Market Overview

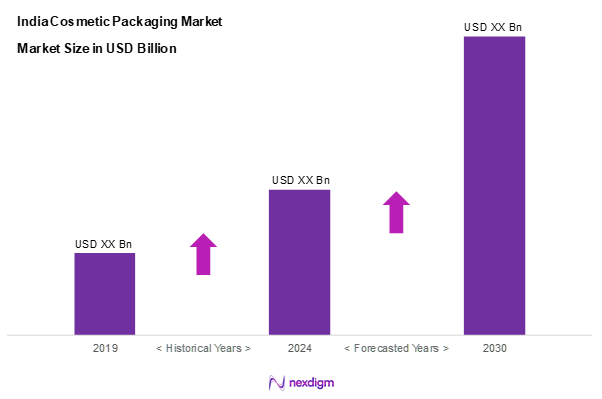

As of 2024, the India cosmetic packaging market is valued at USD 1.5 billion, with a growing CAGR of 6.0% from 2024 to 2030. Growth of this market is largely driven by the booming beauty and personal care industry, which is reinvigorated by increasing consumer awareness about product aesthetics and sustainability practices. As consumers demand more attractive and environmentally friendly packaging, brands are adapting to these preferences while investing in innovative packaging solutions to enhance product appeal and user experience.

While India is diverse in its consumer base, key regions contributing to the cosmetic packaging market include metropolitan areas such as Mumbai, Delhi, and Bengaluru. These cities dominate due to their high population density, evolving lifestyles, and significant presence of both local and global cosmetic brands that leverage these regions for product launches and marketing initiatives. The presence of strong distribution networks in these urban centres further reinforces their dominance.

Market Segmentation

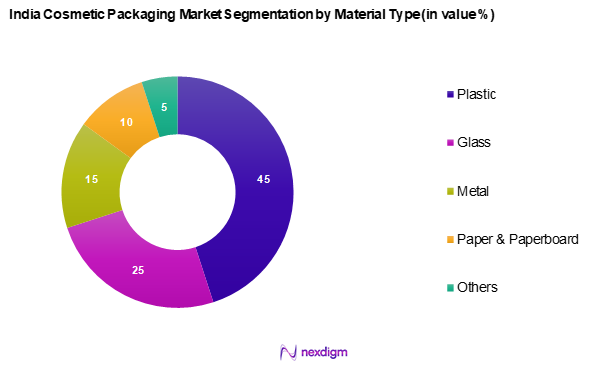

By Material Type

The India cosmetic packaging market is segmented into plastic, glass, metal, paper & paperboard, and others. Plastic packaging holds a dominant position due to its lightweight, versatile nature, and cost-effectiveness. Global brands increasingly rely on plastic for various product categories, ranging from skincare to haircare, largely due to its ability to cater to diverse consumer preferences. Innovations in recyclable and biodegradable plastic materials are also enhancing the appeal and sustainability of this sub-segment.

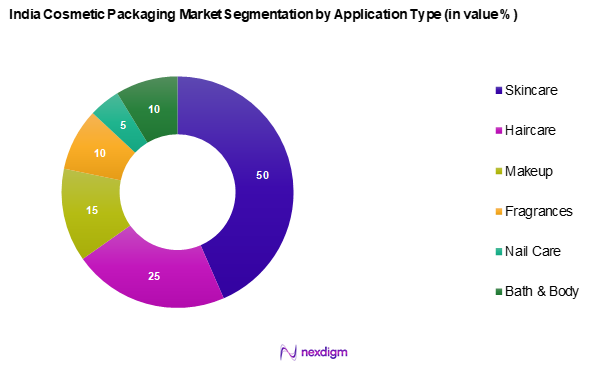

By Application Type

The India cosmetic packaging market is segmented into skincare, haircare, makeup, fragrances, nail care, and bath & body. The skincare segment is currently leading the market as consumers increasingly prioritize skincare products over other categories. This shift is fuelled by rising awareness of personal grooming and wellness, along with the growing influence of social media and beauty influencers who promote skincare routines as essential to a holistic beauty regimen.

