Market Overview

As of 2024, the India car rental and leasing market is valued at USD ~ billion, with a growing CAGR of 14.7% from 2024 to 2030, driven by the rising trend of urbanization, increased disposable income, and a growing interest in travel experiences. As consumers opt for rental services to avoid the burdens of ownership costs and maintenance, the market demonstrates a promising trajectory, particularly in metropolitan areas where accessibility to varied transportation options is vital.

Dominant cities in this market include Mumbai, Delhi, and Bangalore, which play a substantial role due to their economic activity, dense populations, and tourism influx. The urban landscape in these cities is marked by high demand for flexible transportation solutions, contributing to the dominance of car rental services that cater to both personal and corporate needs.

Market Segmentation

By Vehicle Type

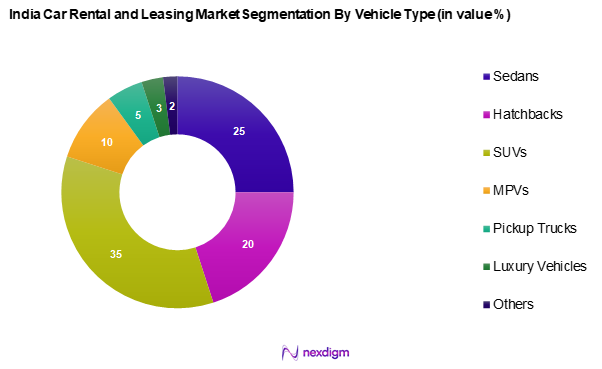

India’s car rental market is segmented into sedans, SUVs, hatchbacks, MPVs, pickup trucks, luxury vehicles, and others. SUVs have emerged as a leading segment due to their versatility, spacious interiors, and suitability for both urban and off-road driving conditions. The growing preference for adventure and leisure travel has elevated SUVs’ appeal among consumers, thereby solidifying their position within the market.

By Rental Duration

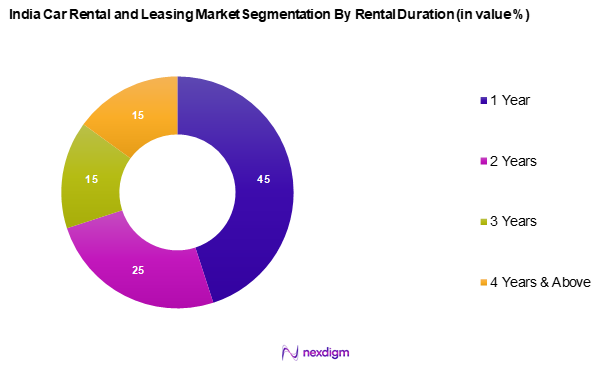

India’s car rental market is segmented into 1 year, 2 years, 3 years, and 4 years & above. The dominant market share is held by the 1-year rental duration, which is largely favored by corporate clients seeking flexibility and cost-effectiveness during project assignments. This preference reflects a shifting trend towards temporary, yet long-term, vehicle availability, catering to dynamic corporate needs and mobility requirements.

Competitive Landscape

The India car rental and leasing market is dominated by a few key players, including companies like Zoomcar and Ola Electric Mobility Pvt Ltd. This competitive consolidation points to the significant influence of these well-established brands, which have cultivated strong consumer recognition and trust.

| Company | Establishment Year | Headquarters | Revenue

(USD Mn) |

Number of Locations | Business Strategy | Market Share % | Weakness |

| Zoomcar | 2013 | Karnataka, India | – | – | – | – | – |

| Ola Electric Mobility Pvt Ltd. | 2010 | Karnataka, India | – | – | – | – | – |

| Avis | 1946 | Maharashtra, India | – | – | – | – | – |

| Revv | 2015 | Haryana, India | – | – | – | – | – |

| Savaari Car Rentals | 2006 | Karnataka, India | – | – | – | – | – |

India Car Rental and Leasing Market Analysis

Growth Drivers

Increasing Travel and Tourism

India’s travel and tourism sector has seen a strong resurgence in recent years, especially with the rebound in domestic travel post-pandemic. The increasing frequency of both business and leisure trips has heightened the demand for accessible transportation services. Car rental offerings are emerging as essential solutions, especially in tourist-heavy regions and tier-2 and tier-3 cities, where public transport may be limited or less convenient. The growing tourism footprint in the country is playing a vital role in supporting the upward trajectory of the car rental and leasing market.

Digital Adoption in Booking Systems

The growing adoption of digital technologies is transforming the way car rental services are accessed and used. With a widespread preference for mobile apps and online platforms, consumers now expect seamless and instant booking options. This behavioral shift toward digital convenience has encouraged car rental firms to innovate, offering user-friendly interfaces and flexible rental plans. The widespread use of smartphones and internet connectivity is enabling deeper market penetration, especially among tech-savvy urban customers, further accelerating industry growth.

Market Challenges

Competition from Ride-Sharing Services

Ride-sharing platforms have gained immense popularity due to their affordability and ease of use, presenting stiff competition to traditional car rental services. Consumers often perceive ride-hailing as a more convenient option, particularly for short-term or one-off trips. This shift in preference is compelling rental companies to reassess their value propositions, customer engagement strategies, and service models in order to remain competitive in a rapidly evolving urban mobility landscape.

