Market Overview

Based on a recent historical assessment, the India Communication Navigation and Surveillance Systems market was valued at USD ~ million, driven by sustained defense modernization, civil aviation expansion, maritime safety requirements, and large scale public sector investments reported by the Ministry of Defense, Airports Authority of India, and ISRO budget disclosures. Demand is supported by upgrades to command and control networks, satellite navigation augmentation, air traffic surveillance systems, and border monitoring infrastructure. Ongoing indigenous manufacturing programs, secure communication mandates, and modernization of legacy platforms collectively underpin stable market expansion across military and civilian domains nationwide.

Based on a recent historical assessment, New Delhi, Bengaluru, Hyderabad, and Pune dominate the India Communication Navigation and Surveillance Systems market due to defense headquarters concentration, aerospace manufacturing clusters, and public sector R&D ecosystems, while coastal regions benefit from maritime surveillance demand. India remains the primary country of dominance due to sovereign defense procurement, satellite navigation ownership, and civil aviation infrastructure scale. Strong government backing, skilled engineering talent, established testing facilities, and integration with national security programs reinforce leadership without reliance on foreign system dependency.

Market Segmentation

By Product Type

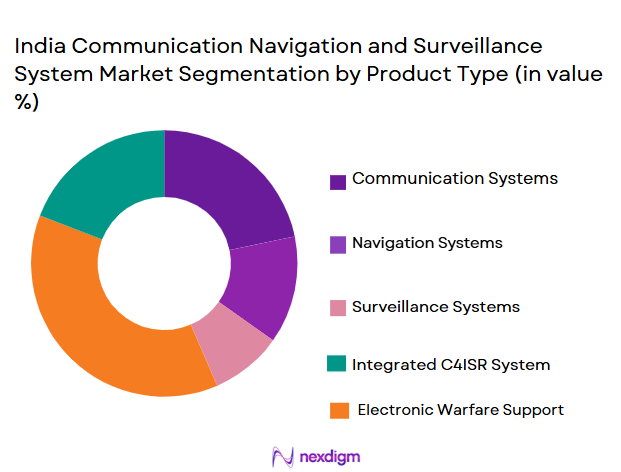

India Communication Navigation and Surveillance Systems market is segmented by product type into communication systems, navigation systems, surveillance systems, integrated C4ISR systems, and electronic warfare support systems. Recently, integrated C4ISR systems have a dominant market share due to unified command requirements, interoperability mandates, and real time data fusion needs across air, land, naval, and space domains. Defense modernization emphasizes centralized situational awareness, driving procurement of multi sensor and multi platform solutions. Indigenous program alignment, reduced latency requirements, and operational efficiency improvements favor integrated systems over standalone products. Large scale defense contracts, lifecycle support advantages, and compatibility with network centric warfare doctrines further reinforce dominance across strategic and tactical deployments nationwide.

By Platform Type

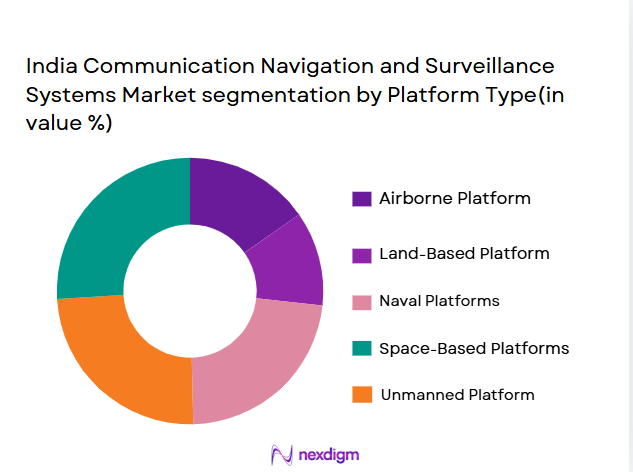

India Communication Navigation and Surveillance Systems market is segmented by platform type into airborne, land based, naval, space based, and unmanned platforms. Recently, airborne platforms have a dominant market share due to continuous fleet upgrades, civil aviation growth, and airborne early warning investments. Aircraft based surveillance and communication systems provide wide area coverage, rapid deployment, and strategic flexibility. Civil aviation traffic growth, airspace safety mandates, and defense ISR requirements collectively increase airborne system adoption. Integration with satellites, ground stations, and unmanned assets further strengthens airborne platform relevance across defense and civil applications.