Competitive Landscape

The India cosmetic packaging market is characterized by competition among both domestic and global players. Major players such as Amcor PLC, Berry Global Inc., and AptarGroup Inc. dominate this landscape with their extensive product range and strong market presence. The consolidation of these companies signifies their impactful influence over market trends and consumer preferences.

| Company | Establishment Year | Headquarters | Market Share | Products Offered | Innovation Initiatives | Revenue

(USD Mn) |

| Amcor PLC | 1860 | Zurich, Switzerland | – | – | – | – |

| Berry Global Inc. | 1967 | Evansville, Indiana | – | – | – | – |

| AptarGroup Inc. | 1992 | Crystal Lake, Illinois | – | – | – | – |

| Gerresheimer AG | 1864 | Düsseldorf, Germany | – | – | – | – |

| Huhtamaki Oyj | 1920 | Espoo, Finland | – | – | – | – |

India Cosmetic Packaging Market Analysis

Growth Drivers

Rise in Beauty Consciousness

The increasing beauty consciousness among Indian consumers has significantly driven the cosmetic packaging market. In 2024, the Indian beauty and personal care industry is projected to exceed USD 23 billion, reflecting a robust growth trajectory due to heightened consumer interest in personal grooming. This increasing investment in beauty products has led companies to focus on innovative packing solutions that attract consumers. According to a survey by the Indian Beauty and Hygiene Association, approximately 67% of consumers aged 18-35 believe that quality packaging influences their purchase decisions. Such statistics spotlight the rising consumer demand for appealing and functional cosmetic packaging.

Increasing Demand for Sustainable Packaging

The trend toward sustainable packaging in the cosmetic sector is increasingly influential. Recent reports indicate that over 50% of Indian consumers express a preference for products packaged in eco-friendly materials. As the global emphasis on sustainability continues to gain traction, companies are responding by adopting biodegradable and recyclable materials. In line with India’s commitment to reducing plastic waste, the government has set a target to reduce single-use plastic consumption by 30% by 2025. This growing consumer awareness and regulatory push are driving the cosmetic packaging market to prioritize sustainability.

Market Challenges

Regulatory Challenges

The India cosmetic packaging market faces significant regulatory challenges that can hinder growth. The Food Safety and Standards Authority of India (FSSAI) and other governing bodies have stringent regulations to ensure safety and quality in cosmetic products and their packaging. In recent assessments, around 30% of companies reported difficulties in complying with these evolving regulations, especially for imported materials. Non-compliance can lead to substantial penalties and market withdrawal, forcing companies to devote resources to navigate compliance challenges rather than focusing on innovation.

High Costs of Advanced Packaging Solutions

Investments in advanced packaging technologies are essential for meeting consumer expectations, yet these solutions often come with high costs that can deter smaller players. Reports indicate that around 45% of packaging companies cited capital investment as a significant barrier to the adoption of innovative packaging solutions. This challenge is especially prevalent for start-ups aiming to compete in a market that favours established brands with deeper financial resources. Consequently, smaller businesses may struggle to differentiate themselves, impacting their ability to capture market share.

Opportunities

Adoption of Smart Packaging

The growing demand for smart packaging solutions presents a notable opportunity in the Indian cosmetic packaging market. Technologies such as QR codes, NFC tags, and augmented reality features are becoming increasingly popular among tech-savvy consumers. In 2024, the smart packaging market is expected to grow significantly, with an emphasis on providing interactive and personalized experiences. Companies embracing these innovations can enhance brand loyalty and meet the rising consumer desire for transparency and product information. Such technological integration could lead to increased market differentiation and growth prospects.

Expansion of Eco-friendly Materials

With a significant shift towards sustainability, the increasing availability and use of eco-friendly materials in the cosmetic packaging sector highlight future growth. The global market for sustainable packaging is projected to reach USD 300 billion by 2025, driven by consumer preferences and government mandates. Companies that invest in sustainable substrates, such as bioplastics and recycled materials, can appeal to the growing segment of environmentally conscious consumers. This trend not only promotes brand equity but also ensures compliance with regulations aimed at reducing environmental impact.

Future Outlook

Over the next few years, the India cosmetic packaging market is poised for substantial growth driven by increasing consumer awareness regarding sustainability and a surge in e-commerce sales for beauty products. As brands focus on innovative and eco-friendly packaging solutions, the market is expected to witness a shift towards smarter, more engaging packaging options that resonate with environmentally conscious consumers.

Major Players

- Amcor PLC

- Berry Global Inc.

- AptarGroup Inc.

- Gerresheimer AG

- Huhtamaki Oyj

- Essel Propack Limited

- HCP Packaging

- Albea Group

- Quadpack Industries

- Sonoco Products Company

- AG Poly Packs Private Limited

- Neopack Enterprise Private Limited

- Vimal Plastics

- Chemco Plastic Industries Private Limited (CPIPL)

- Clarion Cosmetics Private Limited

- Albéa Services S.A.S

- Elham MultiPlast LLP

- Global Print and Pack

- Essel Propack Limited

Key Target Audience

- Cosmetic manufacturers

- Retailers and wholesalers

- E-commerce platforms

- Materials suppliers

- Investments and venture capitalist firms

- Government and regulatory bodies (Bureau of Indian Standards, Food and Drug Administration)

- Brand consultants

- Packaging technology innovators

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves developing a comprehensive ecosystem map that includes all major stakeholders in the India cosmetic packaging market. This process incorporates extensive desk research using secondary and proprietary databases, allowing us to collect relevant and credible industry data. The goal is to identify and precisely define the critical variables affecting market dynamics, facilitating a deeper understanding of trends and consumer behaviour.

