Market Overview

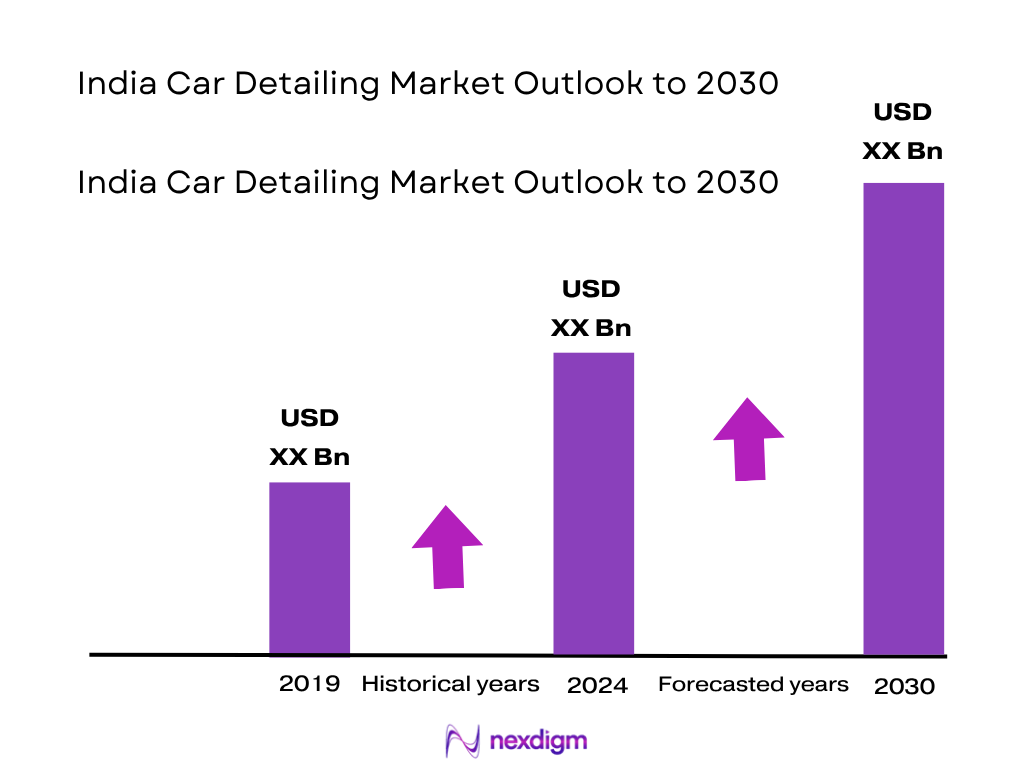

The India car detailing market is valued at INR 3,200 crore, based on a five-year historical analysis and the increasing adoption of premium automotive care services across Tier-1 and metro cities. Demand has been significantly fueled by a rising preference for ceramic coatings and paint protection films (PPF), which are now considered essential for mid-premium to high-end vehicle maintenance. The market has witnessed consistent growth due to a parallel surge in used car sales and a notable shift in consumer attitudes towards vehicle appearance preservation and resale value enhancement. In the previous year, over 18 million car detailing jobs were recorded, with interior cleaning and polishing emerging as the most frequently availed services.

Dominance in the India car detailing market is largely observed in cities such as Delhi NCR, Bengaluru, Mumbai, and Hyderabad. These cities house a substantial population of mid-to-high-end vehicle owners who exhibit greater awareness of surface protection and automotive aesthetics. Moreover, the concentration of service providers, franchise-based detailing chains, and tech-enabled platforms is significantly higher in these urban centers. In contrast, smaller cities continue to experience lower penetration due to limited awareness and price sensitivity, although this is gradually changing with increased mobile-based service availability.

