Market Overview

The India BPO services market is valued at USD ~ million in 2024, according to a recognized industry source that aggregates third-party outsourcing and shared-services operations. This market size reflects growing demand for outsourced customer services, back- and mid-office processing, and support functions across global and domestic clients. The demand drivers include cost arbitrage, a large skilled English-speaking workforce, evolving enterprise demand for support services, and increasing adoption of outsourcing by both multinational clients and domestic Indian companies.

India continues to dominate as a BPO delivery hub. Cities such as Bengaluru, Hyderabad, NCR-Noida/Gurugram, Mumbai-Pune, and Chennai remain leading outsourcing centres because of their established infrastructure, availability of bilingual or multilingual talent, strong telecom & digital connectivity, time-zone advantage for Western clients, and mature ecosystems of training, staffing, and vendor operations. These hubs attract global clients because they combine scale, quality, and cost-effectiveness — making them natural anchors of the India BPO market.

Market Segmentation

By Service Type

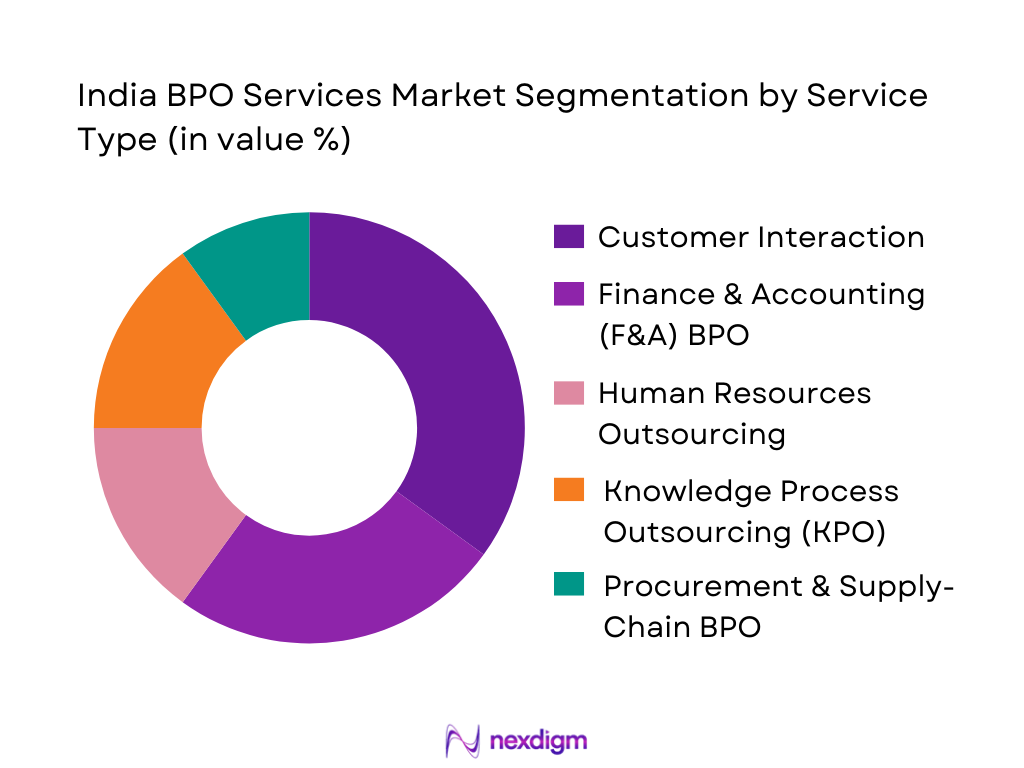

The India BPO market is segmented into Contact Center (voice & non-voice customer interaction), F&A outsourcing, HR outsourcing & admin services, Knowledge Process Outsourcing (including analytics and specialized services), and Procurement/Back-office processing. Among these, Contact Center (CX) remains the dominant sub-segment — accounting for roughly 35% of market revenue. This dominance arises because global enterprises continue to outsource high-volume customer support and service desk operations to India, leveraging the country’s cost advantage and large English-proficient workforce. The scalability and flexibility of CX operations, combined with India’s global time-zone compatibility, make Contact Center BPO the backbone of the industry. Meanwhile, F&A outsourcing holds the second-largest share (~25%), driven by demand for standardized finance, accounting, payroll, and record-keeping tasks that firms prefer to outsource for cost-efficiency and compliance.

