Market Overview

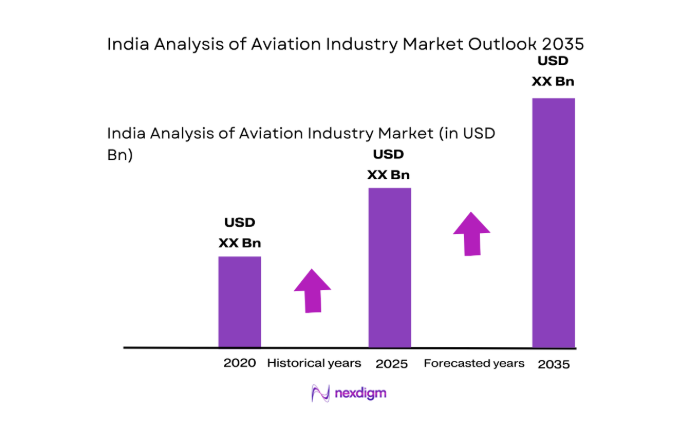

The aviation industry is seeing significant growth, driven by increasing air travel demand, rising disposable incomes, and expanding tourism sectors. Based on recent historical assessments, the global aviation market is projected to be valued at over USD ~ in 2025. Factors such as government investments in infrastructure, evolving passenger preferences, and technological advancements are fueling this expansion. The sector is also benefiting from increased investments in fleet modernization, sustainability efforts, and the growth of low-cost carriers.

The dominant players in the aviation industry are concentrated in key regions, with North America, Europe, and Asia-Pacific emerging as the main hubs. The U.S. and China are leading the market, largely due to high demand for both domestic and international flights, along with strong governmental support for aviation development. These regions benefit from advanced infrastructure, regulatory frameworks, and strong consumer markets, which continue to position them as dominant players in the global aviation landscape.

Market Segmentation

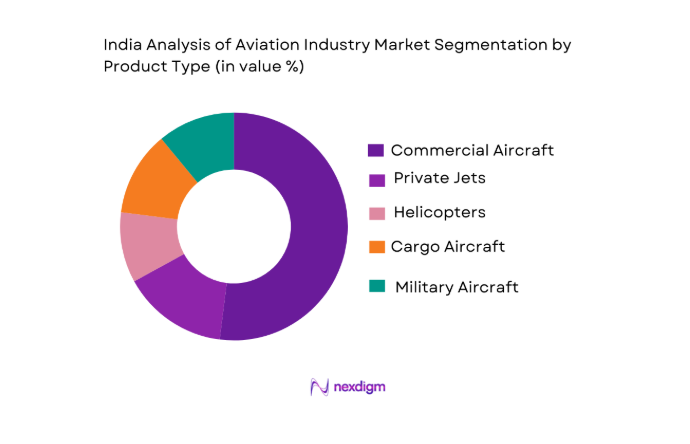

By Product Type:

The aviation industry market is segmented by product type into commercial aircraft, private jets, helicopters, cargo aircraft, and military aircraft. Recently, commercial aircraft has a dominant market share due to the growing demand for both short and long-haul travel. The increasing number of low-cost carriers has expanded access to air travel, driving demand for commercial aircraft. Additionally, investments in upgrading fleets to more fuel-efficient models have further bolstered the growth of this segment, especially in emerging economies.

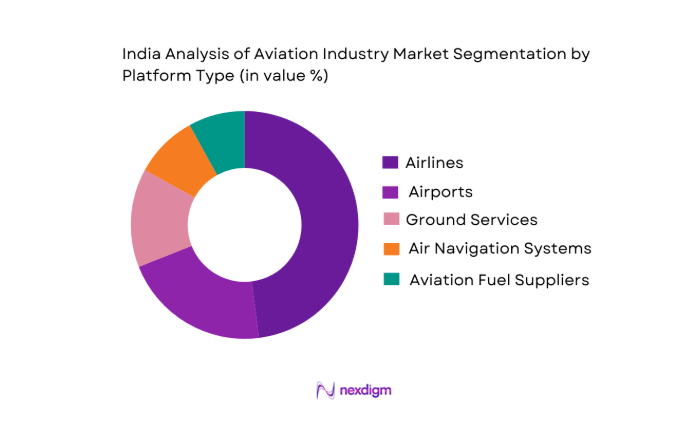

By Platform Type:

The aviation market is segmented by platform type into airports, airlines, ground services, air navigation systems, and aviation fuel suppliers. Among these, airlines dominate the market due to the increasing number of domestic and international flights. The rise of budget airlines and expansion of international routes contribute to the growth of this segment. Additionally, the consolidation of airline carriers and partnerships has driven significant market activity, making airlines the primary segment influencing the global aviation market.

