Market Overview

Based on a recent historical assessment, the India Ballistic Protection Market recorded a total market size of approximately USD ~ billion, driven primarily by sustained defense modernization spending, internal security upgrades, and large-scale procurement programs for personnel and platform survivability. Spending by the Ministry of Defence, Ministry of Home Affairs, and state police organizations supported demand for body armor, vehicle protection kits, and infrastructure shielding. Programs focused on soldier protection, armored vehicle induction, and border security modernization created consistent procurement pipelines supported by budgetary allocations published by the Government of India and defense public sector undertakings.

Based on a recent historical assessment, India emerged as the dominant geography within South Asia due to centralized procurement authority, large standing armed forces, and active internal security requirements across multiple regions. New Delhi functions as the primary decision-making hub due to the presence of defense headquarters and procurement agencies, while industrial clusters in Bengaluru, Hyderabad, Pune, and Chennai lead manufacturing and integration activities. These cities benefit from skilled defense engineering ecosystems, testing facilities, and proximity to public sector units, enabling faster development and deployment of ballistic protection solutions.

Market Segmentation

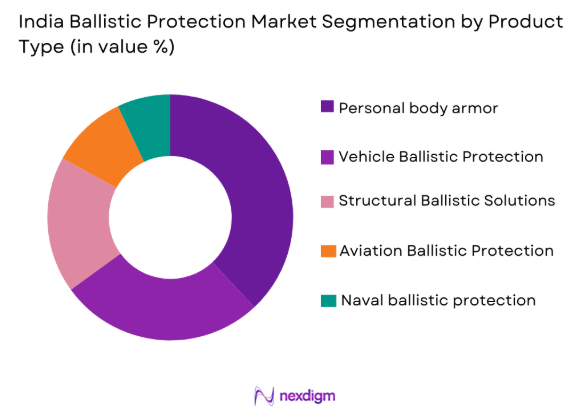

By Product Type

India Ballistic Protection Market is segmented by product type into personal body armor, vehicle ballistic protection, structural ballistic solutions, aviation ballistic protection, and naval ballistic protection. Recently, personal body armor has a dominant market share due to sustained procurement for armed forces, paramilitary units, and law enforcement agencies operating in varied threat environments. Rising deployment in border areas, counterinsurgency zones, and urban security operations has driven continuous replacement and upgrade cycles. Standardization of protection levels, improved ergonomics, and domestic manufacturing under national defense initiatives further reinforced adoption. The emphasis on soldier survivability and mobility ensured consistent budget prioritization, making personal body armor the most procured ballistic protection category across central and state agencies.

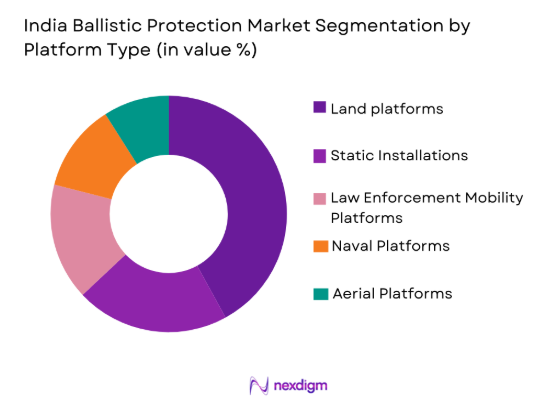

By Platform Type

India Ballistic Protection Market is segmented by platform type into land platforms, naval platforms, aerial platforms, static installations, and law enforcement mobility platforms. Recently, land platforms have a dominant market share due to extensive deployment of armored vehicles, troop carriers, and tactical mobility assets across the armed forces and internal security units. Ongoing induction of infantry combat vehicles, mine-protected vehicles, and logistics convoys increased demand for scalable ballistic kits. Land platforms also benefit from retrofit opportunities and localized manufacturing, making them cost-effective compared to aerial or naval solutions, thereby sustaining higher procurement volumes across multiple agencies.