By Client Industry Vertical

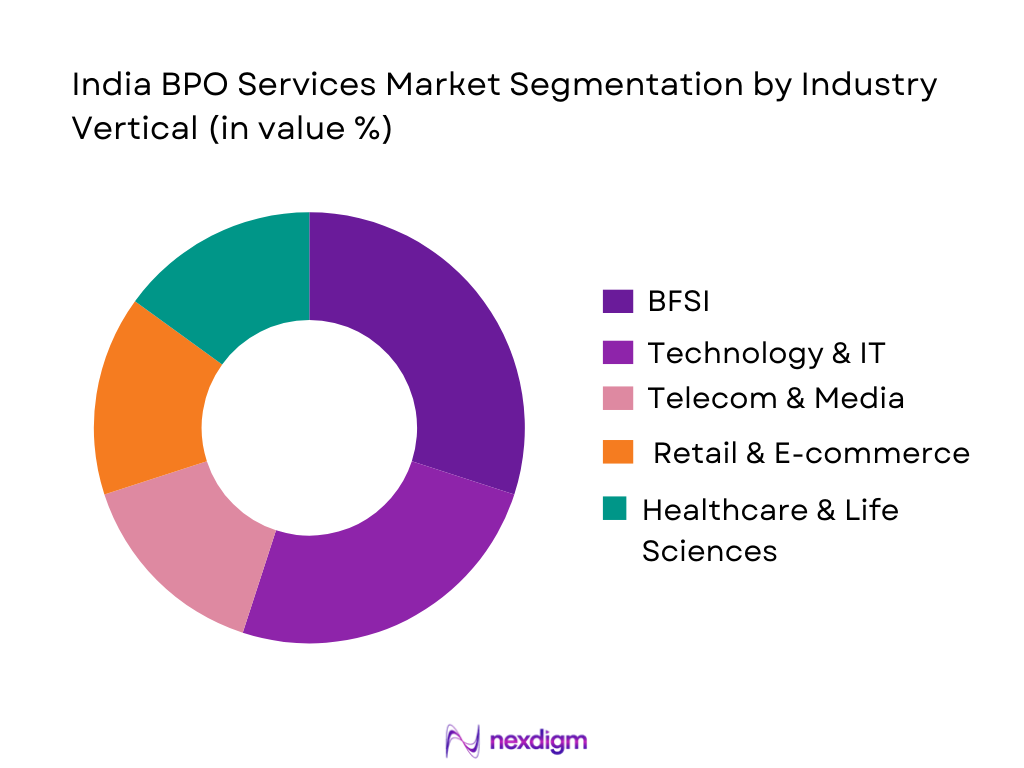

The BPO market in India is segmented across multiple client industries, including BFSI, Technology/IT/Platform firms, Telecom & Media, Retail & E-commerce, Healthcare & Life Sciences, and Travel/Hospitality/Other services. Among these, BFSI commands the largest share (~30%) — mainly because banking, insurance, and financial services firms worldwide increasingly outsource processes like customer support, claims management, loan processing, compliance, and back-office accounting to India. The highly regulated nature of BFSI processes, along with requirements for accuracy, compliance, and data handling, makes outsourcing attractive for achieving scale and cost efficiencies. Technology, IT services and SaaS/Platform clients follow with around 25% share: these firms often outsource support, technical helpdesk, HR administration, and software-related support to Indian BPOs. The adaptability, technical skill base, and existing infrastructure make India a natural hub for such vertical outsourcing.

