Market Overview

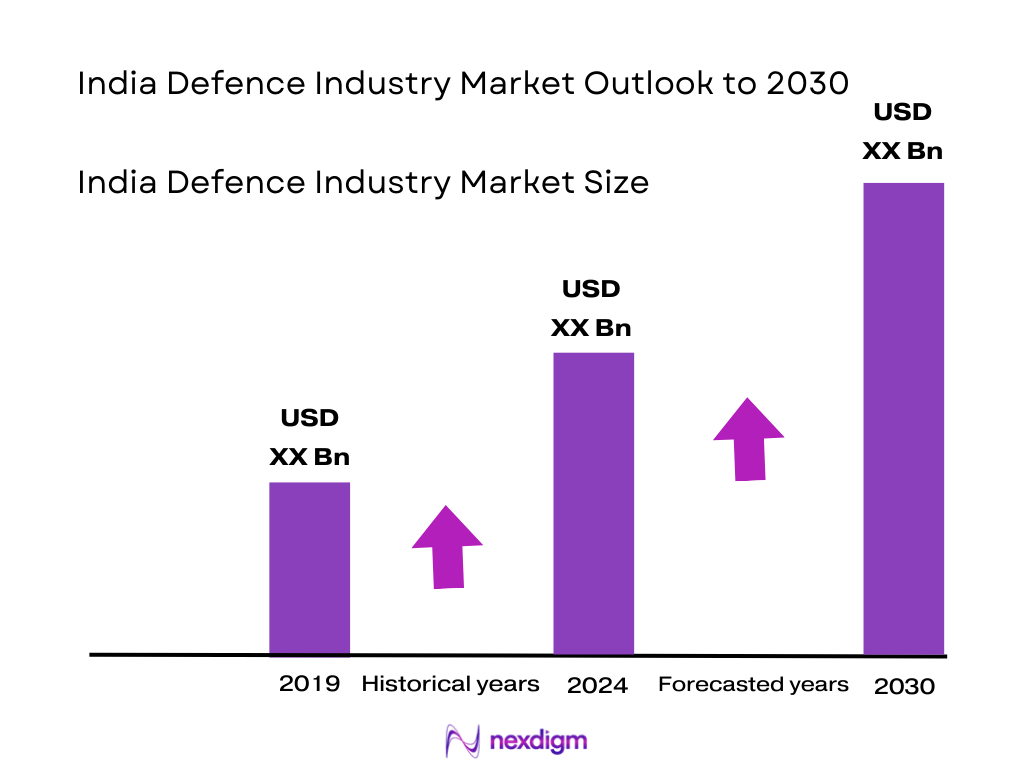

The India Defence Industry Market is valued at USD 17.30 billion, based on comprehensive industry data for 2024, drawn from authoritative secondary sources. This valuation reflects measured government investment in modernization—particularly land, air, and naval platforms—combined with a robust push toward indigenized manufacturing. The record rise in domestic defence output (₹1.27 lakh crore in production during FY 2023–24) underlines how Make‑in‑India initiatives and increased procurement from both DPSUs and private-sector firms are fueling the market’s scale.

The industry’s dominance centers in specific cities and regions with deep-rooted defence infrastructure. Leading hubs such as Bengaluru (aerospace & avionics R&D), Hyderabad (missiles and artillery systems), and Chennai/Machilipatnam (shipbuilding and naval systems) uphold market strength due to the presence of DRDO labs, DPSUs like HAL and BEL, private firms, and robust vendor ecosystems. These locations benefit from enhanced R&D infrastructure, institutional backing, and proximity to government procurement centers, cementing their dominance in the national defence landscape.

