Market Overview

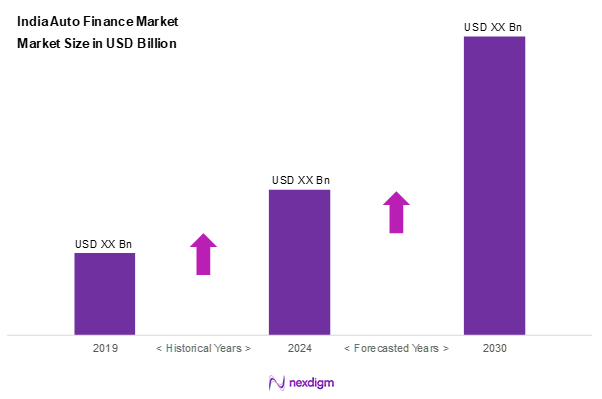

As of 2024, the India auto finance market is valued at USD ~ billion, with a growing CAGR of 9.1% from 2024 to 2030, reflecting robust growth propelled by the rising demand for personal and commercial vehicles coupled with increased disposable incomes. The financing landscape is driven by a shift towards easier access to credit and attractive interest rates, allowing more consumers to own vehicles. This market has seen steady growth, fueled by innovative financing options and the expansion of player offerings in recent years, with projections indicating an upward trend heading into 2024.

Dominance in the India auto finance market is particularly visible in metropolitan areas such as Delhi, Mumbai, and Bengaluru. These cities exhibit higher vehicle ownership rates and income levels, fostering a competitive landscape replete with various financing products. Additionally, infrastructure development and urban expansion fuel demand for auto financing, as consumers seek to upgrade their modes of transportation. The concentration of automobile manufacturers and dealerships in these urban centers enhances the relative strength of the auto finance market in India.

Market Segmentation

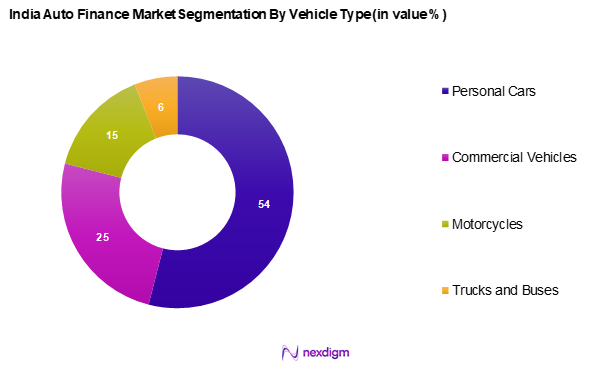

By Vehicle Type

The India auto finance market is segmented into personal cars, commercial vehicles, motorcycles, and trucks and buses. Personal cars dominate the market due to the increasing trend of owning personal vehicles among middle-class consumers. This preference is fueled by the desire for convenience and the growing availability of financing options that make car ownership more attainable. Moreover, promotional schemes and lower interest rates on personal loans contribute significantly to the popularity of personal cars among borrowers.

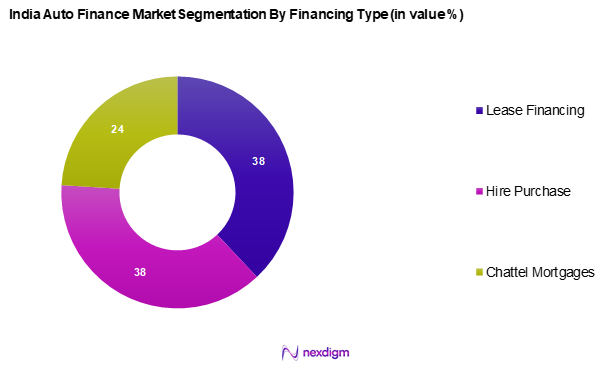

By Financing Type

The India auto finance market is segmented into lease financing, hire purchase, and chattel mortgages. Lease financing has recently gained prominence, primarily due to its financial flexibility and tax benefits attractive to both individuals and corporate entities. The ability to upgrade vehicles frequently without significant capital investment makes lease financing appealing, especially among younger consumers. Corporate clients tend to favor lease financing as it allows them to manage their fleet more efficiently while freeing up capital for other business investments.

