Market Overview

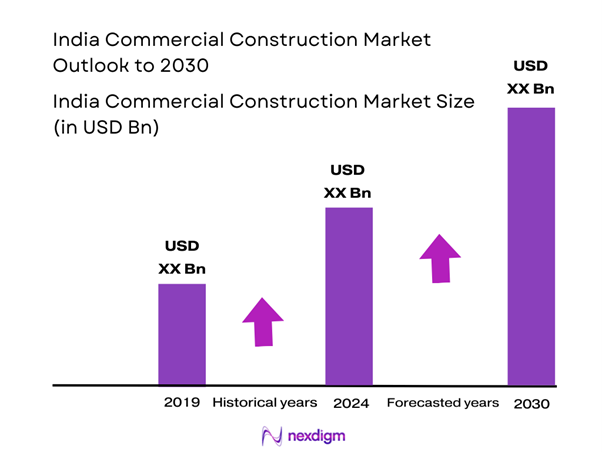

The India Commercial Construction Market is valued at USD 192 billion, driven by rapid urbanization, increasing investments in infrastructure, and a growing demand for commercial spaces. This growth is supported by government initiatives such as the Smart Cities Mission and various infrastructure projects.

Key cities dominating the India Commercial Construction Market include Mumbai, Delhi, Bengaluru, and Hyderabad. These metropolitan areas exhibit high demand for commercial real estate due to their economic significance and concentration of businesses. Factors contributing to this dominance include robust urbanization rates, bustling economic activities, and substantial foreign direct investment, which continue to stimulate the commercial construction landscape in these regions.

The Indian government continues to promote the commercial construction sector through supportive regulations and incentives. The introduction of the Goods and Services Tax (GST) consolidated various indirect taxes into a single tax structure, greatly simplifying compliance for the construction industry. Additionally, various states are offering capital investment subsidies, with initiatives such as the Production-Linked Incentive (PLI) scheme, aimed at attracting investments in infrastructure. As a result, construction permits are processed faster, leading to a reported 30% decrease in approval timeframes in urban areas, which facilitates quicker project launches.

Market Segmentation

By Project Type

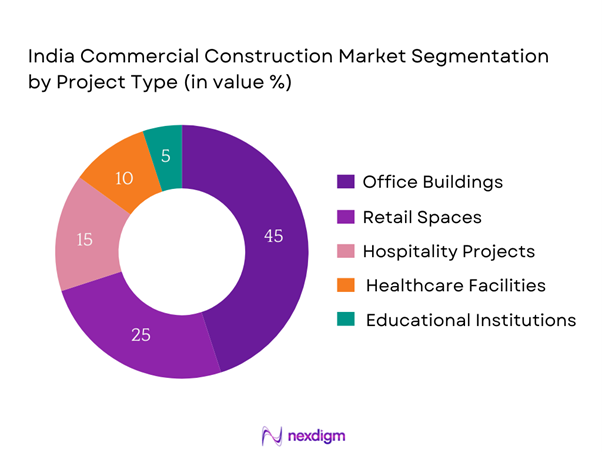

The India Commercial Construction Market is segmented by project type into office buildings, retail spaces, hospitality projects, healthcare facilities, and educational institutions. Among these, office buildings represent the largest sub-segment due to the rapid growth of the IT and ITES sectors in major urban centers. The demand for flexible and modern workspace solutions has led to the development of many office complexes. Also, with multinational companies increasingly establishing their operations in India, the need for high-quality office spaces continues to rise.

By Material Type

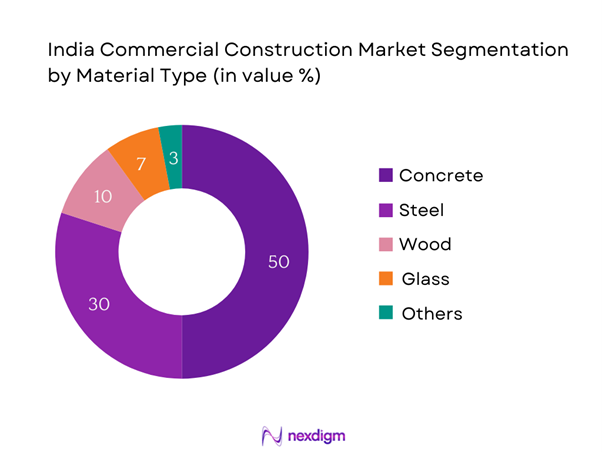

The market is also segmented by material type, consisting of concrete, steel, wood, glass, and others. Concrete holds the dominant position in this segment, as it is the primary material used in constructing durable and stable commercial structures. The versatility and strength of concrete make it the material of choice for office buildings, shopping malls, and other large-scale projects. Additionally, the rapid urbanization and increasing number of construction projects further enhance the demand for concrete in the commercial construction space.

