GNSS Resilience - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Satellite-based PNT

Inertial Navigation Systems

Hybrid PNT Systems

Ground-based PNT

Global Navigation Satellite Systems (GNSS) - By Platform Type (In Value%)

Aerospace

Land-based Platforms

Marine Platforms

Consumer Electronics

Telecommunications Infrastructure - By Fitment Type (In Value%)

Integrated PNT Systems

Stand-alone PNT Modules

Custom-fit PNT Solutions

Aftermarket PNT Solutions

OEM PNT Solutions - By EndUser Segment (In Value%)

Defense & Aerospace

Telecommunications

Transportation & Logistics

Consumer Electronics

Industrial Automation - By Procurement Channel (In Value%)

Direct Procurement

Channel Partners

Distributors

E-commerce Platforms

Government Procurement - By Material / Technology (in Value%)

Silicon-based Technologies

Gallium Arsenide Technologies

RF-based Materials

Fiber Optics Technology

Quantum Technologies

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (Technology Integration Capability, System Accuracy Levels, Market Penetration Across Sectors, AfterSales Support Infrastructure, R&D Investment in PNT, Compliance with Defense Standards, Supply Chain Resilience, Cost Competitiveness, Local Manufacturing Footprint)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Altron India Ltd

Bharat Electronics Limited

Alpha Engineering Works Pvt Ltd

ECIL (Electronics Corporation of India Limited)

Mistral Solutions Pvt Ltd

Trans wave Systems India Pvt Ltd

IndraNav Solutions Pvt Ltd

Navistar Technologies Pvt Ltd

Ray metrics Sensors India Pvt Ltd

Teknovus Innovations India Pvt Ltd

Tata Advanced Systems Limited

Lockheed Martin India Pvt Ltd

Honeywell Aerospace India

Thales India Pvt Ltd

Trimble Navigation India Pvt Ltd

- Government and Military Applications

- Telecommunications Infrastructure Providers

- Autonomous Systems Developers

- Smart City and IoT Integrators

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035