Market Overview

The India Decoys and Dispensers market is projected to witness significant growth based on recent historical assessments. With a steady increase in defense investments and advancements in military technologies, the market is expected to expand, driven by the growing need for enhanced defense systems. Factors such as technological innovations, government initiatives, and the rising demand for sophisticated decoy systems to counter modern warfare threats will further propel this market’s expansion. In 2024, the market size is estimated to be valued at approximately USD ~ billion.

India remains a dominant player in the decoys and dispensers’ market due to its robust defense infrastructure and ongoing modernization efforts. Key cities such as New Delhi, Bangalore, and Hyderabad have emerged as the central hubs for defense manufacturing, with the Indian government heavily investing in security and defense technologies. The country’s strong defense policies, combined with strategic geographical positioning and military alliances, have made it a key player in the market. The emphasis on self-reliance in defense manufacturing under the “Make in India” initiative continues to solidify India’s position in the global market.

Market Segmentation

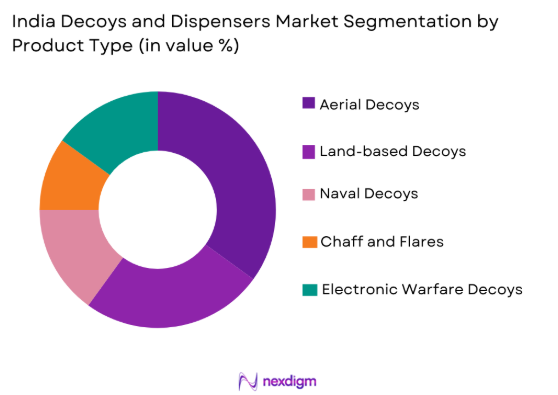

By Product Type

India’s decoys and dispensers market is segmented by product type into Aerial Decoys, Land-based Decoys, Naval Decoys, Chaff and Flares, and Electronic Warfare Decoys. Recently, aerial decoys have taken a dominant market share due to their extensive use in military air operations for countering incoming threats and ensuring the safety of aircraft. The continuous innovation in aerial decoy technologies, coupled with the rising demand for more advanced, versatile decoys capable of addressing evolving threats in aerial warfare, is driving their market leadership. Additionally, the integration of electronic warfare capabilities into aerial decoys has further boosted their adoption across defense forces.

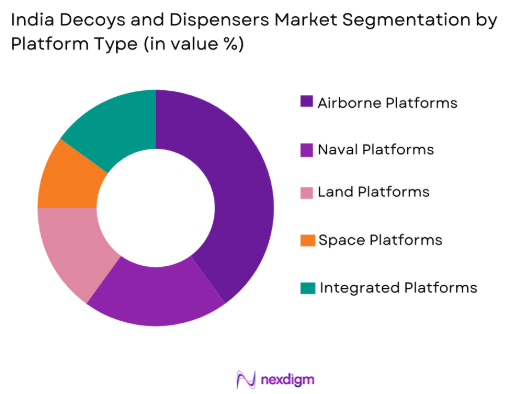

By Platform Type

The market is segmented by platform type into Airborne Platforms, Naval Platforms, Land Platforms, Integrated Platforms, and Space Platforms. Airborne platforms are leading the market, driven by the increasing use of decoy systems in military aviation to protect aircraft during combat and surveillance missions. As air forces around the world modernize their fleets and enhance their electronic warfare capabilities, the demand for advanced decoys for airborne platforms has significantly risen. This trend is driven by the need to counter modern missile systems and advanced radar technologies.

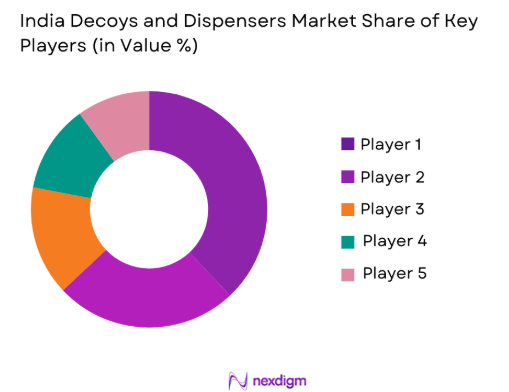

Competitive Landscape

The India Decoys and Dispensers market is highly competitive, with key players consolidating their positions through strategic partnerships, technological innovations, and product diversification. Large defense contractors dominate the market, with a strong focus on advanced decoy systems for military operations. These players continuously invest in R&D to improve the effectiveness and adaptability of their products. The market also experiences the influence of smaller specialized companies offering niche technologies for specific defense applications.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Parameter |

| Lockheed Martin | 1912 | USA | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | UK | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | USA | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | USA | ~ | ~ | ~ | ~ | ~ |