Market Segmentation

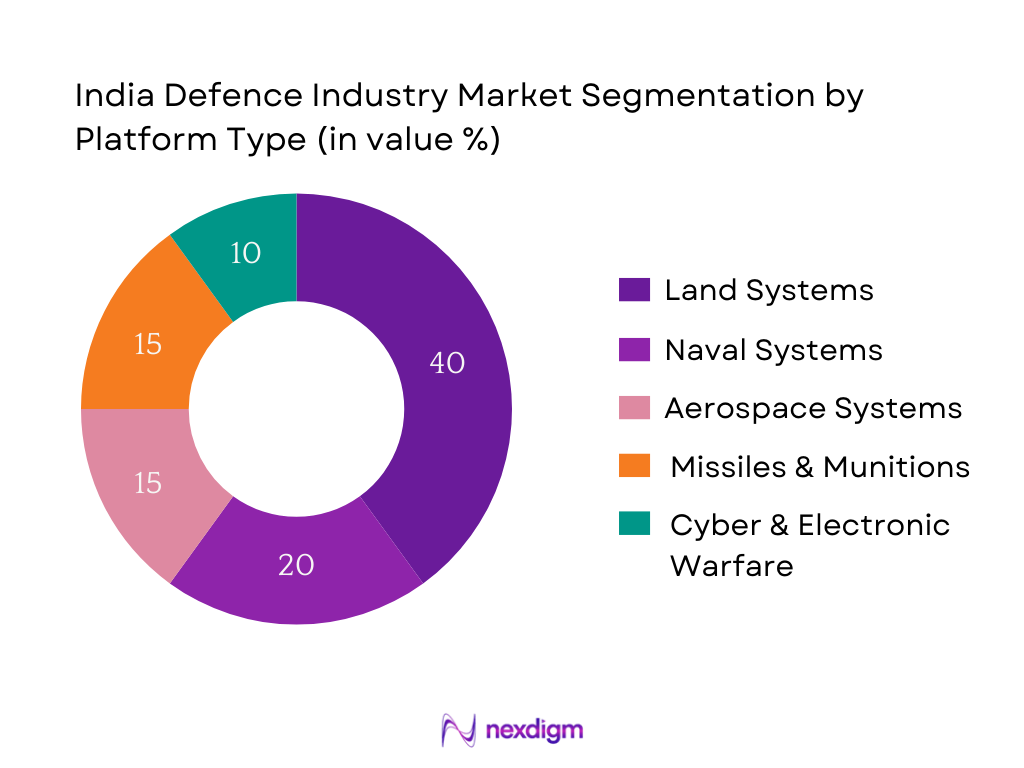

By Platform Type

Land Systems dominate the India Defence Industry Market under the platform-type segmentation. This predominance stems from sustained modernization of ground forces—such as armoured vehicles, artillery, and mobile platforms—addressing legacy systems and border challenges. India’s extended land borders and evolving threat landscape have necessitated accelerated procurement and domestic production, creating a strong demand for upgrades and new platforms. Domestic manufacturers, including Bharat Forge (ATAGS), BDL, and DRDO, have responded with advanced indigenous systems, reinforcing the segment’s lead.