Competitive Landscape

The India auto finance market is dominated by several major players, including HDFC Bank, ICICI Bank, Bajaj Finserv, Tata Capital, and State Bank of India. These companies have implemented innovative strategies to capture larger market shares, focusing on customer-centric products and enhanced digital interaction methods. Their consolidated influence underscores the significant impact they have on financing trends in the country.

| Company | Establishment Year | Headquarters | Annual Revenue (USD Mn) | Market Share

% |

Market Focus | Key Products/Services |

| HDFC Bank | 1994 | Maharashtra, India | – | – | – | – |

| ICICI Bank | 1994 | Maharashtra, India | – | – | – | – |

| Bajaj Finserv | 2007 | Maharashtra, India | – | – | – | – |

| Tata Capital | 2007 | Maharashtra, India | – | – | – | – |

| State Bank of India | 1955 | Maharashtra, India | – | – | – | – |

India Auto Finance Market Analysis

Growth Drivers

Increased Disposable Income

The Indian auto finance market is witnessing strong growth, primarily driven by the rise in disposable income across the population. Economic improvements, better employment opportunities, and salary growth across industries have led to enhanced purchasing power. This financial upliftment enables more individuals and households to consider vehicle ownership as a viable option. As a result, the demand for auto financing options has increased, allowing consumers to make vehicle purchases through structured financial plans. Continued economic recovery has further strengthened this trend, encouraging broader participation in the auto finance ecosystem.

Expansion of the Middle-Class Population

India’s middle class has seen considerable expansion, becoming a major driving force behind the surge in consumer demand. This demographic is increasingly aspiring toward personal mobility, with vehicles seen not just as a utility but as a status symbol. With higher financial awareness and improved access to credit, the middle class is actively seeking financing solutions tailored to their needs. Their rising consumption patterns and preference for convenient financial products have made them a focal point for auto financiers looking to expand their customer base.

Market Challenges

Regulatory Compliance

The regulatory landscape surrounding auto finance in India continues to evolve, presenting operational hurdles for financial institutions. New and stricter norms related to lending transparency, risk assessment, and credit governance have increased the compliance burden. Financial institutions are required to invest more in systems and processes to meet these standards, which can impact cost structures and lending agility. Additionally, ongoing regulatory scrutiny over asset quality and recovery frameworks adds complexity to managing loan portfolios, thereby affecting the overall ease of doing business in this space.

Economic Fluctuations

Macroeconomic uncertainties remain a key challenge for the auto finance sector. Factors such as inflation, rising fuel costs, and fluctuations in consumer sentiment can constrain spending capacity. These dynamics influence the affordability of vehicles and, by extension, reduce the appetite for auto loans. Additionally, economic stress tends to elevate the risk of loan defaults, prompting lenders to adopt more conservative credit strategies. This can create a cautious lending environment, slowing down the pace of market growth.

Opportunities

Technological Advancements in Financing Solutions

Digital transformation is opening up vast opportunities in India’s auto finance market. The increasing penetration of smartphones and mobile banking has simplified access to financial products, making it easier for consumers to explore and secure vehicle loans. Fintech innovations—ranging from instant loan approvals to AI-driven credit scoring—are enhancing the customer experience and improving operational efficiency. These advancements not only attract a tech-savvy generation of borrowers but also bring underserved segments into the fold, expanding the market’s reach.

Growth of Electric Vehicles (EVs)

The emergence of electric vehicles as a popular mobility alternative is reshaping the contours of auto financing. Policy support, rising environmental consciousness, and technological improvements are all contributing to the growing appeal of EVs. This shift is encouraging financial institutions to develop new loan structures and partnerships tailored to the unique needs of EV buyers and manufacturers. As the EV ecosystem grows, so does the opportunity for innovative financing models, positioning the auto finance market for sustained future growth.