Market Segmentation

By Service Type

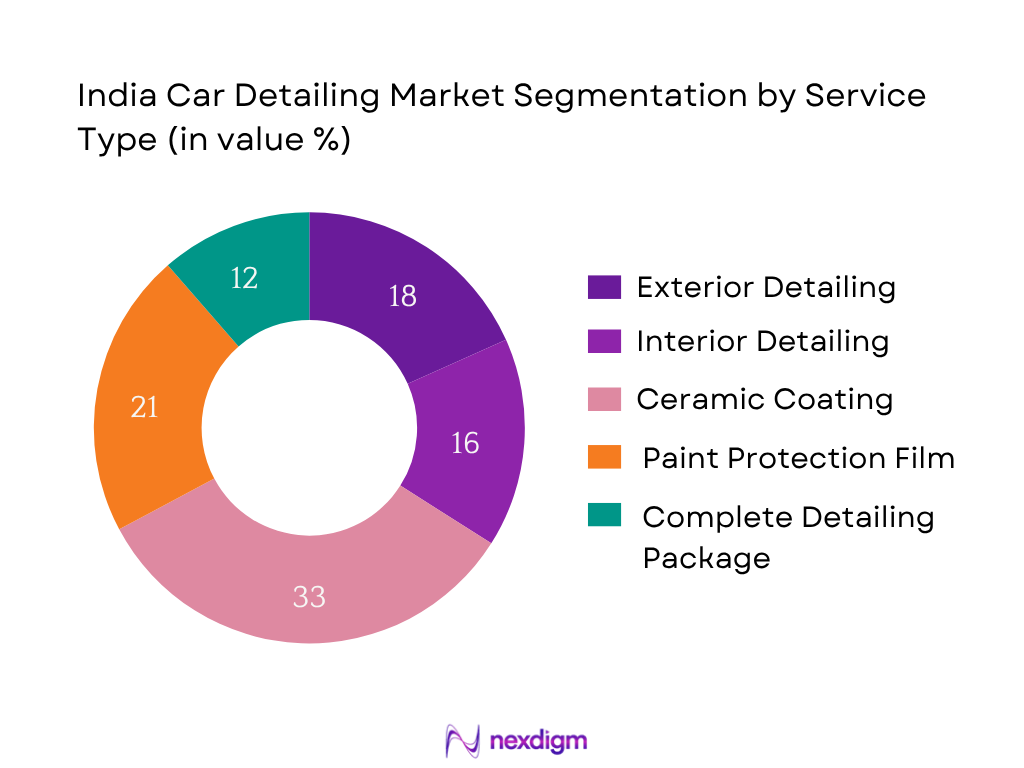

India’s car detailing market is segmented by service type into exterior detailing, interior detailing, ceramic coating, paint protection film (PPF), and complete detailing packages. Among these, ceramic coating currently dominates the segment due to rising consumer awareness of its long-term protection benefits and aesthetic enhancement. High-end car owners and even mid-segment vehicle users have begun favoring ceramic coatings for their hydrophobic and UV-resistant properties. Furthermore, as OEM dealerships and third-party detailing studios increasingly offer ceramic as part of bundled maintenance packages, demand continues to rise. Growing trust in nano-ceramic technologies and extensive promotions by key players have further cemented ceramic coating’s position as the leading sub-segment.

