Market Overview

The India Drones and Anti-Drones market is valued at approximately USD 1.27 billion, based on a five-year historical analysis. This growth is primarily fueled by the Government’s proactive regulatory support, including the Production-Linked Incentive (PLI) scheme worth INR 120 crore, aimed at making India a global drone hub. The Ministry of Civil Aviation has relaxed drone import rules for defense and R&D and lifted several licensing hurdles, encouraging domestic production. Additionally, India’s strong defense focus and adoption in sectors such as agriculture, infrastructure inspection, and surveillance are accelerating drone deployments across the country.

The market is particularly concentrated in states like Maharashtra, Karnataka, Telangana, and Delhi NCR due to their conducive regulatory environments, presence of key drone manufacturers and start-ups, and technological infrastructure. Karnataka, for instance, leads in drone R&D due to aerospace corridors and defense PSUs. Telangana and Maharashtra benefit from innovation hubs and agritech pilots, while Delhi NCR has high institutional procurement by paramilitary and central agencies.

Market Segmentation

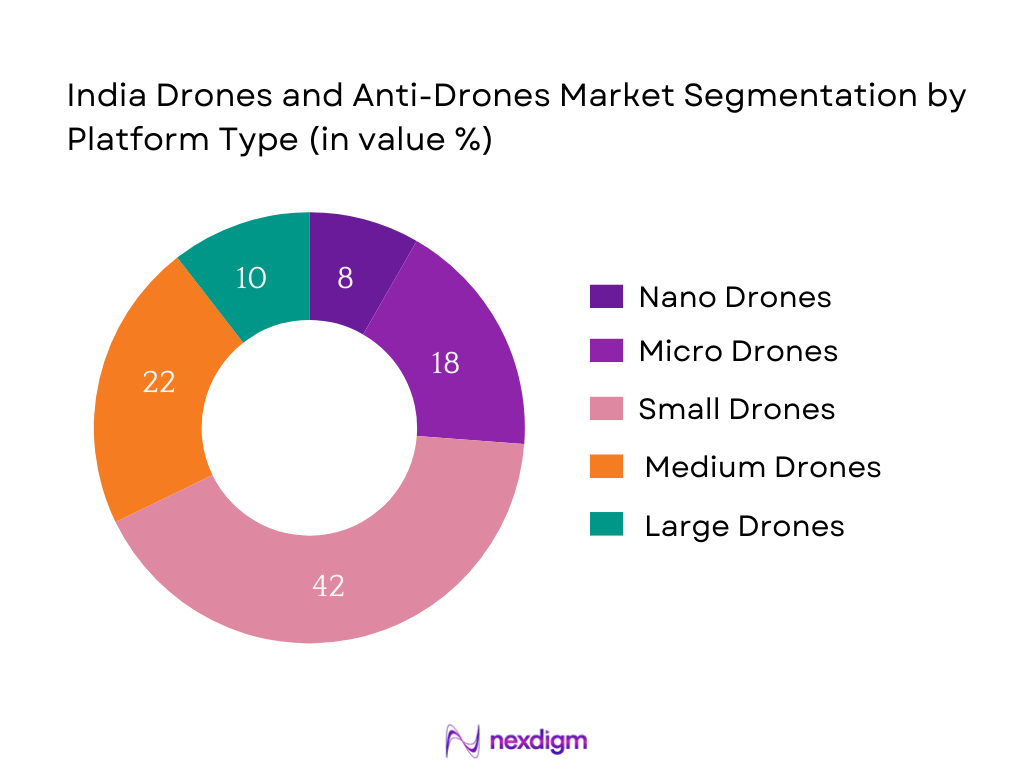

By Platform Type

India Drones and Anti-Drones Market is segmented by platform type into Nano Drones, Micro Drones, Small Drones, Medium Drones, and Large Drones. Recently, small drones have a dominant market share in India under the segmentation platform type. This is primarily due to their versatility in commercial use cases like agriculture spraying, warehouse inspections, and border patrolling. These drones typically weigh between 2-25 kg, making them suitable for urban and semi-urban operations. The popularity of small drones also stems from relaxed DGCA registration norms and increasing application in police surveillance, infrastructure inspection, and land mapping initiatives such as SVAMITVA, which have led to a spike in adoption across state government departments.

