Market Overview

The India E-Bomb market is experiencing significant growth, driven by advancements in electromagnetic pulse (EMP) technology and increased defense spending. The market is propelled by both government investments in national security and the ongoing development of directed energy weapons (DEWs). These factors contribute to a robust demand for advanced weapon systems, with the total market size in 2024 reaching several billion ~ USD. Key drivers include military modernization efforts and technological advancements in non-lethal countermeasures.

India is one of the leading players in the defense sector, with significant contributions from both public and private sectors in the development of next-gen electronic warfare systems. Major cities like New Delhi, Mumbai, and Bengaluru host key defense research and development activities. The country’s strategic location and growing military demands in the region further solidify its dominance in the market. With increasing geopolitical tensions and military modernization, India’s defense sector remains crucial to the global electronic warfare landscape.

Market Segmentation

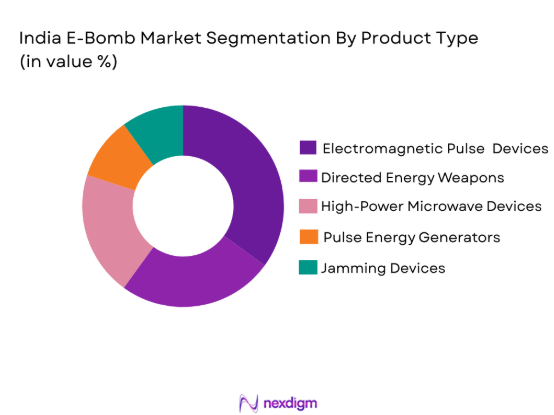

By Product Type

The India E-Bomb market is segmented by product type into electromagnetic pulse (EMP) devices, directed energy weapons (DEWs), high-power microwave (HPM) devices, pulse energy generators, and jamming devices. Recently, EMP devices have seen dominant market share due to their strategic importance in disrupting enemy electronics and infrastructure. The increasing focus on non-lethal warfare strategies, coupled with demand for scalable and cost-effective solutions, has fueled the dominance of EMP devices in the market.

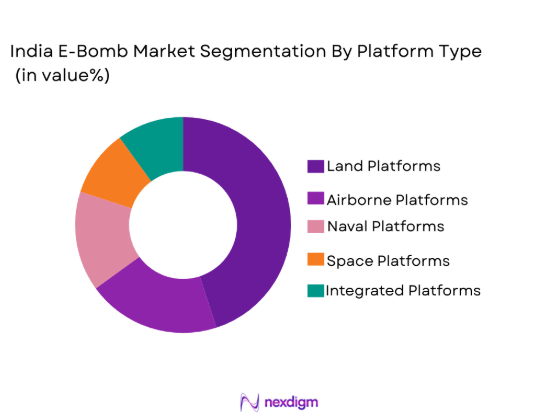

By Platform Type

The India E-Bomb market is segmented by platform type into land platforms, airborne platforms, naval platforms, space platforms, and integrated platforms. Among these, land platforms have a dominant market share due to their widespread use in ground-based defense systems and their cost-effectiveness compared to airborne and naval platforms. The increasing emphasis on enhancing ground security and the development of portable, efficient E-Bomb systems tailored for land-based applications have driven this dominance.

Competitive Landscape

The India E-Bomb market is highly competitive, characterized by significant consolidation. Major defense contractors and technology firms dominate space, driving innovations in EMP and DEW technologies. Companies such as Lockheed Martin and Thales Group continue to lead the market through collaborations with the Indian government and defense agencies. The market is also influenced by technological advancements, with increasing investments in research and development of advanced non-lethal weapons.

|

Company Name |

Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) |

| Lockheed Martin | 1912 | Bethesda, MD, USA | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | Paris, France | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | London, UK | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | Falls Church, VA | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | Waltham, MA, USA | ~ | ~ | ~ | ~ |

India E-Bomb Market Analysis

Growth Drivers

Increased Government Investment in National Security

The surge in government investments in national security is one of the primary growth drivers in the India E-Bomb market. With rising geopolitical tensions, especially in the Indo-Pacific region, India has significantly increased its defense budget to bolster its electronic warfare capabilities. The government’s strategic focus on modernizing the military, including the procurement of advanced electronic warfare systems such as E-Bombs, has created substantial demand in the market. The defense sector’s modernization is also augmented by the “Make in India” initiative, encouraging domestic production and technological development in defense systems. As a result, India has become a key player in the global E-Bomb market, with a focus on enhancing its defense capabilities through indigenous development of EMP and directed energy weapons. This robust investment not only supports the local defense ecosystem but also promotes international collaborations, strengthening India’s position in the global defense industry. Additionally, government policies that support R&D in defense technologies have contributed to the development of advanced E-Bomb systems, further driving market growth. As the nation continues to prioritize security, the demand for such systems will likely expand, reinforcing the critical role of these investments in ensuring defense preparedness.

