Market Overview

As of 2024, the India ECG machines market is valued at USD 197.0 million, with a growing CAGR of 8.8% from 2024 to 2030, driven by the rising prevalence of cardiovascular diseases and technological advancements in medical devices. The increase in lifestyle-related health issues has led to heightened demand for preventative and diagnostic tools, including ECG machines, resulting in a robust market trajectory. Furthermore, innovative technologies like portable ECG devices and telemedicine integrations are enhancing accessibility and efficiency in cardiac care.

Dominant cities in this market include metropolitan hubs like Delhi, Mumbai, and Bengaluru, attributed to their comprehensive healthcare infrastructure and the presence of specialized medical institutions. These cities are also focal points for technological advancements and healthcare investments, leading to a concentrated demand for ECG machines. The local government initiatives aimed at improving healthcare service delivery in urban regions contribute significantly to their dominance in the ECG device market.

Market Segmentation

By Product Type

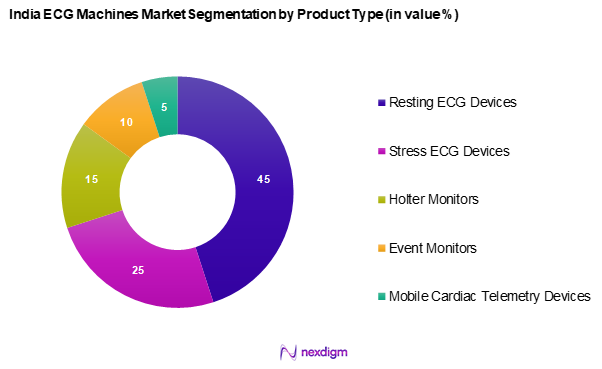

India ECG machines market is segmented into resting ECG devices, stress ECG devices, Holter monitors, event monitors, and mobile cardiac telemetry devices. Currently, resting ECG devices dominate the market share as they are essential for routine cardiovascular assessments and are widely used in hospitals and clinics for early detection of heart conditions. Their established reliability and broader applications in various healthcare settings contribute to their market leadership, reinforced by a growing aging population and increased emphasis on preventive healthcare.

By End User

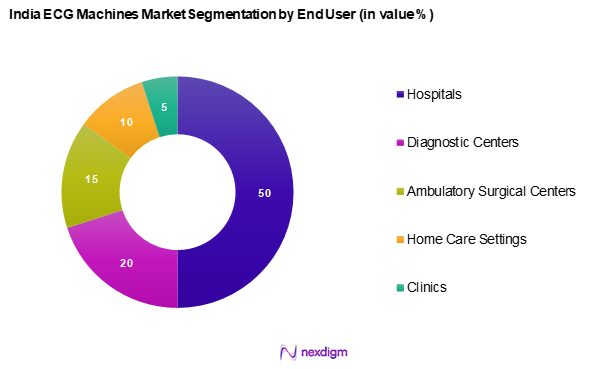

India ECG machines market is segmented into hospitals, diagnostic centers, ambulatory surgical centers, home care settings, and clinics. Hospitals represent a significant share of the market owing to their comprehensive cardiac care facilities and the continuous need for ECG monitoring in patient management. This dominance is driven by the increasing hospitalization rates and the need for constant monitoring of cardiac patients, enhanced by the growth of hospital infrastructures across urban areas.

Competitive Landscape

The India ECG machines market is dominated by key players, including global and local manufacturers. Major players include GE Healthcare, Philips, Siemens Healthineers, Abbott, and Nihon Kohden. These organizations leverage their technological expertise and established distribution channels to maintain competitive advantages. The consolidation among these leading firms suggests a significant influence over market trends and innovations.

| Company | Establishment Year | Headquarters | Revenue

(USD Mn) |

Market Share | Business Strategies | Weakness |

| GE Healthcare | 1892 | Chicago, USA | – | – | – | – |

| Koninklijke Philips N.V. | 1891 | Amsterdam, Netherlands | – | – | – | – |

| Siemens Healthineers AG | 1966 | Erlangen, Germany | – | – | – | – |

| Abbott | 1888 | Illinois, USA | – | – | – | – |

| Nihon Kohden Corporation | 1951 | Tokyo, Japan | – | – | – | – |

India ECG Machines Market Analysis

Growth Drivers

Increasing Cardiovascular Diseases

As per the World Health Organization (WHO), cardiovascular diseases (CVDs) accounted for approximately 17.9 million deaths globally in 2019, with India witnessing a significant rise in CVD instances, leading to increased demand for ECG machines. The rate of heart diseases in urban areas has escalated due to factors like lifestyle changes and pollution, with a report indicating a 30% increase in cardiovascular disease cases among young adults aged 30-45 from 2022 to 2024. This surge underscores the growing market for ECG machines aimed at early detection and monitoring.

Technological Advancements

The India ECG machines market is witnessing significant growth, driven by continuous advancements in medical technology. The introduction of portable and wireless ECG solutions is revolutionizing cardiac care by enabling real-time data analysis and remote patient monitoring. As per NASSCOM, over 30% of healthcare start-ups in India are actively integrating artificial intelligence (AI) and machine learning (ML) into medical devices, including ECG machines. This innovation enhances diagnostic accuracy and efficiency, positioning India as a key player in healthcare technology. These technological advancements are improving patient outcomes and accelerating the adoption of advanced ECG solutions, thereby fuelling market expansion.

Market Challenges

High Cost of Equipment

The high cost of medical equipment is a significant barrier to the growth of the ECG machine market in India. According to a report by India’s Ministry of Health and Family Welfare, the average cost of ECG machines ranges from INR 50,000 (USD 582.5) to INR 2,00,000 (USD 2,330.3) placing a financial burden on smaller healthcare facilities and impacting accessibility. In 2022, nearly 60% of rural hospitals cited budget constraints as a major reason for not having adequate diagnostic tools. This challenge is compounded by fluctuating exchange rates for imported medical equipment, adversely affecting affordability and availability.