Competitive Landscape

The India BPO Services Market is largely consolidated among a few major players such as TCS, Genpact, Wipro, Accenture, and EXL – each offering broad service portfolios across customer support, F&A, HR, analytics, and vertical-specific BPO. The predominance of these firms reflects the high entry barriers for smaller players, owing to the need for global delivery infrastructure, multilingual talent pools, automation investments, compliance capabilities, and established client relationships. Their broad vertical coverage and ability to deliver both scale and specialized services enable them to cater to demands from BFSI, healthcare, technology, retail, and other sectors.

| Company | Establishment Year | Headquarters (Country) | Service Scope (Key Service Lines) | Delivery Footprint (India Locations / Global) | Digital & Automation Capabilities | Client Vertical Focus / Strengths |

| Tata Consultancy Services (TCS) | 1968 | India | ~ | ~ | ~ | ~ |

| Genpact Ltd. | 1997 | USA / Global | ~ | ~ | ~ | ~ |

| Wipro Limited (BPO / BPM arm) | 1945 | India | ~ | ~ | ~ | ~ |

| Accenture Operations India | 1989 (parent) | Ireland / Global | ~ | ~ | ~ | ~ |

| EXL Service | 1999 | USA / Global | ~ | ~ | ~ | ~ |

India BPO Services Market Analysis

Growth Drivers

Cost Advantage

India’s macro cost base remains a core advantage for the India BPO Services Market. Per capita GDP at current prices stands at ₹2,12,600, while per capita private final consumption expenditure is ₹1,29,400, indicating a still-moderate income and consumption level that keeps relative wage expectations competitive for global clients. The economy generated GDP of ₹2,96,57,745 crore at current prices, with private consumption of ₹1,80,51,291 crore and gross fixed capital formation of ₹88,32,161 crore, reflecting strong domestic demand that sustains a large services workforce without pushing wages to developed-market levels. Low communication and connectivity costs also underpin India’s value proposition: TRAI reports 954.40 million internet subscribers and 924.07 million broadband subscribers as of end-March, with wireless internet users at 914.13 million and wired at 40.27 million, ensuring a nationwide digital backbone that supports 24×7 outsourced delivery. At the same time, commercial services such as “financial, real estate and professional services” generated GVA of ₹58,26,765 crore at current prices, up from ₹53,00,147 crore, confirming that globally tradable services can scale at Indian cost levels and still contribute meaningfully to national income.

Talent Depth

The India BPO Services Market is supported by a very large and increasingly active labour pool. MoSPI’s Periodic Labour Force Survey shows the labour force participation rate for people aged 15 and above rising to 60.1, with the worker population ratio at 58.2 and unemployment at just 3.2 on a usual status basis, indicating both deep participation and tight labour market conditions. Female LFPR improved sharply from 37.0 to 41.7 in only one survey round, adding millions of potential knowledge-service workers to the employable base and widening the hiring pool for voice, non-voice, finance, healthcare and legal BPO roles. At the macro level, India’s population is recorded at 1,395 million in the national accounts, which, combined with per capita GDP of ₹2,12,600, shows a very large, relatively low-income but increasingly skilled workforce that is structurally motivated to engage in services employment. Services-oriented sectors where BPO talent is typically sourced are also expanding: at constant prices, “trade, hotels, transport, communication and services related to broadcasting” generated GVA of ₹29,77,007 crore, while “financial, real estate and professional services” contributed ₹36,15,545 crore, reflecting sustained demand for service skills that can be redeployed into export-oriented BPO.

