Market Overview

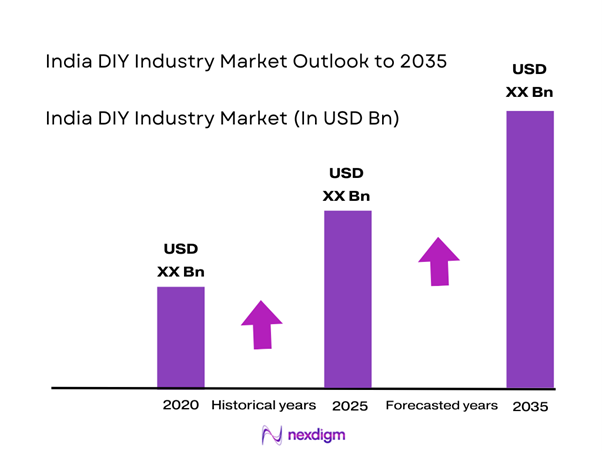

The India DIY Industry market current size stands at around USD ~ million driven by growing home improvement activity, rising discretionary household spending, and increased product availability across channels. In 2024 and 2025, participation levels expanded steadily, with ~ percent growth in organized retail touchpoints and ~ percent increase in online DIY searches. Product penetration improved across tools, paints, fixtures, and fittings, supported by wider assortment access and improved logistics coverage in urban and semi-urban locations nationwide.

Demand concentration remains strongest across Tier I and Tier II cities including Delhi NCR, Mumbai, Bengaluru, Chennai, Hyderabad, and Pune, supported by dense housing stock and renovation cycles. Southern and western regions benefit from stronger organized retail ecosystems and higher apartment ownership. Northern regions show demand driven by repainting and refurbishments, while eastern regions remain emerging. Policy support for housing upgrades, smart cities, and urban redevelopment further strengthens ecosystem maturity.

Market Segmentation

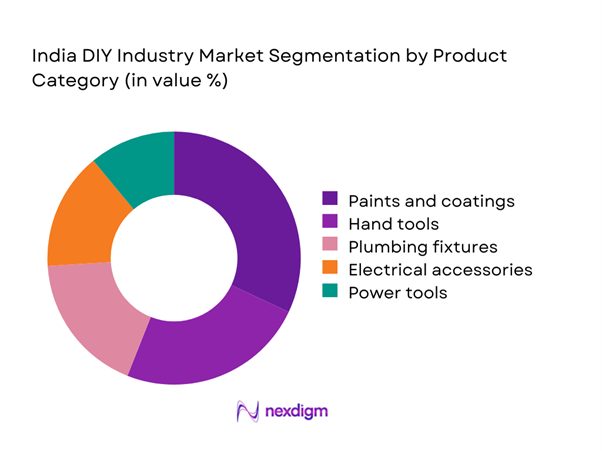

By Product Category

Hand tools and basic home improvement materials dominate the India DIY Industry market due to affordability, low skill barriers, and frequent usage cycles across households. Paints, adhesives, plumbing fixtures, and electrical accessories record higher repeat purchase rates compared to power tools. In 2024 and 2025, consumers increasingly preferred modular, ready-to-install products that reduce dependency on skilled labor. Urban households drive demand for décor-led DIY activities, while semi-urban segments focus on functional repairs. The dominance of entry-level products reflects evolving but still cautious adoption behavior across income segments and experience levels.

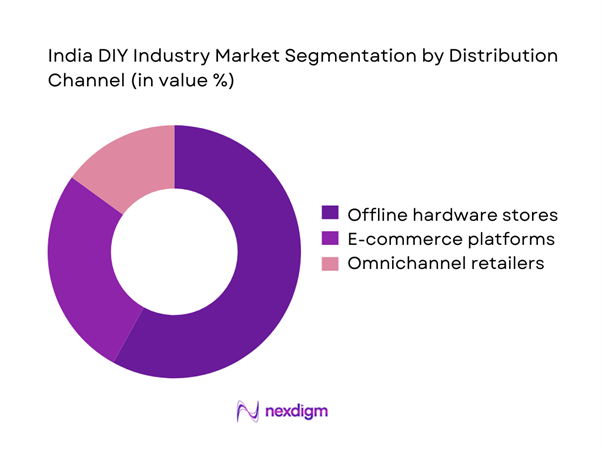

By Distribution Channel

Offline retail continues to dominate the India DIY Industry market, supported by trust, physical inspection, and immediate availability advantages. However, digital platforms showed faster traction during 2024 and 2025, driven by wider assortment access, instructional content integration, and doorstep delivery convenience. Omnichannel strategies combining online discovery with offline fulfillment gained relevance. Urban consumers increasingly research online before purchasing offline, while younger homeowners directly transact through e-commerce platforms. Channel dominance reflects infrastructure reach, logistics reliability, and evolving consumer confidence in self-installation products.

