Market Overview

As of 2024, the India dyes and pigments market is valued at USD 65.6 billion, with a growing CAGR of 4.3% from 2024 to 2030. This market is driven by the thriving textile industry, which constitutes a significant portion of India’s industrial output. Continual demand for vibrant and varied colours in textiles and a growing automotive sector are further fuelling the market growth. Additionally, technological advancements in dyeing processes are enhancing efficiency and reducing costs, contributing positively to market expansion.

Dominant regions in the India dyes and pigments market include Maharashtra and Gujarat, which have established themselves as major industrial hubs. These regions benefit from a robust infrastructure and a skilled labour force. Maharashtra hosts a significant number of textile manufacturers, while Gujarat is known for its extensive chemical industry. The proximity to raw material suppliers and export facilities enhances their market dominance.

Market Segmentation

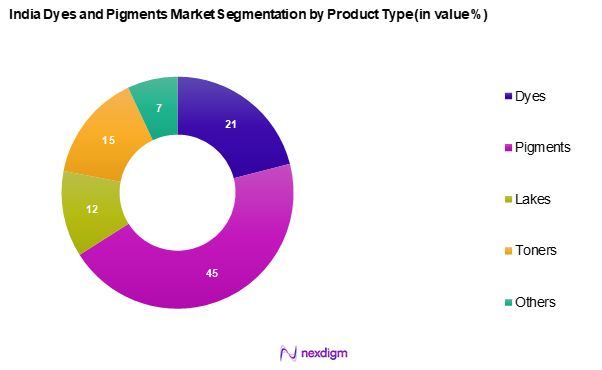

By Product Type

The India dyes and pigments market is segmented into dyes, pigments, lakes, toners, and others. Dyes segment dominant the market share due to their extensive use in the textile industry. The need for sustainable and eco-friendly products has led to innovations in dye formulations, making them preferable to pigments. The vibrant colour outputs and cost-effectiveness of synthetic dyes also contribute to their dominant position in the market.

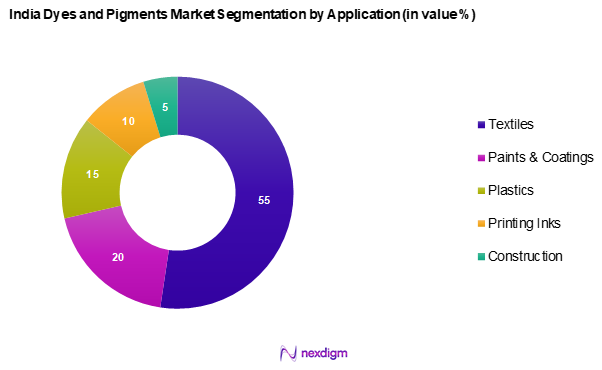

By Application

The India dyes and pigments market is segmented into textiles, paints and coatings, plastics, printing inks, and construction. Textiles dominate this segment due to the vast size and growth of the domestic textile sector. The growing preference for fashionable apparel among the burgeoning middle class is driving demand. Furthermore, innovations in fabric dyeing techniques, which improve efficiency and reduce water usage, are enhancing the attractiveness of this sub-segment.

Competitive Landscape

The India dyes and pigments market is concentrated among a few dominant players, which include both domestic leaders and global powerhouses. This consolidation is a testament to the significant influence and competitive advantage these companies maintain, including robust supply chains, extensive distribution networks, and substantial R&D investments.

| Company Name | Establishment Year | Headquarters | R&D Investment | Revenue (USD Mn) | Market

Share |

Product

Revenue |

Sustainability Initiatives |

| Sudarshan Chemical Industries | 1952 | Pune | – | – | – | – | – |

| Clariant AG | 1995 | Muttenz, Switzerland | – | – | – | – | – |

| BASF SE | 1967 | Ludwigshafen, Germany | – | – | – | – | – |

| Atul Ltd | 1947 | Gujarat, India | – | – | – | – | – |

| Kiri Industries | 1998 | Gujarat, India | – | – | – | – | – |

India Dyes and Pigments Market Analysis

Growth Drivers

Rapid Industrialization

India’s rapid industrialization is showcased by its industrial output, which reached approximately USD 125 billion in 2022. A favourable Mark-up Index, combined with the government’s initiative to enhance “Make in India,” is expected to boost the manufacturing sector, including the dyes and pigments industry. The industrial growth rate is projected to scale further with the introduction of new technologies and modernization of existing infrastructure, thereby establishing a robust supply chain necessary for dyes and pigments production. As a result, the market stands to benefit from the growing demand across various industrial sectors, such as textiles and coatings.

