Market Overview

Based on a recent historical assessment, the India Battlefield Management Systems market was valued at USD ~ billion, supported by official procurement disclosures from the Ministry of Defense and publicly released defense budget allocation documents. Market growth is driven by sustained force modernization initiatives, rising emphasis on network-centric warfare, and accelerated digitization of command, control, communications, computers, intelligence, surveillance, and reconnaissance architectures. Indigenous development mandates, increasing capital outlay for land forces, and integration of real-time situational awareness systems across tactical units further reinforce demand and long-term system deployment commitments.

Based on a recent historical assessment, New Delhi, Bengaluru, Hyderabad, Pune, and Chennai dominate the India Battlefield Management Systems market due to concentration of defense command establishments, system integrators, and advanced electronics manufacturing ecosystems. New Delhi leads through centralized procurement, strategic planning, and command oversight, while Bengaluru and Hyderabad benefit from strong clusters of defense software, electronics, and systems engineering firms. Pune supports land systems integration and testing, while Chennai strengthens naval and coastal command integration, reinforcing India’s leadership through sustained sovereign modernization priorities.

Market Segmentation

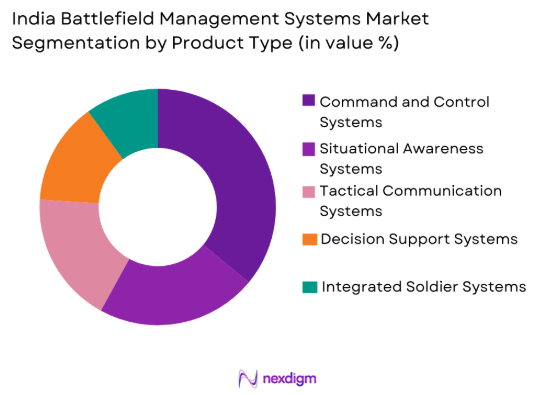

By Product Type

India Battlefield Management Systems market is segmented by product type into command and control systems, situational awareness systems, tactical communication systems, decision support systems, and integrated soldier systems. Recently, command and control systems have held a dominant market share due to their central role in coordinating multi-unit operations and enabling hierarchical command visibility. These systems receive priority funding because they directly influence operational effectiveness, mission planning, and real-time coordination. Continuous upgrades, mandatory interoperability requirements, cybersecurity reinforcement, and compatibility with legacy infrastructure have made command and control platforms the primary procurement focus across defense formations.

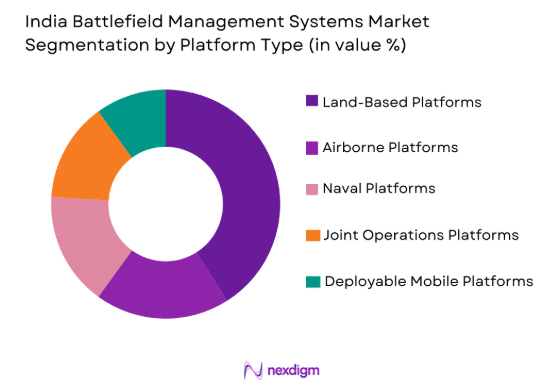

By Platform Type

India Battlefield Management Systems market is segmented by platform type into land-based platforms, airborne platforms, naval platforms, joint operations platforms, and deployable mobile platforms. Recently, land-based platforms have dominated the market due to the scale of army modernization programs and extensive deployment requirements across diverse terrains. Land forces require continuous battlefield visibility, secure communications, and command integration at multiple operational levels. These platforms benefit from sustained budgetary allocations, phased technology induction, and long deployment cycles, resulting in higher cumulative adoption compared to other operational platforms.

