Market Overview

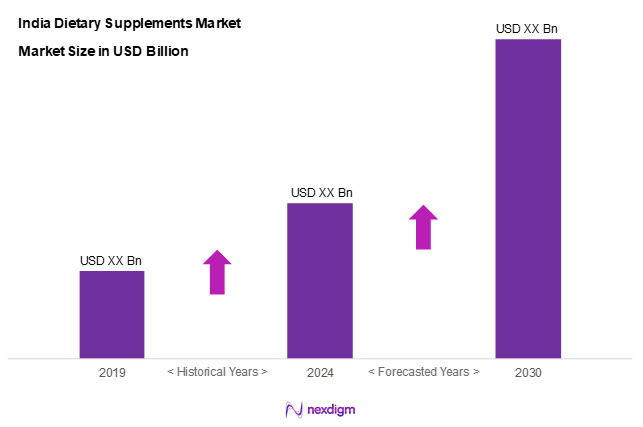

As of 2024, the India dietary supplements market is valued at USD 177.9 billion, with a growing CAGR of 10.8% from 2024 to 2030. This market is driven by the increasing health consciousness among consumers, particularly in urban areas, as they seek to enhance their well-being and prevent health issues. The growing influence of social media and the rise of e-commerce platforms have also contributed to the expanding consumer reach, offering accessibility and convenience for purchasing dietary supplements. Furthermore, dietary supplements are gaining popularity among different demographics, including wellness enthusiasts and those recovering from health conditions.

The dominant regions in the India dietary supplements market include Maharashtra, Karnataka, and Delhi-NCR. These cities benefit from a higher concentration of affluent consumers and health-conscious individuals. Urban areas in these regions show a notable appetite for dietary supplements owing to their awareness of health management and preventive care. The robust infrastructure supporting retail and online sales, along with increasing disposable income, further fortifies their position as market leaders.

Market Segmentation

By Product Type

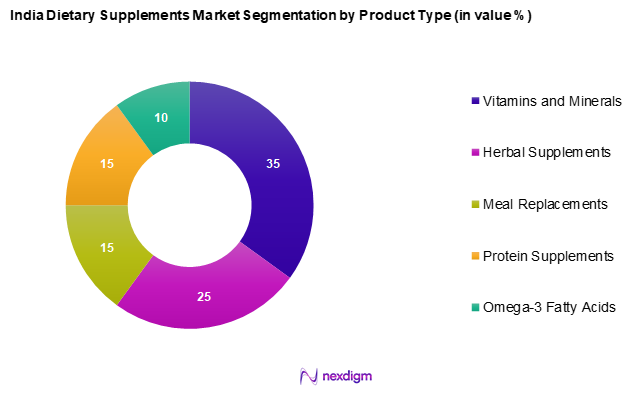

The India dietary supplements market is segmented by product type into vitamins and minerals, herbal supplements, meal replacements, protein supplements, and omega 3 fatty acids. The vitamins and minerals segment dominant the market share due to their essential role in maintaining health and well-being. The increasing prevalence of nutritional deficiencies and lifestyle-related diseases has spurred consumers to incorporate these supplements into their daily routines. Furthermore, manufacturers are innovating with fortified products that appeal to various age groups, enhancing consumption rates.

By Application

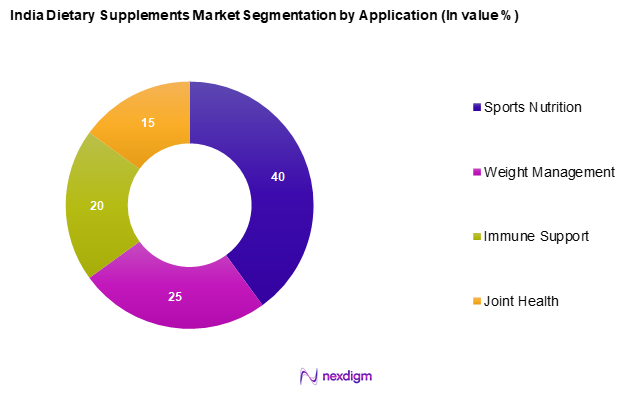

The market is also segmented by application into sports nutrition, weight management, immune support, and joint health. The Sports nutrition segment dominant the market share due to increasing popularity of fitness activities and sports among youth and fitness enthusiasts. The rising trend of health clubs and gyms in urban areas, coupled with the surge in athletic competitions and events, drives demand for these products. This segment’s growth is further enhanced by endorsements and promotional campaigns from athletes and fitness influencers, making sports nutrition products highly sought after.