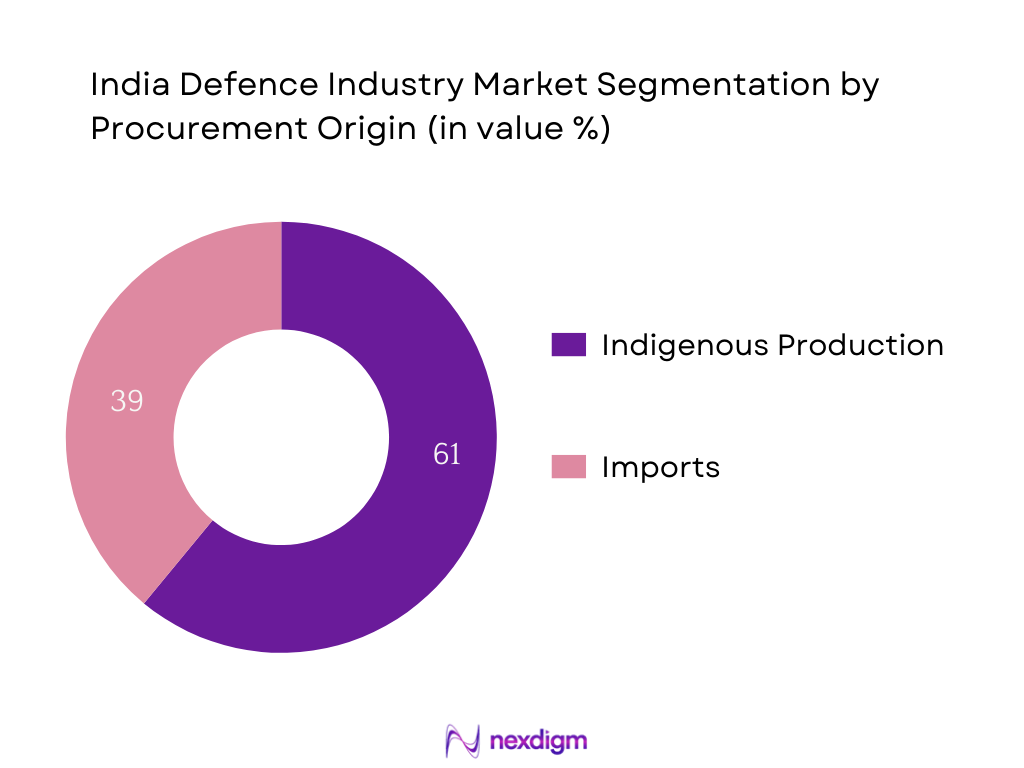

By Procurement Origin

Indigenous Production holds a commanding share within the procurement-origin segmentation. Government policies under Make‑in‑India, Positive Indigenisation Lists, and domestic procurement mandates have elevated the share of in‑country manufacturing. DPSUs, MSMEs, and private-sector partners have ramped up capacity to meet ~61.10% of procurement through domestic supply, reducing reliance on foreign imports and fostering self-reliance.

Competitive Landscape

The India Defence Industry Market is driven by a core set of established defence OEMs, both public and private, that collectively steer the industry’s direction and technological trajectory. Key competitive dynamics show consolidation around a few major entities—HAL, BEL, MDL—complemented by rising private peers like Tata Advanced Systems and Adani Defence & Aerospace, showcasing a blend of heritage OP capabilities and agile innovation.

| Company | Establishment Year* | Headquarters | Indigenous Share | Export Focus | R&D Allocation | Strategic Partnerships | Manufacturing Footprint | Private/Public |

| Hindustan Aeronautics Ltd (HAL) | 1940s | Bengaluru | – | – | – | – | – | – |

| Bharat Electronics Ltd (BEL) | 1950s | Bengaluru | – | – | – | – | – | – |

| Mazagon Dock Ltd (MDL) | 1930s | Mumbai | – | – | – | – | – | – |

| Tata Advanced Systems | 2010s | Hyderabad | – | – | – | – | – | – |

| Adani Defence & Aerospace | 2020s | Ahmedabad/Various | – | – | – | – | – | – |

India Defence Industry Market Analysis

Growth Drivers

Defence Budget Allocation

India’s Ministry of Defence received ₹6,21,941 crore in central government allocations for the 2024‑25 fiscal year, marking a slight decrease from the revised estimate of the previous year yet remaining the second-largest allocation among ministries, accounting for approximately 12.9% of total ministerial expenditure. Within this, the capital outlay towards procurement of new weapons, aircraft, and naval assets was earmarked at ₹1,80,000 crore, reflecting a 4.65% increase over earlier estimates. Despite pressures from personnel costs—where in 2024‑25, roughly ₹1,72,000 crore was designated for capital modernization and ₹1,41,205 crore for pensions—the sustained high-level capital commitment signals strategic prioritization of modern equipment across the Indian Army, Navy, and Air Force.

Indigenization Push

India’s defence production in FY 2023‑24 reached ₹1.27 lakh crore, representing a cumulative 174% growth since 2014‑15—a clear reflection of policy-driven manufacturing ramp-up. In FY 2024‑25, defence exports surged to ₹23,622 crore, underscoring expanding capability in indigenous systems reaching global markets. In addition, under the Make-in-India and Atmanirbhar Bharat initiatives, more than 194 defence-focused startups and MSMEs participated in innovation ecosystems, and DRDO’s research wings saw allocations increase to ₹26,816 crore for FY 2025‑26—up from ₹23,855 crore the prior year—showcasing deliberate financial support for domestic R&D. Collectively, these data points reveal a focused government-led push toward self-reliance, strengthening local production and advanced capability development across platforms.

Market Challenges

Delays in Procurement

A long-standing bottleneck persists in procurement cycles. Even with increasing defence allocations, emergency purchases were required—Reuters reports India approved US$4.6 billion in emergency procurement alongside a $7 billion deal for Rafale naval jets shortly after cross-border conflict in 2025. Further, despite an allocated defence budget of $75 billion for 2024‑25, a considerable portion went to salaries and pensions, constraining funds for modernization and translating into delays in equipment acquisition. These reactive expenditures underscore the systemic lag between budgeting and procurement delivery, with capital assets like aircraft and naval platforms (₹48,600 crore and ₹24,390 crore respectively) seeing allocation hikes but still not fully meeting modernization needs. The cumulative data highlights inefficiencies in procurement pipelines, where bureaucratic processes and underfunded modernization lines lead to emergency spending and unmet capability gaps.

