Market Overview

The India construction chemicals market is valued at USD ~ million for 2024, supported by recent estimates. This level of market value reflects a sharp uptick from previous years and is being driven by expanding infrastructure investment, rising demand for high-performance construction materials in residential and commercial builds, and increasing adoption of advanced admixtures, waterproofing and coatings. The key drivers include government programmes for housing and transport, growth in ready-mixed concrete (RMC) usage, and greater specification of durability and sustainability in construction projects.

In India the northern region—particularly the Delhi NCR corridor, Haryana and Uttar Pradesh—and the western chemical-hub states such as Gujarat dominate the construction chemicals market because they combine high infrastructure-project volumes, large metropolitan real-estate developments and well-established chemical and construction supply-chains. For example, Gujarat retains a lion-share of the chemicals manufacturing and export ecosystem, which supports local availability of raw materials and proximity to large urban real-estate developments. These regional hubs benefit from strong developer activity, logistics advantages (ports, industrial clusters) and early adopter status for performance-chemicals in construction, giving them a dominant position in this market.

Market Segmentation

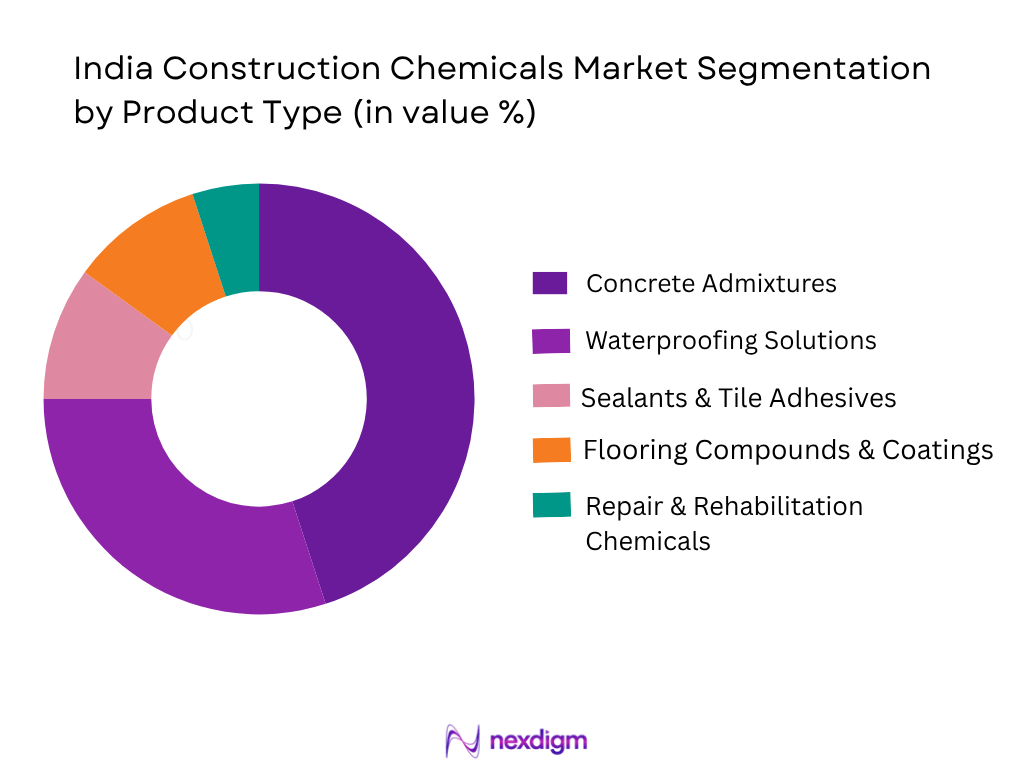

By Product Type

Among these, the Concrete Admixtures sub-segment is dominating the market share in India. This dominance stems from the fact that the construction industry is increasingly using ready-mixed concrete and high-performance concrete mixes across infrastructure, commercial and residential sectors, demanding admixtures to improve workability, strength development, set control, and durability. Admixtures are becoming embedded in project specifications for large infrastructure projects and high-rise residential buildings, which lifts their share. Many cited reports highlight that admixtures are the leading revenue generation product in the India market.