By Vehicle Type

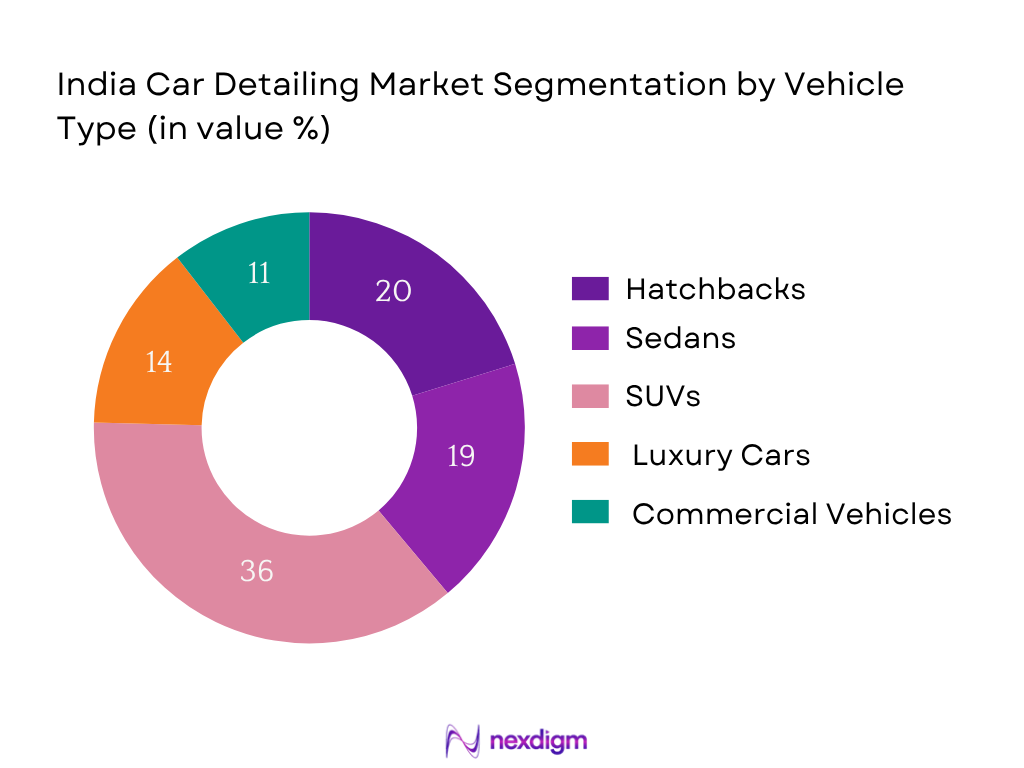

India’s car detailing market is segmented by vehicle type into hatchbacks, sedans, SUVs, luxury cars, and commercial vehicles. SUVs currently lead in terms of detailing service consumption. This is attributed to their rising ownership share and larger surface areas, which make them more susceptible to paint degradation and wear. SUV owners tend to opt for ceramic coatings and PPF more frequently due to the vehicle’s perceived utility and higher on-road value. Additionally, SUV users typically belong to higher income brackets and are more willing to invest in long-term vehicle care. The growth of mid-size SUVs in India’s urban landscape has further amplified this trend, making them the top-performing sub-segment in this category.

Competitive Landscape

The India car detailing market is moderately consolidated with a mix of national chains, OEM-affiliated service centers, and hyperlocal players. Leading franchise-based brands such as 3M Car Care and Detailing Devils dominate the organized sector, while players like GoMechanic and Urban Company are leveraging digital channels and doorstep services to capture market share. The increasing popularity of ceramic and graphene coatings has also encouraged international players to partner with local distributors. The market is evolving from traditional workshop setups to branded, tech-enabled, and convenience-focused platforms, shaping consumer expectations in urban regions.

| Company Name | Establishment Year | HQ Location | No. of Outlets | Core Service Specialization | Tech Integration | Franchise Model | Avg. Ticket Size | Coating Types Offered |

| 3M Car Care | 2008 | Bengaluru | – | – | – | – | – | – |

| Detailing Devils | 2016 | New Delhi | – | – | – | – | – | – |

| CarzSpa | 2006 | Surat | – | – | – | – | – | – |

| Urban Company | 2014 | Gurugram | – | – | – | – | – | – |

| GoMechanic Detailing | 2016 | Gurugram | – | – | – | – | – | – |

India Car Detailing Market Analysis

Growth Drivers

Rising Ownership of Premium and SUV Cars

India’s premium passenger vehicle registrations increased from 4.62 million in FY 22–23 to 5.02 million in FY 23–24, with utility vehicle (SUV) sales rising from 2.004 million to 2.521 million units. SUV owners typically seek detailing services such as ceramic coating and paint protection film (PPF) to preserve larger surface areas and maintain aesthetic appeal, driving higher service consumption. This trend is reinforced by Maharashtra alone registering approximately 450,000 new cars in 2024 , surpassing smaller states. Premium vehicle penetration in metros amplifies demand, with detailing providers expecting repeat service intervals every 6–12 months. Growing SUV stock—over 2.5 million units—is thus a direct impetus for the detailing market.

Surge in Used Car Sales & Resale Value Maintenance

Used vehicle sales reached an estimated 5.41 million units in 2024, exceeding new-car sales of 4.16 million units. Owners prioritize cosmetic and protective detailing before resale to justify asking prices and reduce depreciation. Utility vehicle models comprised around 16.7 percent of all used-car transactions in 2024, highlighting that higher-value vehicles are more frequently serviced. As used car sales continue upward, driven by digitized platforms offering transparent inspections and refurbishing options, detailing plays a crucial role in achieving resale readiness. This rise in pre-owned sales (5.4 million) represents a fundamental component bolstering detailing demand.

Market Challenges

Low Awareness in Tier 2 & 3 Cities

Tier 2 and 3 cities accounted for only about 28 percent of detailing job volumes in 2024, despite owning 48 percent of India’s registered vehicles, per MoRTH RTO data. Low brand presence, limited consumer understanding of advanced detailing methods like ceramic coating, and budget constraints contribute to this gap. In cities outside metropolitan areas, the majority of workshops offer manual washing and waxing, lacking trained technicians and awareness of hydrophobic protection or PPF. For instance, Maharashtra’s rural vehicle registrations totaled over 25 lakh, yet detailing footfall outside Pune/Mumbai remained under 30 percent. Bridging this awareness gap is a significant obstacle to pan‑India market growth.

