Market Overview

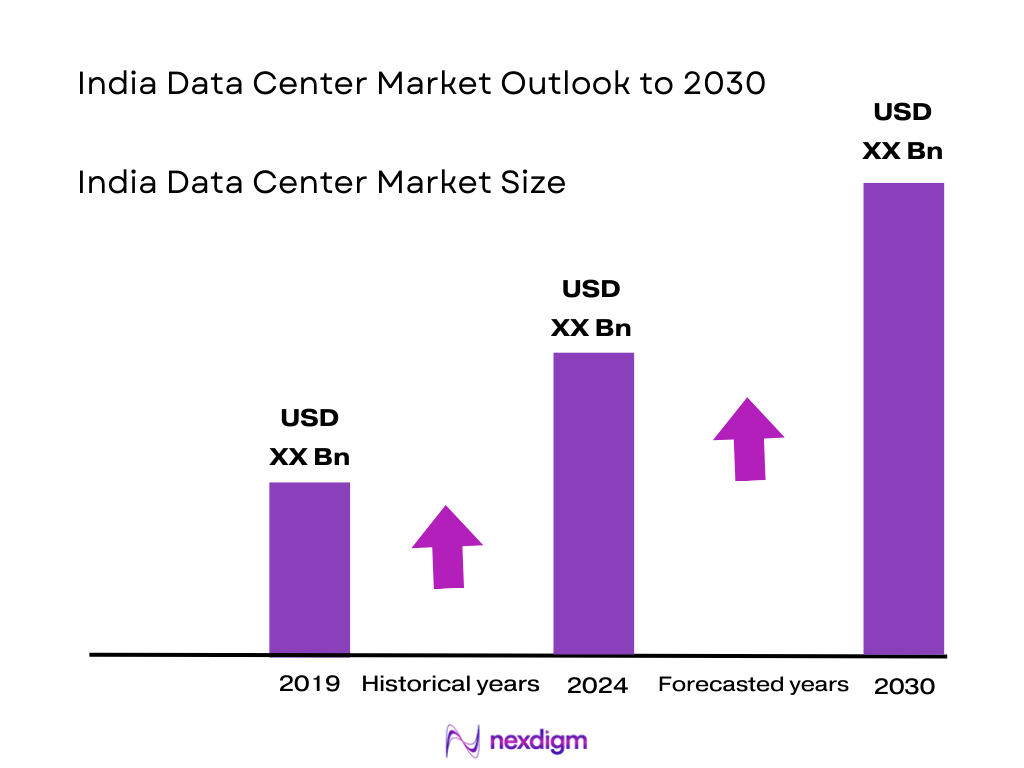

The India data center market is valued at USD 9,174.5 million, based on comprehensive industry analysis covering recent trends and infrastructure investments. This valuation reflects robust demand from sectors like cloud services, telecommunications, and enterprise digitalization, reinforced by favorable government policies and increasing internet penetration. The steady rise in digital consumption and cloud adoption across industries such as BFSI and e‑commerce is fueling this growth trajectory.

Mumbai, Chennai, Delhi‑NCR, Hyderabad, Bengaluru, and Kolkata lead the India data center market due to their advanced digital ecosystems, superior power and connectivity infrastructure, and strong presence of hyperscalers and enterprises. These cities benefit from strategic placement of submarine cable connectivity, availability of talent, and smart city ecosystems, making them natural hubs for both enterprise and hyperscale data center deployments.