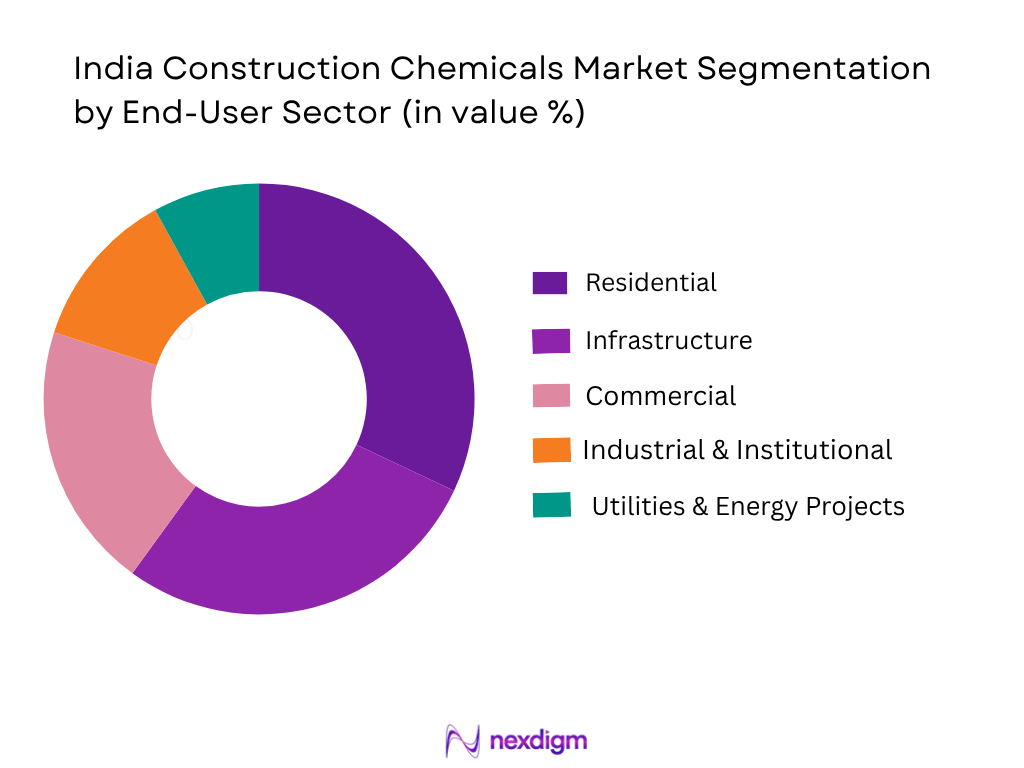

By End-User Sector (Application)

In the India construction chemicals market, the Residential segment is currently dominant. The reason is the large volume of housing construction driven by urbanisation, government housing schemes, rising incomes, and developer activity in high-rise and township projects. These residential developments often specify performance construction chemicals (admixtures, waterproofing, adhesives) to meet durability, finishing and maintenance requirements, which elevates the share of residential end-use. Reports note that residential application commanded approximately one-third of value share in recent years.

Competitive Landscape

The India construction chemicals market is characterised by several major global and domestic players, many of whom hold strong product portfolios, manufacturing presence and distribution networks in India. The competitive arena shows consolidation at the top with strong brand names, while many regional/local players serve fragmented demand, especially in Tier II/III cities.

| Company | Establishment Year | Headquarters | Product Portfolio Breadth (Construction Chemicals) | Manufacturing Capacity in India | Distribution Network Reach (Dealers/Distributors) | Technical / R&D Capability | Recent Strategic Move |

| Pidilite Industries Ltd. | 1959 | Mumbai, India | – | – | – | – | – |

| Sika India Pvt. Ltd. | 1994 | Pune, India | – | – | – | – | – |

| Fosroc International Ltd. | 1990s | Mumbai, India | – | – | – | – | – |

| Saint-Gobain Weber India Pvt. Ltd. | 1999 | Mumbai, India | – | – | – | – | – |

| Mapei Construction Products India Pvt. Ltd. | 2003 | Gujarat / Mumbai, India | – | – | – | – | – |

India Construction Chemicals Market Analysis

Growth Drivers

Growing Penetration of Organised Retail and DIY Construction Products

India’s retail sector contributes close to one-tenth of national GDP and employs a large share of the workforce, with a visible transformation toward organised trade formats. The expansion of hardware chains, home-improvement stores, and e-commerce platforms has opened new demand channels for sealants, tile adhesives, and repair compounds. Rising consumer participation in small-scale renovation and home-improvement projects is broadening the consumption base beyond industrial and project-based applications, driving steady growth in retail-grade construction chemicals.

Increasing Foreign Investment Inflows into Infrastructure and Industrial Parks

Sustained foreign direct investment in infrastructure, logistics corridors, industrial parks, and manufacturing zones is reinforcing long-term demand for high-performance construction materials. The establishment of new industrial estates and technology parks across Gujarat, Maharashtra, Tamil Nadu, and Telangana has expanded concrete and flooring requirements, translating into higher consumption of admixtures, grouts, and protective coatings. This inflow of capital ensures continued project pipelines that underpin consistent demand for advanced chemical solutions.