Expanding Textile Industry

The Indian textile industry is projected to reach USD 223 billion by 2025, driven by increased domestic consumption and growing exports, which surpassed USD 40 billion in 2022. The government’s initiatives to boost textile manufacturing, such as the Production Linked Incentive Scheme (PLI), have fuelled demand for dyes and pigments. Additionally, the expanding middle-class population is increasing consumer spend on textiles, contributing to market growth. This progression is integral as textiles account for one of the largest market segments for dyes and pigments in India, creating a favourable environment for industry players.

Market Challenges

Environmental Regulations

Increasing environmental regulations pose a significant challenge to the dyes and pigments market. India has committed to various international environmental agreements, leading to stricter emission and waste disposal norms in the chemicals sector. As of 2022, approximately 40% of dyeing facilities faced non-compliance issues, resulting in fines and operational shut-downs. The Central Pollution Control Board is actively monitoring compliance rates and has introduced initiatives aimed at reducing water pollution by 30% by 2025. Companies are thus compelled to invest in eco-friendly production technologies, adding to their operating costs.

Fluctuation in Raw Material Prices

Fluctuations in raw material prices present ongoing challenges to manufacturers in the dyes and pigments industry. For instance, the price of key raw materials like aniline rose 25% in 2022 due to supply chain disruptions caused by geopolitical tensions and pandemic-related constraints. As a predominantly import-dependent market for certain chemicals, any price volatility can significantly impact production costs. Manufacturers are struggling to maintain profit margins while balancing market prices, which leads to pricing instability across the dyes and pigments market. Such vulnerabilities may compel some businesses to adjust their procurement strategies or absorb costs, impacting overall competitiveness.

Opportunities

Rise of Eco-Friendly Products

The demand for eco-friendly dyes and pigments is on the rise, driven by changing consumer preferences and regulatory pressures. The market for natural dyes is currently valued at USD 250 million as of 2022 and is expected to double within the next few years. Manufacturers are increasingly investing in green chemistry initiatives to create bio-based dyes that are biodegradable and non-toxic, allowing them to capture a significant market share. This shift aligns with the global trend toward sustainable consumption, presenting an exciting growth opportunity for players willing to innovate and adapt to this demand shift. The growing emphasis on sustainability in the fashion industry further accelerates this trend.

Innovations in Organic Dyes

Investments in the research and development of organic dyes are substantial, with over USD 100 million allocated by major players in 2022. The introduction of innovative organic formulations has expanded the product portfolio within the market, making these dyes more appealing due to their vibrant colours and reduced environmental impact. Brands that incorporate organic dyes into their textile production are increasingly sought after by environmentally conscious consumers and companies. As the market moves toward sustainable practices, organic dyes are well-positioned to drive significant growth and push manufacturers to improve their offerings continuously and adapt accordingly.

Future Outlook

Over the next few years, the India dyes and pigments market is expected to exhibit robust growth driven by the evolution of the textile industry, increasing demand for eco-friendly dyes, and innovations in pigment technologies. Increasing environmental awareness is likely to boost the shift towards sustainable and non-toxic dyes, prompting market players to invest in green chemistry and bio-based products. As the industry navigates regulatory hurdles, sustainability will become a key competitive differentiator.

Major Players

- Sudarshan Chemical Industries Limited

- Clariant AG

- BASF SE

- Atul Ltd

- Kiri Industries

- Arkema SA

- DyStar Group

- Kronos Worldwide, Inc.

