Market Overview

The India combats vehicle systems market current size stands at around USD ~ million, reflecting steady procurement momentum driven by armored fleet modernization and upgrades of legacy platforms. Demand is shaped by operational readiness requirements, indigenization priorities, and integration of advanced vetronics, optronics, and protection systems. Budgetary allocations and multi-year acquisition programs sustain procurement continuity, while lifecycle support contracts and retrofit programs reinforce aftermarket activity. Indigenous development initiatives strengthen domestic supply chains and expand integration capabilities across platforms.

Demand concentration is highest across northern and western operational commands with dense deployment of armored formations and testing ranges. Urban industrial clusters with mature defense manufacturing ecosystems anchor production and integration activity, supported by co-development corridors and test facilities. Infrastructure readiness around proving grounds, ordnance depots, and maintenance hubs accelerates deployment cycles. Policy emphasis on domestic sourcing and platform standardization strengthens ecosystem maturity, while regional supply chains and integrator networks shape procurement execution.

Market Segmentation

By Platform Type

Platform demand is dominated by main battle tanks and infantry fighting vehicles due to sustained fleet upgrades, mobility requirements across diverse terrains, and integration of advanced fire control and protection systems. Wheeled armored platforms gain traction for rapid response and internal security missions, while self-propelled artillery modernization supports networked fires. Unmanned ground vehicles remain niche, driven by trials and pilot deployments. Platform-specific upgrade pathways and retrofit cycles influence procurement prioritization, with tracked platforms retaining dominance due to survivability requirements and legacy fleet sustainment needs.

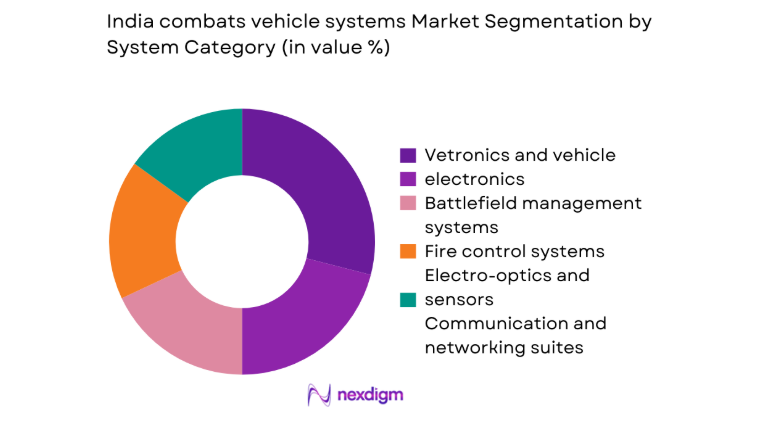

By System Category

System demand is led by vetronics and battlefield management systems as platforms transition toward network-centric operations. Fire control and electro-optics adoption remains strong to improve first-hit probability and night-fighting capability. Communication and networking suites gain priority for secure interoperability across formations. Active protection systems adoption expands through retrofit programs on frontline platforms. Integration complexity and software-defined architectures elevate system-level procurement over standalone components, reinforcing the role of integrators and long-term sustainment contracts.

Competitive Landscape

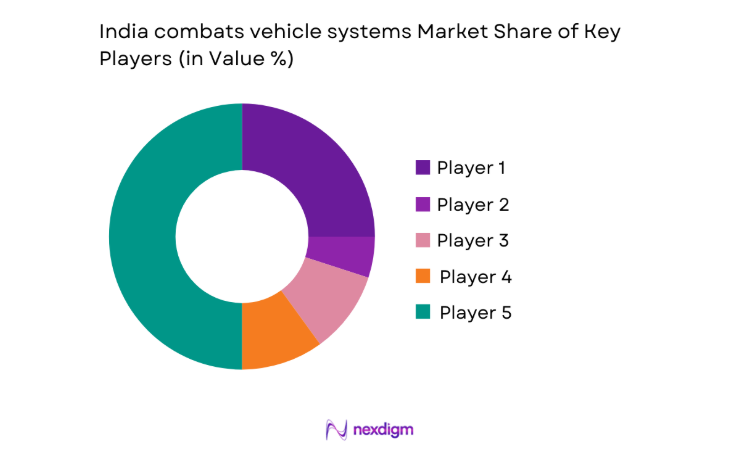

The competitive environment features a mix of domestic integrators and global system suppliers collaborating under indigenization frameworks, with competition centered on platform integration depth, lifecycle support, and compliance readiness for defense procurement pathways.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Larsen & Toubro Defence | 1938 | India | ~ | ~ | ~ | ~ | ~ | ~ |

| Tata Advanced Systems | 2010 | India | ~ | ~ | ~ | ~ | ~ | ~ |

| Bharat Electronics Limited | 1954 | India | ~ | ~ | ~ | ~ | ~ | ~ |

| Mahindra Defence Systems | 2015 | India | ~ | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