Dependence on Imports

India remains one of the world’s largest arms importers despite strides in domestic manufacturing. Till recently, reliance on external suppliers has persisted—in 2025, even after substantial indigenous output, India’s defence import bill remained sizable, and the nation continued to host major foreign suppliers. The high imports are partly due to technical gaps in radar, missile, and aircraft systems, which domestic firms are progressively addressing but have yet to fully supplant. While defence exports jumped to ₹23,622 crore in FY 2024‑25, imports still accounted for vital capability enhancements, especially in sophisticated aerospace, electronic warfare, and naval systems. Limited domestic capacity, skill shortages, and continued reliance on foreign tech create structural constraints, slowing the transition to a self-reliant defence supply chain.

Opportunities

Defence Exports

India’s defence export trajectory shows significant acceleration. In FY 2023‑24, exports crossed ₹21,083 crore, and further expanded to ₹23,622 crore in FY 2024‑25—with arms reaching over 92 countries globally. These figures highlight the global competitiveness of Indian platforms like missiles, avionics components, naval systems, and munitions. With strategic deals underway (e.g., BrahMos missiles to the Philippines, radar systems to Armenia), India is positioning itself as a reliable supplier beyond traditional partners. The expanding export base reflects robust domestic production, diplomatic outreach, and ongoing capability validation—creating new revenue avenues and enabling India to transform surplus production into economic and geopolitical leverage.

iDEX Platform

The Innovations for Defence Excellence (iDEX) initiative has fostered innovation among start-ups and MSMEs. By early 2024, over 300 enterprises were engaged in iDEX challenges, and important contracts were awarded—one startup landed a single iDEX deal valued at more than ₹200 crore. These outcomes illustrate functional mechanisms translating ideation into funded R&D, enabling agile prototyping across technologies like UAVs, artificial intelligence systems, and naval weaponry. The framework’s grant mechanisms (ranging up to ₹10 crore under SPARK and Prime schemes) have catalyzed private participation in defence technology development. Notably, DRDO’s partnerships and Problem Statement programs under iDEX have institutionalized industry collaboration and innovation pathways—creating a fertile environment for future domestic capability growth.

Future Outlook

Over the coming years, the India Defence Industry Market is poised for strong growth, fueled by continued government emphasis on self-reliance, rising threats across land, air, and cyber domains, and increasing exports. Technological innovation spurred by private–public synergy will amplify capacity in areas like UAVs, electronic warfare, next-gen artillery, and naval platforms. Strategic partnerships and streamlining of procurement policies will further reinforce growth trajectories.

Major Players

- Hindustan Aeronautics Ltd (HAL)

- Bharat Electronics Ltd (BEL)

- Mazagon Dock Shipbuilders Ltd (MDL)

- Larsen & Toubro Defence (L&T Defence)

- Bharat Dynamics Ltd (BDL)

- TATA Advanced Systems

- Adani Defence & Aerospace

- DRDO (R&D OEM Partner)

- Garden Reach Shipbuilders & Engineers Ltd (GRSE)

- Cochin Shipyard Ltd (CSL)

- Solar Industries India Ltd

- Paras Defence & Space

- MKU Ltd

- Data Patterns (India) Ltd

- Kalyani Group (Bharat Forge Defence / Kalyani Rafael)

Key Target Audience

- Indian Ministry of Defence (MoD)

- Defence Procurement Wing, Department of Defence Production

- Defence Research & Development Organisation (DRDO)

- Strategic Investment Arms of PSU Syndicate Banks

- Sovereign Funds & Investments and Venture Capitalist Firms

- Export‑Import Bank of India (EXIM Bank)

- Defence Exports Promotion Council

- State Government Industrial Development Departments

Research Methodology

Step 1: Identification of Key Variables

The initial phase entails mapping the ecosystem of defence stakeholders—including government bodies (MoD, DRDO), DPSUs, OEMs, private players, and exporters—by leveraging secondary resources such as official reports, industry databases, and procurement policy documents. This establishes the framework to define variables like platform type, procurement origin, production output, and export volumes.

