Market Overview

The India drones market is valued at USD 1,581.5 million, based on a five‑year historical analysis. This figure reflects growth from USD 654 million in 2024, driven by surging adoption in agriculture, defence, infrastructure inspection, and logistics. Key enablers include the DGCA’s relaxed regulations, the PLI scheme for domestic manufacturing, enhanced autonomy and battery technologies, and commercial pickups in crop monitoring and parcel delivery.

India’s drone ecosystem is dominated by hubs in Tamil Nadu, Karnataka, Telangana, and Maharashtra due to strong public–private R&D ties, defence corridor infrastructure, and supportive state policies. Hyderabad and Bengaluru serve as innovation centers with ready access to startups, premier engineering institutions, and pilot training, while Chennai and Pune host manufacturing clusters strengthened by PLI incentives and the DGCA’s digital approvals platform.

Market Segmentation

By Drone Type

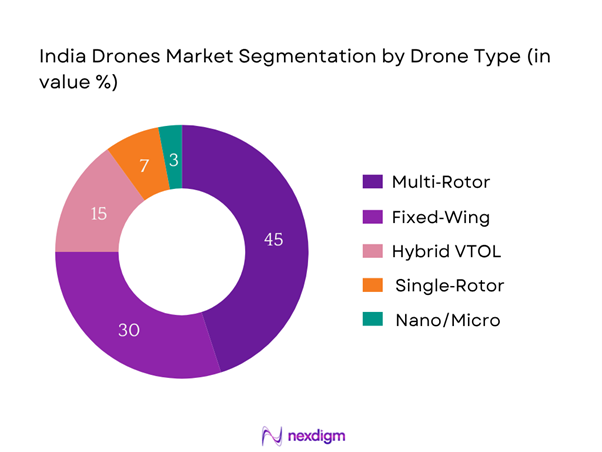

The India drones market is segmented by drone type into multi‑rotor, fixed‑wing, hybrid VTOL, single‑rotor and nano/micro. Multi‑rotor drones currently dominate (~45%), thanks to their versatility in urban mapping, agriculture, surveillance and ease of use. They require lower operator skill and can hover for detailed inspections, making them ideal for infrastructure, media, and precision farming. Startups like Garuda and ideaForge focus on this segment due to its wide applicability and quick deployment potential.

By Application

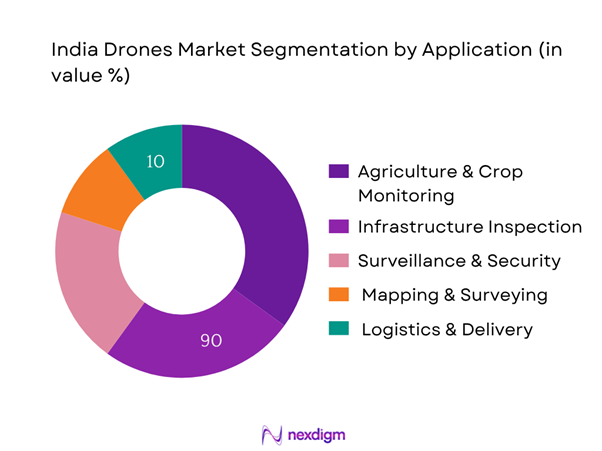

The India drones market is segmented by application into agriculture & crop monitoring, surveillance & security, infrastructure inspection, logistics & delivery, and mapping & surveying. Agriculture leads (~35%), propelled by adoption in pesticide spraying, yield estimation, and crop health monitoring. Large arable areas in Punjab, Maharashtra, and Karnataka are primary adopters; startup Garuda Aerospace supports this with agri‑drones and drAAS solutions in cooperation with ICAR. Government subsidies under the Kisan Drone scheme further reinforce dominance of this segment.