Market Segmentation

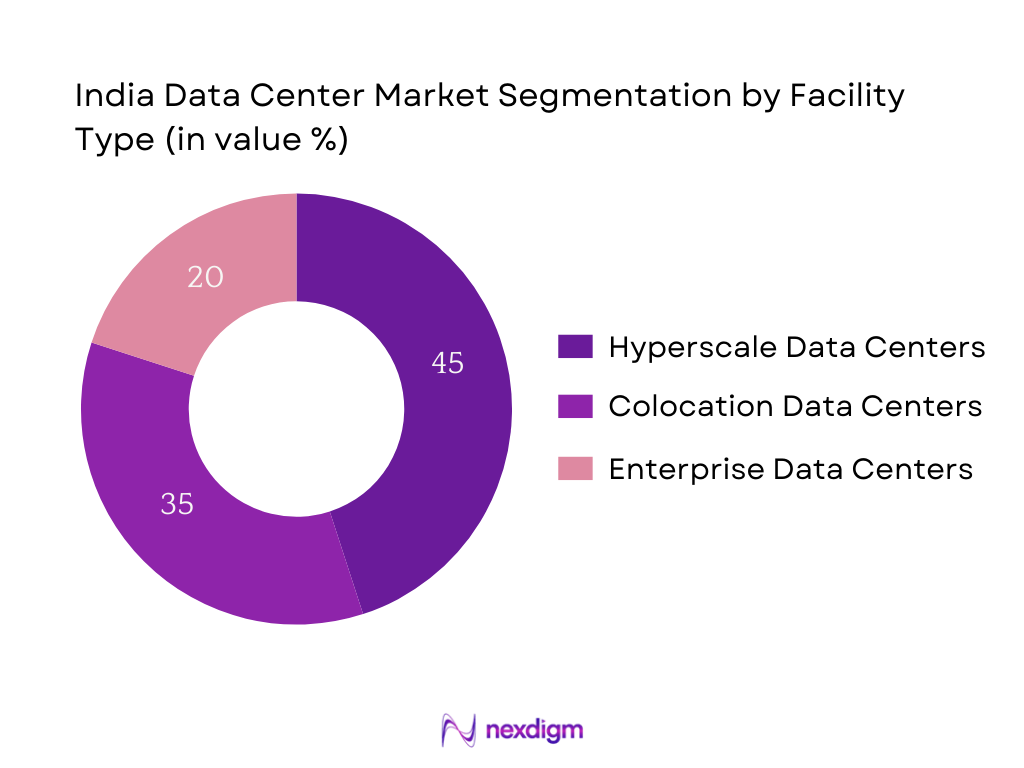

By Facility Type

Among these, Hyperscale Data Centers hold the largest share due to massive investments from global cloud service providers and domestic hyperscalers seeking scalable infrastructure. These facilities offer high-density power, expansive rack capacity, and modular designs optimized for efficiency and rapid deployment—critical as AI, IoT, and 5G workloads surge. Governments’ incentives and data localization norms have further attracted capital expenditure toward large-scale hyperscale campuses.

