Market Overview

The India Digital Forensic Laboratory as a Service market is growing rapidly, driven by the increasing demand for cybersecurity and digital evidence solutions. With the rise in cybercrimes and data breaches, the need for specialized forensic services has surged. According to recent estimates, the market size stands at approximately USD ~ billion based on historical data. This growth is fueled by advancements in forensic technologies, government initiatives supporting cybersecurity, and an increasing number of digital criminal investigations.

The market’s dominance is concentrated in major metropolitan regions such as Delhi, Mumbai, and Bengaluru. These cities are key hubs due to their advanced technological infrastructure, government support for digital initiatives, and a high concentration of cybersecurity firms. The government’s push towards strengthening digital forensics, along with the expansion of cybersecurity awareness, positions India as a leader in the market within the region.

Market Segmentation

By Product Type

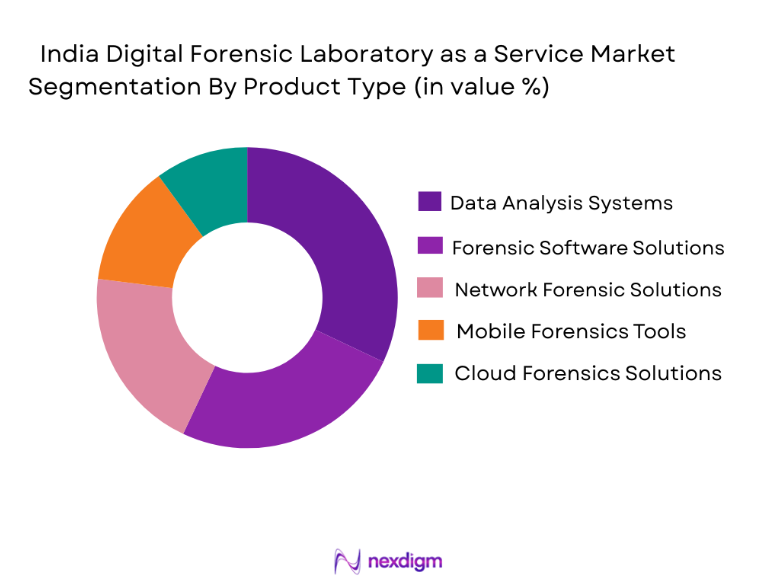

The India Digital Forensic Laboratory as a Service market is segmented by product type into data analysis systems, forensic software solutions, network forensic solutions, mobile forensics tools, and cloud forensics solutions. Recently, data analysis systems have been dominating the market share due to their essential role in analyzing large volumes of digital evidence in real-time. With an increasing focus on data breaches and network-based crimes, the need for advanced data analysis tools has grown, making them a critical component for law enforcement and security agencies.

