Market Overview

As of 2024, the India automotive aftermarket market is valued at USD 17.5 billion, with a growing CAGR of 8.4% from 2024 to 2030, reflecting a robust demand for vehicle maintenance and accessories. This market is driven by increasing vehicle ownership, with over 295 million vehicles currently in use, highlighting the importance of aftermarket services and products. Factors such as urbanization, growth in logistics, and e-commerce trends further contribute to the expansion of the automotive aftermarket market, promoting continuous investments and developments across the sector. The growth trajectory of this market underlines the critical role of aftermarket services in the overall automotive ecosystem.

The dominant regions in the India automotive aftermarket market include North India and South India, which account for a significant market share due to their high vehicle density and extensive road networks. Key cities such as Delhi, Mumbai, and Bangalore serve as critical hubs for automotive services, driven by increasing disposable incomes and urban expansion. Additionally, the presence of numerous manufacturers, retailers, and service providers in these areas enhances the accessibility and variety of aftermarket products and services available to consumers, leading to further market growth.

Market Segmentation

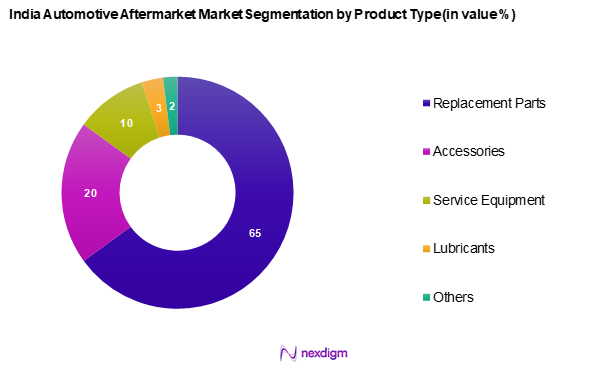

By Product Type

The India automotive aftermarket market is segmented into replacement parts, accessories, service equipment, lubricants, and others. Replacement parts dominate the market, accounting for 65% of the total market share in 2024. This segment is primarily driven by the increasing need for maintenance and repairs due to rising vehicle usage, especially in urban areas. Additionally, the availability of affordable and alternative replacement parts encourages consumers to invest in vehicle maintenance, further solidifying the position of this segment in the automotive aftermarket market.

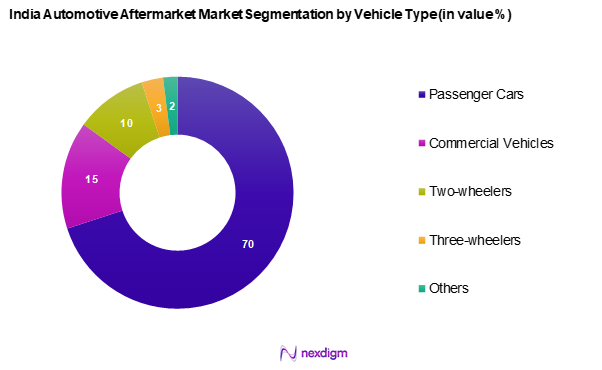

By Vehicle Type

The India automotive aftermarket market is segmented into passenger cars, commercial vehicles, two-wheelers, three-wheelers, and others. Passenger cars represent the largest segment, holding a market share of 70% in 2024. This dominance is largely attributed to the increasing number of personal vehicles on the road, driven by factors such as urbanization and changing consumer preferences towards personal mobility solutions. The continuous advancements in technology and an increased focus on vehicle safety and performance are also fostering growth within this segment.