Step 2: Market Analysis and Construction

Historical data on market size, production output, procurement by force, and export figures are aggregated and analyzed to build a reliable revenue model. This includes quantifying indigenous versus import splits, production growth across sectors, and forecast modeling using bottom-up and top-down perspectives.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions and trends are validated through structured interviews with industry experts from DPSUs, private OEMs, and MoD personnel. These consultations, conducted via CATI and in-person panels, refine understanding of procurement cycles, capacity constraints, technological needs, and policy impacts.

Step 4: Research Synthesis and Final Output

The final report synthesis involves triangulating quantitative estimates with qualitative insights—from OEMs, export stakeholders, and defence policymakers—to ensure the delivery of an accurate, validated, and actionable analysis of the India Defence Industry Market.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Stakeholder Interviews, Primary Research Approach, Limitations and Conclusions)

- Definition and Scope

- Market Genesis and Evolution

- Defence Acquisition Cycle and Procurement Models

- Indigenous Production Ecosystem (Make-I, Make-II, iDEX, AoN, etc.)

- Strategic Partnership Model Overview

- India’s Defence Budget Allocation Framework

- Supply Chain and Value Chain Mapping (PSUs, DPSUs, MSMEs, Tier I/II/III Vendors)

- Growth Drivers [Defence Budget Allocation, Indigenization Push, Strategic Threat Perception, R&D Ecosystem, Export Push, Capability Modernization]

- Market Challenges [Delays in Procurement, Dependence on Imports, Regulatory Complexity, Skill Gaps, Funding Delays]

- Opportunities [Defence Exports, iDEX Platform, Private Sector Integration, MRO Ecosystem, Technology Transfers]

- Trends [Unmanned Systems, Hypersonics, Smart Ammunition, Modular Manufacturing, Dual-use Technology]

- Regulatory Landscape [DPP/DAP Overview, FDI Cap Changes, Offset Guidelines, Testing and QA Processes]

- SWOT Analysis

- Stakeholder Ecosystem [MoD, DRDO, DPSUs, Private Players, MSMEs, Academia, Think Tanks]

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume (Production in Units), 2019-2024

- By Average Order Value, 2019-2024

- By Platform (In Value %)

Land Systems

Naval Systems (Submarines, Frigates, Corvettes, Offshore Patrol Vessels)

Aerospace Systems (Fighter Jets, Helicopters, UAVs, AEW&C)

Missiles and Munitions (Ballistic Missiles, Anti-Tank Missiles, Precision Guided Munitions)

Cyber and Electronic Warfare Systems - By End User (In Value %)

Indian Army

Indian Navy

Indian Air Force

Coast Guard

Special Forces/Paramilitary - By Procurement Model (In Value %)

Capital Acquisition (Buy Global, Buy Indian-IDDM, Buy & Make)

Revenue Procurement

Emergency Procurement (Fast Track Procedure)

Offset Contracts

Strategic Partnership - By Technology Segment (In Value %)

Artificial Intelligence & Robotics

Electronic Warfare & Radars

Cybersecurity & C4ISR

Advanced Materials & Stealth

Simulation and Training Systems - By Region (In Value %)

Northern Region

Western Region

Southern Region

Eastern Region

Central Region

- Market Share Analysis (By Platform, By End User)

- Cross Comparison Parameters (Company Overview, Indigenous vs Imported Share, Export Engagement, Strategic Defence Projects, Involvement in Offset Programs, Technology Domains, Number of Defence Licenses, Manufacturing Infrastructure, R&D Capabilities)

- SWOT Analysis of Major Players

- Pricing Analysis Based on Key Contract Value and Volume

- Detailed Profiles of Major Companies

Hindustan Aeronautics Ltd (HAL)

Bharat Electronics Ltd (BEL)

Mazagon Dock Shipbuilders Ltd (MDL)

Larsen & Toubro Defence

Bharat Dynamics Ltd (BDL)

TATA Advanced Systems

Adani Defence & Aerospace

DRDO (as OEM and R&D Partner)

Garden Reach Shipbuilders & Engineers Ltd (GRSE)

Cochin Shipyard Ltd (CSL)

Solar Industries India Ltd

Paras Defence & Space

MKU Ltd

Data Patterns (India) Ltd

Kalyani Group (Bharat Forge Defence)

- Budget Allocation Mapping by Branch

- Capability Gap Assessment

- Procurement Trends & Decision Cycle

- Technology and Specification Requirements

- Pain Points in Acquisition & Vendor Engagement

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Order Value, 2025-2030