By Platform Type

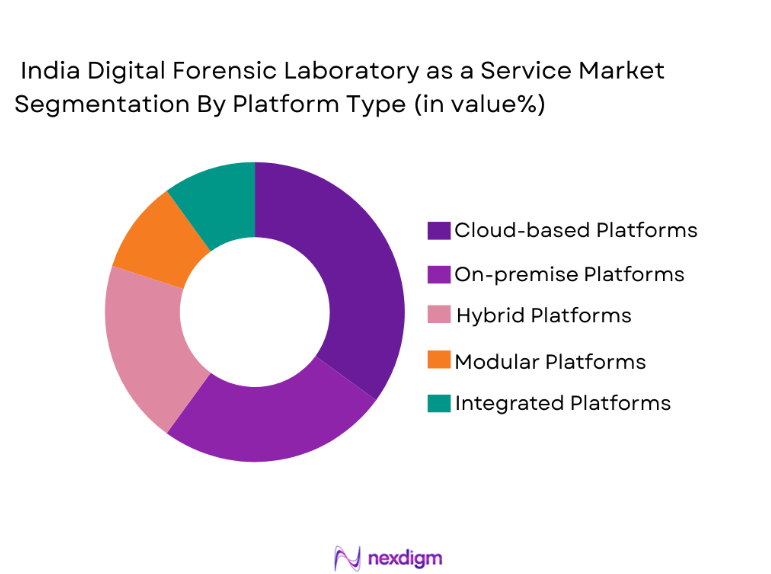

The India Digital Forensic Laboratory as a Service market is segmented by platform type into cloud-based platforms, on-premises platforms, hybrid platforms, modular platforms, and integrated platforms. Cloud-based platforms have emerged as the dominant sub-segment due to their flexibility, scalability, and cost-efficiency, making them ideal for handling large volumes of digital evidence. The growing adoption of cloud solutions across industries, coupled with the increasing shift towards remote work and cloud storage, has significantly contributed to the rise in demand for cloud-based digital forensic tools. Cloud-based platforms also offer greater accessibility and faster processing speeds, which are crucial in today’s fast-paced digital investigations.

Competitive Landscape

The India Digital Forensic Laboratory as a Service market is marked by a competitive landscape where leading players are continuously innovating to meet the growing demand. Consolidation is observed with the presence of major players offering end-to-end solutions for digital forensics, which includes both software tools and consultancy services. The increasing investment in cybersecurity and the need for specialized forensics services have made this market attractive for both established companies and new entrants.

|

Company Name |

Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Parameter |

| Cellebrite | 2007 | Israel | ~ | ~ | ~ | ~ | ~ |

| Magnet Forensics | 2004 | Canada | ~ | ~ | ~ | ~ | ~ |

| OpenText | 1991 | Canada | ~ | ~ | ~ | ~ | ~ |

| MSAB | 1984 | Sweden | ~ | ~ | ~ | ~ | ~ |

| FTK Imager | 1997 | USA | ~ | ~ | ~ | ~ | ~ |

India Digital Forensic Laboratory-as-a-Service Market Analysis

Growth Drivers

Increasing Cybercrime Rates

The surge in cybercrimes, including hacking, identity theft, and financial fraud, has significantly increased the demand for digital forensic services. As crimes become more sophisticated and occur in digital environments, law enforcement and businesses alike require specialized solutions for investigating and preventing such activities. The increasing number of digital crimes is prompting both government agencies and private organizations to invest more in digital forensic tools and services, further propelling market growth. Additionally, the increasing use of digital devices such as smartphones, computers, and IoT products creates a larger pool of digital evidence that requires advanced analysis. Furthermore, the rise in data breaches across sectors has heightened the need for digital forensic laboratories that can identify vulnerabilities and ensure that organizations are compliant with data protection laws. The demand is further intensified by the proliferation of online transactions, leading to more opportunities for cybercriminal activities that necessitate forensic investigation. As a result, cybersecurity experts and digital forensic laboratories are crucial in protecting sensitive information and uncovering cybercrime tactics. These factors combined indicate a continuous and accelerating market growth driven by the relentless rise in cybercrimes and the corresponding demand for forensic solutions.

Government Initiatives on Cybersecurity

Government policies and initiatives focusing on cybersecurity have played a pivotal role in driving the digital forensic laboratory market. With the global increase in cyber threats, governments worldwide, including India, have introduced stringent regulations and frameworks to strengthen the protection of digital assets. These initiatives have not only emphasized the need for enhanced cybersecurity but also highlighted the critical role of digital forensics in investigating cybercrimes. India’s National Cyber Security Policy, alongside initiatives like the Digital India campaign, has created a conducive environment for the adoption of advanced digital forensics solutions. These programs provide funding, training, and technical expertise to enhance the nation’s digital infrastructure, thereby propelling the market for digital forensic services. The government’s support also includes the establishment of dedicated forensic laboratories and cybersecurity awareness programs. Additionally, India has committed to strengthening its cybercrime investigation capabilities through these initiatives, making it a key factor in the growth of the digital forensic market. As cybersecurity becomes a national priority, it directly correlates with the expansion of forensic services, driving further market growth.