Maintenance and Operational Costs

Operational overheads remain a key concern for car rental service providers. The rising cost of vehicle maintenance, repairs, and fluctuating fuel prices are putting pressure on profitability. These challenges often lead to increased rental rates, which can deter price-sensitive customers and impact customer retention. Maintaining a large and diverse fleet also demands robust logistics and efficient inventory management, both of which require significant investment and planning.

Opportunities

Expansion of Electric Fleet

With growing policy support and public interest in electric mobility, car rental companies are increasingly exploring the inclusion of electric vehicles in their fleets. This shift aligns with national goals aimed at reducing vehicle emissions and promoting sustainable transport. Electric vehicles offer the dual benefit of lower running costs and environmental sustainability, making them an attractive proposition for both providers and consumers. Companies tapping into this trend stand to gain a competitive edge in a market that is steadily leaning toward green alternatives.

Growing Demand for Sustainable Mobility

There is a noticeable rise in consumer consciousness around sustainability and eco-friendly choices. Rental providers that align their offerings with these values—through the adoption of cleaner vehicles, carbon offset initiatives, and eco-conscious branding—are likely to appeal to a new segment of environmentally aware customers. This presents a significant opportunity for market differentiation and long-term brand loyalty, particularly as more urban travelers opt for responsible and green travel options.

Future Outlook

Over the next five years, the India car rental and leasing market is expected to demonstrate substantial growth, driven by the continuous evolution of consumer preferences, technological advancements in booking applications, and an increasing focus on sustainable transportation solutions. The market is influenced by urbanization trends and the rise in travel and tourism, as well as infrastructural improvements across the country that encourage greater accessibility to rental services.

Major Players

- Zoomcar

- Ola Electric Mobility Pvt Ltd.

- Avis

- Revv

- Savaari Car Rentals

- MyChoize

- Drivezy

- Eco Rent A Car

- Tata Motors Finance Ltd.

- ORIX Corporation India Limited

- AJAY CAR RENTAL INDIA PRIVATE LIMITED

- WTicabs

- Uber Rentals

- ALD Automotive

- Volkswagen

Key Target Audience

- Investment and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Road Transport & Highways)

- Corporate Clients and Enterprises

- Tourism and Travel Agencies

- Fleet Management Companies

- Automobile Manufacturers

- Event Management Companies

- Logistics and Transportation Enterprises

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map that encompasses all major stakeholders within the India car rental and leasing market. This step is underpinned by extensive desk research which utilizes a combination of secondary sources, including digital databases, industry reports, and news articles, to gather comprehensive industry-level information. The primary goal is to identify and define the critical variables that affect market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data related to the India car rental and leasing market will be compiled and analyzed. This includes assessing market penetration, the ratio of service providers to demand, and the resultant revenue generation. Additionally, an evaluation of various service quality statistics will be conducted to ensure that the revenue estimates are both reliable and accurate.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through interviews with industry experts representing various companies within the car rental sector. These consultations will yield valuable operational and financial insights from seasoned practitioners, which are vital for refining and corroborating market data.

Step 4: Research Synthesis and Final Output

The final phase includes direct engagement with numerous car rental and leasing companies to acquire detailed insights into their product offerings, sales performance, consumer preferences, and relevant market factors. This interaction is essential to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive and accurate analysis of the India car rental and leasing market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Travel and Tourism

Digital Adoption in Booking Systems - Market Challenges

Competition from Ride-Sharing Services

Maintenance and Operational Costs - Opportunities

Expansion of Electric Fleet

Growing Demand for Sustainable Mobility - Trends

Integration of AI in Customer Services

Increasing self-drive rentals - Government Regulation

Licensing and Compliance

Environmental Standards - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Daily Rental Rate, 2019-2024

- By Vehicle Type, (In Value %)

Sedans

Hatchback

SUVs

MPVs

Pickup Trucks

Luxury Vehicles

Others - By Rental Duration, (In Value %)

1 Year

2 Year

3 Year

4 Years & Above - By End-user Type, (In Value %)

Individual Consumers

Corporate Clients

Oil and Gas

Government militaries & ministries

Construction

Logistics and Transportation

Others - By Fuel Type, (In Value %)

Petrol

Diesel

Electric

CNG - By Booking Type, (In Value %)

Offline Booking

Online Booking - By Services Type, (In Value %)

Airport Transfers

Interstate Services

Intrastate Services - By Rental Type, (In Value %)

Business Rental

Chauffeur Drive

Self-Driving

Special Events - By Market Structure, (In Value %)

Organized

Unorganized

- Market Share of Major Players by Value/Volume, 2024

Market Share of Major Players by Type of Vehicle Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths and Weaknesses, Revenue, Distribution Channels, Number of Locations, and Others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Avis

Zoomcar Ltd.

AJAY CAR RENTAL INDIA PRIVATE LIMITED

WTicabs

Revv

MyChoize

Ola Electric Mobility Pvt Ltd.

Uber Rentals

Savaari Car Rentals

Drivezy

Eco Rent A Car

ORIX Corporation India Limited

SMAS Auto Leasing India Pvt. Ltd.

ALD Automotive

Tata Motors Finance Ltd.

Volkswagen

ZiT Car Rental

Others

- Market Demand and Utilization Rate

- Purchasing Power and Behavioural Insights

- Regulatory Compliance and Customer Preferences

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Daily Rental Rate, 2025-2030