- Huntsman Corporation

- LANXESS AG

- Toyo Ink SC Holdings Co., Ltd

- Cabot Corporation

- Ferro Corporation

- Heubach GmbH

- Chem

Key Target Audience

- Textile Manufacturers

- Paints and Coatings Producers

- Automotive Industry Participants

- Printing and Packaging Companies

- Government and Regulatory Bodies (Ministry of Chemicals and Fertilizers)

- Consumer Goods Manufacturers

- Environmental Agencies (Central Pollution Control Board)

- Investments and Venture Capitalist Firms

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map that encapsulates all major stakeholders within the India dyes and pigments Market. This step is driven by extensive desk research and the use of proprietary databases, aimed at identifying key market influencers.

Step 2: Market Analysis and Construction

In this phase, historical data specific to the India dyes and pigments Market are compiled and analyzed. This includes evaluating market penetration, revenue generation, and assessing the quality of products offered by the industry leaders to ensure accuracy in revenue estimations.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are crafted and validated through Computer-Assisted Telephone Interviews (CATIs) with industry experts from diverse companies. These discussions provide insights into operational and financial dynamics from industry practitioners, which are integral to verifying market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with dye manufacturers to gain insights into product segments, sales performance, and consumer preferences. This direct interaction supplements the statistical data gathered using the bottom-up approach, guaranteeing a comprehensive and validated market analysis.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Industry Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Rapid Industrialization

Expanding Textile Industry - Market Challenges

Environmental Regulations

Fluctuation in Raw Material Prices - Opportunities

Rise of Eco-Friendly Products

Innovations in Organic Dyes - Trends

Sustainable Practices

Digital Textile Printing - Government Regulations

Environmental Laws

Trade Policies - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Dyes

– Reactive Dyes

– Disperse Dyes

– Direct Dyes

– Vat Dyes

– Acid Dyes

– Basic Dyes

– Sulfur Dyes

– Azo Dyes

Pigments

– Organic Pigments

– Phthalocyanine

– Azo Pigments

– High-performance Pigments (HPPs)

– Inorganic Pigments

– Titanium Dioxide

– Iron Oxide

– Chromium Oxide

Lakes

– Aluminium Lakes

– Calcium Lakes

– Barium Lakes

Toners

– Printer Toners

– Industrial Powder Toners

– Liquid Toners

Others

– Optical Brighteners

– Fluorescent and Luminescent Pigments

– Solvent Dyes - By Application (In Value %)

Textiles

– Garment Dyeing

– Yarn & Fabric Dyeing

– Home Textiles (Curtains, Upholstery)

Paints and Coatings

– Decorative Paints

– Automotive Coatings

– Industrial Coatings

Plastics

– Packaging Materials

– Automotive Plastics

– Consumer Electronics Casings

Printing Inks

– Flexographic Inks

– Gravure Inks

– Digital Inks

– Offset Inks

Construction

– Concrete & Cement Coloring

– Tiles & Ceramics

– Interior Decorative Products - By Region (In Value %)

North India

South India

East India

West India

Central India - By End Use Industry (In Value %)

Automotive

– Car Paints & Finishes

– Seat Fabric Dyeing

– Interior Components

Construction

– Exterior and Interior Paints

– Flooring and Paving Materials

– Roofing Coatings

Textile

– Apparel

– Home Furnishings

– Technical Textiles

Consumer Goods

– Toys

– Packaging

– Electronics

Agriculture

– Fertilizer Coloring

– Seed Coatings

– Pesticide Labels and Packaging - By Source Type (In Value %)

Synthetic

– Petrochemical-Based Dyes and Pigments

– Coal Tar Derivatives

Natural

– Plant-Based

– Animal-Based

– Mineral-Based

- Market Share Analysis of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Product Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Distribution Channels, Margins, Production Plant, Unique Offerings, etc.)

- SWOT Analysis of Major Players

- Pricing Analysis

- Detailed Profiles of Major Companies

Sudarshan Chemical Industries Limited

Clariant AG

BASF SE

Atul Ltd

Kiri Industries

Arkema SA

DyStar Group

Kronos Worldwide, Inc.

Huntsman Corporation

LANXESS AG

Toyo Ink SC Holdings Co., Ltd

Cabot Corporation

Ferro Corporation

Heubach GmbH

Chemours Company

- Market Demand and Utilization

- Cost Analysis and Budget Allocations

- Regulatory and Compliance Requirements

- Preferences and Pain Point Analysis

- Purchasing Decision Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030