Market Overview

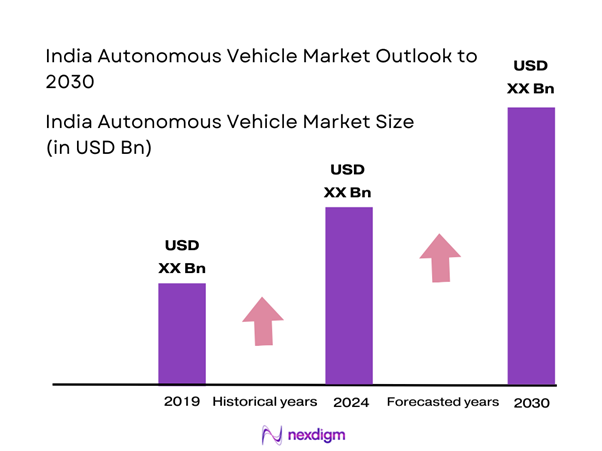

The India Autonomous Vehicle market is valued at USD 2.6 billion in 2024 with an approximated compound annual growth rate (CAGR) of 24% from 2024-2030, reflecting significant growth attributed to ongoing advancements in technology and increasing investments in developing smart transportation solutions. This surge is driven by various stakeholders, including government initiatives aimed at promoting electric and autonomous vehicles, and a rising demand for safety and convenience among consumers.

Major cities contributing to the dominance of the autonomous vehicle market in India include Bengaluru, Delhi, and Mumbai. These cities play a crucial role due to their high population density, advanced technological infrastructure, and strong government support for smart city initiatives. Bengaluru, often dubbed the “Silicon Valley of India,” has a plethora of tech companies and startups focusing on autonomous vehicle technologies, which contributes significantly to the overall market growth.

The Indian government has increasingly focused on promoting autonomous mobility through various initiatives aimed at improving transportation efficiency. The government’s “National Policy on Autonomous Vehicles” emphasizes regulatory frameworks that support the trial and deployment of autonomous technology. Additionally, funding for research and development in the autonomous sector has reached approximately USD 1 billion in 2024, reflecting the government’s commitment to innovation.

Market Segmentation

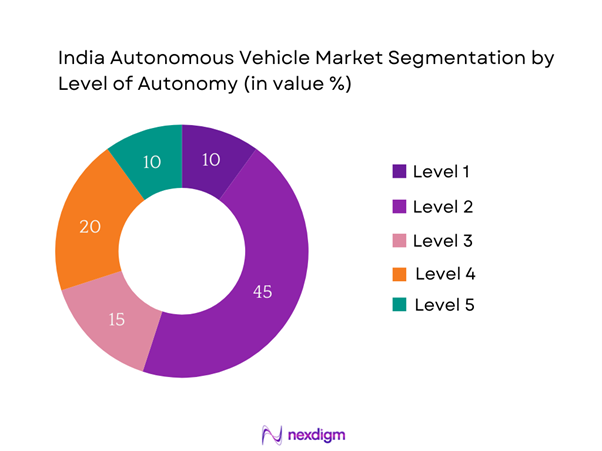

By Level of Autonomy

The India Autonomous Vehicle Market is segmented by the level of autonomy into Level 1 (Driver Assistance), Level 2 (Partial Automation), Level 3 (Conditional Automation), Level 4 (High Automation), and Level 5 (Full Automation). Currently, Level 2 vehicles hold a dominant market share as they are widely adopted by consumers, especially those looking for enhanced safety features like lane-keeping assist and adaptive cruise control. Brands such as Tata Motors and Mahindra are focusing on integrating these advanced features into their models, meeting the consumer demand for additional safety and comfort while driving.

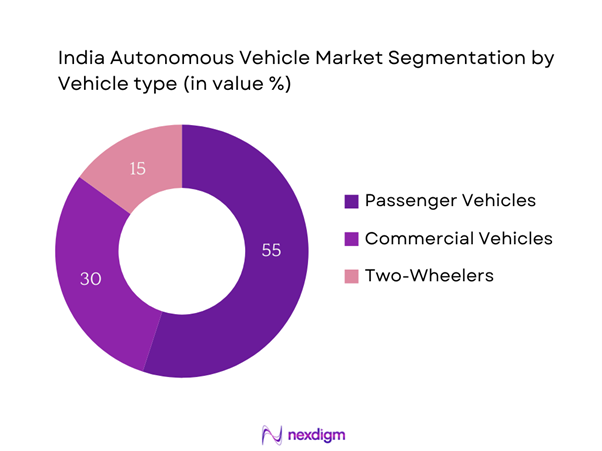

By Vehicle Type

The market is also segmented by vehicle type into Passenger Vehicles, Commercial Vehicles, and Two-Wheelers. The Passenger Vehicles segment is dominating this market due to an increase in demand for personal mobility solutions and the growing preference for convenience and safety features integrated into modern cars. Major players like Tata Motors and Mahindra have invested heavily in electrification and autonomous technologies, making this segment very appealing to consumers who prioritize comfort and safety.

