Market Overview

The India cabin interior composites Market current size stands at around USD ~ million, driven by aircraft induction volumes of ~ units and refurbishment cycles exceeding ~ programs annually. Demand momentum is supported by ~ aircraft deliveries, ~ cabin retrofit projects, and composite penetration rates crossing ~ percent across multiple interior components. Material substitution trends accelerated with ~ programs adopting advanced laminates, while ~ suppliers expanded qualification pipelines. Utilization intensity increased across ~ operational fleets, reinforcing steady consumption baselines.

The market shows strong concentration across aviation hubs such as Bengaluru, Hyderabad, and Nagpur due to aerospace parks, MRO clusters, and skilled composite workforces. Western and southern regions benefit from proximity to airline headquarters, defense establishments, and export-oriented manufacturing zones. Policy support for aerospace localization, certification infrastructure availability, and established supply ecosystems further strengthen these regions. Northern and eastern regions remain demand-led, supported primarily by airline operations and maintenance activities.

Market Segmentation

By Application

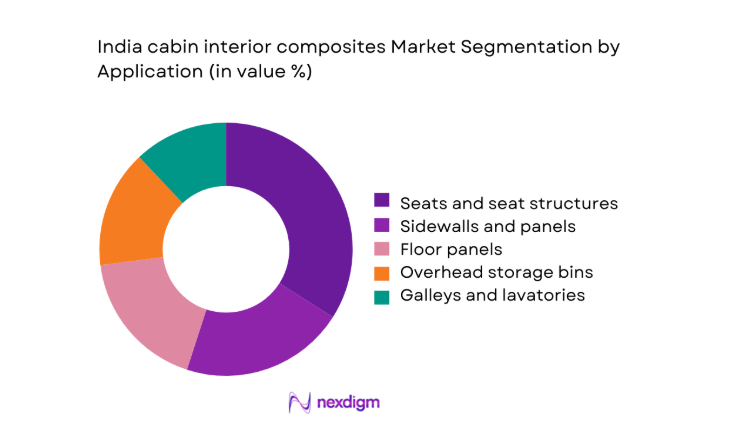

Seats and seat structures dominate the India cabin interior composites Market due to high replacement frequency, stringent weight optimization requirements, and continuous airline-driven configuration changes. In 2024 and 2025, airlines prioritized lightweight seating to improve fuel efficiency across narrow body fleets, directly increasing composite usage intensity. Sidewalls and floor panels followed, supported by regulatory-driven material upgrades and durability requirements. Overhead storage bins and galleys gained traction through modular retrofitting programs, while lavatories remained niche but steady, driven by hygiene-focused refurbishments and lifecycle replacement cycles.

By Fleet Type

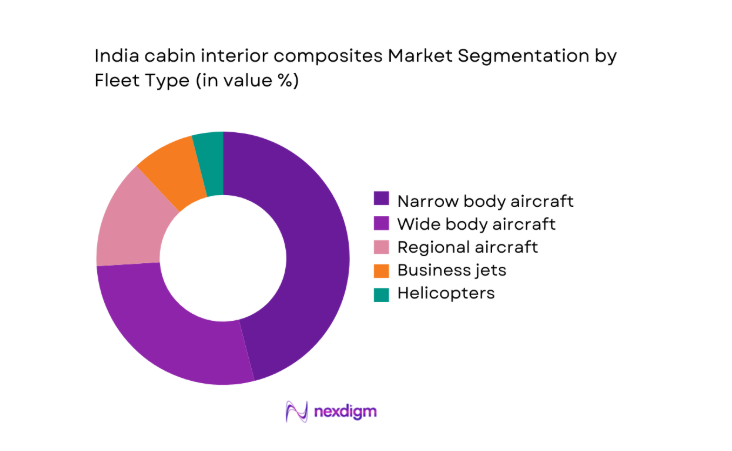

Narrow body aircraft represent the largest fleet type segment, driven by high utilization rates, dense seating layouts, and frequent interior retrofits. In 2024 and 2025, domestic route expansion and low-cost carrier growth amplified composite demand across this fleet category. Wide body aircraft followed, supported by long-haul cabin upgrade programs and premium interior investments. Business jets and helicopters accounted for smaller shares but demonstrated higher customization intensity, while regional aircraft adoption increased gradually with connectivity-focused aviation policies.