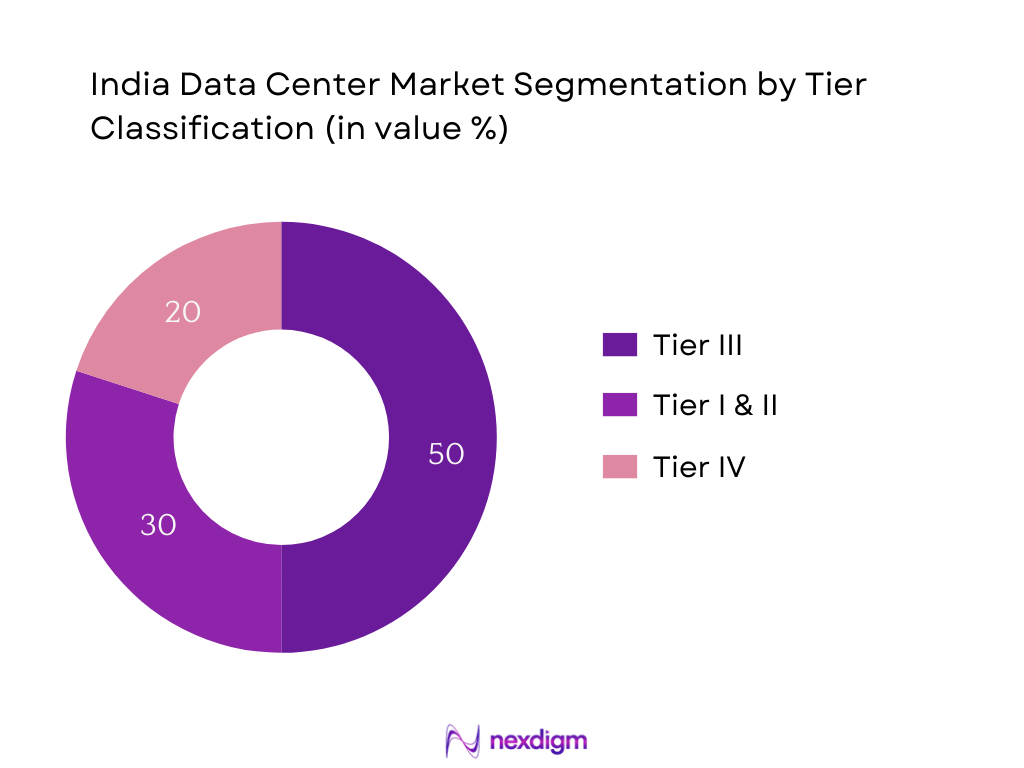

By Tier Classification

Tier III data centers lead the market due to their balanced value proposition—offering high availability, fault tolerance, and uptime guarantees (>99.98 %) at significantly lower capital and operational cost than Tier IV. Enterprises and service providers prefer Tier III as it aligns well with reliability needs for cloud and critical enterprise operations, without the prohibitively higher costs of Tier IV. Additionally, evolving demand demands high uptime yet cost efficiency.

Competitive Landscape

The India data center market is consolidated among a few large players, reflecting high capital requirements and infrastructure complexity. Major hyperscalers and colocation providers drive the expansion. Leading players include Nxtra (Airtel), CtrlS Datacenters, ESDS Software Solution, Adani‑ConneX, Reliance Data Centers (Jio DC), Sify Technologies, STT GDC, Web Werks, Yotta Infrastructure, NTT, Equinix, Pi Datacenters, Microsoft, AWS, and Google.

| Company | Establishment Year | Headquarters | Power Capacity Under Portfolio | Tier Footprint | Cooling Approach | Renewable Energy Use | Edge Capacity Focus |

| Nxtra (Airtel) | — | India | — | — | — | — | — |

| CtrlS Datacenters Ltd. | — | India | — | — | — | — | — |

| ESDS Software Solution Ltd. | — | India | — | — | — | — | — |

| AdaniConneX | — | India | — | — | — | — | — |

| Reliance Data Centers (Jio DC) | — | India | — | — | — | — | — |

India Data Center Market Analysis

Growth Drivers

Increasing Digital Consumption

India’s digital consumption is surging due to rapid mobile internet penetration and escalating broadband usage. As of June 2024, mobile broadband subscriptions exceeded 905 million and total broadband subscriptions crossed 949 million, according to the Ministry of Electronics & IT. In parallel, per capita data usage reached 32 GB per month by end‑2024, making India the global leader in this metric, per Ericsson. This reflects an explosive demand for streaming, cloud gaming, enterprise applications, and digital services—all of which rely heavily on data center infrastructure. The exponential rise from 4.5 exabytes data usage in 2018 to 14.4 exabytes in 2022 demonstrates the data deluge fueling the need for scalable, low-latency data storage and compute

Cloud Demand

India’s enterprise and hyperscale cloud demand is driven by vast internet user base and digital-first businesses. With 918 million internet subscribers as of September 2023—and 65.9% net penetration—most accessing services via broadband or mobile, the transition to cloud-native models is accelerating. For instance, UPI digital payments volume reached 12.20 billion transactions in January 2024, valued at ₹18.41 trillion (USD ~2.85 trillion), reflecting backend cloud and digital infrastructure needs. The scale of digital transactions and online services mandates robust cloud hosting, stimulating investments in hyperscale data center capacity to support enterprise, fintech, and commerce platforms.