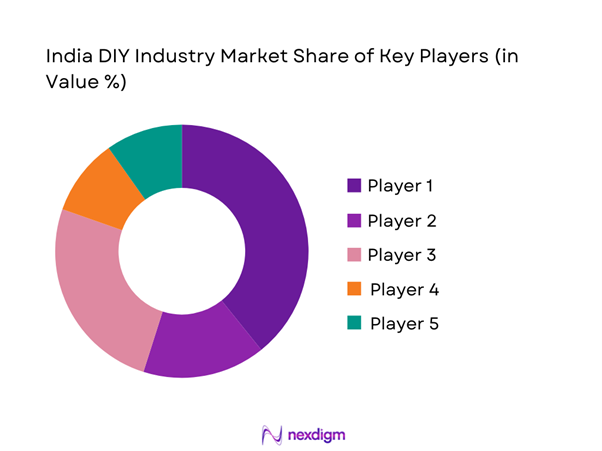

Competitive Landscape

The India DIY Industry market features a fragmented competitive structure combining domestic manufacturers, global brands, and private-label retailers. Competition centers on product breadth, accessibility, pricing flexibility, and service support rather than scale dominance.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Asian Paints Limited | 1942 | Mumbai | ~ | ~ | ~ | ~ | ~ | ~ |

| Berger Paints India Limited | 1923 | Kolkata | ~ | ~ | ~ | ~ | ~ | ~ |

| Pidilite Industries Limited | 1959 | Mumbai | ~ | ~ | ~ | ~ | ~ | ~ |

| Bosch Power Tools India | 1951 | Bengaluru | ~ | ~ | ~ | ~ | ~ | ~ |

| IKEA India | 1943 | Hyderabad | ~ | ~ | ~ | ~ | ~ | ~ |

India DIY Industry Market Analysis

Growth Drivers

Rising urban home ownership and renovation spending

Urban home ownership expansion continues influencing the India DIY Industry market through higher renovation frequency and personalization-focused interior improvement activities. New homeowners increasingly prefer self-executed upgrades to manage timelines and reduce dependence on informal contractors. In 2024 and 2025, apartment refurbishment cycles accelerated due to aging housing stock across major metropolitan clusters. Consumers allocate incremental discretionary budgets toward aesthetic upgrades, storage optimization, and functional enhancements. DIY participation improves confidence and cost control for routine upgrades. Renovation-led demand remains resilient despite macroeconomic fluctuations. Product standardization supports ease of adoption. Availability of tutorials enhances execution capability. Peer influence encourages experimentation. Urban density sustains repeat purchase behavior.

Growth of e-commerce and organized home improvement retail

Digital platforms significantly reshape the India DIY Industry market by improving discovery, comparison, and accessibility across diverse product categories. Organized retail chains enhance consumer trust through standardized assortments and return policies. In 2024 and 2025, online product listings expanded substantially across tools and fixtures. Integrated content assists first-time DIY participants. Logistics reliability improved delivery times across urban zones. Digital promotions influence trial purchases. Organized formats reduce counterfeit risks. Brand visibility improves through curated platforms. Consumer education strengthens adoption confidence. Retail modernization accelerates category formalization.

Challenges

Low DIY culture penetration compared to global markets

Limited cultural familiarity with self-executed home improvement constrains broader adoption within the India DIY Industry market. Many households traditionally rely on hired labor for minor repairs and upgrades. Behavioral inertia remains strong across older demographics. In 2024 and 2025, awareness improved but execution hesitation persisted. Social norms favor outsourcing skilled work. Time constraints reduce experimentation willingness. Lack of confidence slows trial conversion. Peer validation remains limited. Cultural transition requires sustained exposure. Adoption remains uneven geographically.

Skill gaps and safety concerns among consumers

Insufficient technical skills and safety awareness present persistent barriers within the India DIY Industry market. Consumers often lack familiarity with tools, materials, and installation procedures. In 2024 and 2025, safety apprehensions discouraged power tool adoption. Improper usage risks property damage and injury. Absence of standardized training limits confidence. Protective equipment adoption remains inconsistent. Instructional content penetration varies by language. Fear of errors restricts project scope. Skill-building infrastructure remains fragmented. Safety perception influences purchase restraint.

Opportunities

Expansion of DIY education and skill-building platforms

Structured learning platforms create meaningful growth opportunities for the India DIY Industry market by reducing execution anxiety. Digital tutorials, workshops, and guided kits enhance consumer confidence. In 2024 and 2025, vernacular content adoption expanded reach. Retail-led demonstrations encourage trial behavior. Skill certification concepts improve credibility. Partnerships with housing communities support engagement. Education shortens learning curves. Safety awareness improves adoption. Confidence drives repeat purchases. Knowledge democratization expands addressable demand.

Private label and affordable tool brand growth

Affordable private-label offerings unlock volume expansion opportunities within the India DIY Industry market. Price-sensitive consumers increasingly prefer functional alternatives over premium brands. In 2024 and 2025, retailers expanded exclusive assortments. Private labels improve margin control. Entry pricing encourages experimentation. Simplified designs reduce intimidation. Packaging clarity enhances usability. Retail trust supports acceptance. Affordable tools widen participation base. Value positioning accelerates penetration.