By Application

India Drones and Anti-Drones Market is segmented by application into Agriculture, Surveillance & Border Management, Infrastructure Inspection, Delivery & Logistics, and Mapping & Surveying. Recently, surveillance and border management hold a dominant market share in India under the segmentation application. This is driven by robust government procurement by defense and paramilitary forces for tactical operations. Drones are increasingly used along international borders for night surveillance, anti-infiltration operations, and rapid terrain assessment. Ongoing projects with Bharat Electronics and DRDO to integrate AI-based surveillance drones, coupled with threats from rogue drones in border states, have further necessitated anti-drone technology deployments, leading to sustained investment in this segment.

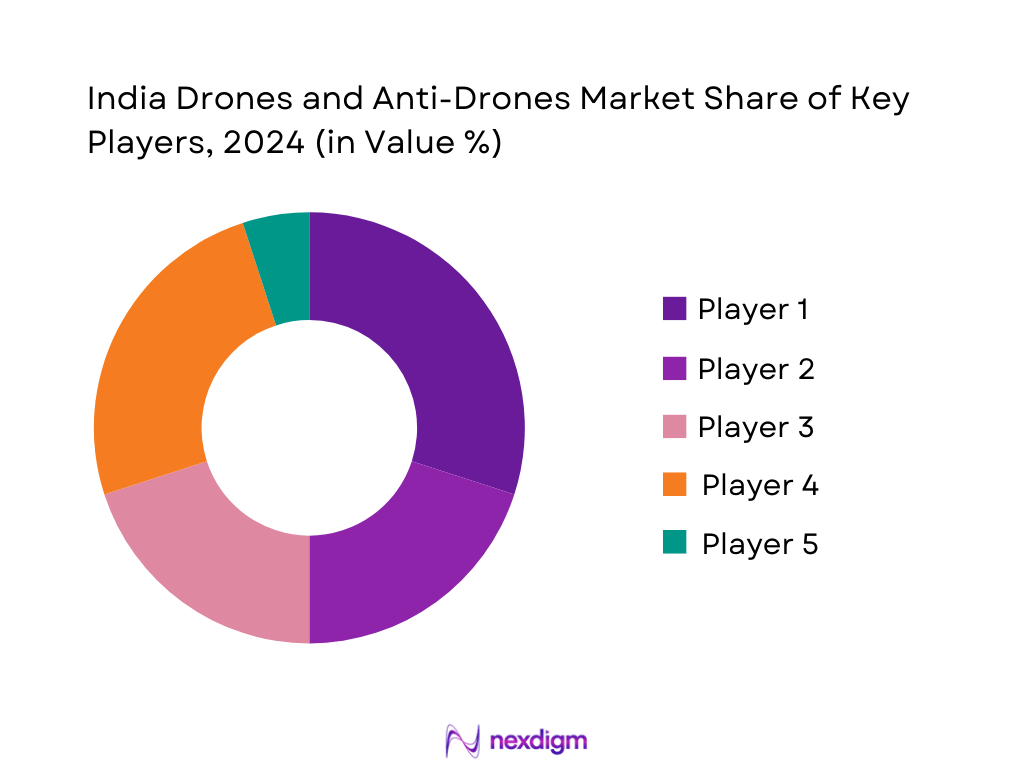

Competitive Landscape

The India Drones and Anti-Drones market is dominated by key domestic players such as ideaForge, Garuda Aerospace, and Asteria Aerospace, alongside specialized defense integrators. This consolidation highlights the significant influence of these key companies, particularly those who have secured DGCA certifications, MoD procurement approvals, and have local manufacturing capability. Companies with dual expertise in both drones and counter-UAV systems are gaining a strategic edge.

