Market Overview

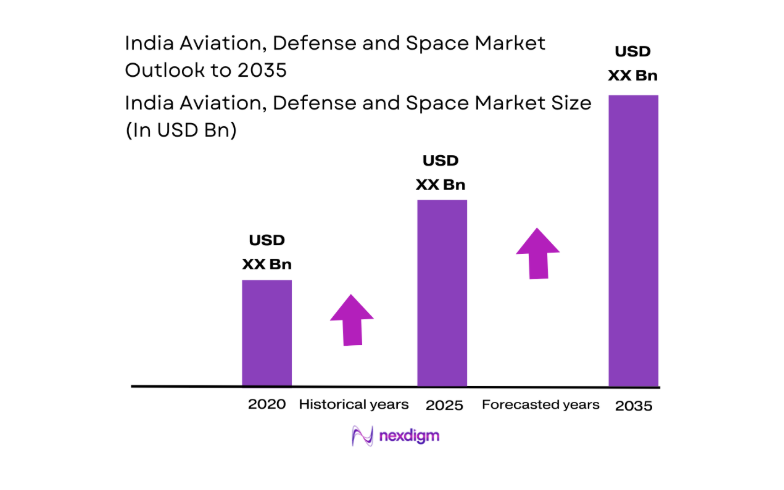

The India Aviation, Defense and Space market current size stands at around USD ~ million, reflecting sustained procurement cycles, fleet modernization programs, and mission-oriented space deployments. Capital-intensive platform development, long program gestation periods, and lifecycle sustainment contracts shape demand patterns across aviation, defense, and space domains. Public sector procurement anchors baseline demand, while private participation accelerates subsystem manufacturing, integration, and services. Indigenous development programs and offset-linked sourcing influence supplier selection and long-term industrial capacity building across the ecosystem.

Demand concentration is strongest across major aerospace and defense clusters anchored by Bengaluru, Hyderabad, Pune, Chennai, and the National Capital Region, supported by testing ranges, MRO hubs, and satellite integration facilities. These regions benefit from skilled engineering talent, proximity to program authorities, and mature supplier networks. Coastal shipyards and air bases strengthen naval aviation ecosystems, while spaceport infrastructure and mission control facilities anchor downstream services. Policy support, procurement corridors, and industrial parks continue to reinforce regional specialization and ecosystem maturity.

Market Segmentation

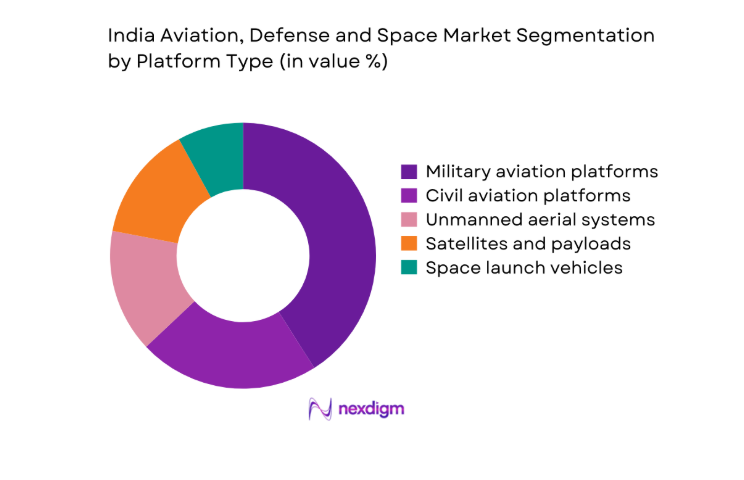

By Platform Type

Military aviation platforms and satellites dominate demand due to ongoing fleet induction, ISR modernization, and mission-driven payload deployment. Unmanned systems increasingly supplement manned platforms for surveillance and border security, while commercial aviation growth supports MRO and fleet expansion. Launch vehicles and mission operations gain traction as private participation broadens access to space services and responsive launch capabilities. Interoperability requirements and lifecycle sustainment elevate demand for avionics, propulsion upgrades, and mission systems integration across platforms. Indigenous programs shape procurement preferences toward domestic manufacturing and co-development pathways.