Competitive Landscape

The India Communication Navigation and Surveillance Systems market exhibits moderate consolidation, with public sector enterprises and large private defense firms dominating large contracts, while specialized electronics companies compete in subsystems and upgrades. Strategic partnerships, indigenization focus, and long term government contracts shape competitive positioning.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Defense Certification |

| Bharat Electronics Limited | 1954 | Bengaluru | ~ | ~ | ~ | ~ | ~ |

| Hindustan Aeronautics Limited | 1940 | Bengaluru | ~ | ~ | ~ | ~ | ~ |

| Larsen and Toubro Defence | 2011 | Mumbai | ~ | ~ | ~ | ~ | ~ |

| Tata Advanced Systems | 2007 | Hyderabad | ~ | ~ | ~ | ~ | ~ |

| Data Patterns India | 1985 | Chennai | ~ | ~ | ~ | ~ | ~ |

India Communication Navigation and Surveillance Systems Market Analysis

Growth Drivers

Defense Modernization and Network-Centric Capability Enhancement:

Defense modernization and network-centric capability enhancement act as a primary growth driver for the India Communication Navigation and Surveillance Systems market, as national security priorities increasingly emphasize real-time situational awareness, secure data exchange, and joint-force interoperability. Armed forces modernization programs focus on replacing fragmented legacy systems with integrated communication, navigation, and surveillance architectures capable of operating across air, land, naval, space, and cyber domains. Network-centric doctrines require resilient, encrypted, and low-latency communication links that can support command and control functions under contested conditions. Surveillance systems are being upgraded to enable continuous monitoring, threat detection, and data fusion from multiple sensor sources. Navigation systems aligned with sovereign satellite infrastructure enhance operational autonomy and accuracy for both strategic and tactical missions. Large-scale procurement programs, supported by long-term defense planning frameworks, provide sustained demand visibility for system integrators and technology suppliers. Indigenous development initiatives further accelerate deployment by aligning system design with operational requirements, while lifecycle support and upgrades extend revenue streams across decades.

Expansion of Civil Aviation, Maritime Security, and Space Infrastructure:

Expansion of civil aviation, maritime security, and space infrastructure is a significant growth driver for the India Communication Navigation and Surveillance Systems market, driven by rising transportation volumes, safety regulations, and strategic infrastructure development. Civil aviation growth necessitates advanced air traffic management, surveillance radars, communication links, and navigation augmentation systems to manage increasingly complex airspace operations. Maritime domain awareness initiatives require coastal surveillance networks, vessel tracking systems, and secure communication platforms to ensure port security, trade route protection, and disaster response readiness. Space infrastructure development, including satellite launches and ground segment expansion, supports navigation accuracy, communication resilience, and wide-area surveillance coverage. Regulatory mandates for safety, interoperability, and redundancy compel operators to continuously upgrade systems rather than rely on outdated technologies. Integration between civil and defense systems further amplifies demand for interoperable solutions capable of serving multiple use cases. Public sector investment, supported by long-term national infrastructure programs, ensures consistent funding flows. Together, these factors create a broad-based demand environment that sustains market growth across civilian and strategic applications.

Market Challenges

System Integration Complexity and Interoperability Constraints:

System integration complexity and interoperability constraints represent a critical challenge for the India Communication Navigation and Surveillance Systems market due to the coexistence of legacy platforms, multi-vendor architectures, and rapidly evolving digital standards. Defense and civil users operate heterogeneous systems acquired across different timeframes, resulting in compatibility gaps between communication protocols, data formats, and security frameworks. Integrating airborne, land, naval, space-based, and unmanned platforms into a unified operational picture requires extensive customization, testing, and validation. Certification and airworthiness approvals further extend deployment timelines, particularly for safety-critical navigation and surveillance systems. Cybersecurity requirements add additional layers of complexity, as integrated systems must meet stringent encryption, redundancy, and resilience standards. Limited availability of specialized system integration expertise within domestic supply chains can affect implementation quality and increase reliance on a small pool of experienced vendors. Testing and evaluation cycles are resource intensive, increasing program costs and slowing modernization efforts. These constraints collectively reduce operational agility and create execution risks for large-scale national programs.