| Company Name | Year of Establishment | HQ Location | Product Specialization | DGCA Approved? | Defense Contracts | Local Manufacturing | Export Presence | R&D Investment |

| ideaForge | 2007 | Mumbai | – | – | – | – | – | – |

| Garuda Aerospace | 2015 | Chennai | – | – | – | – | – | – |

| Asteria Aerospace | 2011 | Bengaluru | – | – | – | – | – | – |

| Zen Technologies | 1993 | Hyderabad | – | – | – | – | – | – |

| Paras Aerospace | 2020 | Bengaluru | – | – | – | – | – | – |

India Drones and Anti‑Drones Market Analysis

Growth Drivers

PLI Scheme Outlay of ₹120 Crore for Drones

The Government of India has allocated ₹120 crore under the Production-Linked Incentive (PLI) scheme to support drone manufacturing, including UAS and their components. The scheme covers 20% of incremental sales over a base year, fostering scale-up in drone production. In 2024, domestic drone manufacturing surged by 35% YoY, largely due to reduced import dependence and localized supply chains. Drone exports from Indian firms reached ₹150 crore in the first half of 2024. These figures align with India’s nominal GDP growth, which reached USD 3.74 trillion in 2023, boosting investment appeal.

MoD Tenders for UAV Procurement

The Indian Ministry of Defence issued procurement orders totaling approximately ₹2,400 crore in 2024 for UAV platforms like SWiFT and Rustom-II. These tenders included both fixed-wing and rotary UAVs with night-vision and ISR capabilities. The procurement reflects rising defense expenditure, which amounted to USD 83 billion in 2023 (≈2.8% of GDP). This scale of defense spending underpins demand for both surveillance drones and anti-drone systems as part of layered air defense, stimulating growth in domestic drone OEM capacity and R&D pipelines.

Market Challenges

Lack of Trained UAV Pilots and Certification Bottlenecks

DGCA records indicate that, as of mid-2024, only 16,000 Remote Pilot Certificates (RPCs) had been issued by 116 approved RPTOs across India. This is significantly below the estimated need of 40,000 certified pilots to meet both defense and commercial demand. The shortage is particularly acute for medium and large drone operations. Despite the presence of 70 DGCA-certified UAS models and 48 manufacturer licenses, the rate of RPC issuance grew by just 10% in 2024. This gap in pilot supply not only limits deployment capacity but also delays projects requiring NPNT (No Permission No Take-off) compliance, causing deployment bottlenecks.

Fragmented Supply Chain for Indigenous Drone Components

As of 2024, only 15% of drone components (e.g., autopilots, sensors, GPS units) are sourced domestically; remaining 85% are imported. The government reports that 32 Indian component suppliers support the local drone industry, but they primarily provide mechanical parts, not electronics. India’s electronics imports hit USD 80 billion in 2023, placing high dependency on foreign supply chains. This fragmentation inflates costs by 25–30% per unit and delays manufacturing timelines. Unless localized components increase to at least one-quarter of total bill of materials, OEMs remain vulnerable to supply disruptions.

Market Opportunities

Swarm Drones in Border Security and Battlefield Surveillance

India has conducted 25 official swarm drone trials, including multi-UAV operations along disputed border zones in Ladakh and North-East. In one 2024 test, 20 drones simultaneously flew surveillance patterns covering 150 sq km in a single mission. The Defence Research and Development Organisation (DRDO) has earmarked ₹450 crore for swarm technology development. Given India’s dry ad spend with military logistics at USD 5 billion/year, these swarm systems offer scalable ISR coverage, quicker deployment, and reduced OPCOST (operational cost). This evolving capability makes swarm drones a frontier opportunity in both military and paramilitary contexts.

