Market Overview

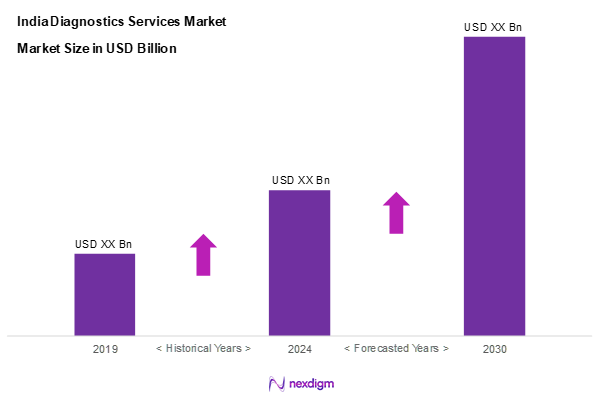

As of 2024, the India diagnostics services market is valued at USD 35.4 billion, with a growing CAGR of 13.4% from 2024 to 2030, reflecting an increasing demand due to a rise in chronic disease prevalence and technological advancements. Factors driving this market include improved healthcare infrastructure and the growth of preventive care measures across various demographics. These elements are contributing to a robust expansion in service offerings and availability in urban as well as rural areas, enhancing accessibility for the population.

Key cities contributing to the dominance of the India diagnostics services market include Delhi, Mumbai, and Bengaluru. These metropolitan areas benefit from advanced healthcare infrastructure, a high concentration of diagnostic laboratories, and an increasingly health-conscious population. Additionally, the presence of major healthcare institutions and research facilities in these regions facilitates innovation and higher service standards, further solidifying their market position.

Market Segmentation

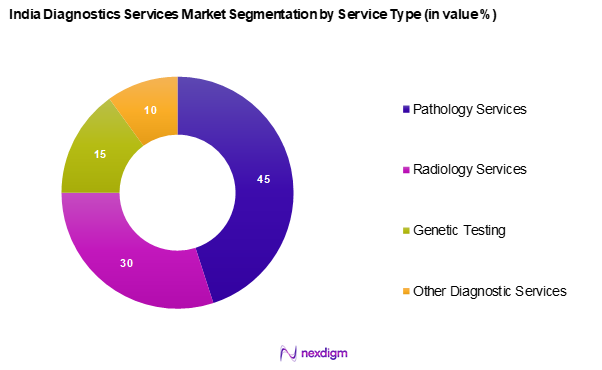

By Service Type

The India diagnostics services market is segmented by into pathology services, radiology services, genetic testing, and other diagnostic services. Pathology services dominates the market share, accounting for a significant portion of revenue generation. This sub-segment includes vital diagnostic tests such as blood tests and tissue biopsies that are essential for the early detection and management of diseases. The high prevalence of conditions like diabetes and cancer, combined with increased awareness of routine health check-ups, drives the demand for pathology services.

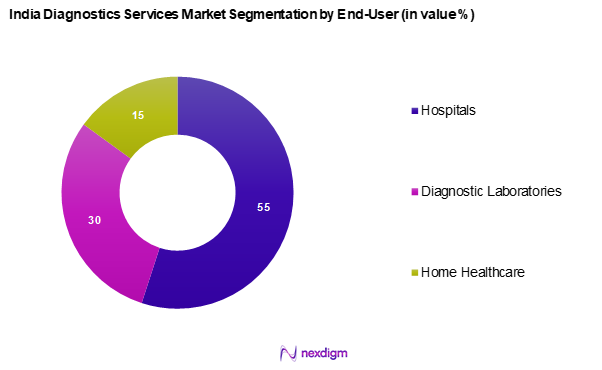

By End-User

The India diagnostics services market is segmented by into hospitals, diagnostic laboratories, and home healthcare. Hospitals represent the most significant share because they are the primary point of service delivery for patients requiring immediate and comprehensive diagnostic tests. The integration of advanced diagnostic tools and the presence of specialized departments have allowed hospitals to provide rapid test results, enhancing patient care and outcomes, which in turn boosts their share in the diagnostic services market.

