Market Overview

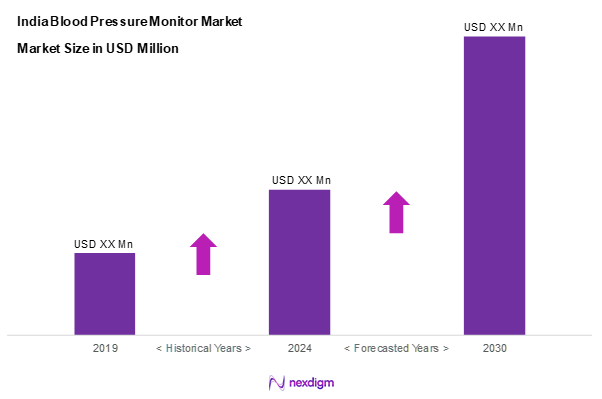

As of 2024, the India blood pressure monitor market is valued at USD 94.8 million, with a growing CAGR of 13.0% from 2024 to 2030. This market growth is driven by an increasing prevalence of hypertension and cardiovascular diseases, alongside rising health consciousness among the population. Moreover, the growing adoption of telehealth and smart health technology is enhancing the demand for home-based monitoring devices, further propelling market expansion.

The dominant players in the market are primarily concentrated in metropolitan regions such as Delhi, Mumbai, and Bengaluru. These cities boast advanced healthcare infrastructure, a higher concentration of healthcare professionals, and significant consumer access to innovative health technology. The urban population’s increasing awareness regarding personal health management and the availability of various healthcare services also contribute to the dominance of these cities in the blood pressure monitor market.

Market Segmentation

By Product Type

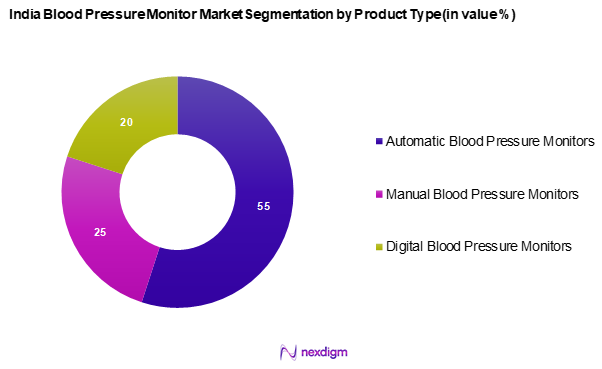

The India blood pressure monitor market is segmented into automatic blood pressure monitors, manual blood pressure monitors, and digital blood pressure monitors. The automatic blood pressure monitors currently dominate the market share due to their ease of use, accuracy, and convenience for regular monitoring. Consumers prefer these devices as they provide hassle-free measurements and are equipped with advanced features such as memory storage and ability to connect to smartphones, thereby appealing to tech-savvy users.

By End User

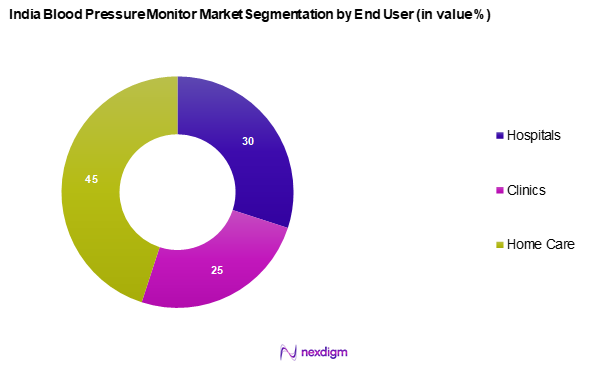

The India blood pressure monitor market is segmented into hospitals, clinics, and home care. Home care segment dominate the market due to the aging population and increasing cases of hypertension necessitate continuous monitoring, leading consumers to invest in personal health devices for home use. The convenience of in-home monitoring, combined with the rising trend of self-health management, positions this segment as a key driver for market expansion.