Market Challenges (Operational and Structural)

Fragmented Distribution Networks and Limited Dealer Penetration in Rural India

Distribution of construction chemicals across India is fragmented, with a mix of national brands and numerous regional players catering to localised demand. Supply-chain inefficiencies, long lead times, and lack of cold-chain or controlled-storage capabilities for sensitive formulations hinder product availability in remote regions. The dominance of small-scale retailers and limited digital integration in logistics further constrain scale, resulting in higher operational costs and inconsistent supply for end-users outside tier-I cities.

Regulatory and BIS Compliance Delays for New Chemical Formulations

Introducing new chemical formulations in India requires adherence to multiple certification and testing procedures governed by the Bureau of Indian Standards and other regulatory bodies. Compliance timelines can extend significantly, delaying commercialisation of innovative products. Frequent revisions of environmental and material standards, combined with regional approval processes, create bottlenecks for multinational players and domestic SMEs alike, slowing the pace of product innovation and market responsiveness.

Market Opportunities (Untapped and Emerging White Spaces)

Growth in Refurbishment, Repair, and Retrofitting Projects for Aging Infrastructure:

India’s existing infrastructure base—spanning highways, bridges, industrial plants, and public utilities—presents an enormous retrofit and maintenance opportunity. With installed cement capacity exceeding 590 million tonnes per year, the scale of built infrastructure is vast. Refurbishment projects require extensive use of structural-repair mortars, bonding agents, epoxy injections, and protective coatings. This segment is growing rapidly as government bodies and private developers focus on extending the lifespan of critical assets, making repair and rehabilitation a high-margin opportunity for chemical manufacturers.

Expansion of Sustainable Product Lines (Bio-Based and Low-VOC Admixtures)

The momentum towards sustainability has encouraged producers to introduce bio-based polymers, low-VOC coatings, and recycled-content adhesives. These eco-aligned formulations are being prioritised in tenders for smart-city and green-building projects, where environmental performance is part of the evaluation criteria. Manufacturers that invest in green-chemistry innovation and secure product certifications early are well-positioned to capture growing demand from developers, architects, and industrial clients committed to sustainable construction practices.

Future Outlook

Over the next six years the India construction chemicals market is expected to continue its growth trajectory, supported by persistent infrastructure investment, rising residential and commercial construction activity, greater specification of durability and sustainability in projects, and the increasing penetration of high-performance and green construction chemicals. Demand is expected to shift increasingly towards eco-friendly, low-VOC, recyclable content products and digital/IoT-enabled chemical solution systems, thereby offering growth levers beyond base volume expansion.

Major Players

- Pidilite Industries Ltd.

- Sika India Pvt. Ltd.

- Fosroc International Ltd.

- Saint-Gobain Weber India Pvt. Ltd.

- Mapei Construction Products India Pvt. Ltd.

- MBCC Group (BASF Construction Chemicals Division)

- Ardex Endura (India) Pvt. Ltd.

- MYK Laticrete India Pvt. Ltd.

- STP Ltd.

- Chryso India Pvt. Ltd.

- Sunanda Specialty Coatings Pvt. Ltd.

- Flowcrete India Pvt. Ltd.

- Jotun India Pvt. Ltd.

- Bostik (India) Pvt. Ltd.

- Ruia Chemicals Pvt. Ltd.

Key Target Audience

- Real-estate developers and major infrastructure EPC contractors

- Construction chemicals manufacturers (domestic & international)

- Distributors, dealers and channel partners of construction materials

- Private equity firms and venture capital firms investing in construction chemicals and building-materials technologies

- Chemical raw-material suppliers (resins, polymers, additives) seeking downstream market insight

- Government and regulatory bodies such as Ministry of Housing & Urban Affairs

- Large contractors undertaking retrofit/rehabilitation of infrastructure

- Technology providers and start-ups focused on smart construction chemical solutions

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing a comprehensive ecosystem map covering raw-material producers (e.g., resins, polymers), chemical formulators, applicators/contractors, distributors and end-users in the India construction chemicals market. This step is underpinned by extensive desk research, utilising both secondary data (industry reports, trade associations) and proprietary databases to identify key drivers, restraints, market definitions and standardised units.