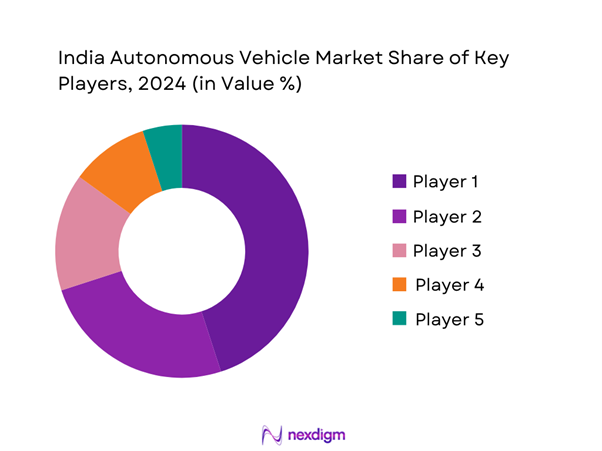

Competitive Landscape

The India Autonomous Vehicle market is comparatively consolidated, led by a few major players such as Tata Motors, Mahindra, and international brands like Mercedes-Benz. These companies are well-equipped to leverage technological advancements and compliance with regulatory frameworks, ensuring their dominance within the sector.

| Company | Establishment Year | Headquarters | R&D Expenditure | Market Reach | Product Portfolio | Autonomous Tech Development | Partnerships |

| Tata Motors | 1945 | Mumbai, India | – | – | – | – | – |

| Mahindra & Mahindra | 1945 | Mumbai, India | – | – | – | – | – |

| Mercedes-Benz | 1926 | Stuttgart, Germany | – | – | – | – | – |

| Hyundai | 1967 | Seoul, South Korea | – | – | – | – | – |

| Ford Motor Company | 1903 | Dearborn, USA | – | – | – | – | – |

India Autonomous Vehicle Market Analysis

Growth Drivers

Increasing Investment from Automotive Companies

Investment from automotive companies in autonomous vehicle technology is on the rise, driven by the competitive landscape and the threat of disruption within the sector. In 2023, major automakers, including Tata Motors and Mahindra, collectively invested over USD 2.2 billion in the development and marketing of autonomous technologies. This influx of funding is focused on building robust R&D infrastructures, with the workforce dedicated to next-generation vehicle technologies projected to exceed 50,000 by end of 2025.

Demand for Safety and Convenience

Consumer demand for enhanced safety features and convenience is fueling the growth of the autonomous vehicle market in India. With traffic accidents resulting in over 150,000 fatalities annually, the appetite for technologies that promise to reduce road accidents is substantial. Current studies indicate that around 75% of consumers express interest in vehicles equipped with autonomous safety features, reflecting a cultural shift towards prioritizing safety in mobility solutions. Furthermore, the emphasis on convenience and time-saving transportation options has made autonomous vehicles appealing to urban populations, pushing manufacturers to innovate continuously.

Market Challenges

High Development Costs

High development costs are a significant barrier to market entry and expansion in the autonomous vehicle sector. The financial requirements for developing autonomous technology can reach several million dollars per vehicle, primarily due to sensor technology, software development, and extensive testing procedures. Research indicates that the average cost of developing a fully autonomous vehicle is around USD 4 million. Consequently, many smaller firms struggle to compete against well-funded giants. This financial burden can deter investment in the long term, hindering innovations in the market.

Public Acceptance

Public acceptance remains a critical challenge for the acceptance of autonomous vehicles in India. While interest is growing, surveys indicate that over 60% of consumers express skepticism about the reliability of autonomous technology. Concerns about the safety and ethical implications of fully autonomous systems often lead to hesitance from potential adopters. Moreover, incidents involving malfunctioning self-driving technology can engender fear and distrust among the populace, further complicated by a lack of awareness about the technology’s benefits. Ongoing public education campaigns are essential to improving acceptance rates.

