Market Overview

The India Digital Battlefield market has been experiencing significant growth driven by increasing investments in national defense technologies. The market, valued at USD ~ billion, has seen a rise in demand for digital solutions such as command-and-control systems, surveillance tools, and cybersecurity platforms. The continuous modernization of military forces, coupled with the integration of AI and advanced technologies, has been a key driver in expanding the market. Increasing governmental funding, especially under defense initiatives, further fuels market expansion.

Dominant countries such as India lead the digital battlefield market due to their large-scale military modernization programs, significant investments in technology, and an increasingly complex security environment. India, with its geopolitical challenges, has become a major player in implementing advanced military technologies. Moreover, the country’s focus on autonomous systems, cyber defense, and real-time surveillance has positioned it as a leader in adopting digital battlefield technologies. The growing partnership between defense contractors and tech firms has further bolstered the region’s technological infrastructure.

Market Segmentation

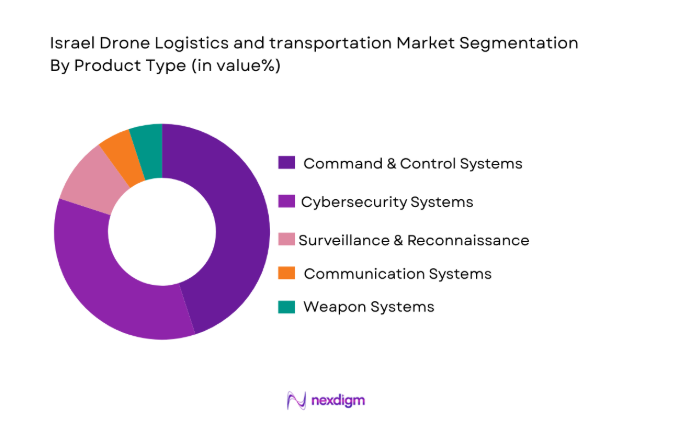

By Product Type

India Digital Battlefield market is segmented by product type into command-and-control systems, cybersecurity systems, surveillance and reconnaissance systems, communication systems, and weapon systems. Recently, command and control systems have had a dominant market share due to their critical role in enabling real-time operational effectiveness on the battlefield. Command and control systems integrate various data sources to assist military personnel in making critical decisions, making them indispensable for military operations. The demand for real-time data analytics, improved decision-making capabilities, and efficient communication within defense operations has been the key driver for this segment’s dominance.

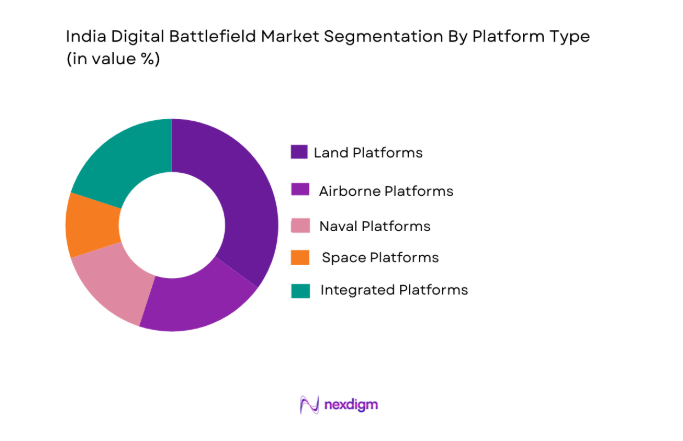

By Platform Type

India Digital Battlefield market is also segmented by platform type, which includes land platforms, airborne platforms, naval platforms, space platforms, and integrated platforms. Among these, land platforms have a dominant market share, primarily due to the high demand for terrestrial military vehicles and unmanned systems equipped with digital battlefield solutions. These platforms play a critical role in ground-based operations, particularly in defense scenarios requiring real-time data collection, decision-making, and integrated communication. As India continues to modernize its ground forces, the demand for these platforms remains high, which reinforces their dominant position in the market.