Market Challenges

Attrition

Strong macro-growth in India’s services and allied sectors intensifies job mobility, creating structural attrition risk for the India BPO Services Market. At constant prices, GVA from “trade, hotels, transport, communication and services related to broadcasting” increased from ₹44,48,156 crore to ₹47,07,728 crore, while “construction” GVA rose from ₹20,27,545 crore to ₹22,21,363 crore, adding competing employment options—often in urban and peri-urban locations where BPO centres are concentrated. Simultaneously, PLFS data shows LFPR moving up to 60.1 and WPR to 58.2, with unemployment dropping to 3.2; this combination of high participation and low unemployment implies that experienced workers can switch employers or sectors relatively easily, raising replacement and retraining costs for BPO operators. Tele-density and connectivity expansion also broaden alternative job avenues: total telephone subscribers increased from 1,172.34 million to 1,199.28 million over one year, with wireless subscribers at 1,165.49 million, giving both gig-work and platform-work models a large reachable base that competes with traditional BPO employment. In practice, this macro environment means BPO providers must invest heavily in career-pathing and upskilling to contain attrition among high-quality process owners and team leaders.

Wage Inflation

Wage pressure in the India BPO Services Market is closely linked to broader inflation and productivity trends. MoSPI’s indicators show the CPI General Index recording a year-on-year change of 6.9 followed by 5.5 in successive financial years, signalling persistent consumer-price pressure that feeds into employee wage expectations, especially in urban BPO hubs with higher living costs. At the same time, per capita PFCE at current prices increased from ₹1,19,277 to ₹1,29,400, and per capita GDP rose from ₹1,96,983 to ₹2,12,600, indicating rising consumption and income levels that gradually move the reservation wage upwards. TRAI data shows monthly ARPU for wireless services climbing from ₹152.55 to ₹153.54 in the quarter ending March, while total wireless data revenue grew from ₹1,74,144 crore to ₹1,86,226 crore between two successive years; this reflects higher spending on digital connectivity that employees treat as essential expenditure. These macro dynamics combine with steady growth in professional-services GVA—“financial, real estate and professional services” at ₹58,26,765 crore—to create an environment where skilled BPO professionals, especially in analytics, finance and healthcare processes, negotiate higher compensation to maintain real incomes, compressing margins for providers.

Opportunities

AI & Analytics-Led BPO

India’s national AI and digital agenda is creating a strong launch-pad for AI- and analytics-rich BPO services. The IndiaAI Working Group under MeitY recommends establishing best-in-class AI compute infrastructure at five locations with 3,000 AI petaflops of capacity, plus 2,500 AI PF of inference farm and 500 AI PF of edge compute systems—an aggregate of 6,000 AI PF dedicated to national AI workloads. These plans sit on top of robust digital rails: TRAI reports 954.40 million internet subscribers, 924.07 million broadband users and 914.13 million wireless internet subscribers as of end-March, ensuring that data-intensive back-office and real-time analytics workloads can be supported from distributed delivery centres. Payment data streams further expand the analytics opportunity; TRAI notes that wireless data usage increased from 1,60,054 petabytes in 2022-23 to 1,94,774 petabytes in 2023-24, while wireless data revenue grew to ₹1,86,226 crore, illustrating the scale of digital behaviour data that enterprises need to analyse and operationalise through outsourced partners. With per capita PFCE at ₹1,29,400 and exports of goods and services showing positive growth, Indian households and firms are generating richer transaction footprints that are ideal for AI-driven customer support, credit decisioning, fraud analytics and omnichannel service BPO.

Industry Platforms

Expanding digital and physical platforms across India are multiplying addressable workloads for the India BPO Services Market. TRAI data shows total internet subscribers reaching 954.40 million, with 924.07 million broadband connections and 398.35 million rural plus 556.05 million urban internet subscribers, confirming that platform-based services now reach deep into both metros and smaller towns. Telephone subscribers grew to 1,199.28 million, with 1,165.49 million on wireless networks, strengthening the base for app-based commerce, mobility, healthcare and fintech platforms that require outsourced customer experience, KYC operations and dispute-resolution support. MoSPI’s main indicators show exports of goods and services posting positive year-on-year change, while cargo handled at major sea ports and passengers handled at airports continued to expand, signalling rising throughput on logistics, travel and e-commerce platforms that increasingly externalise back-office, documentation and claims processing tasks. At the macro level, GVA from “trade, hotels, transport, communication and services related to broadcasting” stands at ₹47,07,728 crore at current prices, and “financial, real estate and professional services” contributes ₹58,26,765 crore, underscoring the depth of platform-intensive verticals—retail, banking, insurance, travel and OTT—where Indian BPO firms can build vertically specialised, transaction-heavy managed-service platforms for global and domestic clients.