Opportunities

Expansion of Smart City Initiatives

The expansion of smart city initiatives across India presents a significant opportunity for the autonomous vehicle market. According to the Smart Cities Mission, the Indian government has allocated approximately USD 1.5 billion to develop 100 smart cities, focusing on enhanced urban infrastructure and intelligent transportation systems. These projects facilitate the integration of autonomous vehicles into urban environments, enabling real-time data sharing and improved traffic management. With approximately 60 smart cities already participating in intelligent transportation initiatives, the collaboration between automotive manufacturers and local governments can foster a conducive atmosphere for the deployment of autonomous technologies.

Growth in EV Adoption

The growth in electric vehicle (EV) adoption also presents a favorable outlook for the autonomous vehicle market in India. With electric vehicle sales projected to reach over 1.2 million units by 2025, driven by government incentives and rising environmental awareness, the synergy between EVs and autonomous technologies becomes increasingly relevant. Policies like FAME II provide significant financial support for EV purchases, further boosting adoption rates. This increasing acceptance of electric vehicles creates a promising market environment for integrating autonomous technology in EVs, making them more appealing to environmentally-conscious consumers.

Future Outlook

Over the coming years, the India Autonomous Vehicle market is expected to experience substantial growth driven by supportive government regulations, continuous innovation in autonomous technologies, and rising consumer acceptance of smart mobility solutions. The market outlook stabilizes with increasing collaborations between automotive manufacturers and technology firms, facilitating the development of sophisticated vehicles equipped with AI-driven features.

Major Players in the Market

- Tata Motors

- Mahindra & Mahindra

- Mercedes-Benz

- Hyundai

- Ford Motor Company

- Waymo

- Tesla

- Volvo Cars

- General Motors

- BMW

- Nissan

- Audi

- Honda

- Fisker Inc.

- Nuro

Key Target Audience

- Automotive Manufacturers

- Technology Providers

- Logistics and Transportation Companies

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (e.g., Ministry of Road Transport and Highways)

- Automotive Component Suppliers

- Fleet Operators

- Smart City Developers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the India Autonomous Vehicle Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the India Autonomous Vehicle Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple autonomous vehicle manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the India Autonomous Vehicle Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Consumer Demand for Safety

Advancements in Sensor Technology

Supportive Government Regulations - Market Challenges

High Development Costs

Regulatory Hurdles in Vehicle Approvals - Opportunities

Rising Adoption of Smart City Initiatives

Partnerships with Technology Companies - Trends

Integration of IoT in Vehicles

Emergence of Shared Mobility Services - Government Regulation

Safety Standards for Autonomous Vehicles

Incentives for Electric Autonomous Vehicles - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Level of Autonomy (In Value %)

Level 1: Driver Assistance

– Adaptive Cruise Control (ACC)

– Lane Keeping Assistance

– Blind Spot Detection

– Parking Assistance

Level 2: Partial Automation

– Highway Autopilot

– Automated Braking & Lane Centering

– Hands-on monitoring required at all times

Level 3: Conditional Automation

– Traffic Jam Assist

– Auto lane changes under supervision

– Vehicle handles

Level 4: High Automation

– Urban Robotaxis

– Fixed-route autonomous shuttles

Level 5: Full Automation

– Fully driverless vehicles - By Vehicle Type (In Value %)

Passenger Vehicles

Commercial Vehicles

Two-Wheelers - By Technology (In Value %)

Sensor Technologies

– LiDAR

– Radar

– Ultrasonic Sensors

– Camera-based Vision Systems

V2X Communication (Vehicle-to-Everything)

– V2V (Vehicle-to-Vehicle)

– V2I (Vehicle-to-Infrastructure)

– V2N (Vehicle-to-Network)

Control Algorithms

– Sensor Fusion & Object Detection Algorithms

– Path Planning & Motion Control Software

– AI/ML Models - By Region (In Value %)

North India

South India

East India

West India - By Application (In Value %)

Ride-Hailing

Logistics and Transportation

Personal Use

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Autonomous Vehicle Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths and Weaknesses, Organizational Structure, Revenues (Total and AV-Specific), AV Models by SAE Level, Technology Partnerships, R&D Investment and Focus Areas, Unique Value Proposition (UVP), Testing & Safety Metrics, Regulatory & Deployment Readiness, Others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Tata Motors Ltd.

Mahindra & Mahindra

Ashok Leyland

Bosch Limited

ZF Friedrichshafen AG

Hyundai Motor India

Maruti Suzuki India Ltd.

NVIDIA Corporation

Ather Energy

Ola Electric

Uber Technologies Inc.

Google (Waymo)

BYD Company Limited

Hero Electric

Ashok Leyland

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030