Technological Advancements in EMP and DEWs

Technological advancements in EMP and directed energy weapons are accelerating the growth of the India E-Bomb market. The continuous development of high-power microwave (HPM) devices, pulse energy generators, and jamming systems has revolutionized electronic warfare. These technologies have become crucial in neutralizing enemy electronic systems without causing physical destruction, offering a non-lethal approach to combat. With significant advancements in energy storage, targeting accuracy, and system integration, the capabilities of E-Bombs have expanded. Additionally, innovations in solid-state technologies are improving the efficiency and scalability of EMP devices, making them more viable for widespread military use. The integration of artificial intelligence and machine learning into these systems enhances their targeting accuracy, adaptability, and response time. Furthermore, the reduction in cost per unit due to technological progress makes these advanced systems more accessible for military forces globally, including India. This evolution in EMP and DEW technology not only strengthens India’s defense capabilities but also positions it as a leader in the development and deployment of next-generation electronic warfare systems. As these technologies continue to evolve, the Indian E-Bomb market is expected to witness sustained growth.

Market Challenges

High Capital Expenditure in Defense Projects

High capital expenditure in defense projects remains a significant challenge in the India E-Bomb market. Developing advanced electronic warfare systems like EMP devices and DEWs requires substantial investments in research, testing, and production. The cost of acquiring cutting-edge technologies and manufacturing them domestically adds a layer of financial burden to defense budgets. While government initiatives such as “Make in India” aim to reduce reliance on foreign technology, the initial cost of developing and maintaining such systems remains high. Additionally, the lengthy development cycles for these systems, coupled with the need for specialized infrastructure, further exacerbate the financial challenge. These high costs often result in delays in procurement, limiting the market’s ability to scale quickly. Despite these challenges, India’s commitment to national security has led to increased funding in defense, which is expected to gradually reduce financial barriers and drive growth in the long term. However, cost constraints continue to impact the adoption and deployment of these systems, particularly in resource-constrained regions. The need for a balanced approach between advanced technology development and fiscal responsibility remains a key consideration for policymakers.

Technological Integration and Interoperability Issues

Another challenge in the India E-Bomb market is technological integration and interoperability issues. The successful deployment of E-Bombs requires seamless integration with other military systems such as radar, communication networks, and defense command systems. However, existing systems may lack the required compatibility with newer technologies, leading to difficulties in integration. In addition, military forces often rely on legacy systems that are not designed to support the advanced capabilities of EMP and DEW systems, creating gaps in performance. Ensuring that these systems work together efficiently requires overcoming technological hurdles such as system compatibility, data sharing protocols, and communication infrastructure. Furthermore, interoperability between different platforms, such as land-based systems, aircraft, and naval vessels, is critical for the effective use of E-Bombs in diverse operational environments. The challenge of integrating new technology into existing defense frameworks often leads to delays in system deployment and higher costs. Overcoming these barriers is essential for maximizing the effectiveness of E-Bombs in modern warfare scenarios. Addressing integration and interoperability challenges will require ongoing collaboration between defense contractors, government agencies, and technology developers.

Opportunities

Partnerships with Private Tech Firms for E-Bomb Development

A significant opportunity in the India E-Bomb market lies in the potential for partnerships with private technology firms. These collaborations could accelerate the development of advanced E-Bomb systems by leveraging cutting-edge innovations in artificial intelligence, machine learning, and materials science. Private firms have the agility and expertise to drive technological advancements, while defense agencies offer the infrastructure and resources necessary for large-scale production and deployment. By working together, both sectors can develop more efficient and cost-effective solutions for the defense market. Additionally, these partnerships could lead to the commercialization of new technologies, which could have applications beyond military use, such as in cyber defense or critical infrastructure protection. As India continues to push for self-reliance in defense technology, partnerships between the public and private sectors can help streamline the development of high-tech solutions. These collaborations could result in a broader and faster deployment of E-Bomb systems, benefiting both national security and the defense industry’s growth. The growing trend of public-private partnerships in India offers a promising avenue for the development of next-generation E-Bombs, positioning India as a leader in electronic warfare technologies.