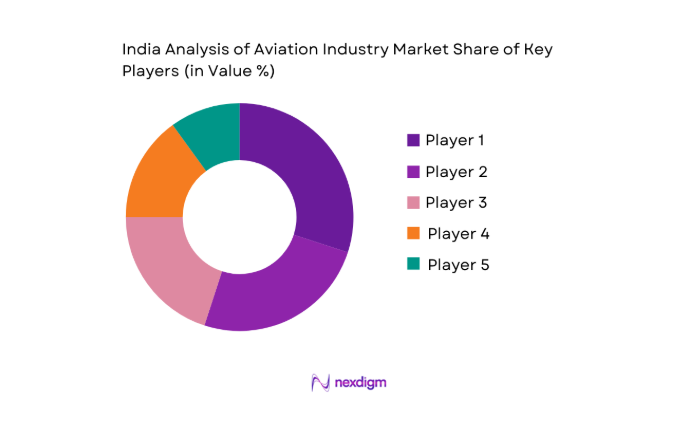

Competitive Landscape

The aviation industry is highly competitive, with key players engaging in constant innovation to stay ahead. Major players focus on fleet expansion, technological advancements, and sustainability initiatives. Consolidation is a growing trend as companies look to improve operational efficiency and expand market reach. The influence of major players such as Boeing, Airbus, and regional carriers continues to shape the market dynamics, with mergers and strategic alliances further intensifying competition.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | R&D Expenditure |

| Boeing | 1916 | Chicago, USA | ~ | ~ | ~ | ~ | ~ |

| Airbus | 1970 | Toulouse, France | ~ | ~ | ~ | ~ | ~ |

| Embraer | 1969 | São José dos Campos, Brazil | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ | ~ |

| Bombardier | 1942 | Montreal, Canada | ~ | ~ | ~ | ~ | ~ |

India Aviation Industry Market Analysis

Growth Drivers

Increasing Demand for Air Travel

The growth in air travel is being driven by several factors such as rising disposable income, the expansion of tourism, and increased business travel. As economic conditions improve globally, the demand for air travel, both domestic and international, has surged. Lower-cost airlines have played a pivotal role by expanding access to air travel for the middle class, while increasing numbers of business travelers seek the efficiency of air travel for work. Furthermore, major airlines have expanded routes to emerging markets, facilitating growth in regional travel. With long-term projections for air passenger traffic consistently showing a positive trend, air travel is expected to remain a key growth driver for the aviation industry. Global tourism growth is also a contributing factor, with international arrivals increasing year over year, boosting demand for air travel services.

Technological Advancements in Aircraft Design

The aviation industry is also benefiting from advancements in aircraft design and technology, which are improving fuel efficiency, safety, and passenger experience. Manufacturers like Boeing and Airbus are continuously innovating, integrating the latest technologies into their fleets. The development of more fuel-efficient engines, lighter materials, and the introduction of electric or hybrid aircraft are expected to reduce operational costs and improve sustainability. These technological advancements have made air travel more affordable, which, in turn, has driven the growth of low-cost carriers. Additionally, airlines are increasingly investing in automation and artificial intelligence to optimize flight operations and improve efficiency, contributing to the overall growth of the market. With governments and manufacturers working together to meet environmental regulations, green technologies such as sustainable aviation fuel (SAF) are expected to become more prevalent, providing further growth opportunities.

Market Challenges

High Operational Costs for Airlines

The aviation industry faces significant challenges related to high operational costs, particularly for airlines. Rising fuel prices, maintenance costs, and labor expenses continue to put pressure on profit margins. The volatility of fuel prices, driven by geopolitical tensions and supply chain disruptions, makes it difficult for airlines to manage operating costs efficiently. This unpredictability in fuel costs impacts airline profitability and, in some cases, leads to fare hikes, which could dampen consumer demand. Additionally, the need for regular aircraft maintenance and the introduction of new regulations regarding safety and environmental standards further elevate operational costs. Airlines, especially in the low-cost segment, must find innovative ways to manage these expenses while maintaining competitive fares.

Regulatory Compliance and Environmental Standards

Stringent regulatory compliance and increasing environmental standards present ongoing challenges for the aviation industry. Airlines and aircraft manufacturers must comply with various safety regulations, emissions standards, and airspace management protocols set by governmental bodies such as the FAA and EASA. These regulations add complexity and cost to operations, particularly as governments worldwide continue to push for stricter emission reductions in line with climate change goals. The aviation sector is also under increasing pressure to reduce its carbon footprint, leading to higher investment in research and development of green technologies. However, meeting these regulatory requirements often involves significant investment in infrastructure and technology, which can be burdensome, especially for smaller operators or those in emerging markets.