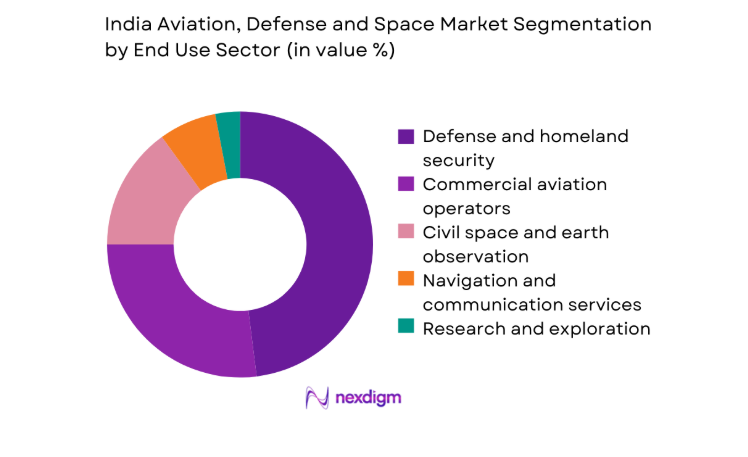

By End Use Sector

Defense and homeland security remain the primary demand centers, driven by border surveillance, ISR, and force readiness mandates. Commercial aviation operators drive steady demand for fleet growth and localized MRO capabilities. Civil space applications support earth observation, navigation augmentation, and communications backhaul, while research missions sustain advanced payload development and testing. Integration across agencies creates cross-sector synergies in sensors, ground systems, and software-defined architectures. Procurement pathways increasingly emphasize lifecycle support, reliability metrics, and domestic value addition across end-use segments.

Competitive Landscape

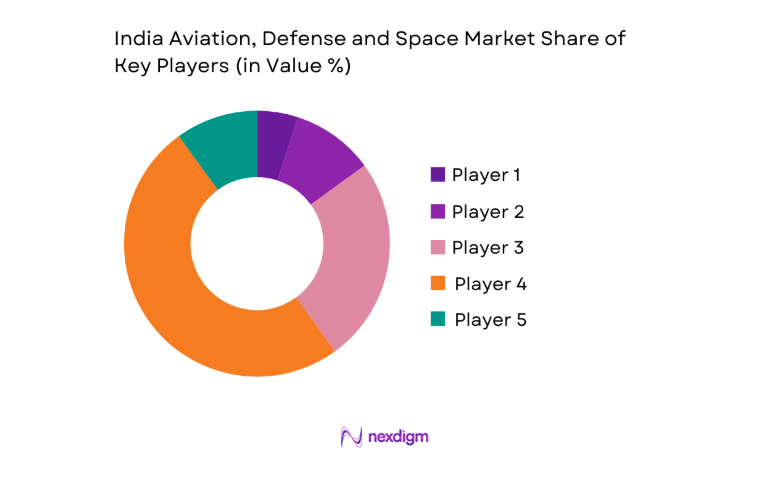

The competitive environment features a mix of public sector primes, private integrators, and specialized subsystem suppliers, with partnerships enabling technology absorption and lifecycle support coverage across aviation, defense, and space programs.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Hindustan Aeronautics Limited | 1940 | Bengaluru | ~ | ~ | ~ | ~ | ~ | ~ |

| Bharat Electronics Limited | 1954 | Bengaluru | ~ | ~ | ~ | ~ | ~ | ~ |

| Larsen & Toubro | 1938 | Mumbai | ~ | ~ | ~ | ~ | ~ | ~ |

| Tata Advanced Systems | 2007 | Hyderabad | ~ | ~ | ~ | ~ | ~ | ~ |

| Godrej Aerospace | 1989 | Mumbai | ~ | ~ | ~ | ~ | ~ | ~ |

India Aviation, Defense and Space Market Analysis

Growth Drivers

Rising defense capital outlay and long-term acquisition plans

Force modernization programs expanded procurement across airframes, avionics, and ISR assets. Defense capital allocations increased across 2022 to 2025 with multi-year contracts supporting induction of squadrons, helicopters, and maritime patrol aircraft. Annual induction targets rose with delivery milestones across 24 bases and 12 forward operating locations. Border surveillance upgrades expanded sensor deployments at 280 sites, while satellite tasking supported 365 day coverage windows for reconnaissance. Training pipelines scaled to 18000 technical personnel annually, enabling maintenance readiness. Policy continuity across 2023 and 2024 ensured sustained procurement velocity, improving industrial planning horizons and vendor capacity utilization nationwide.