India combats vehicle systems Market Analysis

Growth Drivers

Modernization of armored fleet under FRCV and FICV programs

Fielded armored formations operate across 14 corps areas with 2 major strike corps prioritizing platform renewal. Acceptance trials covered 18 configurations between 2022 and 2025, expanding digital fire control integration across 6 regiments annually. The induction pipeline scheduled 120 tracked vehicles for user trials, while 24 mobility trials were conducted across desert and high-altitude terrains. Networked command integration linked 9 brigade headquarters to armored battalions. Indigenous content thresholds increased from 50 to 60 across subsystems. Testing throughput at 3 proving grounds rose, enabling parallel validation cycles and faster configuration freezes for series production readiness.

Rising border tensions and asymmetric warfare requirements

Forward deployments across 2 active fronts required sustained mobility across 4 terrain classes, prompting upgrades to survivability and night-fighting capabilities. Thermal imager fitment expanded to 8 battalion equivalents annually between 2022 and 2025. Counter-drone trials integrated 12 sensor nodes per formation for convoy protection. Electronic countermeasure suites were validated across 5 operational exercises with live-network integration. Maintenance cycles compressed from 180 to 120 days for frontline units, improving availability. Crew training throughput increased to 1,200 personnel annually, enabling rapid assimilation of upgraded vetronics and command systems across operational brigades.

Challenges

Delays in procurement approvals and tender cycles

Capital acquisition approvals experienced deferrals across 3 annual budget cycles, with 14 RFP amendments issued between 2022 and 2025. Technical evaluation committees reconvened 6 times for specification clarifications on fire control and protection suites. User trials extended across 2 seasons due to environmental compliance, adding 90 days per iteration. Contracting timelines stretched as 4 offset clarifications were raised per program. Indigenization audits added 2 compliance layers to documentation. Vendor pre-qualification reviews expanded to 18 criteria, increasing bid preparation timeframes and delaying series production decisions across multiple configurations.

Dependence on imported subsystems and critical components

High-dependence components across sensors, processors, and power modules accounted for 7 critical line items per platform configuration during 2022 to 2025. Export control compliance reviews triggered 11 documentation cycles for integration approvals. Lead times for specialized optics extended to 36 weeks, affecting integration schedules. Qualification of alternate sources required 4 test campaigns per component class. Localization pilots validated 3 domestic substitutes but required 2 additional environmental test cycles. Certification backlogs across 5 labs constrained throughput, delaying acceptance testing and increasing platform integration complexity during fielding windows.

Opportunities

Localization of vetronics and optronics manufacturing

Domestic electronics clusters expanded cleanroom capacity by 6 lines between 2022 and 2025, supporting ruggedized computing assembly. Qualification of 4 locally fabricated boards met shock and vibration thresholds across 3 terrain profiles. Optical assembly localization achieved 2 production batches per quarter for panoramic sights. Software-defined architecture pilots integrated 5 modular interfaces, enabling faster upgrades. Workforce skilling added 420 certified technicians across integration centers. Test automation reduced validation cycles by 20 days per configuration, improving readiness for serial integration and accelerating sustainment upgrades across deployed platforms.

Retrofit and life extension of legacy T-72 and BMP fleets

Legacy fleets across 18 regiments underwent phased upgrades with 2 retrofit kits validated per platform family from 2022 to 2025. Power management retrofits improved auxiliary availability across 9 battalions. Digital fire control upgrades completed 4 acceptance campaigns with live-fire validation. Survivability enhancements added 3 modular protection packages for varied threat profiles. Depot-level turnaround improved by 30 days through standardized kits. Fleet availability rose as preventive maintenance intervals aligned to 120-day cycles, enabling sustained operational readiness while extending platform serviceability across multiple formations.