Opportunities

Growth in Low-Cost Carriers

The rise of low-cost carriers (LCCs) has opened up significant opportunities for growth in the aviation industry. LCCs are expanding rapidly, driven by the growing demand for affordable air travel. These carriers provide consumers with a budget-friendly alternative to traditional full-service airlines, allowing more people to access air travel. The ability of LCCs to keep operational costs low through strategies such as secondary airports, point-to-point services, and unbundled pricing has contributed to their success. Additionally, the expansion of low-cost carriers in emerging markets is expected to continue to drive growth in the sector, particularly as these markets experience increasing economic growth and demand for air travel. The rise of ultra-low-cost carriers is also creating new competition in the market, leading to innovation in pricing models and service offerings.

Investments in Green Aviation Technologies

As the global demand for sustainability grows, the aviation industry is focusing on green aviation technologies as an opportunity for future growth. The push for carbon neutrality and reducing the environmental impact of air travel has led to the development of alternative fuel options such as sustainable aviation fuel (SAF) and electric propulsion systems. Governments and private companies are investing heavily in the development of these technologies to meet emissions reduction targets. Green aviation is not only a response to regulatory pressures but also a market demand, as passengers increasingly seek eco-friendly travel options. With the aviation industry accounting for a significant portion of global carbon emissions, the adoption of greener technologies presents a lucrative opportunity for businesses that can innovate in this space. Moreover, airlines adopting these technologies can position themselves as environmentally conscious brands, attracting environmentally aware customers and further driving growth in this segment.

Future Outlook

The aviation industry is poised for significant growth over the next five years, driven by factors such as rising air passenger traffic, technological advancements, and increased investments in infrastructure. As sustainability becomes a primary focus, the industry is expected to see a greater adoption of eco-friendly technologies, including electric and hybrid aircraft, sustainable aviation fuel, and carbon-neutral initiatives. Regulatory support, along with continued demand from emerging economies, will bolster the industry’s recovery and growth. Advancements in digitalization and automation will also contribute to improving operational efficiencies, while increasing connectivity will help meet the growing global demand for air travel.

Major Players

- Boeing

- Airbus

- Embraer

- Lockheed Martin

- Bombardier

- Rolls-Royce

- General Electric

- Safran

- Honeywell

- United Technologies

- Pratt & Whitney

- Mitsubishi Aircraft Corporation

- Textron Aviation

- Gulfstream Aerospace

- Raytheon Technologies

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Airlines

- Aircraft manufacturers

- Airport operators

- Aviation service providers

- Aircraft leasing companies

- OEM suppliers

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying key variables such as market drivers, challenges, and opportunities, based on data gathered from primary and secondary sources. This is critical for understanding the scope of the aviation market.

Step 2: Market Analysis and Construction

In this step, market size, share, and segmentation are analyzed by reviewing historical and current data, focusing on key metrics like revenue and market trends.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through expert consultations, interviews, and case studies with key industry players. Insights are gathered to refine the analysis and enhance its accuracy.

Step 4: Research Synthesis and Final Output

The final research is synthesized into a comprehensive market report, consolidating all data and insights to provide actionable recommendations and forecast market trends.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing air passenger traffic

Government investments in aviation infrastructure

Rising disposable incomes and travel demand - Market Challenges

High operating costs for airlines

Limited airport capacity in major cities

Stringent regulatory compliance - Market Opportunities

Growth in low-cost carriers

Increasing demand for air cargo transportation

Advancements in green aviation technologies - Trends

Adoption of eco-friendly aircraft

Expansion of regional airports

Rise in digitalization of aviation services - Government Regulations

- SWOT Analysis

- Porter’s Five Forces

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Commercial Aircraft

Private Jets

Helicopters

Cargo Aircraft

Military Aircraft - By Platform Type (In Value%)

Airports

Airlines

Ground Services

Air Navigation Systems

Aviation Fuel Suppliers - By Fitment Type (In Value%)

OEM Fitment

Retrofit Fitment

Aftermarket Fitment

Custom Fitment

Upgraded Systems - By EndUser Segment (In Value%)

Commercial Aviation

Private Aviation

Military Aviation

Cargo Transport

Aviation Services - By Procurement Channel (In Value%)

Direct Purchase

Leasing

Government Contracts

- Market Share Analysis

- Cross Comparison Parameters (Market Value, Installed Units, System Complexity, Procurement Channels, Platform Types)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

IndiGo

Air India

Jet Airways

SpiceJet

GoAir

Vistara

Airbus India

Boeing India

Bombardier India

Tata Aviation

Hindustan Aeronautics Limited

Gulfstream Aerospace

Embraer India

Lufthansa Technik

Raytheon Technologies

- Commercial Airlines

- Private Jet Operators

- Cargo and Freight Operators

- Government and Military Entities

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035