Competitive Landscape

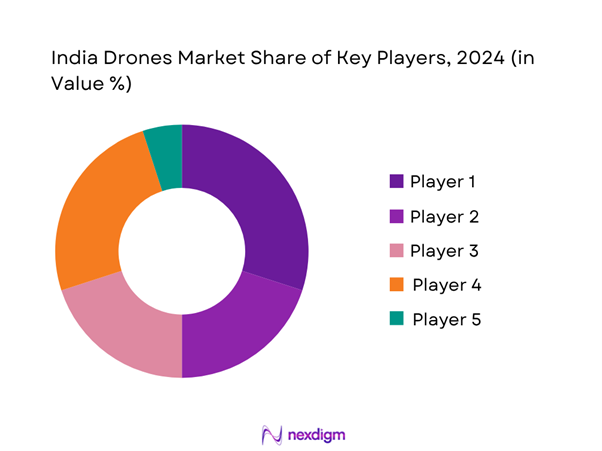

The India drones market is led by a cluster of domestic champions and tech‑innovative startups, supported by manufacturing incentives and regulatory clarity. Consolidation among key players reflects competitive maturity and specialization.

| Company | Year Established | Headquarters | Drone Type Focus | Payload Range (kg) | Autonomy Level | DGCA Certification | Manufacturing Capacity (units/year) | Primary End-Use |

| ideaForge | 2007 | Mumbai | – | – | – | – | – | – |

| Garuda Aerospace | 2015 | Hyderabad | – | – | – | – | – | – |

| Asteria Aerospace | 2007 | Bengaluru | – | – | – | – | – | – |

| Marut Drones | 2016 | Bengaluru | – | – | – | – | – | – |

| Paras Defence | 2008 | Hyderabad | – | – | – | – | – | – |

India Drones Market Analysis

Growth Drivers

PLI Scheme & FDI Push in Indigenous Manufacturing

The Production-Linked Incentive (PLI) scheme in electronics offers ₹48,000 crore for incentive support across 14 sectors, significantly targeting drone component manufacturing. In FY 24, India attracted USD 28.08 billion in FDI inflows, despite global decline, signaling policy momentum. The Make in India program, though showing manufacturing as 15.9% of GDP in FY 24, is reinforcing local supply chains—including avionics and battery production—under PLI. Such industrial scaling underpins Indian drone OEMs to domestically source key parts like LiDAR, EV batteries, and navigation modules at competitive costs.

Rising Agri‑Tech Demand in Precision Farming

Agriculture constitutes 18.4% of India’s GVA, with net irrigated area of 71.6 million hectares. The Ministry of Agriculture allocates up to 75% subsidy (capped at ₹7.5 lakh) for purchasing crop-spraying drones. This has directly spurred adoption across over 5 million hectares under drone spraying and crop monitoring. The SVAMITVA scheme has used drones in surveys across 310,388 villages by end-2024. This strong policy‑driven technology uptake cements agriculture as a key entry point for drone penetration across rural regions.

Market Challenges

Regulatory Delays & Policy Volatility

India recorded 0.7871% of GDP as FDI inflow in 2023 however, global FDI to developing economies dropped to USD 435 billion in 2023—the lowest since 2005. This reflects investor caution amid regulatory bottlenecks, including delays in BVLOS approvals—approved drone corridors remain operational in only 6 of 100 planned national zones. Over 400 remote pilot certifications are backlogged due to DGCA procedural delays, impacting deployment. These regulatory inefficiencies limit investor confidence and slow down commercial rollout in high-potential applications such as logistics and smart cities.

Limited Indigenous Drone Component Manufacturing

Although the PLI scheme supports electronics, manufacturing share stayed at 15.9% of GDP. India continues to import >80% of advanced drone sensors (LiDAR, thermal cameras) and GNSS modules. Domestic component assembly capacity is only ~30,000 units annually, compared to over 200,000 units needed by startups and defence combined. R&D centers in Bengaluru and Hyderabad account for <10% of total necessary investment in avionic research infrastructure. This gap in propulsion, sensor, and AI-software hardware limits drone autonomy and customization for niche missions.