Future Outlook

Over the next several years, the India BPO Services Market is expected to show robust growth, driven by increasing adoption of outsourcing by both global enterprises and domestic firms, rising demand for digital-first and analytics-driven services, and continued focus on cost optimization and scalability. The proliferation of cloud-based delivery, AI/automation integration, remote/hybrid working models, and regulatory complexity will further propel demand for specialized BPO services such as analytics, compliance handling, and domain-specific vertical BPO (e.g., healthcare, fintech, regulatory).

Given these dynamics, the market is likely to evolve beyond traditional voice and back-office services into high-value, tech-enabled BPO operations, offering long-term opportunities for both established players and new entrants focusing on niche verticals or advanced capabilities.

Major Players

- Tata Consultancy Services (TCS)

- Genpact Ltd.

- Wipro Limited (BPO / BPM arm)

- Accenture Operations India

- EXL Service

- HCL Technologies (Business Services)

- Infosys BPM

- Tech Mahindra Business Process Services

- Concentrix India

- Teleperformance India

- Firstsource Solutions Ltd.

- Cognizant Technology Solutions (BPO arm)

- Hinduja Global Solutions (HGS)

- Sutherland Global Services India

- WNS Global Services

Key Target Audience

- Chief Investment Officers / Portfolio Managers at Investment & Venture Capital Firms

- Private Equity Fund Managers

- Corporate Strategy / Corporate Development Heads at Enterprises (Global & Indian)

- Global Asset Management Firms with exposure to outsourcing & offshoring sectors

- Shared Services / Global Capability Centre (GCC) Heads at Multinational Corporations

- CFOs & Finance Heads evaluating outsourcing for back-office / finance functions

- Procurement & Operations Heads at firms seeking third-party BPO vendors

- Government & Regulatory Bodies

Research Methodology

Step 1: Identification of Key Variables

We started by mapping out all stakeholders in the India BPO ecosystem — providers, buyers (global clients, Indian enterprises), delivery locations, service lines, and industry verticals. We identified variables like service type mix, delivery footprint, vertical demand, pricing constructs, and automation adoption. Data was collected via industry reports, public filings, and regulatory disclosures.

Step 2: Market Analysis and Construction

Historical data from 2019–2023 was compiled — covering outsourcing revenues, service-line shares, vertical demand, and delivery location growth. We triangulated revenues via reported earnings of leading BPO firms, vendor billing data (where publicly available), and aggregated sector-wide statistics from secondary reports.

Step 3: Expert Validation and Interviews

Hypotheses around growth drivers, demand patterns, and vertical shifts were validated through conversations with industry insiders: delivery-center leads, operations heads in major BPO firms, and procurement/outsourcing decision-makers at client organisations. Insights about evolving demand (e.g., analytics, compliance outsourcing) were cross-checked with providers’ public disclosures.

Step 4: Research Synthesis and Final Output

We consolidated bottom-up and top-down data, validated with expert input, reconciled divergent estimates, and applied normalization (e.g., adjusting for currency fluctuations, multi-currency contracts, and variable utilization) to derive the final revenue size, segmentation shares, and forecast models.