Future Outlook

Over the next five years, the India auto finance market is anticipated to exhibit robust growth, driven by technological advancements, shifting consumer preferences towards personal mobility, and the government’s focus on encouraging vehicle ownership. The increasing proliferation of digital platforms for loan processing will make financing more accessible, further stimulating market demand. A growing electric vehicle segment will also carve new opportunities within the market, supported by incentives for consumers and a push towards sustainability.

Major Players

- HDFC Bank Limited

- State Bank of India

- ICICI Bank Limited

- Bajaj Finserv

- Tata Capital

- Mahindra & Mahindra Financial Services Limited

- Axis Bank Limited

- Kotak Mahindra Finance

- Toyota Finance

- Cholamandalam Investment and Finance Company Ltd.

- MAS Financial Services Limited

- Sundaram Finance Ltd.

- Shriram Transport Finance Co. Ltd.

- Reliance Capital

- Other Local and National Financing Institutions

Key Target Audience

- Financial Institutions

- Automotive Manufacturers

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Reserve Bank of India, Ministry of Finance)

- Banks and NBFCs (Non-Banking Financial Companies)

- Insurance Companies

- Vehicle Dealerships

- Auto Financing Technology Firms

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing a comprehensive ecosystem map that encompasses all major stakeholders within the India auto finance market. This stage relies on extensive desk research, utilizing a combination of secondary and proprietary databases to gather in-depth industry-level information. The primary objective is to pinpoint and characterize the critical variables shaping market dynamics, including customer behavior, regulatory frameworks, and financial products.

Step 2: Market Analysis and Construction

In this phase, historical data pertaining to the India auto finance market is compiled and analyzed. This includes evaluating market penetration levels, the ratio of financing options available, and the outcomes of revenue generation activities. Moreover, metrics on service quality and customer satisfaction are examined to ensure reliable and precise revenue estimations are made for future projections.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts across a diverse range of organizations. These discussions yield vital insights regarding operational practices, financial modeling, and emergent trends within the market, which are crucial for refining and corroborating the quantitative data obtained.

Step 4: Research Synthesis and Final Output

The final phase entails direct collaboration with multiple participants in the auto finance sector, ensuring comprehensive insights into product segments, sales performance, consumer preferences, and other salient factors. These interactions serve to verify and enhance the statistics derived from a bottom-up analytical approach, ultimately ensuring a thorough, accurate, and validated analysis of the India auto finance market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increased Disposable Income

Expansion of the Middle-Class Population - Market Challenges

Regulatory Compliance

Economic Fluctuations - Opportunities

Technological Advancements in Financing Solutions

Growth of Electric Vehicles (EVs) - Trends

Rise of Fintech in Auto Financing

Shift Towards Digital Loan Processing - Government Regulation

Regulatory Framework for Auto Loans

Consumer Protection Policies - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Interest Rate, 2019-2024

- By Vehicle Type, (In Value %)

Personal Cars

Commercial Vehicles

Motorcycles

Trucks and Buses - By Financing Type, (In Value %)

Lease Financing

Hire Purchase

Chattel Mortgages - By Customer Type, (In Value %)

Individual Consumers

Businesses/Corporate Entities

Governmental Entities - By Region, (In Value %)

Northern India

Southern India

Western India

Eastern India - By Duration of Finance, (In Value %)

Short-term (1-4 years)

Medium-term (5-7 years)

Long-term (8+ years) - By Loan Provider, (In Value %)

Banks

Captives

Credit Unions

NBFCs

Others - By Purpose, (In Value %)

Loan

Leasing

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Vehicle Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Revenue by Vehicle Type, Number of Branches/Offices, Distribution Channels)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

HDFC Bank Limited

State Bank of India

ICICI Bank Limited

Mahindra & Mahindra Financial Services Limited.

Axis Bank Limited

Bajaj FinServ

Kotak Mahindra Fianace.

Toyota Finance

Cholamandalam Investment and Finance Company Ltd.

MAS Financial Services Limited

Sundaram Finance Ltd.

Shriram Transport Finance Co.Ltd.

Others

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Interest Rate, 2025-2030