Competitive Landscape

The India diagnostics services market is dominated by several major players, including both local and international firms. Key companies include Dr. Lal PathLabs, SRL Diagnostics, and Apollo Diagnostics, which have established strong brand identities and extensive service networks. These companies continuously innovate to differentiate their offerings in a highly competitive environment.

| Company Name | Establishment Year | Headquarters | No. of Services Offered | Market Focus Areas | Revenue | Market Share |

| Dr. Lal PathLabs | 1949 | Haryana, India | – | – | – | – |

| SRL Diagnostics | 1995 | Haryana, India | – | – | – | – |

| Apollo Diagnostics | 2015 | Telangana, India | – | – | – | – |

| Metropolis Healthcare | 1981 | Maharashtra, India | – | – | – | – |

| Thyrocare | 1996 | Maharashtra, India | – | – | – | – |

India Diagnostics Services Market Analysis

Growth Drivers

Increasing Prevalence of Chronic Diseases

The rise in chronic diseases such as diabetes, cardiovascular disorders, and cancer is a significant driver in the India diagnostics services market. India has seen a surge in diabetes prevalence, with approximately 77 million people affected in 2022, a figure projected to reach 134 million by 2045, as documented by the International Diabetes Federation. Furthermore, cardiovascular diseases remain the leading cause of mortality, accounting for nearly 28% of all deaths in India according to the National Health Profile 2022. The increasing burden of these conditions enhances the demand for diagnostic testing as early detection and ongoing management are integral to effective treatment. The heightened focus on health screening reinforces the growth of the diagnostics services sector.

Advancements in Diagnostic Technology

The advancements in diagnostic technology, particularly imaging and lab testing methods, are reshaping the India diagnostics services market. Technologies such as next-generation sequencing and advanced imaging techniques contribute to more accurate and faster diagnoses. For instance, the Indian medical technology market is estimated to reach USD 50 billion by 2030, driven by innovations in diagnostics. The integration of AI in diagnostics enhances efficiency and aids in the interpretation of complex data, which is crucial for accurate patient care. The modernization of medical equipment, led by increased research and development investments, indicates a trend towards adopting sophisticated diagnostic modalities.

Market Challenges

Regulatory Compliance Issues

Regulatory compliance remains a significant challenge facing the India diagnostics services market. The complexity of the regulatory landscape can hinder the speed of new diagnostic technology approvals, leading to delays in product availability. According to data from the Central Drug Standard Control Organization (CDSCO), the backlog in medical device approvals reached approximately 1,500 applications in early 2023. The stringent norms and documentation requirements contribute to these delays, impacting innovation and market responsiveness. Moreover, the potential for non-compliance can result in significant penalties and loss of market access, further complicating operational dynamics in an evolving healthcare landscape.

Inconsistent Quality Standards

Inconsistent quality standards across diagnostic laboratories pose another challenge to the India diagnostics services market. Many diagnostic centers operate without stringent adherence to protocols, leading to variability in testing outcomes. According to the NABL (National Accreditation Board for Testing and Calibration Laboratories), only about 18% of diagnostic labs are accredited, which results in concerns over test reliability. The lack of uniform regulations can lead to misdiagnosis and treatment errors, undermining patient trust in diagnostic services. As the market grows, enhancing quality control measures is essential to ensure patient safety and service credibility.

Opportunities

Growth of Telemedicine

The growth of telemedicine presents significant opportunities for the India diagnostics services market. With rising smartphone penetration, which stands at over 700 million users in 2023, telemedicine has become more accessible, particularly in rural areas where healthcare resources are limited. Remote diagnostics and consultations are gaining traction, enabling patients to receive timely and convenient healthcare services. Recent reports indicate that telemedicine usage increased by 154% from 2019 to 2022, emphasizing its potential to integrate diagnostic services seamlessly into patient care. This trend underscores the need for diagnostic providers to adapt their services to capitalize on this growing demand.

Expansion of Home Testing

The expansion of home testing kits offers another growth avenue for the India diagnostics services market. In 2023, the demand for at-home health tests surged, driven by an emphasis on convenience and increased health awareness, especially post-pandemic. The market for home healthcare services is projected to reach USD 35.2 billion by 2030 following accelerated adoption. Key drivers include lifestyle changes and patients preferring to conduct tests at home for privacy and comfort. This new trend encourages diagnostics companies to innovate and provide easy-to-use home testing solutions, thus broadening their service offerings.