Opportunities

Drone‑as‑a‑Service (DaaS) Model Adoption

Despite hardware limitations, over 70 startups now offer DaaS—including crop spraying, mapping, and inspection—across 250 districts. The NDVI-based monitoring service covers more than 4 million hectares annually. In infrastructure, 300 EPC firms signed 2,000+ service contracts in 2023 for drone-assisted survey and inspection. With over USD 670 billion in foreign exchange reserves, public and private infrastructure spending continues unabated—creating immediate demand for drone services rather than hardware ownership. Thus, flexible, pay-per-use DaaS models are accelerating sector growth and adoption.

Drone Corridor Development in Logistics

The government plans 50 drone corridors; 6 are currently operational across Karnataka, Gujarat, and Assam. Telangana’s medical drone corridor serves 80 villages over 125 km, proving viability. Concurrently, refrigerated drone payload pilots for COVID vaccines delivered to 40 PHCs. With state-capital expenditure rising 28% in FY 24 , developing specialized corridors for logistics and healthcare purposes could dramatically increase commercial usage, lowering delivery costs in hard-to-reach areas and validating large-scale corridor rollouts.

Future Outlook

Over the next six years, the India drones market is poised for robust growth, driven by sustained regulatory easing, technological progress, and rising commercial adoption. Hardware and services revenues will grow in tandem as DaaS and BVLOS operations scale. Infrastructure development in agri-tech and smart cities, combined with support for drone corridors and indigenous manufacturing, will continue to fuel momentum. This transformation positions drones as a core pillar in India’s digital infrastructure ecosystem.

For insights on Anti Drones market check out our report: India Drones and Anti Drones Market

Major Players

- ideaForge

- Garuda Aerospace

- Asteria Aerospace

- Marut Drones

- Paras Defence

- Zen Technologies

- Throttle Aerospace

- General Aeronautics

- DroneAcharya

- Zen Technologies

- RattanIndia

- Indrones

- TechEagle

- NewSpace Research & Technologies

- IoTechWorld

Key Target Audience

- Defence procurement agencies (DGCA, MoD, DRDO)

- Agriculture and food‑tech conglomerates

- Infrastructure EPC firms

- E‑commerce logistics integrators

- Insurance companies (for risk monitoring)

- Venture capital & investment firms

- State government mission teams (e.g., Tamil Nadu UAV Corp)

- Telecom operators implementing 5G IoT projects

Research Methodology

Step 1: Ecosystem & Variable Identification

Constructed a stakeholder ecosystem map spanning manufacturers, service providers, regulators, and end‑users. Utilized secondary research and primary expert interviews. Defined the key variables influencing market dynamics—e.g., policy environment, payload capacity, flight autonomy.

Step 2: Market Size Modelling

Compiled historical sales and usage data; segmented by drone type, application, and end‑user. Combined top‑down mapping with bottom‑up forecasts, including equipment ASP, flight-hours, and services contracts. Triangulated using publicly disclosed revenues, tender bids, and contract databases.

Step 3: Expert Validation & Hypothesis Testing

Conducted off‑the‑record CATI interviews with 20+ stakeholder representatives (startups, DGCA, state UAV cells, EPC firms) to validate assumptions around market penetration, operating cost, regulatory friction, demand pipeline, and component pricing. Adjusted model accordingly.

Step 4: Finalisation & Quality Review

Finalized report through engagement with industry operators including ideaForge, Asteria, Garuda, EPC firms, and MoD advisors. Enhanced data through cross-verification with tender award announcements, manufacturing output data, and drone import/substitution metrics.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Methodology, Market Triangulation Techniques, Primary and Secondary Data Sources, Limitations and Assumptions)