Competitive Landscape

The competitive landscape of the India Ballistic Protection Market is moderately consolidated, with a mix of domestic defense manufacturers and international firms operating through local subsidiaries and partnerships. Indigenous players benefit from procurement preferences and established government relationships, while global firms contribute advanced material technologies. Strategic collaborations, technology transfers, and licensing agreements are common to meet localization requirements. Competition is influenced by certification capabilities, material innovation, and production scalability rather than price alone.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Parameter |

| Tata Advanced Systems | 2001 | India | ~ | ~ | ~ | ~ | ~ |

| MKU Limited | 1985 | India | ~ | ~ | ~ | ~ | ~ |

| Larsen and Toubro Defence | 2011 | India | ~ | ~ | ~ | ~ | ~ |

| Bharat Forge Defence | 2017 | India | ~ | ~ | ~ | ~ | ~ |

| Mahindra Defence Systems | 2015 | India | ~ | ~ | ~ | ~ | ~ |

India Ballistic Protection Market Analysis

Growth Drivers

Soldier Modernization and Survivability Programs

Soldier modernization and survivability programs represent a core growth driver for the India Ballistic Protection Market because national defense planning increasingly prioritizes individual protection as a foundational combat capability rather than a supplementary asset. Large-scale equipment modernization initiatives emphasize improved ballistic resistance, reduced system weight, and enhanced ergonomic design to ensure soldiers remain operationally effective during prolonged deployments across diverse terrains. Procurement policies increasingly mandate certified protection levels for infantry, special forces, and paramilitary units, driving repeat orders and structured replacement cycles. Continuous exposure to asymmetric threats reinforces institutional demand for upgraded helmets, vests, and modular armor solutions. Domestic production ecosystems aligned with defense indigenization policies enable faster customization and reduce procurement risk. Training doctrines increasingly integrate protective equipment as standard issue, expanding baseline demand. Lifecycle management approaches require periodic upgrades and refurbishment, supporting recurring revenue streams. Integration of protection with communication and mobility systems further elevates procurement volumes across services.

Expansion of Armored Mobility and Platform Protection Requirements

Expansion of armored mobility and platform protection requirements is a significant growth driver as India continues to induct and upgrade protected vehicles for military and internal security operations. Modern operational doctrines emphasize protected mobility for troop movement, logistics support, and rapid response, increasing demand for vehicle-level ballistic kits and structural armor. Existing fleets undergo retrofit programs to extend service life while meeting evolving threat conditions, generating sustained demand beyond new vehicle induction. Border infrastructure development and internal security deployments increase utilization of protected platforms across multiple regions. Standardization of vehicle platforms across agencies simplifies logistics while increasing aggregate armor procurement volumes. Domestic integrators benefit from long-term supply agreements tied to platform production schedules. Protection solutions increasingly extend to command vehicles and support assets, broadening the addressable market. Integration complexity and certification requirements favor established suppliers, reinforcing consistent procurement momentum.

Market Challenges

High Cost and Supply Chain Dependence for Advanced Ballistic Materials

High cost and supply chain dependence for advanced ballistic materials represents a critical challenge for the India Ballistic Protection Market because high-performance ceramics, aramid fibers, and advanced composites require complex manufacturing processes and limited global supplier bases. Domestic availability of key raw materials remains constrained, forcing manufacturers to rely on imports that expose procurement programs to currency volatility, geopolitical risks, and long lead times. Certification standards require consistent material quality, increasing rejection risk and wastage during production. Research and development investments needed to reduce weight while maintaining protection levels add further financial pressure on manufacturers. Smaller domestic firms struggle to achieve economies of scale, limiting competitive pricing for government tenders. Cost sensitivity is particularly high for state police and paramilitary agencies operating under fixed budgets. Lifecycle costs, including maintenance and replacement, amplify affordability concerns across long deployment cycles. Balancing protection performance, weight reduction, and cost efficiency remains a persistent structural constraint.