Market Challenges

High Capital Investment

One of the primary challenges facing the India Digital Forensic Laboratory as a Service market is the significant capital investment required to set up and maintain forensic laboratories. Digital forensic tools, including software and hardware, are expensive to procure and often require regular updates to stay relevant with emerging cybercrime tactics. The cost of establishing a forensic laboratory, including training staff, acquiring advanced technological tools, and ensuring compliance with regulations, is a significant barrier, particularly for smaller organizations and law enforcement agencies with limited budgets. Moreover, the ongoing costs related to maintaining the lab infrastructure, upgrading forensic software, and handling large volumes of data can be financially prohibitive. For many small and medium-sized businesses, the capital expenditure required for these services is simply too high, restricting market growth. While government bodies may provide some funding, the investment demands remain a significant challenge for private players aiming to enter the market. Additionally, as cybercriminal activities become increasingly sophisticated, forensic labs must invest in cutting-edge technology, which further escalates operational costs. This challenge is exacerbated by the lack of affordable solutions, making digital forensics a highly capital-intensive sector.

Complexity in Integrating New Forensic Tools

Another challenge faced by the India Digital Forensic Laboratory as a Service market is the complexity in integrating new forensic tools into existing systems. Digital forensic solutions require seamless interoperability with other technologies, such as data storage systems, cybersecurity platforms, and network monitoring tools. However, integrating new tools into existing infrastructure can be a complicated and time-consuming process. The rapid pace of technological advancements means that forensic tools must be continuously updated to keep up with evolving cybercrimes and threats. The challenge lies in ensuring that these updates integrate smoothly with other systems and are compatible with existing processes. Forensic laboratories often struggle with the technical hurdles associated with this integration, which can lead to delays in service delivery and increased operational costs. Furthermore, some law enforcement agencies and small businesses may lack the technical expertise necessary to implement and manage these advanced tools. This complexity in integration restricts the overall effectiveness of digital forensic services and hinders market growth, as stakeholders must deal with technical challenges alongside the growing demand for faster and more efficient solutions.

Opportunities

Expansion of AI-driven Forensic Solutions

The India Digital Forensic Laboratory as a Service market holds significant opportunities with the integration of artificial intelligence (AI) in forensic investigations. AI-driven solutions have the potential to revolutionize the way digital evidence is analyzed and processed. These tools can automatically detect patterns, identify anomalies, and provide insights that would otherwise be impossible to uncover manually. By leveraging machine learning algorithms, AI can sift through vast amounts of data more efficiently and accurately, reducing the time and human resources required for investigations. This technology is particularly valuable in cases involving large-scale data breaches, financial fraud, or cyber espionage, where the volume of digital evidence can overwhelm traditional forensic methods. Additionally, AI-powered forensic tools can assist in real-time surveillance, predictive analysis, and data recovery, which are essential for modern digital forensics. As organizations and law enforcement agencies increasingly recognize the benefits of AI, the market for AI-based digital forensic solutions is expected to expand rapidly. This opportunity presents a pathway for both established companies and new entrants to enhance their offerings and gain a competitive edge in the market.

Demand for Mobile and Cloud Forensics

With the growing use of mobile devices and cloud storage services, there is a surge in demand for mobile and cloud forensics. Mobile devices, including smartphones, tablets, and laptops, store vast amounts of personal and business-related data, making them a prime target for forensic investigations. Similarly, as more businesses migrate their data to the cloud, cloud forensics has emerged as a crucial area of focus. Investigating cloud-based crimes requires specialized tools and techniques to access and analyze data securely stored in the cloud. With the proliferation of cloud-based platforms, particularly among SMEs, demand for cloud forensic services is on the rise. Mobile forensics has also grown due to the increasing use of mobile phones for a wide range of activities, from banking to social media, creating new opportunities for forensic laboratories. This trend reflects the shifting focus of digital forensic services toward mobile devices and cloud environments, providing significant growth prospects in the market. As mobile and cloud forensics evolve, so too will the market demand for advanced forensic services tailored to these technologies.