Competitive Landscape

The competitive landscape of the India Digital Battlefield market is marked by a few key players that dominate with their advanced technologies and product offerings. These players are consolidating their positions through strategic mergers, acquisitions, and collaborations with local defense firms. The increasing need for sophisticated defense systems to safeguard national security has led to a high demand for advanced digital battlefield solutions. As the demand for integrated military solutions rises, major players focus on providing multi-functional systems that meet the complex requirements of modern defense environments.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (in USD) | Additional Parameter |

| Lockheed Martin | 1912 | Bethesda, MD | ~ | ~

|

~

|

~

|

~

|

| Thales Group | 2000 | Paris, France | ~

|

~

|

~

|

~

|

~

|

| BAE Systems | 1999 | London, UK | ~

|

~

|

~

|

~

|

~

|

| Raytheon Technologies | 2020 | Waltham, MA | ~

|

~

|

~

|

~

|

~

|

| Northrop Grumman | 1939 | Falls Church, VA | ~

|

~

|

~

|

~

|

~

|

India Digital Battlefield Market Analysis

Growth Drivers

Increasing Government Investment in National Defense

The growth of the India Digital Battlefield market is largely driven by the significant rise in government defense spending. The Indian government has been allocating considerable resources toward modernizing its military infrastructure. A key focus of this modernization has been the implementation of advanced digital battlefield technologies, which include command and control systems, surveillance, cybersecurity solutions, and real-time communication tools. This focus is directly linked to increasing concerns over national security and geopolitical tensions in the region. The government’s defense initiatives are encouraging investments in digital technologies that can help improve operational capabilities, streamline military operations, and enable strategic decision-making. These efforts are particularly important as the Indian military continues to strengthen its defenses with cutting-edge technologies like artificial intelligence (AI) and machine learning (ML). Additionally, the government’s collaboration with defense contractors and tech firms ensures that both public and private sectors work together to bring the latest innovations into India’s defense system. As the military continues to modernize and digitalize, the demand for digital battlefield solutions is expected to grow, further propelling the market’s expansion. Moreover, the consistent rise in defense budgets and strategic defense procurements will continue to fuel the digital transformation of India’s armed forces, ultimately benefiting the overall market.

Technological Advancements in AI and Cybersecurity

Another significant growth driver for the India Digital Battlefield market is the ongoing technological advancements in artificial intelligence (AI) and cybersecurity. These technologies have become essential for modern military operations, offering enhanced decision-making capabilities, improved intelligence gathering, and superior operational coordination. AI allows for the automation of various defense tasks, such as surveillance, reconnaissance, and real-time data analysis. This not only reduces the workload on human personnel but also provides faster and more accurate decision-making capabilities on the battlefield. Cybersecurity advancements, on the other hand, are critical as military systems become more interconnected and vulnerable to cyberattacks. With increasing reliance on digital systems for communication, data sharing, and command operations, ensuring robust cybersecurity measures is a top priority for the Indian government. As defense forces continue to integrate AI-based solutions and bolster their cybersecurity infrastructure, these technological advancements will remain crucial to the market’s continued growth. Moreover, the government’s support for research in these areas, along with partnerships between defense contractors and technology firms, is accelerating innovation and driving the demand for advanced digital battlefield solutions across the country.