Competitive Landscape

The India dietary supplements market is characterized by a presence of a few major players that dominate the landscape. Key companies include Herbalife Nutrition Ltd., Amway India Enterprises Pvt. Ltd., Abbott Nutrition, GNC Holdings, Inc., and Nestle S.A. This consolidation demonstrates the influence over consumers’ purchasing decisions and market trends. Their established brand reputation, extensive distribution networks, and diverse product portfolios make them formidable in catering to the varied needs of health-conscious consumers.

| Company | Establishment Year | Headquarters | Market Share | Revenue | Revenues by Type of Product | Inventory Size |

| Herbalife International of America, Inc. | 1980 | Los Angeles, USA | – | – | – | – |

| Amway India Enterprises Pvt. Ltd. | 1959 | Gurgaon, India | – | – | – | – |

| Abbott | 1888 | Chicago, USA | – | – | – | – |

| GNC Holdings, LLC | 1935 | Pittsburgh, USA | – | – | – | – |

| Nestlé | 1866 | Vevey, Switzerland | – | – | – | – |

India Dietary Supplements Market Analysis

Growth Drivers

Increasing Health Consciousness

The increasing health consciousness among Indian consumers is evident from the growing trend of fitness and wellness lifestyles. As of 2022, the healthcare spend in India is estimated to reach USD 225.0 billion, reflecting a compound growth as individuals focus on prevention and health maintenance. Government initiatives like Ayushman Bharat aim to provide accessible healthcare, further driving demand for dietary supplements as preventive health measures. This growing awareness not only strengthens market growth potential but also fosters a culture of wellness that prioritizes nutritional supplements as essential components of daily health regimens.

Rising Disposable Income

As of 2023, India’s Gross National Income (GNI) per capita is projected to reach approximately USD 2,690.0 showcasing an upward trend in disposable income. This increment in income allows consumers to allocate more funds towards health and wellness products, including dietary supplements. Particularly in urban areas, a higher disposable income directly correlates with increased spending on health-related products, thereby enhancing market growth. This emerging consumer class is less price-sensitive and more inclined to purchase premium dietary supplements, ensuring sustained expansion in the sector.

Market Challenges

Quality Assurance Issues

Quality assurance remains a significant challenge in the Indian dietary supplements market. Reports indicate that nearly 30% of supplements available in local markets are either adulterated or misbranded, compromising consumer safety and trust. Enhanced quality control measures are crucial, as consumers increasingly demand assurance about the efficacy and safety of dietary products. In response, companies are investing in manufacturing technologies and third-party certifications; however, the high incidence of substandard products continues to hinder market growth and credibility.

Market Saturation

Market saturation poses a challenge for segmentation and differentiation within the dietary supplement landscape. With over 1,000 brands operating in India, the market is becoming increasingly competitive, making it difficult for new entrants to gain market share. This saturation has led to price wars, affecting profitability and limiting the scope for product innovation. Compounding this challenge, consumer loyalty can swiftly shift towards brands with better marketing rather than quality, making it essential for companies to develop competitive strategies that go beyond price to maintain relevance and market presence.

Opportunities

Innovations in Product Formulation

The dietary supplements market in India is witnessing significant opportunities for innovation in product formulation. As health awareness rises, consumers are increasingly seeking supplements tailored to specific health needs, such as digestive health, stress relief, and joint support. The current trend leans towards clean label products, which emphasize natural ingredients and transparency in manufacturing processes. Reports indicate that the demand for plant-based supplements is growing, with manufacturers investing in research and development to incorporate functional botanicals into their formulas. This innovation not only meets consumer demands but also positions companies competitively in a rapidly evolving market landscape.

Collaboration with Healthcare Professionals

Collaborating with healthcare professionals presents an excellent opportunity to bolster the credibility and acceptance of dietary supplements among consumers. An increasing number of healthcare providers are now recommending dietary supplements to patients to address nutrient deficiencies and support health management. In 2022, approximately 55% of healthcare professionals expressed the intention to incorporate dietary supplements into their patient recommendations, reflecting a positive shift towards broader acceptance of these products. By establishing partnerships with healthcare institutions, brands can enhance consumer trust and drive sales, solidifying their positioning within the market.

Future Outlook

Over the next five years, the India dietary supplements market is expected to show significant growth driven by increased consumer awareness of health and wellness, innovations in supplement formulations, and continuous expansion in retail distribution channels. The market is poised for expansion as more individuals recognize the importance of dietary supplements in maintaining overall health, thereby determining the trajectory of sector growth.

Major Players in the Market

- Herbalife International of America, Inc.

- Amway India Enterprises Pvt. Ltd.

- Abbott

- GNC Holdings, LLC

- Nestlé

- Bayer AG

- Cipla

- Pharma Nord, Inc.

- Intengine Enterprises Inc.

- Isagenix Worldwide, Inc.

- Unicity International, Inc.

- Newtrition Plus

- Herbalife International of America, Inc.