Indigenization mandates under DAP and Atmanirbhar Bharat

Indigenization requirements expanded domestic content thresholds across procurement categories, accelerating localization of avionics, structures, and mission computers. Between 2022 and 2025, over 450 line items transitioned to domestic sourcing lists, while 12 production corridors enabled supplier clustering. Certification throughput increased with 38 test benches commissioned for propulsion and composites validation. Offset discharge mechanisms promoted co-development across 19 programs, strengthening supplier maturity. Skill development pipelines trained 22000 technicians and engineers across aerostructures and electronics. These institutional mechanisms reduced dependency risks, improved supply continuity, and reinforced domestic manufacturing depth across programs and platforms.

Challenges

Lengthy procurement cycles and tender delays

Complex tendering and multi-stage approvals extended procurement timelines across aviation and space programs. Average bid evaluation cycles spanned 14 to 22 months during 2022 to 2025, delaying platform induction schedules and subsystem upgrades. Trial evaluations across 9 test ranges constrained throughput, while documentation revisions required 6 to 10 resubmissions per program. Contract negotiations encountered schedule slippages due to evolving technical requirements across 4 committees. These delays impacted readiness planning across 18 operational units, compressing delivery windows and straining maintenance backlogs, ultimately constraining deployment tempo for surveillance and mobility missions.

Technology transfer constraints and IP restrictions

Technology transfer pathways faced constraints due to export controls and licensing conditions across critical subsystems. Between 2022 and 2025, 27 component families required alternative qualification pathways following restricted access to source data. Certification timelines extended by 9 to 15 months for propulsion control units and advanced sensors. Joint development programs required alignment across 5 regulatory approvals, slowing prototype maturation. Limited access to materials recipes affected yield rates across 11 manufacturing lines. These constraints elevated program risk, reduced schedule predictability, and increased requalification cycles for mission-critical avionics and propulsion subsystems.

Opportunities

Private sector participation in space launch and satellite manufacturing

Policy reforms expanded access for private launch providers and satellite manufacturers, enabling responsive launch services and constellation buildouts. Between 2022 and 2025, launch cadence increased across 6 dedicated pads, while 24 smallsat integration campaigns matured mission operations workflows. Ground segment expansion added 14 tracking stations to improve coverage windows. Manufacturing throughput rose with 9 cleanroom facilities commissioned for payload integration. Regulatory streamlining shortened mission authorization cycles across 3 agencies, improving program velocity. These developments position domestic providers to serve earth observation, connectivity backhaul, and scientific missions with faster turnaround times.

MRO localization for narrowbody and widebody fleets

Localized MRO capacity expanded to support fleet readiness and reduce downtime. From 2022 to 2025, hangar capacity increased across 11 facilities, enabling concurrent heavy checks for 120 aircraft. Engine test cells rose to 7 units supporting turnaround targets within 21 days. Parts pooling networks expanded across 5 logistics hubs, improving component availability across 42 airports. Technician certifications scaled to 16000 annually, strengthening reliability metrics. These operational gains improve fleet utilization, enhance safety compliance, and position domestic MRO providers as regional service nodes for transit corridors.

Future Outlook

The market outlook through 2035 reflects sustained modernization cycles, deeper indigenization, and growing private participation in space missions. Policy continuity and procurement reforms are expected to streamline program execution. Ecosystem maturity will expand across manufacturing, MRO, and mission operations. Cross-domain digitalization and open architectures will strengthen interoperability and lifecycle efficiency.

Major Players

- Hindustan Aeronautics Limited

- Bharat Electronics Limited

- Bharat Dynamics Limited

- Larsen & Toubro

- Tata Advanced Systems

- Mahindra Aerospace

- Adani Defence and Aerospace

- Godrej Aerospace

- MTAR Technologies

- Data Patterns

- Paras Defence and Space Technologies

- Alpha Design Technologies

- Skyroot Aerospace

- Agnikul Cosmos

- Ananth Technologies

Key Target Audience

- Investments and venture capital firms

- Ministry of Defence

- Defence Acquisition Council

- Indian Air Force

- Indian Navy

- Indian Space Research Organisation

- Directorate General of Civil Aviation

- Airport operators and MRO service providers

Research Methodology

Step 1: Identification of Key Variables

Platform classes, mission profiles, subsystem maturity, certification pathways, and lifecycle support parameters were mapped across aviation, defense, and space domains. Demand drivers, procurement mechanisms, and regulatory constraints were structured into measurable variables. Ecosystem roles across primes, integrators, and suppliers were delineated to frame competitive positioning.