Future Outlook

The India combats vehicle systems market outlook centers on accelerated indigenization, modular open architectures, and phased fleet renewal through the next decade. Platform upgrades will prioritize networked command integration, survivability enhancements, and sustainment efficiency. Procurement pathways are expected to stabilize as testing throughput improves and localization deepens, supporting scalable upgrades and lifecycle programs.

Major Players

- Larsen & Toubro Defence

- Tata Advanced Systems

- Bharat Electronics Limited

- Bharat Dynamics Limited

- Mahindra Defence Systems

- Armoured Vehicles Nigam Limited

- Rheinmetall Defence

- BAE Systems

- General Dynamics Land Systems

- Elbit Systems

- Rafael Advanced Defense Systems

- Thales Group

- Saab AB

- Hanwha Defense

- Kalyani Strategic Systems

Key Target Audience

- Ministry of Defence, Department of Defence Production

- Indian Army Armoured Corps Directorate

- Directorate General of Quality Assurance

- Defence Research and Development Organisation program offices

- State police special armed units procurement wings

- Platform integrators and system integrators

- Tier-1 and Tier-2 subsystem manufacturers

- Investments and venture capital firms

Research Methodology

Step 1: Identification of Key Variables

Operational requirements, platform families, subsystem architectures, and integration pathways were mapped through structured program documentation reviews. Deployment environments and lifecycle sustainment parameters were identified to frame system performance variables and qualification thresholds.

Step 2: Market Analysis and Construction

Program pipelines, retrofit cycles, and platform roadmaps were synthesized to construct demand pathways. Supply ecosystem capabilities were mapped across integration readiness, test infrastructure access, and compliance workflows.

Step 3: Hypothesis Validation and Expert Consultation

Assumptions on integration velocity, localization feasibility, and sustainment cycles were stress-tested through expert consultations across operations, maintenance, and certification functions. Field feedback loops informed refinement of platform-level constraints.

Step 4: Research Synthesis and Final Output

Findings were consolidated into platform, system, and ecosystem narratives, ensuring internal consistency across demand drivers, constraints, and opportunity pathways.

- Executive Summary

- Research Methodology (Market Definitions and scope of combat vehicle platforms and onboard systems in India, Primary interviews with MoD procurement officials OEM program heads and DPSU engineers, Analysis of defense capital acquisition budgets RFPs and DAC approvals)

- Definition and Scope

- Market evolution

- Operational deployment pathways

- Ecosystem structure

- Defense supply chain structure

- Growth Drivers

Modernization of armored fleet under FRCV and FICV programs

Rising border tensions and asymmetric warfare requirements

Increased defense capital outlay for land systems - Challenges

Delays in procurement approvals and tender cycles

Dependence on imported subsystems and critical components

Complex trials and qualification processes - Opportunities

Localization of vetronics and optronics manufacturing

Retrofit and life extension of legacy armored platforms

Co-development with global OEMs under ToT frameworks - Trends

Adoption of active protection systems on MBTs and IFVs

Shift toward modular open architecture vetronics - Government Regulations

- SWOT Analysis

- Porter’s Five Forces

- By Value, 2020–2025

- By Shipment Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Platform Type (in Value %)

Main battle tanks

Infantry fighting vehicles

Armored personnel carriers

Light armored vehicles and MRAPs - By System Category (in Value %)

Vetronics and vehicle electronics

Fire control systems

Electro-optics and sensors

Battlefield management systems

Active protection systems

Communication and networking suites - By Mobility and Powertrain (in Value %)

Tracked platforms

Wheeled platforms

Hybrid-electric drive systems

Auxiliary power units - By End User (in Value %)

Indian Army

Paramilitary forces

State armed police forces

Defense R&D and test units - By Procurement Mode (in Value %)

Indigenously developed and manufactured

Licensed production

Direct imports

- Market share of major players

- Cross Comparison Parameters (platform coverage, indigenization depth, ToT partnerships, lifecycle support capability, manufacturing footprint in India, system integration expertise, cost competitiveness, compliance with MoD procurement categories)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Larsen & Toubro Defence

Tata Advanced Systems

Bharat Electronics Limited

Bharat Dynamics Limited

Mahindra Defence Systems

Ordnance Factory Board

Armoured Vehicles Nigam Limited

Rheinmetall Defence

BAE Systems

General Dynamics Land Systems

Elbit Systems

Rafael Advanced Defense Systems

Thales Group

Saab AB

Hanwha Defense

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- By Value, 2026–2035

- By Shipment Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035