Competitive Landscape

The competitive landscape of the India cabin interior composites Market is characterized by a mix of global aerospace interior specialists and emerging domestic manufacturers. Competition is shaped by certification capability, OEM relationships, material technology depth, and aftermarket responsiveness.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Safran Cabin | 1925 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Collins Aerospace | 2018 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Diehl Aviation | 2006 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| FACC AG | 1989 | Austria | ~ | ~ | ~ | ~ | ~ | ~ |

| Jamco Corporation | 1955 | Japan | ~ | ~ | ~ | ~ | ~ | ~ |

India cabin interior composites Market Analysis

Growth Drivers

Rising aircraft deliveries and fleet expansion in India

Aircraft fleet expansion accelerated during 2024 and 2025 as airlines inducted new narrow body aircraft supporting regional connectivity growth. Increased aircraft count directly raised demand for certified cabin interior composite components across multiple interior zones. Fleet utilization intensity remained high, driving faster refurbishment and replacement cycles for composite interior parts. Government support for aviation infrastructure expansion strengthened airline confidence in long-term capacity planning decisions. Domestic travel growth encouraged carriers to standardize interiors, increasing recurring composite material consumption volumes. OEM production ramp-ups supported stable demand visibility for tier suppliers manufacturing interior composite assemblies. Fleet age management strategies emphasized material upgrades rather than full aircraft replacement. Interior retrofitting programs expanded across existing fleets to enhance passenger experience competitiveness. Composite suppliers benefited from predictable delivery schedules aligned with airline induction timelines. Overall fleet expansion remained a foundational structural driver sustaining market momentum.

Increasing focus on lightweight materials for fuel efficiency

Airlines increasingly prioritized lightweight cabin materials during 2024 and 2025 to manage operational efficiency pressures. Composite interiors offered measurable weight reduction compared to traditional metallic or wood-based alternatives. Fuel efficiency improvement initiatives extended beyond airframes into interior architecture decisions. Airlines collaborated with OEMs to redesign seating and panels using advanced composite layups. Lightweight interiors enabled marginal payload improvements across high-frequency domestic routes. Regulatory pressure on emissions indirectly reinforced lightweight material adoption strategies. Composite solutions supported durability without compromising safety and flammability requirements. Interior weight optimization became a competitive differentiation factor among carriers. Maintenance benefits further justified composite adoption across multiple cabin components. Lightweight material focus continued reshaping supplier innovation priorities.

Challenges

High dependence on imported composite raw materials

India’s cabin interior composite supply chain relied heavily on imported prepregs and specialty fibers during 2024 and 2025. Limited domestic production constrained supplier cost control and lead-time flexibility. Currency volatility created procurement uncertainty for interior component manufacturers. Import dependence increased exposure to global logistics disruptions and geopolitical risks. Certification requirements restricted rapid substitution with locally available alternatives. Smaller suppliers faced working capital pressure due to bulk import procurement cycles. Delays in material availability impacted interior production schedules and retrofit timelines. OEMs demanded consistent quality despite supply variability challenges. Import reliance limited scalability during demand surges. Localization efforts remained gradual due to technical complexity barriers.

Stringent certification and qualification requirements

Cabin interior composites are subject to rigorous flammability, smoke, and toxicity standards across aviation programs. Certification timelines often extended product development cycles during 2024 and 2025. Smaller manufacturers faced challenges meeting documentation and testing requirements. Qualification costs increased barriers for new material formulations entering the market. Any design change required revalidation, limiting rapid customization flexibility. Regulatory alignment across international platforms added compliance complexity. OEM audits demanded extensive traceability and process control documentation. Testing facility availability created scheduling bottlenecks for suppliers. Certification risks discouraged aggressive innovation without assured demand commitments. Overall compliance intensity constrained speed-to-market dynamics.

Opportunities

Localization of cabin interior manufacturing under Make in India

Policy initiatives encouraged domestic manufacturing of aerospace components including cabin interiors during 2024 and 2025. Localized production reduced dependency on imported subassemblies and logistics risks. OEMs increasingly evaluated Indian suppliers for interior work packages. Joint ventures enabled technology transfer and certification capability development. Domestic manufacturing supported faster turnaround for retrofit programs. Cost competitiveness improved through local labor and infrastructure advantages. Government incentives strengthened supplier investment confidence. Local production enhanced supply chain resilience for airlines. Indigenous manufacturing aligned with long-term fleet growth expectations. Localization emerged as a structural opportunity reshaping industry economics.

Growing demand for premium cabin upgrades

Airlines expanded premium economy and business class offerings during 2024 and 2025 to improve yield management. Premium cabins required advanced composite interiors with higher customization levels. Aesthetic flexibility of composites supported differentiated brand identities. Airlines invested in cabin refresh cycles to enhance passenger comfort perception. Premium seating structures drove higher composite usage per aircraft. Long-haul route expansion reinforced demand for upgraded interiors. Composite materials enabled integration of lighting and modular features. Passenger experience became a strategic competitive lever. Retrofit demand increased alongside new aircraft deliveries. Premium cabin growth expanded value-added application opportunities.