Competitive Landscape

The India automotive aftermarket market is characterized by a competitive landscape with several major players influencing market dynamics. Key players such as Bosch Limited, DENSO Corporation, and Uno Minda lead the market through a combination of innovation, product diversification, and strategic partnerships. This competitive environment emphasizes the importance of continuous adaptation to market trends and consumer needs.

| Major Player | Established Year | Headquarters | Product Portfolio | Distribution Channels | Revenue

(USD Mn) |

| Bosch Limited | 1886 | Bengaluru, India | – | – | – |

| DENSO Corporation | 1949 | Kariya, Japan | – | – | – |

| Uno Minda | 1985 | Gurgaon, India | – | – | – |

| Endurance Technologies Limited | 1985 | Pune, India | – | – | – |

| Sundaram Clayton Limited | 1961 | Chennai, India | – | – | – |

India Automotive Aftermarket Market Analysis

Growth Drivers

Rapid Urbanization

Rapid urbanization in India is a significant driver of the automotive aftermarket market, as the urban population is projected to reach 600 million by 2031. With urban areas expanding, the demand for vehicles is increasing, leading to a rise in aftermarket services. The increasing urban density has fostered a greater need for mobility solutions, as more individuals seek personal vehicles for convenience. Moreover, improved infrastructure in urban zones, such as enhanced road networks and connectivity, has facilitated easier access to automotive services, further fuelling growth in the aftermarket sector.

Rising Vehicle Ownership

The increasing vehicle ownership in India plays a pivotal role in energizing the automotive aftermarket market. As of 2025, passenger vehicle sales are expected to hit 3.8 million units, driven by factors including increased disposable incomes and a shift in consumer preference towards personal mobility. Additionally, as vehicle ownership rises, the need for regular maintenance and parts replacement becomes necessary, subsequently enhancing the aftermarket landscape. According to recent data, India’s car ownership per 1,000 people stands at approximately 22, indicating significant potential for further growth in vehicle numbers.

Challenges

Regulatory Compliance

Regulatory compliance presents notable challenges to stakeholders in the India automotive aftermarket market. Increasingly stringent regulations concerning emissions and safety standards necessitate adherence to automotive norms established by the Indian government. As of 2023, the phased implementation of Bharat Stage VI (BS-VI) emissions standards has led to significant investments in compliance technologies by manufacturers. The regulatory framework requires companies to invest in R&D and technology to ensure product compliance. Failure to meet these standards can result in severe penalties, further complicating operational efficiencies in the aftermarket segment.

Competition from OEMs

Competition from Original Equipment Manufacturers (OEMs) poses a substantial challenge for businesses within the automotive aftermarket market. OEMs often dominate the market through established brand loyalty, providing high-quality parts and services that compete directly with aftermarket alternatives. Currently, the market share of OEM parts in total vehicle replacement parts remains significant, causing price pressures on aftermarket suppliers who struggle to offer similar quality at competitive prices. This scenario compels aftermarket businesses to innovate and provide enhanced services to differentiate themselves from OEM offerings.

Opportunities

E-commerce Growth

The growth of e-commerce presents transformative opportunities for the automotive aftermarket market in India. The e-commerce sector is projected to reach USD 200 billion by 2026, creating a substantial platform for automotive parts and accessories sales online. Currently, consumer trends indicate a growing preference for purchasing auto parts through online platforms, driven by convenience and the ability to compare products easily. This shift is enabling aftermarket service providers to tap into new customer bases and expand their reach, propelling growth in the sector.

Expansion of Aftermarket Services

The ongoing expansion of aftermarket services creates avenues for growth in the India automotive aftermarket market. Service sectors such as vehicle repair, maintenance, and customization are witnessing an increased demand due to rising vehicle ownership and changing consumer preferences towards vehicle upkeep. By 2025, the demand for service-based solutions is expected to grow as consumers seek reliable maintenance services to enhance vehicle performance. Additionally, the diversification of service offerings, such as tire changes, electrical services, and collision repairs, is an area of increasing investment and development in the aftermarket landscape.

Future Outlook

Over the next five years, the India automotive aftermarket market is expected to experience substantial growth, driven by rising vehicle adoption rates, advancements in automotive technologies, and an increasing inclination towards e-commerce for parts and services. This growth will be further bolstered by governmental initiatives aimed at enhancing infrastructure and promoting sustainable automotive practices. As consumer awareness regarding vehicle maintenance grows, the aftermarket sector will continue to adapt and expand to meet evolving demands.

Major Players

- Bosch Limited

- DENSO CORPORATION

- Uno Minda

- Endurance Technologies Limited

- Sundaram Clayton Limited

- Varroc Group

- JAMNA AUTO INDUSTRIES LIMITED

- Rane Holdings Limited

- Bharat Forge

- JBM Group.