Step 2: Market Analysis and Construction

In this phase, historical data on the India construction chemicals market were compiled, including revenue (value) and volume metrics, segmentation by product and end-use, pricing trends and average realisations. The supply chain view (from raw material to applicator) was analysed. Data were triangulated across multiple sources to build a credible base year benchmark and to project forward.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses (for example, the rate of adoption of high-performance admixtures, growth of waterproofing chemicals, regional hot-spots) were validated through computer-assisted telephone interviews (CATI) and in-depth interviews with industry experts representing key stakeholders (manufacturers, consultants, large contractors). These consultations provided operational and financial insights directly from practitioners which were instrumental in refining the forecast and validating assumptions.

Step 4: Research Synthesis and Final Output

The final phase involves synthesising secondary research, primary insights and bottom-up build-up of market revenue/volume to prepare the final report. Direct engagement with chemical manufacturers and distribution channel stakeholders helped verify supply-side constraints, pricing trends, margin profiles, and product innovation pipelines. The result is a validated and comprehensive analysis of the India construction chemicals market.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach – Top-Down & Bottom-Up, Supply Chain Validation, Data Triangulation, Primary Research through Industry Experts and Distributors, Secondary Research from Industry Associations – FICCI, ICI, BIS, and Construction Federation of India, Limitation & Future Assumptions)

- Definition and Scope

- Market Genesis and Evolution

- Industry Ecosystem Mapping (raw material suppliers, formulators, contractors, applicators, project consultants)

- Supply Chain and Value Chain Analysis (polymer resin sourcing, blending, packaging, logistics, end-user channels)

- Regulatory Framework (BIS IS standards, VOC emission limits, EIA norms, green building certifications, and import policies)

- Macro-Economic and Infrastructure Linkages (urban infrastructure investment, cement output, construction sector contribution to GDP, public–private partnership programs)

- Technological Landscape (nano-coatings, bio-based polymers, low-VOC adhesives, IoT-based admixture dosing systems)

- Growth Drivers (macroeconomic, policy, and industry catalysts)

Expanding urban infrastructure and housing projects under PMAY and Smart City Mission

Rising cement and ready-mix concrete production

Adoption of green building certifications (LEED, GRIHA) driving eco-friendly chemical demand

Growing penetration of organized retail and DIY construction products

Increasing foreign investment inflows into infrastructure and industrial parks - Market Challenges (operational and structural)

Price volatility of raw materials such as acrylics, epoxy resins, and polymers

Low adoption rate in tier-II/III cities due to lack of trained applicators

Fragmented distribution networks and limited dealer penetration in rural India

Regulatory and BIS compliance delays for new chemical formulations - Market Opportunities (untapped and emerging white spaces)

Growth in refurbishment, repair, and retrofitting projects for aging infrastructure

Expansion of sustainable product lines (bio-based and low-VOC admixtures)

Local manufacturing under “Make in India” and import substitution

Increasing public–private partnerships in metro, airport, and smart city projects - Market Trends (emerging technologies and consumption shifts)

Integration of IoT-enabled smart dosing systems in concrete batching plants

Shift toward pre-mixed, ready-to-use construction chemicals

Growing adoption of nano-modified surface protection coatings

Expansion of water-proofing membranes with energy-efficient formulations - Government Regulation and Standards (BIS IS 9103: Concrete Admixtures, IS 2645: Waterproofing Compounds, EIA Notification, GST implications on construction chemicals, Environment & Safety Norms)

- Porter’s Five Forces Analysis (supplier power, buyer power, threat of substitutes, rivalry, barriers to entry)

- Stakeholder Ecosystem (developers, contractors, consultants, distributors, raw-material manufacturers)

- SWOT Analysis (industry-wide strategic positioning)

- By Value (INR Crore/USD Million), 2019-2024

- By Volume (KT), 2019-2024

- By Average Price (INR/kg or per litre), 2019-2024

- By Product Type (In Value %)

Concrete Admixtures

– Plasticizers & Superplasticizers (high-range water reducers)

– Accelerators

– Retarders

– Air-Entraining Agents

– Shrinkage-Reducing Admixtures

– Water-Proofing Admixtures

– Corrosion Inhibitors

– Viscosity-Modifying Agents

Waterproofing Solutions

– Liquid-Applied Membranes (acrylic / bituminous / PU / cementitious)

– Sheet Membranes (PVC / HDPE)

– Crystalline Waterproofing Compounds

– Integral Waterproofing Admixtures

– Elastomeric Coatings

– Injection Grouting Systems

Flooring Compounds and Coatings

– Epoxy Flooring Systems

– Polyurethane (PU) Coatings

– Cementitious Self-Leveling Compounds

– Anti-Static and ESD Flooring

– Polished Concrete Systems

– Decorative and Metallic Floor Coatings

Sealants and Tile Adhesives

– Cementitious Tile Adhesives (Class C1/C2)

