Market Overview

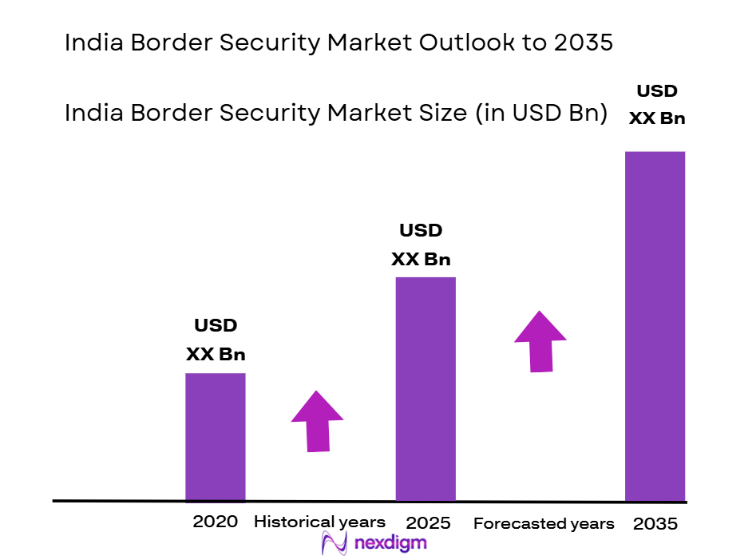

The India Border Security Market is valued at approximately USD ~ billion in 2025, with a robust growth trajectory. The market is primarily driven by India’s growing defense and homeland security budgets, with significant investments in border surveillance systems, UAV technologies, and border fencing initiatives. The strategic focus on enhancing border security infrastructure, increasing incidences of cross-border threats, and ongoing modernization of forces like BSF, ITBP, and Assam Rifles fuel the demand for advanced security systems. Furthermore, the “Make in India” initiative is boosting domestic manufacturing of defense technologies, making India a self-reliant force in securing its borders.

India is the dominant player in the Asia-Pacific region regarding border security infrastructure. The market is mainly concentrated in cities near India’s international borders, including Jammu, Srinagar, Amritsar, and Ahmedabad, all of which face significant security challenges from neighboring countries. The government’s prioritization of securing both land and maritime borders in states like Jammu & Kashmir, Punjab, Gujarat, and Rajasthan enhances the demand for border security solutions. Moreover, the presence of key defense manufacturing hubs such as Hyderabad, Bengaluru, and New Delhi further strengthens the market.

Market Segmentation

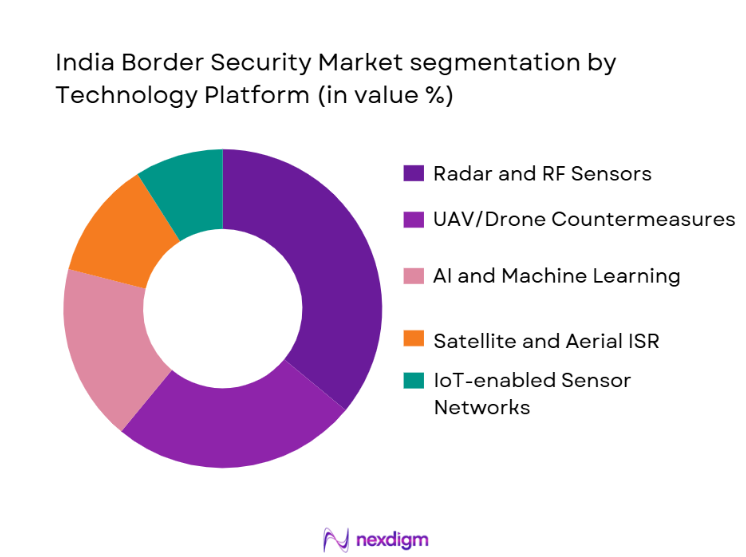

By Technology Platform

The India Border Security market is segmented by technology platform into radar and RF sensors, UAV/Drone countermeasures, AI & machine learning-based analytics, satellite and aerial ISR, and IoT-enabled sensor networks. Among these, radar and RF sensors hold the dominant market share, primarily due to their critical role in long-range detection and surveillance. These technologies are particularly essential in monitoring vast and challenging terrains such as India’s border with Pakistan and China. The advanced radar systems provide real-time data, ensuring the border forces can track unauthorized movements, preventing infiltration and smuggling activities. Additionally, the robustness and reliability of radar-based systems in harsh environmental conditions, such as extreme temperatures and rugged terrains, contribute to their dominant position in the market.