- Schaeffler India Limited

- EXIDE INDUSTRIES LTD.

- TVS Motor Company

- Valeo

- APOLLO TYRES LTD

- CIE Automotive India

- Motherson

- Usha International Ltd.

- India Nippon Electricals Limited

- MENON BEARINGS LTD.

- Amara Raja Group

Key Target Audience

- Automotive manufacturers

- Automotive service providers

- E-commerce platforms

- Investments and venture capitalist firms

- Government and regulatory bodies (e.g., Ministry of Road Transport and Highways, Automotive Research Association of India)

- Aftermarket product distributors

- Supply chain and logistics companies

- Vehicle insurance companies

Research Methodology

Step 1: Identification of Key Variables

This phase involves mapping the automotive aftermarket market ecosystem, identifying the primary stakeholders, and outlining the key variables influencing market dynamics. Data is gathered through a comprehensive mix of secondary and primary research utilizing proprietary databases and industry reports. The primary objective is to create an accurate framework for understanding the current market landscape.

Step 2: Market Analysis and Construction

In this step, historical data on the India automotive aftermarket market is compiled and analysed. Attention is paid to market penetration rates, service provider distributions, and revenue generation. The evaluation of service quality metrics ensures that the revenue estimates and projections are both accurate and reliable.

Step 3: Hypothesis Validation and Expert Consultation

Developed market hypotheses are validated through structured interviews with industry experts representing various segments of the automotive aftermarket market industry. These consultations yield essential insights that refine and corroborate the statistics collected, contributing to a more nuanced understanding of market trends and consumer behaviours.

Step 4: Research Synthesis and Final Output

Final insights are gathered through direct engagement with prominent players in the automotive aftermarket market. Detailed discussions with manufacturers and service providers provide granular data regarding product offerings, sales performances, customer preferences, and other pivotal factors, ensuring that the final analysis is comprehensive, accurate, and reflective of current market conditions.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Historical Overview

- Major Players Timeline

- Business Cycle Analysis

- Supply Chain & Value Chain Analysis

- Growth Drivers

Rapid Urbanization

Rising Vehicle Ownership - Challenges

Regulatory Compliance

Competition from OEMs - Opportunities

E-commerce Growth

Expansion of Aftermarket Services - Trends

Shift Toward E-commerce Platforms

Growth in Vehicle Electrification - Government Regulation

Automotive Standards Compliance

Import and Export Regulations - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Replacement Parts

– Tire

– Battery

– Brake Parts

– Filters

– Body parts

– Lighting & Electronic components

– Wheels

– Exhaust components

– Turbochargers

Accessories

Service Equipment

Lubricants

Others - By Vehicle Type (In Value %)

Passenger Cars

Commercial Vehicles

Two-wheelers

Three-wheelers

Others - By Sales Channel (In Value %)

Retail

OEMs

Repair Shops

W&D

Others - By Region (In Value %)

North India

South India

East India

West India - By Service Type (In Value %)

Mechanical Services

Electrical Services

Collision Repair

Maintenance Services

Others - By Certification Type (In Value %)

Genuine

Certified Parts

Uncertified Parts

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Product Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Market Position, Distribution Channels, Revenue Streams, Product/Service Offerings, and Others)

- SWOT Analysis of Major Competitors

- Pricing Analysis of Key Market Players

- Detailed Profiles of Major Companies

Bosch Limited

DENSO CORPORATION

Uno Minda

Endurance Technologies Limited

Sundaram Clayton Limited

Varroc Group

JAMNA AUTO INDUSTRIES LIMITED

Rane Holdings Limited

Bharat Forge

JBM Group.

Schaeffler India Limited

EXIDE INDUSTRIES LTD.

TVS Motor Company

Valeo

APOLLO TYRES LTD

CIE Automotive India

Motherson

Usha International Ltd.

India Nippon Electricals Limited

MENON BEARINGS LTD.

Amara Raja Group

- Market Demand and Utilization Patterns

- Customer Purchasing Behavior

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030