Competitive Landscape

The India blood pressure monitor market is characterized by a handful of leading players who significantly influence market dynamics. This consolidation underscores the considerable impact these key companies have on the industry. Major players include Omron Healthcare, Philips Healthcare, A&D Medical, Beurer, and Braun. Their robust product offerings and extensive distribution networks position them as frontrunners in the market.

| Company | Establishment Year | Headquarters | Market Share | Market Reach | Revenue (USD Mn) | Weakness |

| OMRON Healthcare, Inc | 1933 | Japan | – | – | – | – |

| Koninklijke Philips N.V. | 1891 | Netherlands | – | – | – | – |

| A&D Company | 1956 | Japan | – | – | – | – |

| Beurer GmbH | 1919 | Germany | – | – | – | – |

| Braun | 1921 | Germany | – | – | – | – |

India Blood Pressure Monitor Market Analysis

Growth Drivers

Increasing Prevalence of Hypertension

The prevalence of hypertension in India has reached alarming levels, with recent estimates suggesting that around 29.8% of adults suffer from this condition as of 2023, according to the World Health Organization. The growing number of cases, which translates to approximately 250 million individuals, is largely attributed to changing lifestyles, urbanization, and dietary habits characterized by increased salt intake and sedentary behaviour. Such trends underscore the urgent need for effective blood pressure monitoring solutions, as healthcare professionals emphasize the importance of regular monitoring in managing hypertension effectively. The pressure of this health crisis propels the market for blood pressure monitors significantly as awareness of the condition rises among both healthcare providers and patients.

Rising Health Awareness

Health awareness in India has surged, with significant campaigns directed at informing the public about lifestyle diseases, particularly cardiovascular issues. From 2022 to 2025, the Indian government, alongside various health organizations, has rolled out several initiatives aimed at educating the populace about the risks of hypertension. In a national survey, over 78% of respondents reported an increase in their awareness about health risks associated with high blood pressure. This heightened awareness is fostering a demand for blood pressure monitoring devices, as individuals become more proactive about their health management, seeking to monitor their conditions regularly.

Market Challenges

High Cost of Advanced Devices

The high cost of advanced blood pressure monitoring devices poses a significant challenge to market penetration, particularly in low and middle-income households. Current pricing for quality automatic devices ranges from USD 23.2 to USD 174.4 making it financially burdensome for a portion of the population. Reports indicate that healthcare access disparities persist, with about 60% of Indians unable to afford such technological solutions. This economic barrier limits the reach of essential monitoring devices, impeding advancement in hypertension management across various socio-economic segments, thus stalling potential market growth.

Lack of Awareness in Rural Areas

Despite rising health awareness in urban centres, rural areas in India continue to lag significantly behind. As of 2023, it is estimated that 70% of the rural population remains unaware of the importance of monitoring blood pressure. This knowledge gap contributes to high rates of undiagnosed hypertension, with surveys indicating that only about 15% of individuals in these regions have access to regular health screenings. This limited exposure to health education directly hampers the adoption of blood pressure monitoring devices, leaving a vast segment of the population vulnerable to the dangers of uncontrolled hypertension.

Opportunities

Growing E-commerce Platforms

The expansion of e-commerce platforms in India offers significant opportunities for the blood pressure monitor market. As of 2023, the country has seen a 40% increase in the number of online shoppers, leading to expanded digital sales for health monitoring devices. Major e-commerce sites now prioritize health and wellness categories, enhancing visibility for blood pressure monitors. The convenience of door-to-door delivery and competitive pricing available online appeals directly to consumers who prioritize health monitoring. Thus, the potential for e-commerce to facilitate access to these devices is vast, allowing consumers better access to a variety of affordable monitoring solutions that were previously hard to acquire in local markets. This growth trend in India’s online shopping ecosystem directly supports broader health management initiatives, enabling more users to engage in proactive health monitoring.

Increasing Investment in Healthcare Infrastructure

The Indian government’s ongoing commitment to improving healthcare infrastructure creates an environment ripe for growth in the blood pressure monitor market. As part of its National Health Mission, significant investments totalling approximately USD 5 billion are directed toward enhancing healthcare services and facilities. By 2025, the government aims to improve patient access to diagnostics and preventive care, making it easier for populations to receive regular health screenings. These infrastructural improvements not only facilitate enhanced access to blood pressure monitors but also foster greater awareness and adoption among patients through access to better healthcare facilities.

Future Outlook

Over the forthcoming years, the India blood pressure monitor market is anticipated to exhibit significant growth fuelled by heightened government initiatives promoting health awareness, advancements in monitoring technology, and an increase in chronic disease prevalence among the population. The integration of smart technologies in devices is also expected to boost consumer adoption for improved health management experiences.

Major Players

- OMRON Healthcare, Inc

- Koninklijke Philips N.V.