- Executive Summary

- Research Methodology (Market Definitions & Scope, Industry Classification, Market Taxonomy, Abbreviations Used, Assumptions & Normalization Metrics, Top-Down & Bottom-Up Approach, Market Engineering, Primary Research Inputs, Secondary Data Validation, FTE-to-Revenue Calibration Ratios, Productivity Benchmarking Models, Limitations & Data Treatment Methods)

- Definition and Scope

- Market Evolution & Genesis

- Industry Structure & Operating Models

- India’s Position in the Global BPM Landscape

- Business Cycle Analysis

- Value Chain & Process Flow

- Growth Drivers

Cost Advantage

Talent Depth

Digital Adoption

Domain Specialization

Outsourcing Maturity

Captive Expansion - Market Challenges

Attrition

Wage Inflation

Compliance

Infrastructure Gaps

Automation Threats - Opportunities

AI & Analytics-Led BPO

Industry Platforms

Domestic CX Boom

Tier II/III Delivery

Integrated IT+BPO Deals - Technology & Digital Adoption Trends

RPA

Intelligent Automation

Cloud Contact Centers

Conversational AI

GenAI in CX

Data Lakes - Regulatory & Compliance Framework

DPDP Act

GDPR Alignment

HIPAA for Healthcare BPO

BFSI Regulations

Labor Codes - Pricing Trends & Benchmarking

- Stakeholder Ecosystem

- Porter’s Five Forces

- SWOT Analysis

- By Value, 2019-2024

- By Service Line, 2019-2024

- By Vertical Industry, 2019-2024

- By Client Geography, 2019-2024

- By Delivery Model, 2019-2024

- By Service Line (In Value %)

Customer Interaction Services (Voice/Non-Voice CX)

Finance & Accounting BPO

Human Resources Outsourcing

Procurement & Supply Chain BPO

Knowledge Process Outsourcing & Analytics

Healthcare RCM & Insurance Processing - By Industry Vertical (In Value %)

BFSI

Healthcare & Life Sciences

Telecom & Media

Retail & E-Commerce

Technology & Internet Platforms

Travel, Transport & Hospitality - By Client Size (In Value %)

Large Global Enterprises

Mid-Market Companies

Digital-Native Startups

MSME/SME Clients

Government & Public Sector - By Client Geography Served (In Value %)

- North America

Europe

Asia-Pacific

Middle East & Africa

Domestic India - By Delivery Location Model (In Value %)

Metro Tier I Cities (Bengaluru, NCR, Mumbai, Hyderabad, Pune)

Tier II Cities (Indore, Jaipur, Coimbatore, Chandigarh, Kochi, etc.)

Multi-City Delivery Networks

Nearshore Support Hubs

Remote/Hybrid Workforce Delivery - By Commercial Engagement Model (In Value %)

FTE-Based Engagement

Transaction-Based Pricing

Outcome-Based Pricing

Hybrid Commercial Models

BOT (Build-Operate-Transfer)

- Market Share of Major Players (Value/Volume)

- Market Share by Service Line (Value/Volume)

- Cross Comparison Parameters (Company Overview, Business Strategy, Service-Line Strength, Vertical Penetration, Delivery Footprint, Digital & AI Capabilities, Pricing & Commercial Models, SLA/Quality Performance, Client Portfolio Depth, Contract Wins & Renewal Rates)

- SWOT Analysis of Key Players

- Pricing Analysis of Major Players

- Detailed Profiles of Major Companies

Tata Consultancy Services (TCS)

Infosys BPM

Wipro Ltd

HCLTech Business Services

Accenture Operations India

IBM India

Genpact Ltd

WNS Global Services

Tech Mahindra BPS

Teleperformance India

Concentrix India

Firstsource Solutions

EXL Service

Hinduja Global Solutions (HGS)

Sutherland Global Services India

- End-User Classification

- Demand Drivers & Consumption Behavior

- Purchasing Power & Budget Allocation

- End-User Needs, Desires & Pain Points

- Decision-Making Process

- By Value, 2025-2030

- By Service Line, 2025-2030

- By Industry Vertical, 2025-2030

- By Client Geography, 2025-2030

- By Delivery Model, 2025-2030