Procurement Delays, Budget Rigidities, and Policy Uncertainty:

Procurement delays, budget rigidities, and policy uncertainty significantly constrain the India Communication Navigation and Surveillance Systems market by affecting project continuity, supplier planning, and technology adoption timelines. Public sector procurement processes involve multiple approval layers, technical evaluations, and compliance checks that often extend contract finalization well beyond planned schedules. Annual budget allocations can be subject to reprioritization, resulting in deferred payments or phased procurements that disrupt long-term system deployment strategies. Rigid cost ceilings and price sensitivity limit supplier flexibility in incorporating advanced technologies or absorbing inflationary pressures in components and skilled labor. Policy revisions related to indigenization requirements, offset obligations, and licensing frameworks, while strategically important, can introduce short-term uncertainty for manufacturers and integrators. Smaller and mid-sized firms face working capital stress due to delayed receivables and high compliance costs, impacting their ability to scale operations. Lengthy tender cycles can also discourage rapid innovation adoption, as technologies risk obsolescence before contract award. These structural and financial challenges collectively slow market responsiveness and create barriers to timely capability enhancement across defense and civil infrastructure programs.

Opportunities

Indigenous Technology Development and Strategic Autonomy Expansion:

Indigenous technology development and strategic autonomy expansion present a major opportunity for the India Communication Navigation and Surveillance Systems market as national policy increasingly prioritizes self-reliance in critical defense and infrastructure technologies. Government-backed programs encourage domestic design, development, and manufacturing of communication networks, navigation payloads, surveillance sensors, and integrated command systems. This shift creates sustained demand for locally developed solutions across defense, aviation, maritime, and space applications. Indigenous development reduces long-term dependence on imported systems, enhances supply chain resilience, and allows customization aligned with operational requirements. Public funding support, preferential procurement policies, and testing infrastructure access lower entry barriers for domestic firms. Collaboration between public sector units, private industry, and research organizations accelerates innovation cycles. Long-term maintenance, upgrades, and software-defined enhancements generate recurring revenue opportunities. Export potential to friendly nations seeking cost-effective and sovereign systems further strengthens market attractiveness.

Defense Exports and Dual-Use Civil Applications Growth:

Defense exports and dual-use civil applications growth create a significant opportunity for the India Communication Navigation and Surveillance Systems market by expanding addressable demand beyond domestic procurement. Many emerging and developing nations seek reliable, affordable, and proven communication and surveillance solutions suitable for both defense and civilian use. Indian systems benefit from operational validation, competitive pricing, and increasing international credibility. Dual-use applications in civil aviation, disaster management, maritime safety, and border monitoring allow suppliers to leverage common technology platforms across multiple sectors. Government-to-government agreements, export facilitation mechanisms, and defense diplomacy initiatives support international market access. Customizable system architectures enable adaptation to diverse regulatory and operational environments. After-sales support, training, and lifecycle services enhance long-term customer relationships. Together, export growth and civil integration opportunities diversify revenue streams and reduce reliance on domestic budget cycles.

Future Outlook

The market outlook over the next five years indicates steady growth driven by defense digitization, satellite navigation expansion, and civil aviation modernization. Technological advancements in AI enabled surveillance and secure communications will accelerate adoption. Regulatory support for indigenization will strengthen domestic suppliers. Rising demand for integrated systems across domains will sustain long term momentum.