Competitive Landscape

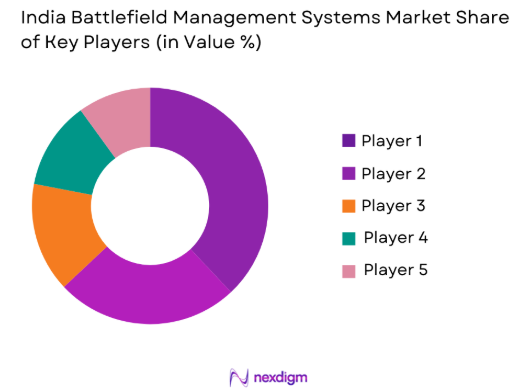

The India Battlefield Management Systems market demonstrates moderate consolidation, characterized by a mix of public sector defense enterprises and private technology-driven firms competing on system integration depth, cybersecurity compliance, and indigenous capability. Major players influence procurement through long-term contracts, lifecycle support capabilities, and alignment with national defense policies.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Indigenous Content Level |

| Bharat Electronics Limited | 1954 | Bengaluru | ~ | ~ | ~ | ~ | ~ |

| Tata Advanced Systems | 2007 | Hyderabad | ~ | ~ | ~ | ~ | ~ |

| Larsen and Toubro Defence | 2011 | Mumbai | ~ | ~ | ~ | ~ | ~ |

| Mahindra Defence Systems | 2015 | Pune | ~ | ~ | ~ | ~ | ~ |

| Alpha Design Technologies | 2003 | Bengaluru | ~ | ~ | ~ | ~ | ~ |

India Battlefield Management Systems Market Analysis

Growth Drivers

Network-Centric Warfare Modernization Programs

Network-centric warfare modernization programs are a primary growth driver for the India Battlefield Management Systems market as defense authorities increasingly emphasize integrated, real-time command and control across dispersed combat units. These programs focus on connecting sensors, communication nodes, decision-makers, and weapon systems into a unified digital battlefield architecture that improves operational responsiveness and situational awareness. Battlefield management systems form the core software and hardware layer enabling this integration, making them indispensable to modern force structures. The shift toward network-centric doctrines increases demand for scalable systems capable of handling large data volumes under contested conditions. Modernization initiatives also require interoperability across legacy and new platforms, expanding system scope and upgrade cycles. Enhanced information sharing reduces decision latency and improves mission coordination, reinforcing operational reliance on these systems. Training doctrines and operational planning are increasingly aligned with digital command environments, further embedding battlefield management systems into routine operations. As modernization programs are structured as multi-phase, long-term initiatives, they generate sustained procurement pipelines rather than one-time purchases. Continuous refinement of these programs ensures recurring demand for software updates, cybersecurity enhancements, and system expansions, directly supporting steady market growth.

Indigenous Defense Manufacturing and Digital Sovereignty Policies

Indigenous defense manufacturing and digital sovereignty policies significantly drive the India Battlefield Management Systems market by reshaping procurement priorities toward locally developed, controlled, and secure technologies. These policies mandate higher domestic content levels, encouraging Indian firms to invest in advanced command software, secure communication protocols, and integrated battlefield solutions. Digital sovereignty requirements emphasize data localization, encryption standards, and national control over operational information, increasing the complexity and value of battlefield management systems. Preference for indigenous solutions reduces reliance on foreign suppliers while enabling customization aligned with national operational doctrines. Procurement frameworks increasingly favor vendors that demonstrate long-term domestic capability development and lifecycle support. These policies also stimulate collaboration between public sector units and private technology firms, strengthening the domestic defense ecosystem. As local capabilities mature, system development cycles shorten and adaptability improves, enhancing adoption rates. Indigenous mandates further support incremental upgrades rather than full system replacements, sustaining recurring revenue streams. Over time, these policies create a self-reinforcing market environment where domestic innovation, regulatory alignment, and operational trust collectively drive long-term demand.

Market Challenges

Complex Integration with Legacy Military Platforms

Complex integration with legacy military platforms represents a persistent challenge for the India Battlefield Management Systems market because operational forces operate a wide mix of equipment inducted over long timelines. Many existing platforms were designed before digital battlefield concepts matured, resulting in fragmented architectures, incompatible data formats, and limited interface standardization. Integrating modern battlefield management systems into such environments requires extensive customization, middleware development, and repeated field validation. These activities increase program complexity and extend deployment schedules. Operational readiness constraints further restrict integration windows, as systems cannot be taken offline for prolonged upgrades during active deployments. Cybersecurity hardening of legacy platforms adds another layer of difficulty, since older hardware often lacks the processing capacity or design flexibility needed for modern encryption and intrusion detection requirements. Interoperability testing across multiple vendors and services introduces coordination risks and additional costs. Any integration failure can have operational consequences, increasing risk aversion among procurement authorities. Vendors must therefore invest heavily in engineering support and long-term maintenance capabilities. Collectively, these factors slow adoption rates, increase lifecycle costs, and create execution risks that act as a structural restraint on faster market expansion.