India Decoys and Dispensers Market Analysis

Growth Drivers

Technological Advancements in Defense Systems

The increasing demand for advanced decoys and dispensers is driven by rapid technological advancements in defense systems, including the integration of artificial intelligence and electronic warfare capabilities. As military operations become more complex and adversaries develop sophisticated targeting systems, the need for decoys that can effectively simulate or confuse threats has grown significantly. Innovations in materials, such as lightweight, durable, and cost-effective composites, have also contributed to the development of more effective decoy systems. These advancements are allowing military forces to deploy decoys that are highly realistic, versatile, and capable of countering modern aerial, land-based, and naval threats. The constant evolution in defense technologies ensures that the demand for state-of-the-art decoys and dispensers will continue to rise, which is a key factor driving market growth.

Geopolitical Tensions and Security Investments

Geopolitical tensions in various regions, particularly in Asia, are a significant growth driver for the decoys and dispensers market. Nations like India, China, and other Southeast Asian countries have been expanding their defense capabilities to address security concerns arising from territorial disputes, military rivalries, and regional instability. As part of their defense strategies, these countries are investing heavily in advanced military systems, including decoys and dispensers, to enhance their security. The need for these systems in both offensive and defensive military strategies, particularly for safeguarding critical assets, is increasing. The geopolitical instability across borders is expected to further push defense budgets, with a corresponding increase in the demand for decoy systems in the coming years.

Market Challenges

High Production Costs of Advanced Decoys

One of the primary challenges facing the India Decoys and Dispensers market is the high cost of advanced decoy systems. Developing decoys that can effectively counter sophisticated threats requires significant investment in R&D, cutting-edge technology, and materials. The integration of advanced features such as AI, sensors, and radar-jamming capabilities in decoys makes them more expensive to produce. This cost factor is particularly challenging for smaller defense forces and nations with constrained defense budgets. Additionally, the complexity of designing decoys that can be used across multiple platforms further adds to the development costs, making them inaccessible to some military organizations. These high production costs can limit the widespread adoption of advanced decoy systems, especially in emerging economies.

Technological Integration and Interoperability Issues

Another significant challenge is the integration of decoys and dispensers with existing military systems. As decoy technologies evolve, they must be compatible with a wide range of platforms, including fighter jets, naval vessels, and ground vehicles. The process of ensuring that new decoy systems work seamlessly with existing military technologies can be complex and time-consuming. Interoperability issues can delay the adoption of new systems and increase the costs associated with their deployment. Additionally, military forces that have invested heavily in legacy systems may face difficulties in transitioning to newer, more advanced decoy technologies. These integration challenges hinder the ability of defense contractors to quickly deploy new solutions and expand their market share.

Opportunities

Growing Demand for Autonomous Systems

The growing demand for autonomous systems presents a significant opportunity for the India Decoys and Dispensers market. As military forces continue to move towards unmanned aerial vehicles (UAVs) and autonomous defense systems, the need for decoys that can simulate or intercept enemy radar and sensor systems becomes critical. These autonomous systems are designed to operate without direct human intervention, making them ideal candidates for incorporating advanced decoy systems that can protect these assets during military operations. The integration of decoys into autonomous systems allows for more flexible and dynamic responses to threats, which is driving the demand for these products in military sectors. As autonomous systems become increasingly important in modern warfare, the decoy market is expected to experience significant growth.