Competitive Landscape

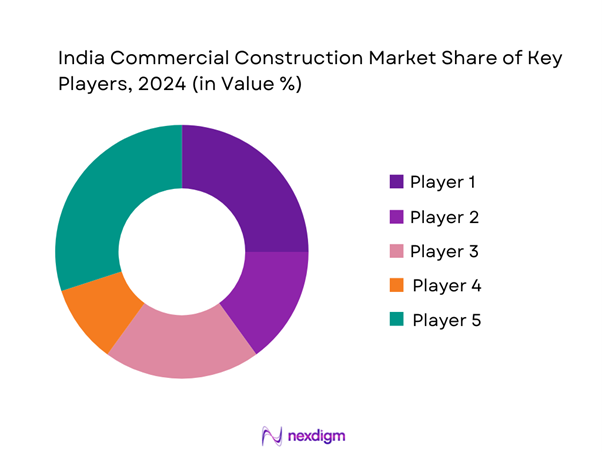

The India Commercial Construction Market is characterized by the presence of several established players, creating a competitive environment. Some major companies include Larsen & Toubro, Shapoorji Pallonji Group, DLF Limited, and Godrej Properties. These companies have a substantial footprint due to their extensive portfolios and proven track records in delivering large-scale projects. Additionally, their deep understanding of the local market dynamics allows them to navigate regulatory landscapes effectively.

| Company Name | Establishment Year | Headquarters | Revenue (USD) | Key Project Types | Market Segment |

| Larsen & Toubro | 1938 | Mumbai | – | – | – |

| Shapoorji Pallonji Group | 1865 | Mumbai | – | – | – |

| DLF Limited | 1946 | New Delhi | – | – | – |

| Godrej Properties | 1990 | Mumbai | – | – | – |

| GMR Group | 1978 | Bengaluru | – | – | – |

India Commercial Construction Market Analysis

Growth Drivers

Urbanization Trends

India is experiencing rapid urbanization, with approximately 31% of its population residing in urban areas as of 2023. The UN projects that by 2030, this figure will increase to around 40%. Urban centers are driving demand for commercial spaces due to economic activities and enhanced infrastructure. In 2022, urban centers contributed approximately 63% of India’s GDP, underscoring the economic significance of these areas. The World Bank highlights that urbanization can add nearly 30% to GDP growth through increased productivity and innovation, positioning urbanization as a key driver for the commercial construction sector.

Infrastructure Development Focus

Infrastructure development is a priority area for the Indian government, reflected in the allocation of INR 10 trillion for infrastructure projects in the recent budget. Key initiatives such as the National Infrastructure Pipeline (NIP) aim to catalyze growth in various sectors by end of 2025, including transport, energy, and urban infrastructure. With an estimated USD 1.4 trillion required for infrastructure investments by end of 2025, this focus is expected to stimulate the commercial construction sector significantly. The economic corridor projects are anticipated to create about 100 million jobs by end of 2025, further bolstering demand for commercial spaces.

Market Challenges

Labor Shortages

India’s commercial construction sector faces increasing labor shortages, with a reported 15% decline in the skilled labor workforce due to migration and other factors by 2022. As infrastructure projects ramp up, the need for skilled workers is projected to grow, leading to significant gaps in workforce availability. The Ministry of Skill Development and Entrepreneurship reported that about 60% of the workforce in the construction sector lacks formal training, leading to a reduced capacity to meet the rising demands of the industry. This shortage is a significant constraint on project timelines and overall productivity.

Material Price Volatility

Material price volatility poses challenges for the commercial construction market, with costs for fundamental materials such as steel and cement increasing by more than 10% in 2022. Influenced by global supply chain disruptions and rising demands, these fluctuations threaten profit margins and project timelines. The Commodity Markets Outlook publication by the World Bank has noted that fundamental raw material prices are projected to remain volatile through 2024, affecting the construction industry directly. Furthermore, manufacturers are experiencing increased costs primarily due to inflationary pressures, impacting project estimates.

Opportunities

Green Building Initiatives

The increasing emphasis on sustainability presents significant opportunities in the commercial construction market through green building initiatives. In India, the green building market has been growing, with over 2,900 registered green building projects and a combined area of approximately 7.8 billion square feet. Government policies promoting eco-friendly construction practices aim to elevate this number, with more than 40% of potential new builds expected to comply with green standards. The commitment to a 30% reduction in carbon emissions by 2030 provides further incentive for incorporating sustainable practices in new developments.