Market Challenges

Land Acquisition

Securing land for data center campuses remains a formidable hurdle. Although precise numbers vary across states, reports show that telecom and data center players expanding megawatt-scale projects—such as Airtel’s Nxtra targeting nearly 400 MW by 2027—face delays due to fragmented land parcels and zoning restrictions. While no single aggregated national land statistic exists, the uneven availability of large contiguous plots in major cities like Mumbai, Delhi-NCR, Hyderabad, and Chennai poses consistency issues. These make it harder to deploy scalable hyperscale facilities that need tens of acres adjacent to high-voltage substations and fiber connectivity. The lack of uniform land banking policies across states further complicates long-term planning for developers.

Grid Infrastructure

India’s electric grid infrastructure is under strain from rising power demand, both from general consumption and data centers. By 31 March 2025, India’s total installed utility power capacity reached 467,885 MW, including 105,646 MW of solar, 50,037 MW of wind, and 47,728 MW of hydro. Even though renewable sources now constitute approximately 48.7% of the total generation capacity, data center load growth is expected to elevate electricity consumption from 0.5% to more than 3% by end of the decade. Further, annual growth in electricity usage is outpacing expectations: while government projections anticipated 6.4% annual growth, actual consumption is trending close to 9%, according to CEEW. Data centers thus compete with industry and residential sectors for grid stability, and state distribution companies—many of which are financially stressed—face challenges upgrading infrastructure to support priority loads.

Emerging Opportunities

Edge Computing

Edge computing is emerging as a critical infrastructure layer to support low-latency and high-throughput applications. With 4G coverage reaching 95% of the population and 290 million 5G subscriptions by end‑2024, India’s wireless network infrastructure is expanding at scale. As latency-sensitive services such as real-time analytics, AR/VR, AI inference, and IoT proliferate, placing compute nearer to the user becomes essential. Edge data centers, which cater to localized compute and storage, are being deployed in tier‑II/III cities and on-premise within industrial zones. The nationwide rollout of 97 crore internet connections by mid‑2024 underscores the geographic spread of user demand. This opens opportunities for micro data center facilities that complement traditional hyperscale sites, reducing backbone traffic while ensuring performance.

Renewable Power Integration

India’s clean energy transition presents opportunity for sustainable data center operations. By mid‑2025, India achieved 50% of installed electricity capacity from non‑fossil sources, five years ahead of its 2030 target under the Paris Agreement. In 2024 alone, the country added 28 GW of solar and wind capacity, while non-hydro renewables reached 184.6 GW by June 2025. Integrating renewable energy into data center power supplies not only reduces carbon footprint but also aligns with global corporate sustainability mandates. Leveraging state-level RE availability, captive solar, or wind sourcing agreements can lower operating risk amid rising grid volatility. This macro trend supports “green data center” business models and reflects forward-looking infrastructure alignment across both energy and digital domains.

Future Outlook

Over the 2024–2030 period, the India data center market is poised for strong growth. Digital transformation, AI workloads, and 5G rollout will drive exponential demand for scalable and low-latency infrastructure. Government push in data localization, renewable energy integration, and greenfield ecosystems will further catalyze expansion across hyperscale, colocation, and edge deployments.

Major Players

- NTT Global Data Centers

- CtrlS Datacenters

- STT GDC (ST Telemedia)

- Sify Technologies

- Yotta Infrastructure

- Nxtra (Airtel)

- Web Werks

- AdaniConneX

- Reliance Data Centers (Jio DC)

- GPX Global Systems

- ESDS Software Solution

- Pi Datacenters

- Cyfuture India

- Equinix Inc.

- Microsoft (cloud/infrastructure presence)

Key Target Audience

- CIOs and Heads of Infrastructure of large enterprises

- Chief Digital Officers in BFSI and e‑commerce sectors

- State government IT departments (e.g., Telangana IT, Maharashtra IT)

- Telecom infrastructure investment divisions

- Energy regulators overseeing digital infrastructure load

- Real estate investment trusts (REITs) focusing on tech parks

- Investment and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

We mapped all stakeholders, including hyperscalers, enterprise users, power utilities, and regulators. Desk research used secondary databases to define critical variables like IT load, capacity, and investment flows.