– Polymer-Modified Adhesives

– Epoxy-Based Grouts

– Silicone Sealants

– Polyurethane Sealants

– MS-Polymer Sealants

– Acrylic Latex Sealants

Repair and Rehabilitation Chemicals

– Polymer-Modified Repair Mortars

– Epoxy Injection Grouts

– Micro-Concrete for Structural Repair

– Anti-Corrosive Coatings for Rebars

– Fiber Wrap Systems (CFRP/GFRP)

– Bonding Agents (Epoxy / Acrylic)

– Protective Overlays and Reprofiling Compounds - By Application (In Value %)

Residential Construction

– Affordable Housing (Slum Redevelopment / PMAY)

– Mid-Segment Apartments

– Luxury and High-Rise Residential Projects

– Townships and Gated Communities

– Redevelopment / Refurbishment of Old Housing Stock

Commercial Complexes and Institutional Buildings

– Office Complexes and Business Parks

– Retail Malls and Multiplexes

– Hospitality Projects (Hotels, Resorts)

– Educational Campuses

– Healthcare Infrastructure (Hospitals, Clinics)

– Public Institutions (Government Offices, Convention Centers)

Industrial Infrastructure

– Manufacturing Plants and Warehouses

– Food and Pharmaceutical Facilities (Hygienic Flooring Applications)

– Chemical and Petrochemical Plants

– Automotive and Heavy Engineering Facilities

– Logistics and Cold Storage Hubs

Transport and Public Infrastructure

– Roads and Highways

– Bridges and Flyovers

– Airports and Runways

– Ports and Harbors

– Rail and Metro Infrastructure

– Urban Transit Terminals and Smart City Projects

Utilities and Energy Projects

– Power Plants (Thermal, Hydro, Renewable)

– Transmission and Distribution Infrastructure

– Water Supply and Wastewater Treatment Plants

– Pipelines and Reservoirs

– Dams and Irrigation Structures

– Oil & Gas Facilities - By Distribution Channel (In Value %)

Direct Sales to Contractors and Developers

Authorized Distributors and Dealers

Project Procurement and EPC Contractors

Retail and Organized Trade Network

Online B2B Sales Platforms - By End-User (In Value %)

Real-Estate Developers

Infrastructure EPC Companies

Government & Public Sector Units

Private Industrial Units

Institutional Clients (healthcare, education, hospitality) - By Region (In Value %)

North India (Delhi NCR, Haryana, Punjab, Uttarakhand, Himachal Pradesh)

West & Central India (Maharashtra, Gujarat, Madhya Pradesh, Rajasthan)

South India (Tamil Nadu, Karnataka, Telangana, Kerala, Andhra Pradesh)

East & Northeast India (Odisha, West Bengal, Assam, Jharkhand, Bihar)

- Market Share of Leading Players (by value and volume)

- Competition Ecosystem (organized vs unorganized split)

- Cross Comparison Parameters (Company Overview, Product Portfolio Breadth, Regional Footprint, R&D Capabilities, Revenue Share by Product Type, Dealer Network Strength, Capacity Utilization, Technical Support Network)

- SWOT Comparison of Major Players

- Pricing Analysis Basis SKUs and Product Grade

- Company Profiles of Major Players

Pidilite Industries Ltd.

Asian Paints Ltd.

Fosroc Chemicals (India) Pvt. Ltd.

Sika India Pvt. Ltd.

Mapei Construction Products India Pvt. Ltd.

MBCC Group (BASF Construction Chemicals Division)

Ardex Endura (India) Pvt. Ltd.

MYK Laticrete India Pvt. Ltd.

STP Ltd.

Chryso India Pvt. Ltd.

Sunanda Specialty Coatings Pvt. Ltd.

Flowcrete India Pvt. Ltd.

Jotun India Pvt. Ltd.

Saint-Gobain Weber India Pvt. Ltd.

Bostik (India) Pvt. Ltd.

- Procurement Channels and Supplier Evaluation Metrics

- Usage Intensity per Construction Type (infrastructure, residential, industrial)

- Budget Allocation and Cost Optimization Strategies

- Regional Hotspots and State-wise Demand Dynamics

- Customer Pain Points (durability, quality assurance, supply reliability)

- By Value (INR Crore/USD Million), 2025-2030

- By Volume (KT), 2025-2030

- By Average Price (INR/kg or per litre), 2025-2030