- A&D Medical

- Beurer GmbH

- Braun

- Suntech Medical

- Microlife Corporation

- Withings

- Mader Medical

- Rossmax International Ltd.

- Lifesense

- Health Scan Diagnostic

- BOSCH + SOHN GmbH u. Co. KG.

- Qardio

- Medistep

- Morepen

- HealthSense

- BPL Medical Technologies

- Citizen Systems Europe

- AccuSure India

Key Target Audience

- Healthcare Providers

- Medical Equipment Suppliers

- Hospitals and Clinics

- Home Healthcare Services

- Health Insurance Companies

- Pharmaceutical Companies

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Health and Family Welfare)

Research Methodology

Step 1: Identification of Key Variables

This phase involves creating an ecosystem map that captures all significant stakeholders in the India blood pressure monitor market. Detailed insights are gathered through extensive desk research utilizing secondary and proprietary databases. This methodological approach helps identify and define critical variables that influence the dynamics of the market.

Step 2: Market Analysis and Construction

During this phase, historical data related to the India blood pressure monitor market is consolidated and analysed. This includes investigating market penetration rates, channel effectiveness, and revenue generation metrics. A thorough evaluation of service quality statistics accompanies this assessment to ensure reliability and accuracy in revenue projections.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are formulated and validated through direct consultations with industry experts using methods like Computer-Assisted Telephone Interviews (CATIs). Engaging professionals who possess diverse experiences across the market provides crucial operational and financial insights, refining and corroborating the analytical data collected in previous phases.

Step 4: Research Synthesis and Final Output

The concluding phase comprises direct engagement with various blood pressure monitor manufacturers. This engagement allows for the collection of comprehensive insights regarding product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a thorough and validated analysis of the India Blood Pressure Monitor market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain & Value Chain Analysis

- Growth Drivers

Increasing Prevalence of Hypertension

Rising Health Awareness - Market Challenges

High Cost of Advanced Devices

Lack of Awareness in Rural Areas - Opportunities

Growing E-commerce Platforms

Increasing Investment in Healthcare Infrastructure - Trends

Rise of Telemedicine

Integration of AI in Monitoring Devices - Government Regulation

Healthcare Standards

Medical Device Regulations - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Selling Price, 2019-2024

- By Product Type (In Value %)

Automatic Blood Pressure Monitors

– Upper Arm Monitors

– Wrist Monitors

– Finger Monitors (limited use)

Manual Blood Pressure Monitors

– Mercury Sphygmomanometers

– Aneroid Sphygmomanometers

– Manual with Stethoscope

Digital Blood Pressure Monitors

– Portable Digital Monitors

– Smart Digital Monitors with Memory Storage

– Rechargeable/USB-Powered Devices - By End User (In Value %)

Hospitals

– Inpatient Wards

– Emergency Departments

– ICU/CCU Units

Clinics

– General Practitioner Clinics

– Specialty Clinics

Home Care

– Senior Citizen Home Monitoring

– Chronic Patient Monitoring

– Telehealth Integrations - By Distribution Channel (In Value %)

Online Retail

– E-commerce Platforms

– Brand Websites

Offline Retail

– Pharmacies & Drugstores

– Medical Equipment Stores

– Hospital-Based Retail Counters

Direct Sales

– Institutional Sales

– Direct-to-Consumer via Company Reps - By Region (In Value %)

North India

South India

East India

West India - By Technology (In Value %)

Bluetooth Enabled Monitors

– App-Synced Devices

– Cloud-Based Tracking and Alerts

– Multi-User Memory Support

Self-Checking Monitors

– One-Touch Operation Devices

– Automatic Inflation & Deflation

– Integrated Error Indicators

- Market Share of Major Players on the Basis of Value/Volume

Market Share of Major Players by Product Type - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Market Positioning, Distribution Channels, Pricing Strategy, Product Range, Revenue, Product Revenue, and others)

- SWOT Analysis of Major Players

- Pricing Analysis by Product Type for Major Players

- Detailed Profiles of Major Companies

OMRON Healthcare, Inc

Koninklijke Philips N.V.

A&D Medical

Beurer GmbH

Braun

Suntech Medical

Microlife Corporation

Withings

Mader Medical

Rossmax International Ltd.

Lifesense

Health Scan Diagnostic

BOSCH + SOHN GmbH u. Co. KG.

Qardio

Medistep

Dr. Morepen

HealthSense

BPL Medical Technologies

Citizen Systems Europe

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Selling Price, 2025-2030