Future Outlook

Over the next five years, the India diagnostics services market is expected to exhibit substantial growth driven by ongoing advancements in diagnostic technologies, increased emphasis on preventive healthcare, and expanding access to healthcare services. The rise of home healthcare and telemedicine will also play pivotal roles in making diagnostics more accessible, allowing for a larger segment of the population to receive timely and accurate medical evaluations.

Major Players

- Lal PathLabs

- SRL Diagnostics

- Apollo Diagnostics

- Metropolis Healthcare

- Thyrocare

- Max Healthcare

- Vijaya Diagnostic Centre

- 24×7 Labs

- Diligent Health

- Quest Diagnostics

- LabCorp

- Unichem Laboratories

- Hitech Diagnostic Centre

- Indo American Health

- Satyam Diagnostic Centre

- Orchard Healthcare Pvt. Ltd.

- Redcliffe labs

- Medanta The Medicity

- Agilus Diagnostics

- Oncquest Laboratories Ltd

- Medall Diagnostics

Key Target Audience

- Healthcare Providers

- Hospitals and Medical Centers

- Diagnostic Laboratories

- Insurance Companies

- Pharmaceuticals

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Health and Family Welfare)

- Public Health Organizations

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map that encompasses all significant stakeholders within the India diagnostics services market. This step is critical for identifying the essential variables influencing market dynamics. Extensive desk research is employed, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data specific to the India diagnostics services market. This includes evaluating market penetration, the ratio of service providers to demand, and resultant revenue generation. A thorough assessment of service quality statistics will also be conducted to ensure the accuracy and reliability of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through Computer-Assisted Telephone Interviews (CATI) with industry experts spanning various sectors of diagnostics services. These consultations provide valuable operational insights directly from practitioners, which are pivotal in refining and confirming the market data.

Step 4: Research Synthesis and Final Output

The final phase involves engaging with multiple diagnostic service providers to gain detailed insights regarding product segments, sales performance, consumer preferences, and other significant factors. This interaction aims to verify and complement data derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the India diagnostics services market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Dynamics

- Historical Market Development

- Business Cycle Analysis

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Prevalence of Chronic Diseases

Advancements in Diagnostic Technology - Market Challenges

Regulatory Compliance Issues

Inconsistent Quality Standards - Opportunities

Growth of Telemedicine

Expansion of Home Testing - Trends

Increase in Preventive Healthcare

Growth of AI in Diagnostics - Regulatory Landscape

Policy Updates

Approval Processes - SWOT Analysis

- Stakeholders Ecosystem

- Porter’s Five Forces Analysis

- By Revenue, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Service Type (In Value %)

Pathology Services

– Anatomic Pathology

– Clinical Pathology

– Histology

– Microbiology

– Others

Radiology Services

– Computed tomography (CT)

– Magnetic resonance imaging (MRI)

– x-Ray

– Ultrasound

– CT scan

– Others

Genetic Testing

– Genomics Services RT-PCR/Sanger

– Genomic Services-Next Generation Sequencing

– BRCA1 & BRCA2

– Hereditary Breast and Ovarian Cancer

– Homologous Recombination Repair (HRR) Panel

– Others - By End-User (In Value %)

Hospitals

Diagnostic Laboratories

Home Healthcare - By Region (In Value %)

North India

South India

East India

West India - By Technology (In Value %)

Imaging Technologies

Point-of-Care Testing

Laboratory Technologies - By Sample Type (In Value %)

Blood Samples

Urine Samples

Tissue Samples

Other Samples - By Market Structure (In Value %)

Organized

Unorganized

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Service Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths and Weaknesses, Technological Capabilities, Market Share, Distribution Channels, Service Differentiation, Revenue and others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Players

Dr. Lal PathLabs

SRL Diagnostics

Apollo Diagnostics

Metropolis Healthcare

Thyrocare

Max Healthcare

Vijaya Diagnostic Centre

24×7 Labs

Diligent Health

Quest Diagnostics

LabCorp

Unichem Laboratories

Hitech Diagnostic Centre

Indo American Health

Satyam Diagnostic Centre

Orchard Healthcare Pvt. Ltd.

Redcliffe labs

Medanta The Medicity

Agilus Diagnostics

Oncquest Laboratories Ltd

Medall Diagnostics

- Market Demand and Utilization Patterns

- End User Preferences and Budget Allocations

- Regulatory Compliance Needs

- Pain Points and User Experience

- Decision Making Trends

- By Revenue, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030