Future Outlook

The India DIY Industry market is expected to mature steadily through 2035 as cultural acceptance improves and organized retail deepens. Technology-enabled guidance, vernacular education, and affordable products will shape adoption trajectories. Urban and semi-urban households will remain primary growth engines.

Major Players

- Asian Paints Limited

- Berger Paints India Limited

- Kansai Nerolac Paints Limited

- Pidilite Industries Limited

- Astral Limited

- Supreme Industries Limited

- Tata Steel Limited

- JSW Steel Limited

- Saint-Gobain India

- IKEA India

- Pepperfry Limited

- Godrej Interio

- Bosch Power Tools India

- Stanley Black & Decker India

- Home Centre India

Key Target Audience

- Urban homeowners and apartment associations

- Rental property owners and landlords

- Small commercial property owners

- Organized hardware and home improvement retailers

- E-commerce home improvement platforms

- Private label manufacturers and suppliers

- Investments and venture capital firms

- Ministry of Housing and Urban Affairs and state housing authorities

Research Methodology

Step 1: Identification of Key Variables

Focused on identifying core DIY product categories, usage scenarios, and consumer engagement variables across urban and semi-urban households. The process mapped household repair behaviors, renovation frequency, and self-execution readiness to establish foundational analytical inputs.

Step 2: Market Analysis and Construction

Involved constructing the market framework using channel mapping, product taxonomy development, and demand pattern analysis. This stage structured segmentation logic across product categories, applications, and distribution formats relevant to DIY adoption.

Step 3: Hypothesis Validation and Expert Consultation

Emphasized validation through structured discussions with retailers, installers, platform operators, and housing community representatives. Insights were used to validate assumptions related to consumer behavior, channel dynamics, and adoption constraints.

Step 4: Research Synthesis and Final Output

Synthesized insights through triangulation, consistency checks, and assumption alignment to deliver coherent market narratives. Findings were refined to ensure analytical integrity, clarity, and alignment with observed market behavior.

- Executive Summary

- Research Methodology (Market Definitions and Scope for DIY Products and Services, DIY Product Taxonomy and Skill-Based Segmentation Logic, Bottom-Up Market Sizing Using Retail Sales and Project Spend Tracking, Revenue Attribution Across Product Categories and Service Attach Rates, Primary Interviews with Retailers Contractors and Urban Homeowners)

- Definition and Scope

- Market evolution

- Usage and home improvement pathways

- Ecosystem structure

- Retail and service channel structure

- Regulatory environment

- Growth Drivers

Rising urban home ownership and renovation spending

Growth of e-commerce and organized home improvement retail

Increasing labor costs driving self-execution

Influence of social media and online tutorials

Expansion of affordable power tools

Government housing and urban development initiatives - Challenges

Low DIY culture penetration compared to global markets

Skill gaps and safety concerns among consumers

Dependence on informal labor market

Limited availability of specialized tools in tier 2 and tier 3 cities

Price sensitivity and preference for low-cost solutions

Fragmented retail and after-sales support - Opportunities

Expansion of DIY education and skill-building platforms

Private label and affordable tool brand growth

Integration of DIY with home services marketplaces

Growth in modular furniture and ready-to-assemble products

Penetration into semi-urban and rural markets

Smart tool and IoT-enabled product adoption - Trends

Shift toward cordless and battery-powered tools

Growth of online DIY content consumption

Increasing participation of women and first-time homeowners

Rise of organized DIY retail formats

Eco-friendly and low-VOC materials adoption

Bundling of products with guided services - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base of Active DIY Households, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Individual urban households

Rural households

Rental property owners

Small commercial property owners - By Application (in Value %)

Painting and surface finishing

Furniture assembly and repair

Plumbing and bathroom upgrades

Electrical fixtures and lighting

Flooring and tiling - By Technology Architecture (in Value %)

Manual hand tools

Electric power tools

Battery-operated cordless tools

Smart and app-enabled tools - By End-Use Industry (in Value %)

Residential housing

Hospitality and rental properties

Small offices and retail spaces

Educational and institutional buildings - By Connectivity Type (in Value %)

Offline retail and hardware stores

E-commerce platforms

Omnichannel retail

Service-led DIY platforms - By Region (in Value %)

North India

South India

West India

East India

North East India

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (Product breadth, Price positioning, Retail reach, E-commerce strength, Brand equity, After-sales support, Innovation capability, Private label presence)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Asian Paints Limited

Berger Paints India Limited

Kansai Nerolac Paints Limited

Pidilite Industries Limited

Astral Limited

Supreme Industries Limited

Tata Steel Limited

JSW Steel Limited

Saint-Gobain India

IKEA India

Pepperfry Limited

Godrej Interio

Bosch Power Tools India

Stanley Black & Decker India

Home Centre India

- Demand and utilization drivers

- Procurement and purchase decision dynamics

- Buying criteria and brand preference

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service and support expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base of Active DIY Households, 2026–2035

- By Average Selling Price, 2026–2035