Step 2: Market Analysis and Construction

Historical data (2019–2024) for revenue, MW capacity, and real estate were compiled and analysed. We assessed colocation versus hyperscale trends and tracked pricing and technology shifts to ensure volume and value integrity.

Step 3: Hypothesis Validation and Expert Consultation

We conducted structured interviews with senior executives at major data center firms, cloud providers, and state IT departments. These insights refined market assumptions, deployment timelines, and capacity utilization projections.

Step 4: Research Synthesis and Final Output

Validated data was triangulated through financial reports, government policy announcements, and infrastructure projects. Final output integrates bottom-up capacity projections and top-down investment forecasts, ensuring accuracy and stakeholder relevance.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Data Center Rack Space Calculations, Power Density Metrics, Primary & Secondary Research Sources, Limitations and Final Conclusion)

- Definition and Scope

- Historical Evolution and Market Genesis

- Timeline of Infrastructure Expansion by Major Players

- Life Cycle and Investment Horizon of Hyperscale Projects

- Colocation and Hyperscale Business Model Value Chain

- Key Growth Drivers (Increasing Digital Consumption, Cloud Demand, AI Workloads, Data Localization)

- Market Challenges (Land Acquisition, Grid Infrastructure, High Operating Costs)

- Emerging Opportunities (Edge Computing, Renewable Power Integration, DCaaS Models)

- Trends and Innovations (Liquid Cooling, Modular Construction, AI in DC Ops)

- Regulatory Environment (Data Localization, Power Tariffs, Construction Norms)

- SWOT Analysis

- Stakeholder Ecosystem Analysis (Operators, Real Estate Developers, Utilities, OEMs)

- Porter’s Five Forces Analysis

- By Total Revenue (In INR Billion), 2019-2024

- By Installed IT Load Capacity (In MW), 2019-2024

- By Rack Space Supply (In Square Feet), 2019-2024

- By Power Consumption (In MVA), 2019-2024

- By Average Utilization Rate (% of Capacity Used), 2019-2024

- By Type of Data Center (In Value %)

Colocation Data Centers

Hyperscale Data Centers

Managed Hosting Data Centers

Edge Data Centers

Enterprise Data Centers - By Tier Classification (In Value %)

Tier I

Tier II

Tier III

Tier IV - By End-User Industry (In Value %)

BFSI

IT & ITES

Government & PSUs

E-commerce & Retail

Media & Entertainment

Healthcare

Manufacturing - By Power Capacity Range (In Value %)

Below 5 MVA

5–15 MVA

15–30 MVA

Above 30 MVA - By Region (In Value %)

West India (Mumbai, Pune)

South India (Chennai, Bengaluru, Hyderabad)

North India (Delhi NCR)

East India (Kolkata, Bhubaneswar)

- Market Share of Major Players (By Installed IT Load and Revenue)

Market Share by Type (Colocation vs Hyperscale vs Managed) - Cross Comparison Parameters (Company Overview, DC Capacity, Tier Classification, Number of Facilities, Rack Space, Power Source – Grid/Diesel/Solar, Expansion Plans, Renewable Adoption, Cooling Type, Client Segments)

- SWOT Analysis of Key Players

- Price Benchmarking by Rack Size, Power Consumption, Tier Type

- Detailed Company Profiles

NTT Global Data Centers and Cloud Infrastructure India

CtrlS Datacenters

ST Telemedia Global Data Centres (STT GDC India)

Sify Technologies

Yotta Infrastructure

Nxtra by Airtel

Web Werks

AdaniConneX

Reliance Data Centers (Jio DC)

GPX Global Systems

Netmagic (An NTT Company)

ESDS Software Solution

Pi DATACENTERS

Cyfuture India

Bridge Data Centres

- Infrastructure Utilization Rates by Sector

- Procurement Preferences and SLAs

- Energy and Sustainability Expectations

- Latency Requirements by Industry Use Case

- Pricing Sensitivity and ROI Benchmarks

- By Total Revenue, 2025-2030

- By Installed IT Load Capacity, 2025-2030

- By Rack Space, 2025-2030

- By Power Demand, 2025-2030

- By Utilization Rate, 2025-2030