Rise of Smart Buildings

The concept of smart buildings is gaining traction in India, based on the growing need for technology integration. The market for smart buildings is projected to expand significantly. Smart buildings utilize IoT devices and energy management systems to enhance operational efficiency. With a current penetration rate of approximately 8% in urban commercial spaces, this figure is projected to rise rapidly due to increasing awareness of energy savings and operational efficiencies through smart technologies.

Future Outlook

Over the next five years, the India Commercial Construction Market is expected to show significant growth propelled by ongoing government initiatives focused on infrastructure development, rising urbanization, and an increase in private and foreign investments. The demand for sustainable and modern commercial spaces is expected to drive innovative construction technologies and practices. This sustained growth trajectory suggests a robust environment for stakeholders involved in the commercial construction market in India.

Major Players

- Larsen & Toubro

- Shapoorji Pallonji Group

- DLF Limited

- Godrej Properties

- GMR Group

- Hindustan Construction Company

- NCC Limited

- Jaypee Group

- Brigade Group

- Tata Projects

- Four Seasons Construction

- Adani Group

- Sobha Limited

- Reliance Infrastructure

- Ajnara India Ltd.

Key Target Audience

- Real Estate Developers

- Construction Companies

- Investment and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Housing and Urban Affairs, National Buildings Organisation)

- Financial Institutions

- Urban Planners

- Architecture and Design Firms

- Construction Material Suppliers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the India Commercial Construction Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the India Commercial Construction Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple construction firms to acquire detailed insights into project segments, revenue performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the India Commercial Construction Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Considerations)

- Definition and Scope

- Market Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Regulatory Framework

- Growth Drivers

Urbanization Trends

Regulatory Support and Incentives

Infrastructure Development Focus - Market Challenges

Labor Shortages

Material Price Volatility - Opportunities

Green Building Initiatives

Rise of Smart Buildings - Market Trends

Digital Transformation in Construction

Modular Construction Practices - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Project Type (In Value %)

Office Buildings

– IT Parks and Business Parks

– Co-working Spaces

– Corporate Headquarters

Retail Spaces

– Shopping Malls

– Standalone Retail Outlets

– Hypermarkets and Supermarkets

Hospitality Projects

– Hotels and Resorts

– Serviced Apartments

– Convention and Exhibition Centers

Healthcare Facilities

– Multi-Specialty Hospitals

– Clinics and Diagnostic Centers

– Wellness and Rehab Centers

Educational Institutions

– Schools and K-12 Campuses

– Colleges and Universities

– Skill Development and Training Centers - By Material Type (In Value %)

Concrete

– Ready-Mix Concrete (RMC)

– Precast Concrete

– Reinforced Concrete

Steel

– Structural Steel Frames

– Steel Rebars and Panels

– Prefabricated Steel Structures

Wood

– Plywood and Laminates

– Engineered Wood Panels

– Timber Framework

Glass

– Facade Glazing

– Safety and Tempered Glass

– Insulated Glass Units (IGUs)

Others

– Composite Materials

– Recycled Building Materials

– Sustainable Alternatives (e.g., AAC blocks, fly ash bricks) - By Region (In Value %)

Northern India

Southern India

Western India

Eastern India - By End-User (In Value %)

Public Sector

– Government Administrative Buildings

– Public Hospitals and Education Facilities

– Infrastructure-linked Commercial Projects

Private Sector

– Real Estate Developers

– Corporates and MNCs

– Private Educational and Healthcare Institutions - By Construction Type (In Value %)

New Construction

– Greenfield Projects

– Smart and Sustainable Buildings

– SEZs and Commercial Complexes

Renovation and Retrofitting

– Structural Upgrades

– Façade and Interior Renovation

– Heritage Commercial Property Revamps

- Market Share of Major Players by Value/Volume, 2024

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths and Weaknesses, Organizational Structure, Revenue Metrics, Number and Type of Projects Undertaken, Project Delivery Models, Key Client Segments, and others)

- SWOT Analysis of Major Players

- Pricing Analysis for Major Players

- Detailed Profiles of Major Companies

Larsen & Toubro

Shapoorji Pallonji Group

Godrej Properties

DLF Limited

GMR Group

Tata Projects

Hindustan Construction Company

NCC Limited

Jaypee Group

Brigade Group

Keller Group

Adani Group

Sobha Limited

Reliance Infrastructure

Four Seasons Construction

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Decision-Making Process

- Regulatory Compliance Insights

- Pain Points and Expectations

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030