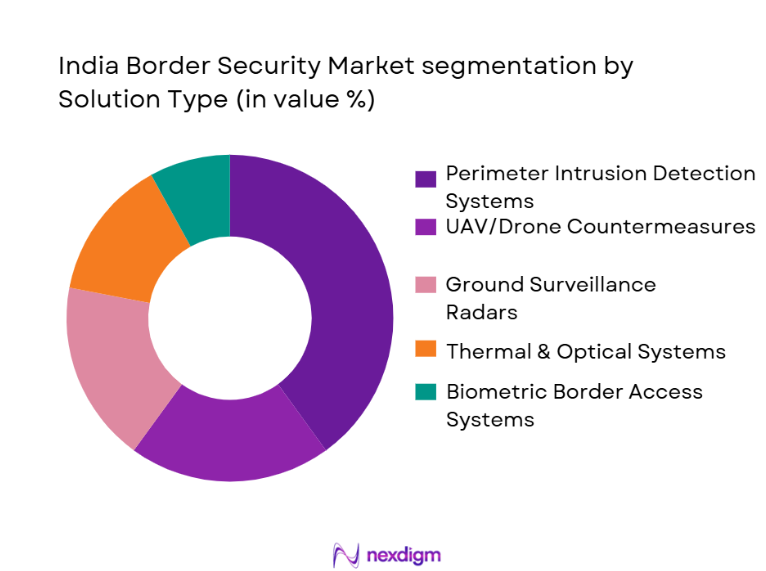

By Solution Type

India’s Border Security market is also segmented by solution type, which includes perimeter intrusion detection systems (PIDS), UAV/Drone countermeasures, ground surveillance radars, thermal & optical systems, and biometric border access systems. The perimeter intrusion detection systems (PIDS) segment is the largest, driven by the large-scale fencing projects on India’s western and eastern borders. The demand for PIDS is increasing as they provide real-time detection and an immediate response mechanism to unauthorized border crossings. These systems are essential for maintaining tight security across thousands of kilometers of border, ensuring quick alerts to border security forces. Their proven track record in preventing infiltration activities makes them a highly preferred solution, especially in high-risk zones.

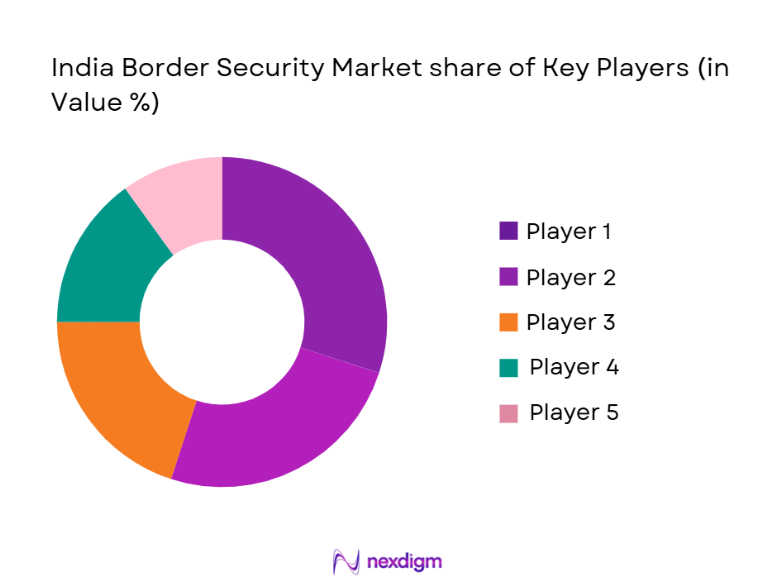

Competitive Landscape

The India Border Security Market is dominated by a few key players, both domestic and international, who provide a diverse range of technologies and solutions to enhance border security. Key players include companies like Bharat Electronics Limited (BEL), L&T Defence, and international players such as Lockheed Martin, Thales, and Elbit Systems. These companies offer a mix of radar, sensor, UAV, and integrated surveillance solutions, contributing to the market’s growth. The consolidation of key players is indicative of the market’s reliance on advanced technology and innovation, with firms investing heavily in research and development to cater to India’s unique border security needs.