Lengthy Defense Procurement and Approval Cycles

Lengthy defense procurement and approval cycles pose a significant challenge to the India Battlefield Management Systems market by delaying the translation of operational requirements into deployed systems. Procurement processes typically involve multiple stages, including requirement formulation, technical evaluation, field trials, financial assessment, and layered administrative approvals. Each stage introduces time lags that can extend project timelines by several years. During this period, technology standards may evolve, creating mismatches between approved specifications and current operational needs. Budgetary approvals are also subject to fiscal prioritization and policy sequencing, further affecting timelines. These delays reduce revenue predictability for suppliers and increase working capital pressure, particularly for private sector firms. Extended procurement cycles can discourage rapid innovation, as vendors are forced to freeze designs early in the process. Changes in operational doctrine during procurement add further complexity and rework costs. For defense users, slow induction delays capability realization and reduces responsiveness to emerging threats. As a result, procurement inertia remains a systemic constraint on market agility and scalability.

Opportunities

AI-Driven Decision Support System Integration

AI-driven decision support system integration represents a significant opportunity for the India Battlefield Management Systems market as armed forces increasingly seek faster, data-driven command capabilities in complex operational environments. Battlefield operations generate large volumes of sensor, communication, and intelligence data that exceed human processing capacity under time-critical conditions. AI-enabled decision support systems can analyze this data in real time, identify patterns, prioritize threats, and recommend optimal courses of action. This capability enhances command effectiveness while reducing cognitive load on commanders. Integration of artificial intelligence also supports predictive analytics, enabling proactive resource deployment and mission planning. Indigenous development of AI algorithms aligns with national digital and defense priorities, increasing acceptance within procurement frameworks. These systems can be layered onto existing battlefield management architectures, allowing incremental adoption without full platform replacement. As operational doctrines evolve toward multi-domain and joint-force coordination, AI-assisted decision-making becomes increasingly valuable. Continuous learning capabilities further improve system performance over time, strengthening operational trust. The growing emphasis on automation, data fusion, and intelligent command environments positions AI-driven decision support as a high-value upgrade path, creating sustained opportunities for software-centric innovation and long-term market expansion.

Export Potential to Strategic Defense Partners

Export potential to strategic defense partners offers a substantial opportunity for the India Battlefield Management Systems market as the country expands its role as a defense technology supplier. Indigenous battlefield management systems developed for domestic requirements can be adapted to meet the operational needs of friendly nations with similar force structures and security challenges. Government-to-government defense cooperation frameworks facilitate technology transfer, joint development, and export approvals, reducing market entry barriers. Proven domestic deployment enhances credibility and demonstrates system reliability under real operational conditions. Customizable architectures allow localization for language, doctrine, and interoperability requirements, increasing attractiveness in international markets. Export programs also benefit from competitive cost structures driven by domestic manufacturing and engineering capabilities. As exports scale, vendors can achieve economies of scale, reducing per-unit costs and improving global competitiveness. International exposure further accelerates technological refinement through diverse operational feedback. Expanding exports diversifies revenue streams beyond domestic procurement cycles, reducing dependency on national budget timing. Over time, sustained export activity strengthens the overall ecosystem, supports capability reinvestment, and positions Indian battlefield management solutions as credible alternatives in the global defense technology landscape.

Future Outlook

The India Battlefield Management Systems market is expected to maintain strong momentum over the next five years, supported by continued digitization of combat forces and integration of advanced command platforms. Technological progress in artificial intelligence, secure networking, and data fusion will shape system evolution. Regulatory backing for indigenous technologies will remain robust, while demand will increasingly emphasize interoperability, resilience, and multi-domain operational effectiveness across defense forces.