Emerging Demand for Cyber-Resilient E-Bomb Systems

The growing threat of cyber-attacks on defense infrastructure presents an opportunity for the development of cyber-resilient E-Bomb systems. As military operations increasingly rely on digital networks, the potential for cyber disruptions to electronic warfare systems, including E-Bombs, has become a significant concern. There is an increasing demand for E-Bombs that can withstand cyber threats, ensuring their effectiveness in combat scenarios. Developing systems with built-in cybersecurity features, such as anti-jamming and anti-tampering capabilities, is essential to maintaining the integrity of these weapons in the face of evolving cyber threats. With India’s focus on strengthening its cybersecurity posture, there is a clear opportunity for defense contractors to invest in the development of secure E-Bomb systems. These advanced systems would not only protect national defense capabilities but also enhance the resilience of India’s critical infrastructure. By addressing the cybersecurity challenge, India can ensure that its defense systems remain operational and secure, even in the face of sophisticated cyber warfare tactics. The rise in demand for cyber-resilient E-Bombs presents a growth opportunity for manufacturers who can integrate cybersecurity features into their designs, making them indispensable in modern warfare.

Future Outlook

The India E-Bomb market is expected to witness robust growth over the next five years, driven by advancements in EMP and directed energy weapon technologies. The market will likely benefit from increasing defense budgets, technological developments, and government support for defense modernization. Additionally, there will be a surge in demand for non-lethal electronic warfare systems, enhancing India’s position as a leader in electronic warfare.

Major Players

- Lockheed Martin

- Thales Group

- BAE Systems

- Northrop Grumman

- Raytheon Technologies

- L3 Technologies

- Leonardo

- Harris Corporation

- Saab Group

- Rheinmetall AG

- Elbit Systems

- Hewlett Packard Enterprise

- Boeing

- Sikorsky Aircraft

- General Dynamics

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Military and defense contractors

- Technology firms

- National security agencies

- Aerospace and defense technology companies

- Cybersecurity firms

- Electronics manufacturers

Research Methodology

Step 1: Identification of Key Variables

Define the key parameters and scope of the research.

Step 2: Market Analysis and Construction

Collect and analyze market data using primary and secondary sources.

Step 3: Hypothesis Validation and Expert Consultation

Validate findings with industry experts and stakeholders.

Step 4: Research Synthesis and Final Output

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased Government Investment in National Security

Advancements in Directed Energy Weapons

Rising Geopolitical Tensions

Growing Military Modernization Programs

Technological Convergence in Defense Systems

- Market Challenges

High Capital Expenditure in Defense Projects

Technological Integration and Interoperability Issues

Regulatory and Compliance Barriers

Cybersecurity Threats to E-Bomb Systems

Political and Social Resistance to Military Expansion - Market Opportunities

Partnerships with Private Tech Firms for E-Bomb Development

Emerging Demand for Cyber-Resilient E-Bomb Systems

Technological Advancements in EMP and DEWs - Trends

Increased Use of EMP Technology in Defense

Integration of AI and Machine Learning in E-Bomb Systems

Surge in Cybersecurity Investments for Defense Technologies

Growing Adoption of Directed Energy Weapons

Military Focus on Non-lethal Countermeasures - Government Regulations

Data Protection and Privacy Regulations

Export Control and Compliance Policies

Government Funding and Grants for Defense Technologies

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Electromagnetic Pulse (EMP) Devices

Directed Energy Weapons (DEWs)

High-Power Microwave (HPM) Devices

Pulse Energy Generators

Jamming Devices - By Platform Type (In Value%)

Land Platforms

Airborne Platforms

Naval Platforms

Space Platforms

Integrated Platforms - By Fitment Type (In Value%)

On-premise Solutions

Cloud-based Solutions

Hybrid Solutions

Modular Solutions

Integrated Solutions - By EndUser Segment (In Value%)

Military Forces

Defense Contractors

Government Agencies

Security Services

Private Sector / Technology Firms - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors

- Market Share Analysis

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, End-user Segment, Fitment Type)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Lockheed Martin

Thales Group

BAE Systems

General Dynamics

Northrop Grumman

Raytheon Technologies

L3 Technologies

Leonardo

Harris Corporation

Saab Group

Rheinmetall AG

Elbit Systems

Hewlett Packard Enterprise

Boeing

Sikorsky Aircraft

- Military Forces’ Increasing Demand for Advanced Weapons

- Government Agencies’ Role in Regulating and Procuring Defense Systems

- Defense Contractors’ Shift Towards Innovation and Integration

- Private Sector’s Growing Interest in Cybersecurity Solutions

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035