Lengthy Procurement Cycles and Complex Certification Frameworks

Lengthy procurement cycles and complex certification frameworks pose a major operational challenge for the India Ballistic Protection Market by extending time-to-contract and delaying revenue realization for suppliers. Multi-stage evaluation processes involving trials, field testing, and compliance reviews significantly increase program timelines. Specification changes during trials often require redesigns, increasing development costs and uncertainty. Limited availability of accredited ballistic testing facilities creates bottlenecks, especially during peak procurement phases. Payment delays linked to milestone-based contracts strain working capital for manufacturers. Smaller firms face difficulties sustaining operations during extended approval periods. Innovation adoption slows as new technologies take longer to clear regulatory validation. Overall, procedural complexity reduces market agility and limits rapid response to evolving threat environments.

Opportunities

Indigenization and Export-Oriented Defense Manufacturing Expansion

Indigenization and export-oriented defense manufacturing expansion presents a substantial opportunity for the India Ballistic Protection Market as national policy frameworks increasingly favor domestically designed and produced protection systems across military and internal security procurements. Preferential procurement rules, higher indigenous content requirements, and long-term framework contracts improve demand visibility for local manufacturers. Expansion of domestic testing, certification, and material processing capabilities reduces dependence on imported components and improves cost competitiveness. Export clearances for protective equipment have improved, enabling Indian manufacturers to target friendly foreign nations seeking affordable and certified ballistic solutions. Shared platform architectures between domestic and export variants improve production scale efficiencies. Technology transfer partnerships with global material specialists accelerate capability development while retaining domestic control. Growing international demand for lightweight and modular armor aligns with India’s cost-performance positioning. Sustained policy continuity strengthens investor confidence, enabling capacity expansion and long-term research investments. As domestic firms mature, branding and global references further reinforce export credibility and diversify revenue streams beyond national procurement cycles.

Development of Lightweight, Modular, and Smart Ballistic Protection Systems

Development of lightweight, modular, and smart ballistic protection systems represents a high-impact opportunity as operational doctrines increasingly emphasize mobility, endurance, and real-time situational awareness alongside protection. Advances in material science enable the use of hybrid composites and next-generation ceramics that reduce system weight without compromising protection thresholds. Modular architectures allow end users to tailor protection levels based on mission profiles, increasing operational flexibility and procurement attractiveness. Integration of sensors and health-monitoring components enables predictive maintenance and improved lifecycle management. Smart armor concepts support data-driven threat assessment and enhance command-level visibility during deployments. Research funding and defense innovation programs support prototyping and rapid iteration of advanced solutions. Dual-use applications in homeland security and critical infrastructure protection expand addressable demand beyond defense forces. Intellectual property development strengthens competitive positioning and licensing potential. Collectively, these technological advancements create pathways for differentiation, premium pricing, and long-term supplier relevance within evolving operational environments.

Future Outlook

Over the next five years, the India Ballistic Protection Market is expected to maintain a steady upward trajectory supported by sustained defense modernization priorities and persistent internal security requirements. Increasing emphasis on indigenous manufacturing and localized supply chains is likely to improve procurement efficiency and reduce long-term lifecycle costs. Technological progress in lightweight composites, modular armor architectures, and integrated protection systems will enhance operational effectiveness across platforms. Regulatory support for domestic producers and improving export clearances will broaden market reach. Demand-side momentum from military, paramilitary, and law enforcement agencies is expected to remain resilient, underpinned by continuous upgrade cycles, expanding protected mobility deployments, and heightened focus on personnel survivability.