BVLOS (Beyond Visual Line of Sight) Trials for Logistics

In partnership with state agencies and private players, the DGCA issued 120 BVLOS approvals in sectors like pharma delivery, agricultural supply chains, and e-commerce last year. Telangana alone issued 35 BVLOS permits, covering 2,500 km of rural routes. Drone deliveries to 85 health centers have transported 4.2 tonnes of medical supplies. India’s logistics sector — valued at USD 330 billion in 2023 — is increasingly interested in last-mile drone delivery to ease the rural-urban supply divide. These operational trials demonstrate drone logistics viability, paving the way for scaled commercial rollouts.

Future Outlook

Over the next 5 years, the India Drones and Anti-Drones market is expected to show significant growth driven by continuous government support, advancements in drone autonomy and AI, and expanding use cases across civilian and defense applications. Initiatives like drone corridors, BVLOS pilot approvals, and 5G-driven real-time drone communication will further enhance deployment capabilities. Additionally, the convergence of drone tech with GIS, IoT, and cloud computing will foster innovation in surveying, disaster response, and smart city monitoring. Furthermore, India’s push to reduce dependency on imported drones and strengthen indigenous manufacturing under Atmanirbhar Bharat will create more room for startups and Tier 2 OEMs to participate in the supply chain, with an emphasis on local value addition and R&D.

Major Players

- ideaForge

- Garuda Aerospace

- NewSpace Research & Technologies

- Asteria Aerospace

- Zen Technologies

- Paras Aerospace

- Adani-Elbit UAVs

- Throttle Aerospace Systems

- Detect Technologies

- TechEagle Innovations

- Dhaksha Unmanned Systems

- Omnipresent Robot Tech

- Marut Drones

- Sagar Defence Engineering

- General Aeronautics

Key Target Audience

- Indian Ministry of Defence (MoD)

- Ministry of Civil Aviation (MoCA)

- Border Security Force (BSF)

- Indian Space Research Organisation (ISRO)

- Department of Agriculture and Farmers Welfare

- Smart City Development Authorities (State & Municipal)

- Government and Regulatory Bodies (DGCA, Invest India, Make in India)

- Investment and Venture Capitalist Firms

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the India Drones and Anti-Drones Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the India Drones and Anti-Drones Market. This includes evaluating market penetration, type-wise deployment (platforms), and sector-specific demand trends. Additionally, state-wise policy analysis and defense procurement activity will be analyzed to estimate baseline revenue generation.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through computer-assisted telephone interviews (CATIs) with defense officials, drone manufacturers, and smart agriculture companies. These consultations offer key insights into sales trends, BVLOS trial results, and state-wise tendering behavior.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with drone technology providers to acquire data on product line evolution, hardware specs, flight time differentials, and value chain localization. These insights are used to validate and finalize the revenue model and growth trajectories.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Drone Classifications as per DGCA, Primary Research Approach with UAV Operators and Manufacturers, Data Triangulation, Limitations and Forecasting Assumptions)

- Definition and Scope

- Evolution of Drone and Anti-Drone Ecosystem

- Timeline of Key Regulatory Milestones

- Value Chain & Stakeholder Mapping

- Business Cycle Analysis

- Policy & Incentive Landscape

- Growth Drivers

PLI Scheme Outlay of ₹120 Crore for Drones

MoD Tenders for UAV Procurement (e.g., SWiFT, Rustom-II)

Smart Agriculture & Digital Farming Push

Infrastructure Surveillance via NHAI & Railways - Market Challenges

Lack of Trained UAV Pilots and Certification Bottlenecks

Fragmented Supply Chain for Indigenous Drone Components

Airspace Integration Constraints & NPNT Enforcement - Market Opportunities

Swarm Drones in Border Security and Battlefield Surveillance

BVLOS (Beyond Visual Line of Sight) Trials for Logistics

Drone-as-a-Service Model (DAAS) Expansion

Integration with 5G Networks for Real-Time Transmission - Market Trends

Shift from Import Dependence to Local Manufacturing

Development of Drone Corridors and UTM Infrastructure

Rise of Dual-Use Drones (Defense + Commercial)