| Company | Establishment Year | Headquarters | Technology Focus | Product Portfolio | Strategic Partnership |

| Bharat Electronics Limited | 1954 | ~ | ~ | ~ | ~ |

| L&T Defence | 1997 | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1996 | ~ | ~ | ~ | ~ |

| Thales Group | 1999 | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | ~ | ~ | ~ | ~ |

India Border Security Market Analysis

Growth Drivers

Government Investment in Border Security Infrastructure

India’s increasing defense budget allocation toward modernizing border security infrastructure, including the deployment of advanced surveillance systems, UAVs, and smart fencing technologies, has been a key growth driver for the market. The government’s strategic focus on securing its land and maritime borders fosters consistent demand for cutting-edge security solutions.

Rising Border Threats and Cross-Border Incidents

Escalating border tensions, especially with neighboring countries like Pakistan and China, and the growing threat from insurgent activities and cross-border smuggling, have significantly heightened the need for robust security solutions. This urgency for enhanced border surveillance and protection drives technological innovation and adoption within the market.

Market Challenges

High Cost of Advanced Security Technologies

The high cost of implementing sophisticated border security solutions, such as UAVs, advanced radar systems, and biometric technologies, poses a significant challenge. Budget constraints at various levels of government and the complexity of integrating these systems into existing infrastructure can limit the market’s overall growth.

Regulatory and Compliance Barriers

The market faces hurdles related to procurement processes, compliance with defense standards, and the slow-moving regulatory framework. Delays in government approval processes and complex defense procurement norms can create roadblocks in the timely deployment of necessary border security technologies.

Opportunities

Expansion of Indigenous Manufacturing Capabilities

The “Make in India” initiative presents significant opportunities for domestic defense companies to develop and supply advanced border security solutions. Encouraging local manufacturing of surveillance systems, drones, and sensors not only reduces dependence on imports but also boosts the growth of the domestic defense sector.

Adoption of AI and Machine Learning for Threat Detection

The integration of AI and machine learning technologies in border security systems offers immense potential. These technologies enhance threat prediction and real-time decision-making, enabling more effective surveillance and rapid responses. As AI-driven systems become more accessible and affordable, they are poised to drive future growth in the market.

Future Outlook

Over the next five years, the India Border Security Market is expected to witness steady growth driven by continuous government support, the expanding need for modern border surveillance systems, and increasing technological adoption in defense operations. The adoption of AI and machine learning for threat prediction and real-time decision-making is expected to transform the market landscape. In addition, the government’s “Make in India” initiative is likely to encourage domestic manufacturing of critical border security equipment, reducing reliance on foreign imports and fostering innovation in this space.

Major Players in the India Border Security Market

- Bharat Electronics Limited (BEL)

- L&T Defence

- Lockheed Martin

- Thales Group

- Elbit Systems

- BAE Systems

- Saab Group

- Raytheon Technologies

- Northrop Grumman Corporation

- Rheinmetall Defence

- General Dynamics Mission Systems

- Honeywell International

- Airbus Group

- Harris Corporation

- Leonardo S.p.A.

Key Target Audience

- Government & Regulatory Bodies

- Defense Contractors

- Border Security Solution Providers

- System Integrators in the Defense Sector

- Investments and Venture Capitalist Firms

- Border Infrastructure Developers

- Military & Defense Equipment Buyers

- Public-Private Partnerships (PPP) Initiators in Border Security

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves gathering data from government agencies, defense contractors, and border security technology providers to identify the critical variables affecting the market, such as procurement cycles, technology adoption rates, and regulatory influences. This will be achieved through desk research and interviews with industry leaders.