Step 2: Market Analysis and Construction

Program pipelines, fleet readiness indicators, and mission cadence were synthesized to construct a coherent demand framework. Supply chain maturity, testing capacity, and workforce availability were integrated to assess execution feasibility. Policy instruments and procurement corridors were embedded to reflect institutional enablers.

Step 3: Hypothesis Validation and Expert Consultation

Assumptions on indigenization depth, launch cadence, and MRO localization were validated through structured consultations with program authorities, certification bodies, and industry practitioners. Scenario testing examined schedule risks, technology access constraints, and capacity bottlenecks to refine directional outlooks.

Step 4: Research Synthesis and Final Output

Findings were consolidated into platform, end-use, and capability lenses to present actionable insights. Cross-domain interdependencies were harmonized to ensure coherence across aviation, defense, and space. Outputs were structured to support strategic planning, procurement alignment, and ecosystem development decisions.

- Executive Summary

- Research Methodology (Market Definitions and scope alignment for aviation, defense and space platforms, Primary interviews with MoD procurement officials OEMs and Tier suppliers, Program-level data triangulation across military aviation and space missions)

- Definition and Scope

- Market evolution

- Usage and mission pathways

- Ecosystem structure

- Supply chain and channel structure

- Growth Drivers

Rising defense capital outlay and long-term acquisition plans

Indigenization mandates under DAP and Atmanirbhar Bharat

Fleet expansion and modernization across air force navy and coast guard - Challenges

Lengthy procurement cycles and tender delays

Technology transfer constraints and IP restrictions

High capital intensity and long program gestation periods - Opportunities

Private sector participation in space launch and satellite manufacturing

MRO localization for narrowbody and widebody fleets

Unmanned systems for ISR and border security - Trends

Shift toward modular open systems architectures

Digital engineering and model-based systems engineering adoption

Hybrid electric and sustainable aviation fuel initiatives - Government Regulations

- SWOT Analysis

- Porter’s Five Forces

- By Value, 2020–2025

- By Shipment Volume, 2020–2025

- By Active Platforms, 2020–2025

- By Unit Economics, 2020–2025

- By Platform Type (in Value %)

Military aviation platforms

Civil aviation platforms

Unmanned aerial systems

Space launch vehicles

Satellites and payloads - By End Use Sector (in Value %)

Defense and homeland security

Commercial aviation operators

Civil space and earth observation

Navigation and communication services

Research and exploration - By Program Type (in Value %)

New platform induction programs

Fleet modernization and upgrades

Maintenance repair and overhaul

Ground support and infrastructure

Launch services and mission operations - By Component and System (in Value %)

Airframes and structures

Propulsion and engines

Avionics and mission systems

Sensors payloads and communication

Ground systems and software - By Manufacturing Tier (in Value %)

OEM prime contractors

Tier I system integrators

Tier II component suppliers

Tier III materials and subcomponents

- Market share of major players

- Cross Comparison Parameters (platform portfolio breadth, indigenization depth, program execution capability, lifecycle support coverage, cost competitiveness, technology partnerships, certification track record, export footprint)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarketing

- Detailed Profiles of Major Companies

Hindustan Aeronautics Limited

Bharat Electronics Limited

Bharat Dynamics Limited

Larsen & Toubro

Tata Advanced Systems

Mahindra Aerospace

Adani Defence and Aerospace

Godrej Aerospace

MTAR Technologies

Data Patterns

Paras Defence and Space Technologies

Alpha Design Technologies

Skyroot Aerospace

Agnikul Cosmos

Ananth Technologies

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- By Value, 2026–2035

- By Shipment Volume, 2026–2035

- By Active Platforms, 2026–2035

- By Unit Economics, 2026–2035