- Definition and Scope

- Market Genesis and Evolution

- Timeline of Major Milestones

- Stakeholder Mapping

- Drone Ecosystem Value Chain

- Growth Drivers

PLI Scheme & FDI Push in Indigenous Manufacturing

Rising Agri-Tech Demand in Precision Farming

Use in Disaster Relief, Mining, and Infra Projects

Defence & Surveillance Budget Allocation Surge

Integration with AI and IoT for Smart Operations - Market Challenges

Regulatory Delays & Policy Volatility

Limited Indigenous Drone Component Manufacturing

Airspace Permissions & Geo-Fencing Gaps

Lack of Skilled Workforce and Pilot Training Facilities - Opportunities

Drone-as-a-Service (DaaS) Model Adoption

Drone Corridor Development in Logistics

PLI Scheme-Enabled MSME Expansion

Drone Startups in Agri-Tech and Mapping - Trends

Drone Swarming for Security Applications

LiDAR-based Payload Integration

Autonomous Navigation via RTK-GNSS

Shift Toward Subscription-Based Drone Software - Government Regulation

Drone Rules (2021 & Amendments)

DGCA Licensing Requirements (UAS/UIN)

Import Restrictions on Foreign Drones

Policy Landscape for Drone Corridors - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Selling Price (ASP) per Unit, 2019-2024

- By Drone Type (In Value %)

Multi-Rotor Drones

– Quadcopter

– Hexacopter

– Octocopter

Fixed-Wing Drones

– Glider-Based Fixed Wings

– Powered Fixed Wings

Single-Rotor Drones

– Commercial Helicopter-Style Drones

– Utility-Grade Vertical Lift UAVs

Hybrid VTOL Drones

– Fixed-Wing VTOL

– Rotor-Based VTOL

Nano/Micro Drones

– Indoor Surveillance Nano-Drones

– Swarm Drones for Tactical Applications - By Application (In Value %)

Agriculture and Crop Monitoring

– Crop Spraying

– Crop Health Imaging

– Soil & Field Analysis

Surveillance and Border Security

– Perimeter Monitoring

– Crowd & Riot Control

– Border Patrol Drones

Infrastructure Inspection

– Power Line & Wind Turbine Monitoring

– Railways and Road Bridges

– Oil & Gas Pipeline Inspection

Logistics and Delivery

– Last-Mile Delivery

– Healthcare & Emergency Parcel Delivery

– Warehouse Drone Logistics

Mapping and Surveying

– 3D Terrain Mapping

– Urban Planning & Land Records

– Mining Area Surveying - By Payload Capacity (In Value %)

<2 kg

2–10 kg

10–25 kg

>25 kg - By End User (In Value %)

Government & Defense

– Border Security Forces

– Disaster Response and Aerial Reconnaissance

– Smart City Surveillance

Agriculture Sector

– Farm Input Companies (FMCG and Fertilizer Firms)

– Agri-Tech Startups

– State Agriculture Departments

Industrial and Infrastructure

– Real Estate & Construction

– Oil & Gas Sector

– Power Utilities

E-Commerce & Logistics

– Hyperlocal and B2C Delivery Startups

– Large E-commerce Platforms (Drone Delivery Pilots)

Media and Entertainment

– Film Production

– Sports Broadcasting

– Live Event Streaming - By Region (In Value %)

North India

West India

South India

East India

Central India

- Market Share of Major Players by Value and Volume

- Cross Comparison Parameters (Market Specific Comparison Parameters: Product Portfolio Breadth, Technology Stack (Autonomy Level, Navigation Systems), Flight Time & Payload, Regulatory Approvals, Production Capacity (Units/Year), Software Integration, Customization Flexibility, Post-Sale Support)

- SWOT Analysis of Major Players

- Pricing Analysis (Per Unit Basis by Payload and Drone Type)

- Detailed Profiles of 15 Key Players

- ideaForge

Garuda Aerospace

Asteria Aerospace

Marut Drones

IoTechWorld Avigation

Paras Aerospace

Aarav Unmanned Systems

Throttle Aerospace Systems

General Aeronautics

DroneAcharya Aerial Innovations

Zen Technologies

RattanIndia Enterprises

Indrones Solutions

TechEagle Innovations

NewSpace Research & Technologies

- Procurement Behavior and Budget Allocation

- Sector-Wise Operational Use Cases

- Compliance and Certification Needs

- Key Pain Points in Adoption

- Buyer Persona and Decision Hierarchy

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Selling Price, 2025-2030