Fragmentation of Service Providers and Lack of Standards

India’s detailing sector remains highly fragmented: over 70 percent of outlets are individual workshops or local entrepreneurs, according to industry aggregators . Quality variance is significant—consumers report inconsistencies in product usage, service times, and standard protocols—eroding trust. Unlike organized sectors, provider accreditation is rare: fewer than 5 percent of small-scale operations follow standardized training or certification. Fragmentation also leads to price discounting and service duplication, making it difficult for premium brands to scale regionally. Consolidation through franchising, quality mandates, and recognized certifications remains essential to professionalize the sector and improve consumer confidence.

Market Opportunities

EV Adoption Creating New Surface Protection Needs

India recorded 186,000 EV passenger vehicle sales in FY 23–24—up from 135,000 in FY 22–23, per SIAM . EVs often feature premium paint finishes and larger glass surfaces, requiring high-grade protective coatings to minimize micro-abrasions and preserve aesthetics. Additionally, range-conscious EV owners prefer waterless and eco-friendly detailing methods to avoid water use and reduce maintenance cycles. Detailing firms can capitalize on this by introducing EV-specific packages (e.g., ceramic + hydrophobic coatings) that cater to affluent early adopters. Alignment with GoI and state subsidy programs for sustainable transport further enables niche marketing and differentiation through eco-certifications.

Growth of Car Subscription and Leasing Models

In FY 23–24, over 25,000 subscription vehicles were active across India, with a projected fleet exceeding 100,000 by FY 24–25 . Leasing and subscription services require quick turnaround after each cycle, prompting demand for express detailing services optimized for repetitive use. Providers integrated into these models can secure recurring B2B contracts, offering routine refresh detailing every 2–4 months. OEM and rental partnerships seek detailing vendors capable of volume, consistency, and standardized quality. Detailers can tap this avenue by developing scalable bundle programs with subscription platforms and fleet managers to capture recurring revenue streams tied to asset rotations.

Future Outlook

Over the next 5 years, the India car detailing market is expected to show robust expansion, driven by rising vehicle personalization trends, the growth of the premium vehicle segment, and the increasing influence of online service discovery and booking platforms. Additionally, the resale value consciousness among used car owners is prompting more consumers to invest in periodic detailing. As OEMs collaborate with service aggregators and detailing studios to offer maintenance bundles, the sector will likely witness better standardization and trust. Waterless detailing and eco-friendly products are projected to gain more traction due to increasing environmental consciousness. New revenue streams such as annual subscription-based maintenance plans and doorstep high-end detailing kits are expected to emerge, especially in metro cities. Brands that invest in training, digital marketing, and quality assurance protocols will outperform others in capturing consumer loyalty.

Major Players

- 3M Car Care

- Detailing Devils

- CarzSpa

- Urban Company (Auto Services)

- Ceramic Pro India

- Exppress Car Wash

- Auto Herb

- DetailXperts India

- The Detailing Mafia

- GoMechanic Detailing

- Indian Detailing Studio

- Clean Car India

- The Mechanic Store

- Autorack India

- Pitstop Car Services

Key Target Audience

- Automotive Dealerships and OEM-affiliated Service Chains

- Franchise Investors and Auto Service Entrepreneurs

- E-commerce Aggregators in Vehicle Services

- Luxury Car Rental and Leasing Companies

- Used Car Marketplaces and Pre-owned Dealers

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Road Transport and Highways, MoRTH; Automotive Research Association of India – ARAI)

- EV Charging Infrastructure Providers seeking bundled services

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping stakeholders including detailing studios, franchise chains, OEMs, aggregators, and end-consumers. Secondary databases such as SIAM, Autocar India, and proprietary reports were examined to define influential market variables.

Step 2: Market Analysis and Construction

This step included analyzing historical revenue streams from detailing chains and vehicle ownership statistics to derive service consumption patterns. Subscription plan trends and pricing models were assessed to estimate market penetration.

Step 3: Hypothesis Validation and Expert Consultation

CATI interviews were conducted with detailing chain owners, OEM service managers, and auto accessory retailers. These conversations helped validate pricing assumptions, service frequency, and urban versus rural uptake.