Future Outlook

The India cabin interior composites Market is expected to benefit from sustained fleet growth and increasing localization through 2035. Regulatory alignment, domestic manufacturing expansion, and evolving airline cabin strategies will shape competitive dynamics. Technological advancements in recyclable and thermoplastic composites are likely to gain prominence. Overall, the market outlook remains structurally positive with moderate innovation-driven differentiation.

Major Players

- Safran Cabin

- Collins Aerospace

- Diehl Aviation

- Jamco Corporation

- FACC AG

- Triumph Group

- Spirit AeroSystems

- GKN Aerospace

- Toray Advanced Composites

- Hexcel Corporation

- Solvay

- Teijin Limited

- SGL Carbon

- Tata Advanced Systems

- Hindustan Aeronautics Limited

Key Target Audience

- Commercial airline operators

- Business jet and charter operators

- Aircraft OEMs and integrators

- Maintenance repair and overhaul providers

- Tier-1 and tier-2 aerospace suppliers

- Investments and venture capital firms

- Ministry of Civil Aviation and Directorate General of Civil Aviation

- Defense aviation procurement agencies

Research Methodology

Step 1: Identification of Key Variables

Identification of key variables focused on aircraft fleet composition, interior component taxonomy, and composite material usage intensity. Demand-side and supply-side parameters were mapped to define market scope clearly.

Step 2: Market Analysis and Construction

Market analysis and construction involved bottom-up assessment of interior applications across fleet types, integrating utilization patterns and refurbishment frequencies to build consistent demand structures.

Step 3: Hypothesis Validation and Expert Consultation

Hypothesis validation and expert consultation were conducted through structured discussions with airline engineers, MRO specialists, and composite manufacturing professionals to validate assumptions.

Step 4: Research Synthesis and Final Output

Research synthesis integrated quantitative modeling with qualitative insights, ensuring internal consistency, logical reconciliation, and preparation of a decision-oriented final output.

- Executive Summary

- Research Methodology (Market Definitions and cabin interior composite scope alignment, aircraft platform and cabin application taxonomy mapping, bottom-up material consumption and component-level market sizing, value attribution across OEM line-fit and aftermarket retrofits, primary interviews with aircraft OEMs tier suppliers and MRO interior specialists, triangulation using fleet delivery data certification databases and import export statistics, assumptions linked to flammability standards localization and airline refurbishment cycles)

- Definition and Scope

- Market evolution

- Usage patterns across commercial and business aviation cabins

- Industry ecosystem and value chain structure

- Supply chain localization and import dependency

- Regulatory and certification environment

- Growth Drivers

Rising aircraft deliveries and fleet expansion in India

Increasing focus on lightweight materials for fuel efficiency

Growth in domestic MRO and cabin refurbishment activities

Adoption of advanced composite materials meeting flammability norms

Expansion of low-cost carriers with high-density cabin layouts - Challenges

High dependence on imported composite raw materials

Stringent certification and qualification requirements

Limited local tier-1 cabin interior manufacturing base

Cost sensitivity of Indian airlines

Long development and validation cycles - Opportunities

Localization of cabin interior manufacturing under Make in India

Growing demand for premium cabin upgrades

Expansion of business jet and regional aircraft fleets

Development of recyclable and sustainable composites

Aftermarket retrofitting and life-extension programs - Trends

Shift toward thermoplastic and recyclable composites

Integration of modular and lightweight interior designs

Increasing outsourcing to tier-2 and tier-3 suppliers

Digital design and simulation in cabin development

Standardization of interior components across fleets - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Narrow body aircraft

Wide body aircraft

Regional aircraft

Business jets

Helicopters - By Application (in Value %)

Seats and seat structures

Sidewalls and panels

Floor panels

Overhead storage bins

Galleys and lavatories - By Technology Architecture (in Value %)

Thermoset composites

Thermoplastic composites

Honeycomb sandwich structures

Fiber reinforced polymer laminates - By End-Use Industry (in Value %)

Commercial aviation

Business and general aviation

Military and government aviation - By Connectivity Type (in Value %)

Connected smart cabin interiors

Conventional non-connected interiors - By Region (in Value %)

North India

West India

South India

East India

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (product portfolio depth, material technology capability, certification and compliance strength, local manufacturing presence, OEM partnerships, aftermarket reach, pricing competitiveness, innovation and R&D intensity)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Safran Cabin

Collins Aerospace

Diehl Aviation

Jamco Corporation

FACC AG

Triumph Group

Spirit AeroSystems

GKN Aerospace

Toray Advanced Composites

Hexcel Corporation

Solvay

Teijin Limited

SGL Carbon

Tata Advanced Systems

Hindustan Aeronautics Limited

- Demand drivers from airlines and aircraft operators

- Procurement and tendering practices with OEMs and MROs

- Key buying criteria including weight cost and certification

- Capital budgeting and financing considerations

- Adoption barriers and operational risk factors

- After-sales support and lifecycle service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035