- Nature’s Way Brands, LLC.

- Garden of Life

- Tata Consumer Products Limited

- Sigma Softgel & Formulation

- NB Healthcare

- Conch Lifescience

- MuscleBlaze

- Himalaya Wellness Company.

- Nutricore Biosciences Private Limited

- BigMuscles Nutrition

- Greenwell Lifesciences

- Lifevision Healthcare

- Bionova

- Stabicoat Vitamins

- Body Cupid Private Limited

- Patanjali Ayurved

- Optimum Nutrition

- OZiva

- Nakoda Dairy Private Limited

- Novus Life Sciences Pvt. Ltd

Key Target Audience

- Retailers and Distributors

- Health and Wellness Stores

- Fitness Centers and Gyms

- E-commerce Platforms

- Hospitals and Healthcare Providers

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (FSSAI, Ministry of Health and Family Welfare)

- Nutritionists and Dieticians

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the India dietary supplements market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyse historical data pertaining to the India dietary supplements market. This includes assessing market penetration, evaluating the ratio of product types to consumer preferences, and analysing revenue generation from various sub-segments. An evaluation of consumer purchasing trends is also conducted to ensure reliability and accuracy in our revenue projections.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through structured interviews with industry experts representing a diverse range of companies in the dietary supplements sector. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with manufacturers and distributors in the dietary supplements sector to acquire detailed insights into product segments, sales performance, market trends, and consumer preferences. This interaction serves to verify and complement the statistics derived from the prior analysis phases, ensuring a comprehensive and validated perspective on the India Dietary Supplements Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain & Value Chain Analysis

- Growth Drivers

Increasing Health Consciousness

Rising Disposable Income - Market Challenges

Quality Assurance Issues

Market Saturation - Opportunities

Innovations in Product Formulation

Collaboration with Healthcare Professionals - Trends

Personalized Nutrition

Plant-Based Supplements

Focus on Immunity Boosting Supplements - Government Regulation

FSSAI Guidelines

Health Claims Regulation

Import Regulations - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Vitamins and Minerals

– Multivitamins

– Single Vitamin (e.g., Vitamin C, D)

– Mineral Supplements (e.g., Iron, Calcium, Zinc)

Herbal Supplements

– Ashwagandha

– Turmeric/Curcumin

– Ginseng

– Giloy

– Triphala

Meal Replacements

– Nutritional Shakes

– Protein Meal Bars

– Balanced Powdered Meals

Protein Supplements

– Whey Protein

– Plant-Based Protein

– Casein Protein

– Pea and Soy Protein

Omega-3 Fatty Acids

– Fish Oil

– Flaxseed Oil

– Algae-Based Omega-3 - By Application (In Value %)

Sports Nutrition

– Sports Drink

– Sports Foods

Weight Management

– Weight Loss Products

– Weight Gain Products

Immune Support

– Vitamin C & Zinc Combinations

– Ayurvedic Immune Boosters

– Elderberry Supplements

Joint Health

– Glucosamine

– Chondroitin

– Collagen-Based Products

Others

– Heart Health

– Digestive Health

– Skin & Hair Care Supplements - By Distribution Channel (In Value %)

Online Retail

– E-commerce Platforms

– Brand Websites

Supermarkets/Hypermarkets

– Organized Retail Chains

Specialty Stores

– Health & Nutrition Chains

– Fitness Centers & Gyms

Others

– Direct Selling (MLMs)

– Chemists/Local Pharmacies - By Region (In Value %)

North India

South India

East India

West India

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Product Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenues, Revenues by Type of Product, Product Certifications & Claims, Distribution Channels, Number of Dealers and Distributors, Margins, Production Plant and Capacity, Geographic Presence, Digital and D2C Reach, Innovation Index, Unique Value Offering, and others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Herbalife International of America, Inc.

Amway India Enterprises Pvt. Ltd.

Abbott

GNC Holdings, LLC

Nestlé

Bayer AG

Cipla

Pharma Nord, Inc.

Intengine Enterprises Inc.

Isagenix Worldwide, Inc.

Unicity International, Inc.

Newtrition Plus

Herbalife International of America, Inc.

Nature’s Way Brands, LLC.

Garden of Life

HealthKart.com

Tata Consumer Products Limited

Sigma Softgel & Formulation

NB Healthcare

Conch Lifescience

MuscleBlaze

Himalaya Wellness Company.

Nutricore Biosciences Private Limited

BigMuscles Nutrition

Greenwell Lifesciences

Lifevision Healthcare

Bionova

Stabicoat Vitamins

Body Cupid Private Limited

Patanjali Ayurved

Optimum Nutrition

OZiva

Nakoda Dairy Private Limited

Novus Life Sciences Pvt. Ltd

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030