Step 2: Market Analysis and Construction

In this phase, we compile and analyse historical data relating to the India cosmetic packaging market. This analysis includes assessing market penetration rates, evaluating the relationship between packaging categories and service utilization, and analysing resultant revenue figures. Additionally, we ensure the reliability of revenue estimates by scrutinizing service quality statistics, which inform the overall market assessment.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses developed during earlier phases are validated through Computer-Assisted Telephone Interviews (CATIs) with industry experts, representing a diverse array of companies in the cosmetic packaging sector. These expert consultations provide valuable operational insights and financial perspectives that are crucial for refining and corroborating market data.

Step 4: Research Synthesis and Final Output

The final phase entails engaging directly with multiple packaging manufacturers to gather detailed insights into product offerings, sales performance, consumer preferences, and additional factors influencing the market. This direct interaction serves to verify and enhance the statistics derived from the bottom-up approach, ensuring an accurate and validated analysis of the India cosmetic packaging market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain & Value Chain Analysis

- Growth Drivers

Rise in Beauty Consciousness

Increasing Demand for Sustainable Packaging - Market Challenges

Regulatory Challenges

High Costs of Advanced Packaging Solutions - Opportunities

Adoption of Smart Packaging

Expansion of Eco-friendly Materials - Trends

Shift Towards Minimalistic Packaging

Use of Biodegradable Materials - Government Regulatory Landscape

Standards for Cosmetic Packaging

Waste Management Regulations - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Material Type (In Value %)

Plastic

– Polyethylene Terephthalate (PET)

– Polypropylene (PP)

– High-Density Polyethylene (HDPE)

– Low-Density Polyethylene (LDPE)

– Acrylic

Glass

– Clear Glass

– Frosted Glass

– Colored Glass

Metal

– Aluminum

– Tin

– Steel

Paper & Paperboard

– Coated Paperboard

– Kraft Paper

– Molded Pulp

Others

– Biodegradable Polymers

– Bamboo

– Ceramics - By Application Type (In Value %)

Skincare

– Moisturizers

– Serums

– Sunscreens

– Face Masks

Haircare

– Shampoos

– Conditioners

– Hair Oils

– Styling Products

Makeup

– Foundations

– Lipsticks

– Mascaras

– Compacts

Fragrances

– Eau de Toilette

– Eau de Parfum

– Roll-Ons

– Body Mists

Nail Care

– Nail Polishes

– Nail Polish Removers

– Nail Serums

Bath & Body

– Body Wash

– Soaps

– Lotions

– Scrubs

Others

– Men’s Grooming

– Baby Care Products - By Packaging Type (In Value %)

Rigid Packaging

– Bottles

– Jars

– Tubes

– Compacts

– Aerosol Cans

Flexible Packaging

– Sachets

– Pouches

– Refill Packs

– Laminates

Others

– Hybrid Packaging

– Airless Packaging

– Smart Packaging - By End User Industry (In Value %)

Personal Care

– Daily Use Products

– Hygiene Products

Beauty

– Professional Salons

– Makeup Brands

Pharmaceuticals

– Medicated Skincare

– Cosmeceuticals

Others

– Herbal & Ayurvedic Brands

– E-commerce Packaging Solutions - By Region (In Value %)

North India

South India

East India

West India

- Market Share of Major Players Based on Value/Volume

Market Share of Major Players by Type of Material Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenues, Distribution Channels, Production Technology, Sustainability Initiatives, and others)

- SWOT Analysis of Major Players

- Pricing Analysis of Major Players

- Detailed Profiles of Major Companies

Amcor PLC

Berry Global Inc.

AptarGroup Inc.

Gerresheimer AG

Huhtamaki Oyj

Essel Propack Limited

HCP Packaging

Albea Group

Quadpack Industries

Sonoco Products Company

AG Poly Packs Private Limited

Neopack Enterprise Private Limited

Vimal Plastics

Chemco Plastic Industries Private Limited (CPIPL)

Clarion Cosmetics Private Limited

Albéa Services S.A.S

Elham MultiPlast LLP

Global Print and Pack

Essel Propack Limited

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030