Future Outlook

The future outlook for the India Digital Forensic Laboratory as a Service market is promising, with strong growth expected over the next five years. Driven by technological advancements in AI, mobile, and cloud forensics, the market is anticipated to experience significant expansion. Increasing government focus on strengthening cybersecurity and the rising number of cybercrimes are further contributing to the growth of digital forensic services. The demand for sophisticated forensic solutions will continue to rise as businesses and government agencies prioritize the protection of sensitive digital data. The integration of new technologies and increasing awareness about cybersecurity will drive further innovations, ensuring that the market remains dynamic and responsive to emerging threats.

Major Players

- Cellebrite

- Magnet Forensics

- OpenText

- MSAB

- FTK Imager

- Axiom Forensics

- Kroll

- Paraben Corporation

- X1 Social Discovery

- Guidance Software

- Digital Detectives

- BlackBag Technologies

- AccessData

- Rapiscan Systems

- International Forensic Research Institute

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Law enforcement agencies

- Corporate security departments

- Digital forensics consultants

- Cybersecurity firms

- Forensic software providers

- Telecom operators

Research Methodology

Step 1: Identification of Key Variables

The key variables influencing the India Digital Forensic Laboratory as a Service market are identified, including market size, demand drivers, and technological advancements.

Step 2: Market Analysis and Construction

A detailed market analysis is performed by collecting data from primary and secondary sources, followed by the construction of a market model.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses about market trends and challenges are validated through consultations with industry experts, ensuring accurate projections.

Step 4: Research Synthesis and Final Output

The research findings are synthesized to create a comprehensive report, which is then refined to ensure actionable insights and strategic recommendations.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Cybercrime Rates

Government Initiatives on Cybersecurity

Technological Advancements in Forensic Tools

Rising Incidences of Data Breaches

Increased Awareness of Digital Evidence - Market Challenges

High Capital Investment

Complexity in Integrating New Forensic Tools

Data Privacy Concerns

Lack of Skilled Professionals

Challenges in Handling Large Volumes of Data - Market Opportunities

Partnerships Between Public and Private Sectors

Expansion of AI-driven Forensic Solutions

Demand for Mobile and Cloud Forensics - Trends

Growth of AI and Machine Learning in Forensics

Increase in Digital Evidence in Legal Cases

Integration of Blockchain Technology

Use of Cloud Solutions for Forensic Data

Rise in Cybersecurity Regulations - Government Regulations & Defense Policy

Data Protection and Privacy Regulations

Cybercrime and Cybersecurity Laws

Regulatory Standards for Digital Forensics - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Data Analysis Systems

Forensic Software Solutions

Network Forensic Solutions

Mobile Forensics Tools

Cloud Forensics Solutions - By Platform Type (In Value%)

Cloud-based Platforms

On-premise Platforms

Hybrid Platforms

Modular Platforms

Integrated Platforms - By Fitment Type (In Value%)

On-premise Solutions

Cloud-based Solutions

Hybrid Solutions

Modular Solutions

Integrated Solutions - By EndUser Segment (In Value%)

Law Enforcement Agencies

Government Organizations

Private Security Firms

Corporate IT Security

Legal and Forensic Firms - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors - By Material / Technology (In Value%)

Cloud Storage Solutions

Blockchain Technology

Encryption Tools

AI-based Forensics Tools

Data Recovery Systems

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, End User Segment, Fitment Type)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Cellebrite

Magnet Forensics

AccessData

MSAB

OpenText

FTK Imager

X1 Social Discovery

Guidance Software

Paraben Corporation

Axiom Forensics

Rapiscan Systems

Kroll

Digital Detectives

BlackBag Technologies

International Forensic Research Institute

- Government Agencies Increasing Investment in Cybersecurity

- Private Sector Adopting Digital Forensic Services

- Forensic Laboratories Expanding Digital Capabilities

- Law Enforcement Agencies’ Dependence on Digital Evidence

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035