Integration of AI for Autonomous Navigation - Government Regulation

DGCA UAS Rules, 2021

PLI and FDI Norms in Drone Tech

Standard Operating Procedures (SOPs) for NPNT Compliance

Airspace Map Classification (Green, Yellow, Red Zones) - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Selling Price, 2019-2024

- By Platform Type (In Value %)

Nano Drones

– Indoor Surveillance

– Educational & Research Use

– Tactical Reconnaissance

Micro Drones

– Border Patrolling

– Short-Range Asset Monitoring

– Forest and Wildlife Surveillance

Small Drones

– Precision Agriculture

– Industrial Inspections

– Delivery Testing

Medium Drones

– Law Enforcement Support

– Oil & Gas Pipeline Inspection

– City Surveillance

Large Drones

– Defense Reconnaissance

– Long-Range Delivery

– Infrastructure Surveying - By Application (In Value %)

Agriculture

– Crop Monitoring

– Aerial Spraying

– Soil Health Analysis

Surveillance & Border Management

– Night Vision & Thermal Monitoring

– Perimeter Intrusion Detection

– Cross-Border Movement Tracking

Infrastructure & Asset Inspection

– Power Grid Monitoring

– Railway & Metro Line Inspection

– Telecom Tower Surveying

Delivery & Logistics

– Last-Mile Urban Delivery

– Rural Medical Supply Drops

– Warehouse to Retail Dispatch

Mapping & Surveying

– Land Records Digitization

– Smart City Infrastructure Mapping

– Construction Progress Audits - By End User (In Value %)

Government & Defense

– Indian Army, Navy, Air Force

– DRDO, BSF, CRPF, Police Forces

– Disaster Management Agencies

Commercial Enterprises

– Infrastructure Firms

– Telecom Providers

– Mining & Energy Sector Companies

Agriculture Bodies

– State Agricultural Universities

– Agro-Tech Startups

– Farmer Producer Organizations (FPOs)

Media & Entertainment

– Film Production Houses

– News Channels

– Event Management Companies

Smart Cities & Municipal Corporations

– Urban Waste Monitoring

– Traffic Management

– Water & Drainage Infra Audits - By Payload (In Value %)

Camera Systems

– HD Cameras

– Thermal Cameras

– Night Vision Systems

LiDAR Sensors

– High-Resolution Terrain Mapping

– Forestry Management

– Road Construction Surveying

Radar Systems

– Anti-Drone Defense Integration

– Surveillance in Low-Visibility Zones

– Weather-Resilient Monitoring

Delivery Mechanism

– Smart Dropping Payloads

– Temperature-Controlled Boxes

– Emergency Release Systems

Multispectral Sensors

– Crop Health Imaging

– Environmental Monitoring

– Water Body Quality Assessment - By Region (In Value %)

North India

South India

East India

West India

Central India

- Market Share of Key Players by Platform Type (Micro, Small, Medium, Large)

- Cross Comparison Parameters (Company Overview, Product Suite, Government & Defense Contracts, R&D Spend and Innovation Capability, Licensing & Regulatory Approvals, Training & Simulation Facilities, Local Manufacturing Capabilities, Integration & Technology Partners, Export Markets & Geographical Reach, Unique Value Proposition, Others)

- SWOT Analysis of Top Players

- Pricing Analysis by Drone Class and Payload (Base Model, AI-Enabled, BVLOS Ready)

- Detailed Profiles of Major Companies

ideaForge

Garuda Aerospace

NewSpace Research & Technologies

Paras Aerospace

Asteria Aerospace

Zen Technologies

Adani-Elbit UAVs

Throttle Aerospace Systems

Detect Technologies

TechEagle Innovations

Dhaksha Unmanned Systems

Omnipresent Robot Tech

Marut Drones

Sagar Defence Engineering

General Aeronautics

- Drone Procurement Behavior of Key Ministries

- Corporate Spend on Drone Services in Infra & Energy

- Pain Point Analysis by End User Category

- User Readiness for Autonomous Drone Adoption

- Post-Deployment ROI and Use Case Expansion

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Selling Price, 2025-2030