Major Players

- Tata Advanced Systems

• MKU Limited

• Larsen and Toubro Defence

• Bharat Forge Defence

• Mahindra Defence Systems

• Kalyani Strategic Systems

• SMPP Advanced Armour India

• Tonbo Imaging

• Anjani Technoplast

• Premier Explosives Defence

• Sioen Ballistics India

• Plasan India

• Rheinmetall India Defence

• NP Aerospace India

• Aadeshwar Defence Systems

Key Target Audience

- Investments and venture capitalist firms

• Government and regulatory bodies

• Defense manufacturers

• Defense system integrators

• Armed forces procurement divisions

• Paramilitary organizations

• Law enforcement agencies

• Homeland security departments

Research Methodology

Step 1: Identification of Key Variables

Key variables including product categories, end users, platforms, and material technologies were identified through secondary research. Government publications and defense procurement documents were reviewed. Historical spending patterns were analyzed. Market boundaries were clearly defined.

Step 2: Market Analysis and Construction

Market structure was constructed using procurement data and company disclosures. Demand drivers and constraints were mapped. Segmentation logic was validated. Data consistency checks were applied.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses were validated through consultations with defense industry experts. Technical feasibility and procurement realism were assessed. Feedback refined assumptions. Cross-verification ensured robustness.

Step 4: Research Synthesis and Final Output

Validated data sets were synthesized into coherent market insights. Qualitative and quantitative findings were integrated. Conclusions were reviewed for accuracy. Final outputs were standardized for reporting.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising modernization of armed forces equipment

Increased focus on soldier survivability programs

Expansion of internal security and border protection needs

Growth in armored vehicle induction programs

Indigenization initiatives under domestic defense manufacturing policies - Market Challenges

High cost of advanced ballistic materials

Complex certification and testing requirements

Dependence on imported raw materials and technologies

Weight and mobility trade-offs in protection systems

Lengthy defense procurement and approval cycles - Market Opportunities

Development of lightweight next generation armor solutions

Expansion of domestic manufacturing and export capabilities

Integration of smart and adaptive protection technologies - Trends

Adoption of modular and scalable armor designs

Increased use of composite and hybrid materials

Focus on weight reduction without compromising protection levels

Integration of ballistic protection with situational awareness systems

Growth in localized testing and certification infrastructure - Government Regulations & Defense Policy

Emphasis on indigenous defense production frameworks

Revised defense acquisition procedures favoring local suppliers

Strengthening of quality assurance and ballistic standards

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Personal body armor systems

Vehicle ballistic protection kits

Structural and infrastructure armor

Aviation ballistic protection solutions

Naval ballistic protection modules - By Platform Type (In Value%)

Land combat platforms

Naval vessels and patrol boats

Military aircraft and helicopters

Static installations and checkpoints

Law enforcement mobility platforms - By Fitment Type (In Value%)

Factory-fitted protection systems

Retrofit protection solutions

Modular add-on armor

Mission-specific removable kits

Hybrid integrated protection systems - By End User Segment (In Value%)

Armed forces

Paramilitary forces

Law enforcement agencies

Homeland security organizations

Critical infrastructure operators - By Procurement Channel (In Value%)

Direct government procurement

Defense public sector undertakings

Private defense integrators

Foreign military collaboration programs

Emergency and special mission procurement - By Material / Technology (in Value %)

Advanced composite armor

Ceramic based ballistic solutions

Aramid fiber materials

Ultra high molecular weight polyethylene

Hybrid multi-layer armor systems

- Market share snapshot of major players

- Cross Comparison Parameters (Protection Level Compliance, Weight Efficiency, Material Technology, Modularity, Customization Capability, Certification Standards, Production Scalability, Cost Efficiency, Aftermarket Support, Delivery Lead Time)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Tata Advanced Systems

MKU Limited

Bharat Forge Defence

Larsen and Toubro Defence

Mahindra Defence Systems

Kalyani Strategic Systems

Premier Explosives Defence

Tonbo Imaging

SMPP Advanced Armour India

Anjani Technoplast

Sioen Ballistics India

Aadeshwar Defence Systems

Plasan India

Rheinmetall India Defence

NP Aerospace India

- Rising demand from armed forces driven by modernization programs

- Increasing requirements from paramilitary forces for internal security operations

- Growing adoption by law enforcement for urban and counterterror missions

- Demand from critical infrastructure operators for asset and personnel protection

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035