Major Players

- Bharat Electronics Limited

- Hindustan Aeronautics Limited

- Larsen and ToubroDefence

- Tata Advanced Systems

- MahindraDefenceSystems

- Data Patterns India

- Astra Microwave Products

- Alpha Design Technologies

- ParasDefenceand Space Technologies

- Centum Electronics

- MTAR Technologies

- Ananth Technologies

- AvantelLimited

- Kalyani Strategic Systems

- IdeaForgeTechnology

Key Target Audience

- Defense ministries

- Armed forces procurement agencies

- Civil aviation authorities

- Maritime security agencies

- Space agencies

- System integrators

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

Key demand, supply, regulatory, and technology variables were identified through secondary research and policy reviews. Industry scope was defined using defense and civil infrastructure classifications. Variables were validated against procurement data. Assumptions were standardized.

Step 2: Market Analysis and Construction

Data was compiled from government budgets, company disclosures, and industry databases. Market structure was mapped across platforms and applications. Historical trends were analyzed. Consistency checks ensured reliability.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary findings were validated through expert interviews and stakeholder consultations. Assumptions were refined based on operational insights. Data gaps were addressed. Conclusions were cross verified.

Step 4: Research Synthesis and Final Output

Validated data was synthesized into a structured report. Analytical frameworks were applied uniformly. Findings were reviewed for coherence. Final outputs reflect factual alignment.

- Executive Summary

- Market Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Modernization of military communication and surveillance infrastructure

Rising demand for integrated C4ISR capabilities across services

Expansion of space-based navigation and surveillance assets

Increasing border security and maritime domain awareness needs

Indigenization initiatives under national defense programs - Market Challenges

High system integration and interoperability complexity

Dependence on critical imported subsystems and components

Lengthy defense procurement and approval cycles

Cybersecurity and electronic vulnerability risks

Budget prioritization constraints across defense programs - Market Opportunities

Development of indigenous satellite navigation and surveillance systems

Export potential to friendly and emerging defense markets

Public private partnerships for advanced sensor and communication technologies - Trends

Adoption of network-centric and software defined systems

Increased use of AI for surveillance data processing

Integration of space air land and naval communication networks

Shift toward modular and scalable system architectures

Enhanced focus on secure and resilient communication links - Government Regulations & Defense Policy

Defense Acquisition Procedure driven localization mandates

Spectrum management and secure communication regulations

Strategic policies supporting indigenous navigation constellations - SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Communication Systems

Navigation Systems

Surveillance Systems

Integrated C4ISR Systems

Electronic Warfare Support Systems - By Platform Type (In Value%)

Airborne Platforms

Land-Based Platforms

Naval Platforms

Space-Based Platforms

Unmanned Platforms - By Fitment Type (In Value%)

Line-Fit Systems

Retrofit Systems

Portable and Deployable Systems

Vehicle-Mounted Systems

Fixed Installation Systems - By EndUser Segment (In Value%)

Defense Forces

Homeland Security Agencies

Civil Aviation Authorities

Maritime and Coast Guard Agencies

Space and Strategic Agencies - By Procurement Channel (In Value%)

Direct Government Contracts

Defense Public Sector Undertakings

System Integrators

OEM Partnerships

Offset and Licensed Production Programs - By Material / Technology (in Value %)

Software Defined Architectures

RF and Microwave Technologies

Satellite-Based Technologies

Sensor Fusion and AI-Enabled Systems

Secure Networking and Encryption Technologies

- Market structure and competitive positioning

- Market share snapshot of major players

CrossComparison Parameters (Technology Breadth, System Integration Capability, Indigenous Content Level, Platform Coverage, Cybersecurity Strength, Program Execution Track Record, Government Relationships, Export Capability, Lifecycle Support) - SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Bharat Electronics Limited

Hindustan Aeronautics Limited

Larsen and Toubro Defence

Tata Advanced Systems

Mahindra Defence Systems

Data Patterns India

Astra Microwave Products

Alpha Design Technologies

Paras Defence and Space Technologies

Centum Electronics

MTAR Technologies

Ananth Technologies

Avantel Limited

Kalyani Strategic Systems

IdeaForge Technology

- Armed forces emphasize interoperable joint communication systems

- Internal security agencies focus on real time surveillance coverage

- Aviation and maritime authorities prioritize safety and navigation accuracy

- Space agencies require secure and redundant communication links

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035