Step 2: Market Analysis and Construction

In this phase, historical data from credible sources such as government budgets and defense ministry reports will be analyzed. The analysis will also include an assessment of key technologies used for border surveillance, like UAVs, radars, and C4ISR platforms, along with the market’s pricing trends.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be validated through interviews with experts, including defense industry veterans, security solution providers, and government officials. These consultations will help refine our understanding of the operational challenges and growth opportunities in the market.

Step 4: Research Synthesis and Final Output

The final phase will involve a synthesis of the collected data, including cross-referencing findings from secondary research and expert consultations. This will provide a comprehensive and accurate picture of the India Border Security Market, including future trends, competitive landscape, and opportunities for growth.

- Executive Summary

- Research Methodology (Market Definitions & Assumptions, India Border Security Definitions, Abbreviations, Research Design & Data Sources, India Primary & Secondary Data Integration, Government Procurement Cycle Mapping, Intelligence Interviews, Limitations & Validation)

- Market Genesis & Evolution

- Border Security Force Architecture

- India Border Security Policy & Doctrine

- Strategic Border Threat Landscape

- National Border Security Ecosystem

- Driving Forces

India Budget Priorities

Modernization Drives

Smart Borders

CrossBorder Crime Data - Market Restraints

Compliance

Rough Terrain Deployments

Cost of Advanced Tech - Opportunities

CounterDrone Tech

AI/ML Adoption

Indigenous Manufacturing

Export Potential - Key Market Trends

Automation

ISR Integration

Predictive Analytics

Sensor Fusion - Government Regulation & Security Standards

MHA/MoD

IT Tech import norms - Industry Value Chain & Procurement Landscape

India Border Security Supply Chain Mapping

Vendor Qualification & Licensing Norms

Tendering & Contracting Process

AfterSales & Maintenance Lifecycle

Indigenous Manufacturing & ‘Make in India’ Contribution

- By Value 2020–2025

- By Volume 2020-2025

- By Deployment Spend 2020-2025

- By Procurement Spend 2020-2025

- Border Security Market CAGR & Growth Trend 2020-2025

- By Domain (In Value%)

Land Surveillance

Coastal Surveillance

HighAltitude Border Surveillance

Airborne

Cyber Border Defense - By Solution Type (In Value%)

Perimeter Intrusion Detection Systems (PIDS)

UAV/Drone Countermeasures

Ground Surveillance Radars

Thermal & Optical Systems

Biometric Border Access Control

Automated Border Control Systems (ABC)

C4ISR Platforms - By Technology Platform (In Value%)

Radar & RF Sensors

Artificial Intelligence & Machine Learning Analytics

Satellite & Aerial ISR

Machine LearningBased Threat Prediction

Internet of Things (IoT) Enabled Sensor Networks - By End User (In Value%)

Central Armed Police Forces

Defence Forces

State Agencies

Private Border Infrastructure Operators

Critical Infrastructure Segments - By Procurement Model (In Value%)

Government Tenders

Foreign Military Sales

Imports

PublicPrivate Partnerships (PPP)

Domestic R&D & MakeinIndia Programs

- CrossComparison Parameters (Company Overview, India Business Units, Government Certifications, Product Portfolio Breadth, R&D Investment, Field Deployments, Strategic Partnerships, Pricing & Contract Terms)

- SWOT of Key Players

- Major Players

Bharat Electronics Limited (BEL)

Tata Advanced Systems

L&T Defence

HCL & Tech Mahindra

Jacobs/Thales

Lockheed Martin

Raytheon/RTX Corp

Elbit Systems

Saab

Siemens

Honeywell

CP Plus/Genetec

Bosch Security Systems

Rafael Advanced Defense Systems

Anduril Industries

- Border Threat Profiles – Western, Northern, Eastern & Coastal Frontiers

- Force Deployment Dynamics

- Budget Allocations & Prioritization by Force

- Pain Points & Technology Gaps

- Adoption Roadmap for NextGen Security Tech

- Value & Growth Trajectory 2026-2035

- Domain & Solution Demand 2026-2035

- Domestic vs Import Procurement 2026-2035