Major Players

- Bharat Electronics Limited

- Tata Advanced Systems

- Larsen and Toubro Defence

- Mahindra Defence Systems

- Alpha Design Technologies

- Data Patterns India

- Astra Microwave Products

- Centum Electronics

- ParasDefence

- Mistral Solutions

- SamtelAvionics

- Accord Software and Systems

- Bharat Dynamics Limited

- Hindustan Aeronautics Limited

- Solar Industries Defence

Key Target Audience

- Defense ministries

- Armed forces procurement divisions

- Defense public sector undertakings

- Private defense manufacturers

- System integrators

- Investments and venture capitalist firms

- Government and regulatory bodies

- Strategic technology partners

Research Methodology

Step 1: Identification of Key Variables

Key demand, supply, regulatory, and technology variables were identified through defense policy documents and procurement frameworks. Variables were categorized by operational relevance. Historical procurement patterns were assessed. Data consistency checks were applied.

Step 2: Market Analysis and Construction

Market structure was developed using verified procurement values and program disclosures. Segmentation logic was validated against operational doctrines. Competitive positioning was mapped. Cross-validation ensured coherence.

Step 3: Hypothesis Validation and Expert Consultation

Assumptions were validated through consultations with defense analysts and industry specialists. Technical feasibility was reviewed. Policy alignment was confirmed. Expert feedback refined conclusions.

Step 4: Research Synthesis and Final Output

Findings were synthesized into an integrated analytical framework. Quantitative and qualitative insights were aligned. Consistency checks ensured rigor. Outputs were structured for strategic decision-making.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising focus on network-centric warfare capabilities

Ongoing modernization of land and joint combat forces

Increased emphasis on real-time situational awareness

Expansion of indigenous defense manufacturing ecosystem

Integration of advanced ISR and command technologies - Market Challenges

Complex system integration across legacy platforms

High cybersecurity and data protection requirements

Interoperability issues between multi-vendor systems

Lengthy defense procurement and approval cycles

Skill gaps in advanced digital battlefield operations - Market Opportunities

Development of indigenous AI-driven battle management software

Export potential to friendly foreign defense forces

Integration with space-based and unmanned systems - Trends

Adoption of AI-assisted decision support tools

Growing use of cloud-enabled battlefield networks

Shift toward modular and scalable system architectures

Increased joint-force interoperability initiatives

Emphasis on cyber-secure command infrastructures

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Command and Control Systems

Situational Awareness Systems

Tactical Communication Systems

Decision Support and Analytics Systems

Integrated Soldier Systems - By Platform Type (In Value%)

Land-Based Platforms

Airborne Platforms

Naval Platforms

Joint Operations Platforms

Space-Enabled Platforms - By Fitment Type (In Value%)

New Platform Integration

Platform Upgrade and Modernization

Retrofit Installations

Modular Add-On Systems

Portable and Deployable Units - By End User Segment (In Value%)

Indian Army

Indian Navy

Indian Air Force

Paramilitary Forces

Joint Defense Commands - By Procurement Channel (In Value%)

Direct Government Contracts

Defense Public Sector Undertakings

System Integrators

Make in India Partnerships

Technology Transfer Programs - By Material / Technology (in Value %)

AI-Enabled Command Software

Secure Tactical Data Links

Sensor Fusion Technology

Cloud-Based Battle Networks

Cyber-Resilient Communication Architectur

- Market share snapshot of major players

- Cross Comparison Parameters (System Integration Capability, Indigenous Content Level, Cybersecurity Compliance, Platform Interoperability, AI and Analytics Capability, Scalability, Lifecycle Support, Government Partnerships, Export Readiness)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Bharat Electronics Limited

Tata Advanced Systems

Larsen and Toubro Defence

Mahindra Defence Systems

Data Patterns India

Alpha Design Technologies

Astra Microwave Products

Centum Electronics

Paras Defence and Space Technologies

Mistral Solutions

Samtel Avionics

Accord Software and Systems

Bharat Dynamics Limited

Hindustan Aeronautics Limited

Solar Industries Defence Systems

- Operational demand for real-time battlefield visibility across forces

- Need for secure and resilient communication under combat conditions

- Focus on joint command integration for multi-domain operations

- Requirement for scalable systems adaptable to diverse terrains

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035