Regulatory Complications

India’s medical device regulatory framework poses challenges that hinder the prompt introduction of ECG machines in the market. The Central Drugs Standard Control Organization (CDSCO) has tightened regulations for medical equipment, leading to longer approval timelines; a 2023 report indicated an average approval process time of 12 to 18 months for new ECG devices. Furthermore, compliance with foreign standards, such as ISO and CE markings, is adding complexity to the market entry process for manufacturers, making it crucial for companies to navigate these regulatory waters effectively to promote their products.

Opportunities

Growing Home Healthcare Sector

The home healthcare sector in India is poised for significant growth driven by increasing chronic disease prevalence and a preference for personalized care. As of 2023, the home healthcare market is estimated to be valued at INR 80,000 crore, with a growth trajectory suggesting a rise in demand for devices like ECG machines. Patients are now prefer receiving care at home, highlighting the potential for portable ECG devices capable of delivering timely diagnostics outside traditional healthcare settings. This trend aligns with the evolving healthcare landscape, presenting lucrative opportunities for market players to innovate and expand their offerings.

Heightened Awareness of Preventive Care

The emphasis on preventive healthcare has significantly grown, especially in the post-pandemic era. More individuals are prioritizing regular health check-ups to detect potential health concerns at an early stage, including cardiovascular conditions. This shift in mind-set is fuelling the demand for medical devices like ECG machines, as people seek reliable tools for early diagnosis and continuous health monitoring. The expanding awareness of proactive health management presents a promising opportunity for ECG machine manufacturers to cater to the evolving needs of the healthcare sector.

Future Outlook

Over the next five years, the India ECG machines market is expected to display significant growth driven by continuous advancements in medical technology, increasing awareness of cardiovascular health, and a growing preference for early diagnosis and remote patient monitoring. Furthermore, the expansion of healthcare infrastructure, particularly in rural and underserved areas, is anticipated to boost the adoption of ECG devices in India.

Major Players

- GE Healthcare

- Koninklijke Philips N.V.

- Siemens Healthineers AG

- Abbott

- Nihon Kohden Corporation

- Hill-Rom Holdings, Inc.

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Analogic Corporation

- Cardioline

- Mortara Instrument

- Schiller AG

- WA Warehouse

- Innomed, Inc.

- Trividia Health, Inc.

- Bosch Healthcare Solutions GmbH

Key Target Audience

- Healthcare Providers

- Medical Equipment Distributors

- Equipment Manufacturers

- Government and Regulatory Bodies

- Hospital Administrators

- Research Institutions

- Investments and Venture Capitalist Firms

- Health Insurance Companies

Research Methodology

Step 1: Identification of Key Variables

The initial phase of this research involves the identification and mapping of key stakeholders in the India ECG machines market. By conducting extensive desk research and leveraging proprietary and secondary databases, we gather comprehensive industry-level information. This step is essential to define the critical variables impacting market dynamics, focusing on factors such as consumer behavior, technological advancements, and regulatory frameworks.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical and current data related to the India ECG machines market. This involves evaluating market penetration rates, assessing the quantity of devices utilized in healthcare facilities, and estimating revenue generation within the segment. Additionally, we review service quality indicators to ensure the accuracy and reliability of our revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Developed hypotheses about market trends will be validated through direct consultations with healthcare and medical equipment experts. This is facilitated through Computer-Assisted Telephone Interviews (CATIs) with professionals across various organizations. Their insights into industry practices and financial performance will significantly enrich our understanding and refine our data.

Step 4: Research Synthesis and Final Output

The final phase includes direct engagements with key ECG manufacturers for comprehensive insights into product offerings, sales performance, consumer preferences, and evolving market dynamics. This interaction will enhance the verification process and complement the statistics obtained from both bottom-up and top-down approaches, allowing for a validated and in-depth analysis of the India ECG machines market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Dynamics

- Timeline of Major Players

- Business Cycle Analysis

- Supply Chain & Value Chain Analysis

- Growth Drivers

Increasing Cardiovascular Diseases

Technological Advancements - Market Challenges

High Cost of Equipment

Regulatory Complications - Opportunities

Growing Home Healthcare Sector

Heightened Awareness of Preventive Care - Trends

Integration with Telemedicine - Government Regulation

Medical Device Regulations - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Resting ECG Devices

Stress ECG Devices

Holter Monitors

Event Monitors

Mobile Cardiac Telemetry Devices - By Lead Type (In Value %)

Single Lead ECG

Lead ECG

3 Lead ECG

6 Lead ECG

12-Lead ECG - By Technology, (In Value %)

Digital ECG Systems

Analog ECG Systems - By Distribution Channel, (In Value %)

Direct Sales

Third-Party Distributors

Online Platforms - By End User, (In Value %)

Hospitals

Diagnostic Centers

Ambulatory Surgical Centers

Home Care Settings

Clinics - By Region, (In Value %)

North India

South India

East India

West India

Central India

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Product Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenues, Distribution Channels, Customer Base, Unique Value Offerings, and Others)

- SWOT Analysis of Major Players

- Pricing Analysis of Major Players

- Detailed Profiles of Major Companies

GE Healthcare

Koninklijke Philips N.V.

Siemens Healthineers AG

Abbott

Bosch Healthcare Solutions GmbH

NIHON KOHDEN CORPORATION

Hill-Rom Holdings, Inc.

Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

Analogic Corporation

Cardioline

Mortara Instrument

Schiller AG

WA Warehouse

Innomed, Inc.

Trividia Health, Inc.

- Market Demand and Utilization

- Purchasing Trends and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030