Market Challenges

Cybersecurity Threats and Vulnerabilities

One of the most prominent challenges faced by the India Digital Battlefield market is the rising threat of cybersecurity vulnerabilities. As the military increasingly relies on interconnected digital systems for communications, surveillance, and operational management, the risk of cyberattacks targeting sensitive defense infrastructure grows significantly. Cyberattacks on critical military systems could lead to theft of classified information, disruption of defense operations, or even the manipulation of military strategies, which could have dire consequences for national security. The digital transformation of defense systems, while enhancing operational efficiency, also opens numerous entry points for cybercriminals and hostile entities to exploit vulnerabilities. As such, the Indian government faces increasing pressure to implement advanced cybersecurity protocols and technologies to protect sensitive military data and ensure the continuity of defense operations. This challenge requires continuous investment in the development and deployment of robust cybersecurity solutions, which in turn requires specialized talent and resources. The complexity of safeguarding highly sensitive systems against cyberattacks, combined with the increasing sophistication of cyber threats, poses a significant challenge to defense agencies and contractors working to secure digital battlefield technologies.

Integration and Interoperability Issues

The integration of new digital technologies into existing military infrastructure is another key challenge faced by the India Digital Battlefield market. As India modernizes its defense systems, the need to ensure that new technologies can seamlessly integrate with legacy systems becomes increasingly difficult. Many of the current defense systems were designed years ago and were not built to accommodate the latest digital technologies, including AI, machine learning, and advanced cybersecurity solutions. Integrating these new technologies with legacy systems is a complex task that requires overcoming significant technical hurdles, such as ensuring compatibility, managing data flow, and maintaining system integrity. Additionally, ensuring that different platforms and systems can communicate effectively with one another remains a significant challenge. Interoperability issues can create gaps in defense capabilities, reduce operational efficiency, and potentially lead to critical failures during military operations. The integration of new and old technologies requires substantial investments in research, development, and testing, which may delay the full adoption of digital battlefield solutions and increase costs for defense contractors and the government.

Opportunities

AI-Driven Defense Solutions

One of the most promising opportunities for growth in the India Digital Battlefield market is the expansion of artificial intelligence (AI) in military applications. The integration of AI can transform military operations by providing advanced data analytics, predictive intelligence, and enhanced decision-making capabilities. AI-powered systems can assist military personnel in identifying threats, improving resource allocation, and optimizing mission execution. In addition to these capabilities, AI enables autonomous systems, such as drones and unmanned vehicles, which can perform complex tasks without human intervention. The growing demand for autonomous platforms, coupled with the need for faster and more accurate decision-making, positions AI as a key driver for the market. Moreover, the Indian government has been increasingly focused on developing AI-driven solutions to modernize its defense systems, creating a significant opportunity for defense contractors to collaborate with tech firms to bring these innovations to market. With the ongoing advancements in AI technologies and increasing investments in AI research, this opportunity represents a major growth avenue for the India Digital Battlefield market, as it promises to enhance operational efficiency, improve strategic planning, and reduce human intervention in dangerous tasks.

Partnerships with Private Tech Firms for Enhanced Cybersecurity

Another significant opportunity in the India Digital Battlefield market lies in partnerships between defense contractors and private technology firms specializing in cybersecurity. As the Indian military continues to digitize its operations and adopt interconnected systems, the risk of cyber threats becomes more pronounced. To mitigate these risks, the defense sector can collaborate with private technology companies that specialize in advanced cybersecurity solutions. These partnerships would enable the military to implement cutting-edge security measures, such as AI-based threat detection, encryption technologies, and real-time monitoring systems, to protect critical defense infrastructure from cyberattacks. Additionally, collaborations with tech firms can accelerate the development of innovative solutions tailored specifically to the needs of defense operations. The government’s increasing focus on enhancing the cybersecurity capabilities of its armed forces presents a valuable opportunity for both local and international tech firms to play a significant role in securing India’s digital battlefield technologies. As these partnerships grow, they will strengthen India’s defense capabilities while driving the demand for advanced cybersecurity solutions across the market.

Future Outlook

The future of the India Digital Battlefield market appears promising, with expectations of steady growth driven by increasing government defense spending and technological advancements. Key trends such as the integration of AI, machine learning, and enhanced cybersecurity into defense operations will dominate the coming years. Additionally, regulatory support, along with a focus on military modernization, will continue to propel market growth. Demand-side factors, including rising geopolitical tensions and evolving security threats, will further fuel the need for advanced digital solutions to ensure national security. Over the next five years, technological innovations, coupled with government initiatives, will play a pivotal role in shaping the future of the digital battlefield market.