Advances in Electronic Warfare (EW) Technologies

Advances in electronic warfare technologies offer a significant opportunity for the India Decoys and Dispensers market. EW involves the use of electromagnetic energy to disrupt or deceive adversary radar and communications systems, and decoys play a crucial role in these operations. The ongoing developments in EW technologies are enabling the creation of more sophisticated and effective decoys that can counter advanced missile guidance systems, radar detection, and tracking systems. As military forces around the world enhance their EW capabilities, the demand for decoys that can simulate or confuse enemy sensors is increasing. This creates a lucrative opportunity for manufacturers to develop new and improved decoy products that cater to these evolving needs, fueling market growth.

Future Outlook

The future of the India Decoys and Dispensers market appears promising, with significant growth anticipated over the next five years. As global defense spending increases and technological advancements continue to reshape military strategies, the demand for advanced decoy systems is expected to surge. Moreover, the integration of AI, autonomous systems, and electronic warfare capabilities will play a key role in shaping future decoy technologies. With the rise in defense budgets and the increasing need for modern military solutions, the India Decoys and Dispensers market is positioned for sustained growth.

Major Players

- Lockheed Martin

- BAE Systems

- Thales Group

- Northrop Grumman

- Raytheon Technologies

- Boeing

- Leonardo

- Saab Group

- Elbit Systems

- Harris Corporation

- L3 Technologies

- Textron Systems

- Rafael Advanced Defense Systems

- Rheinmetall AG

- General Dynamics

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense contractors

- Aerospace manufacturers

- Military forces

- Security agencies

- Technology developers

- Private sector / Technology firms

Research Methodology

Step 1: Identification of Key Variables

The initial stage involves identifying critical variables impacting the India Decoys and Dispensers market. This includes defining key factors such as technological trends, regulatory frameworks, and geopolitical influences.

Step 2: Market Analysis and Construction

The next step is analyzing the market dynamics, including segmentation, growth drivers, challenges, and competitive landscape. This forms the basis for constructing the market model.

Step 3: Hypothesis Validation and Expert Consultation

Expert consultations and validation of market hypotheses ensure that the analysis accurately reflects current trends and future projections in the market.

Step 4: Research Synthesis and Final Output

The final output is synthesized by combining insights from primary and secondary research, forming a comprehensive market report with actionable conclusions.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased Government Investment in National Security

Technological Advancements in Electronic Warfare

Growing Military Modernization Programs - Market Challenges

High Capital Expenditure in Defense Projects

Technological Integration and Interoperability Issues

Regulatory and Compliance Barriers - Market Opportunities

Expansion in Artificial Intelligence-Driven Defense Solutions

Partnerships with Private Tech Firms for Enhanced Cybersecurity

Emerging Demand for Autonomous Systems - Trends

Increase in Use of Autonomous and Unmanned Systems

Integration of AI and Machine Learning in Defense Systems

Surge in Cybersecurity Investments for Defense - Government Regulations

Data Protection and Privacy Regulations

Export Control and Compliance Policies

Government Funding and Grants for Defense Technologies

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Aerial Decoys

Land-based Decoys

Naval Decoys

Chaff and Flares

Electronic Warfare Decoys - By Platform Type (In Value%)

Airborne Platforms

Naval Platforms

Land Platforms

Integrated Platforms

Space Platforms - By Fitment Type (In Value%)

On-premise Solutions

Cloud-based Solutions

Hybrid Solutions

Modular Solutions

Integrated Solutions - By End User Segment (In Value%)

Military Forces

Defense Contractors

Government Agencies

Security Services

Private Sector / Technology Firms - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors

- Market Share Analysis

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, End User Segment, Fitment Type, Technology Integration, Production Capacity, Geographical Reach, Product Differentiation, Pricing Strategy)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Boeing

Saab Group

BAE Systems

General Dynamics

Northrop Grumman

Thales Group

Lockheed Martin

Raytheon Technologies

Leonardo

Elbit Systems

Harris Corporation

Rheinmetall AG

L3 Technologies

Textron Systems

Rafael Advanced Defense Systems

- Military Forces’ Increasing Demand for Digital Systems

- Government Agencies’ Role in Regulating and Procuring Defense Systems

- Defense Contractors’ Shift Towards Innovation and Integration

- Private Sector’s Growing Interest in Cybersecurity Solutions

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035