Step 4: Research Synthesis and Final Output

Data gathered was synthesized through triangulation and vetted with direct inputs from detailing service partners across Delhi, Bengaluru, and Hyderabad. This ensured cross-verification of market sizing and customer behavior.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Primary Research Interviews, Data Triangulation Techniques, Limitations and Future Assumptions)

- Definition and Scope

- Industry Evolution and Genesis

- Timeline of Market Expansion and Key Entrants

- Demand-Supply Dynamics

- Value Chain and Service Workflow

- Franchise vs Standalone Detailing Models

- Growth Drivers

Rising Ownership of Premium and SUV Cars

Surge in Used Car Sales & Resale Value Maintenance

Urbanization and Rise in Consumer Disposable Income

Demand for Preventive Maintenance over Corrective Repairs - Market Challenges

Low Awareness in Tier 2 & 3 Cities

Fragmentation of Service Providers and Lack of Standards

High Cost of Premium Coating Products (e.g., PPF, Ceramic) - Market Opportunities

EV Adoption Creating New Surface Protection Needs

Growth of Car Subscription and Leasing Models

Strategic Tie-ups with Insurance/Automotive OEMs - Market Trends

Preference for Eco-Friendly and Waterless Detailing

Ceramic Coatings Overtaking Wax and Teflon

Bundled Annual Maintenance Plans for Fleet Operators - Regulatory Landscape

Pollution Norms Impacting Chemical Usage in Detailing

GST Implications for Multi-service Workshops - SWOT Analysis

- Stakeholder Ecosystem Mapping

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Ticket Size per Service, 2019-2024

- By Service Type (In Value %)

Exterior Detailing

– Pressure Washing & Foam Cleaning

– Claying & Polishing

– Waxing & Sealants

– Headlight Restoration

– Interior Detailing

Upholstery Vacuuming

– Dashboard & Panel Cleaning

– Leather Conditioning

– Cabin Sanitization

Ceramic Coating

– 1-Year Coating

– 3-Year Coating

– 5-Year Coating

– Graphene Ceramic Coating

Paint Protection Film (PPF)

– Gloss Finish PPF

– Matte Finish PPF

– Self-Healing PPF

– Partial PPF (e.g., Bonnet, Bumper)

Complete Detailing Packages

– Basic Combo (Interior + Exterior)

– Premium Combo with Ceramic/PPF

– Annual Maintenance Packages - By Vehicle Type (In Value %)

Hatchbacks

– Entry-Level

– Premium Hatchbacks

Sedans

– Compact Sedans

– Mid-size & Executive Sedans

SUVs

– Compact SUVs

– Full-Size SUVs

Luxury Cars

– Premium Sedans

– Premium SUVs

Commercial Vehicles

– Taxis

– Fleet Cars

– Utility Vans - By Service Provider Type (In Value %)

Multi-brand Detailing Chains

OEM-affiliated Centers

Independent Local Workshops

Mobile Detailing Services

E-commerce Aggregators - By Distribution Channel (In Value %)

Offline Retail (In-Shop Services)

– Walk-In Workshops

– Malls & Fuel Station Outlets

Online Booking Platforms

– Aggregator Websites

– OEM Service Portals

Subscription-Based Services

– Monthly/Quarterly Cleaning Packages

– Annual Ceramic/PPF Maintenance

Doorstep/Mobile App-based Services

– Urban Company, AutozSpa Mobile

– Location-Based On-Demand Services - By Region (In Value %)

North India

South India

West India

East India

Central India

- Market Share of Major Players (Value & Volume), By Service Type, By Booking Channel

- Cross Comparison Parameters (Company Overview, Business Model, Number of Service Centers/Touchpoints, Revenue by Service Type, Pricing Strategy, Product Portfolio Breadth, Technology Adoption, Customer Retention & Loyalty Program Metrics, Unique Selling Proposition, Others)

- SWOT Analysis of Major Players

- Comparative Pricing by Service Type (Across SKUs)

- Detailed Company Profiles

3M Car Care

Detailing Devils

The Detailing Mafia

CarzSpa

Urban Company (Auto Services Vertical)

Ceramic Pro India

Exppress Car Wash

Auto Herb

DetailXperts India

Autorack India

Clean Car India

The Mechanic Store

GoMechanic (Car Detailing Division)

Indian Detailing Studio

Pitstop Car Services

- Consumer Profiles and Usage Frequency

- Tier-1 vs Tier-2/3 City Behavioral Comparison

- Factors Influencing Purchase Decisions

- Pricing Sensitivity and Willingness to Pay

- Demand Seasonality and Peak Booking Patterns

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Ticket Size per Service, 2025-2030