Major Players

- Lockheed Martin

- Thales Group

- BAE Systems

- General Dynamics

- Northrop Grumman

- Raytheon Technologies

- L3 Technologies

- Leonardo

- Harris Corporation

- Saab Group

- Rheinmetall AG

- Elbit Systems

- Hewlett Packard Enterprise

- Boeing

- Sikorsky Aircraft

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Military and defense agencies

- Defense contractors

- Security services

- Technology providers for defense applications

- Private sector technology firms

- Aerospace and defense solution providers

Research Methodology

Step 1: Identification of Key Variables

Identify the critical variables that affect the India Digital Battlefield market, including technological trends, regulatory influences, and defense spending patterns.

Step 2: Market Analysis and Construction

Analyze the current state of the market, focusing on key drivers, barriers, opportunities, and challenges, to create a comprehensive market model.

Step 3: Hypothesis Validation and Expert Consultation

Consult industry experts and stakeholders to validate the assumptions and hypotheses generated in earlier research steps.

Step 4: Research Synthesis and Final Output

Synthesize the data collected, finalizing the market report with insights, predictions, and recommendations for stakeholders in the India Digital Battlefield market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased Government Investment in National Security

Technological Advancements in AI and Cybersecurity

Rising Geopolitical Tensions

Growing Military Modernization Programs

Integration of Commercial Technologies into Defense Systems - Market Challenges

High Capital Expenditure in Defense Projects

Cybersecurity Threats and Vulnerabilities

Regulatory and Compliance Barriers

Technological Integration and Interoperability Issues

Political and Social Resistance to Military Expansion - Market Opportunities

Expansion in Artificial Intelligence-Driven Defense Solutions

Partnerships with Private Tech Firms for Enhanced Cybersecurity

Emerging Demand for Autonomous Systems and Robotics - Trends

Increase in Use of Autonomous and Unmanned Systems

Integration of AI and Machine Learning in Battlefield Operations

Surge in Cybersecurity Investments for Defense Systems

Government Push for Smart City Integration with Defense Systems

Emergence of 5G and its Impact on Communication in Defense - Government Regulations & Defense Policy

Data Protection and Privacy Regulations

Export Control and Compliance Policies

Government Funding and Grants for Defense Technologies - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Command & Control Systems

Cybersecurity Systems

Surveillance & Reconnaissance Systems

Communication Systems

Weapon Systems - By Platform Type (In Value%)

Land Platforms

Airborne Platforms

Naval Platforms

Space Platforms

Integrated Platforms - By Fitment Type (In Value%)

On-premise Solutions

Cloud-based Solutions

Hybrid Solutions

Modular Solutions

Integrated Solutions - By EndUser Segment (In Value%)

Military Forces

Defense Contractors

Government Agencies

Security Services

Private Sector / Technology Firms - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors - By Material / Technology (In Value%)

AI-driven Technologies

Sensor Technologies

Communication Protocols

Robotic and Autonomous Technologies

Data Processing & Analysis Technologies

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (System Type, Platform Type, End-user Segment, Procurement Channel, Material/Technology)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Lockheed Martin

Thales Group

BAE Systems

General Dynamics

Northrop Grumman

Raytheon Technologies

L3 Technologies

Leonardo

Harris Corporation

Saab Group

Rheinmetall AG

Elbit Systems

Hewlett Packard Enterprise

Boeing

Sikorsky Aircraft

- Military Forces’ Increasing Demand for Digital Systems

- Government Agencies’ Role in Regulating and Procuring Defense Systems

- Defense Contractors’ Shift Towards Innovation and Integration

- Private Sector’s Growing Interest in Cybersecurity Solutions

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035