Market Overview

As of 2024, the India electric lawn mower market is valued at USD 413.1 million, with a growing CAGR of 5.3% from 2024 to 2030 backed by a rising consumer inclination towards environmentally friendly gardening solutions and significant investments in green technology. These elements have been pivotal in driving market growth, with a noticeable shift towards electric options since they offer convenience and lower maintenance costs compared to traditional gas-powered mowers. Market conditions are favourable as more consumers and landscape professionals seek sustainable alternatives that reduce carbon emissions and operational costs.

Major urban centers such as Delhi, Mumbai, and Bangalore dominate the electric lawn mower market, primarily due to their high population density and growing disposable incomes. These cities are witnessing an increase in residential lawns and commercial green spaces, creating demand for efficient lawn care equipment. The rising trend in home gardening and landscaping is further augmented by increased environmental awareness, making these locations crucial hubs for electric lawn mower sales.

Market Segmentation

By Product Type

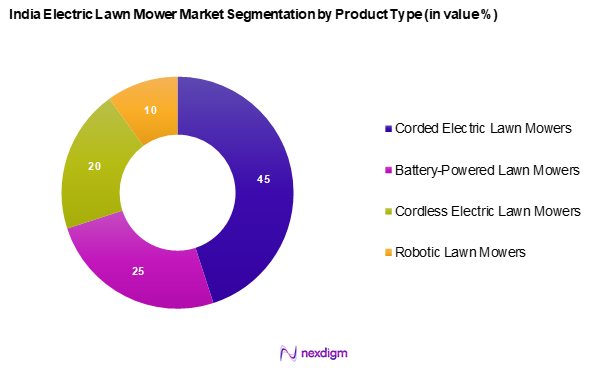

The India electric lawn mower market is segmented into corded electric lawn mowers, battery-powered lawn mowers, cordless electric lawn mowers, and robotic lawn mowers. In this segmentation, corded electric lawn mowers have a dominant market share due to their affordability and consistent performance. They are preferred by consumers looking for efficient and low-maintenance options for home lawns and gardens. Furthermore, the absence of battery limitations makes them particularly favourable for larger areas, driving their popularity in urban homes, commercial spaces, and parks.

By End-User

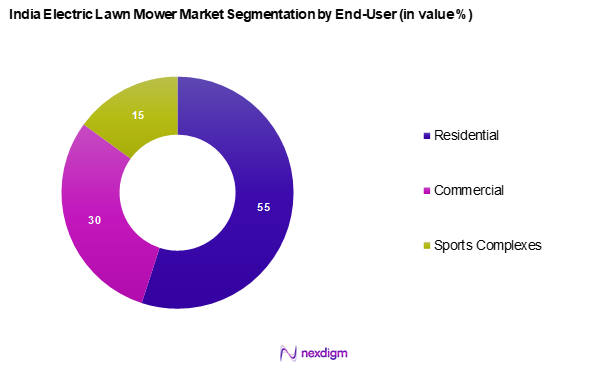

The India electric lawn mower market is segmented into end user, comprising residential, commercial, and sports complexes. The residential segment currently dominates the market due to the increasing number of homeowners opting for electric lawn mowers to maintain their gardens efficiently. A rising trend in gardening and landscaping among urban dwellers is augmenting this segment. Moreover, the convenience and environmental benefits of electric mowers appeal to eco-conscious homeowners, further solidifying their place as the leading end user in this market.

Competitive Landscape

The India electric lawn mower market is dominated by several key players, including global brands and local manufacturers. Companies such as Husqvarna, Bosch, and Greenworks are notable examples, leveraging their established market presence and innovative product lines to maintain competitive advantage. This consolidation highlights the influence of these key companies, as they continue to shape market dynamics through product innovation and effective marketing strategies.

| Company | Establishment Year | Headquarters | Product Range | Market Share | Revenue

(USD Mn) |

Product

Revenue |

| Husqvarna | 1689 | Sweden | – | – | – | – |

| Bosch | 1886 | Germany | – | – | – | – |

| Greenworks | 2007 | USA | – | – | – | – |

| Black & Decker | 1910 | USA | – | – | – | – |

| Ego Power+ | 2012 | USA | – | – | – | – |

India Electric Lawn Mower Market Analysis

Growth Drivers

Increasing Urbanization

Urbanization in India is accelerating, with the urban population projected to reach 600 million by 2031, constituting approximately 40% of the total population. This urban growth is driving up demand for residential gardens and green spaces within urban environments. Additionally, urban areas often have limited space; therefore, electric lawn mowers are becoming a preferred choice for maintaining smaller lawns due to their efficiency and ease of use. Urban centers are increasingly focused on green infrastructure, further enhancing the market potential for electric lawn mowers.

Rising Environmental Awareness

As awareness of environmental issues rises, individuals and communities are prioritizing sustainable gardening practices. India’s commitment to reducing carbon emissions, as outlined in its Nationally Determined Contributions (NDCs), aims to increase the share of non-fossil fuel sources in power generation to 500 GW by 2030. Electric lawn mowers, which produce fewer emissions compared to traditional gas-powered models, are gaining traction among environmentally conscious consumers. This prevailing trend toward sustainability is further evidenced by an increase in eco-friendly products, with organic fruit and vegetable cultivation reported to have risen by 12% last year.

Market Challenges

High Initial Investment

The initial cost of electric lawn mowers is often higher than that of traditional models, which can discourage potential buyers. A typical electric mower can range from USD 300 to USD 800, while gas-powered alternatives can start as low as USD 150. This price discrepancy is significant in a price-sensitive market like India, where buyers often prioritize affordability. Additionally, many consumers are not fully informed about the long-term savings associated with electric mowers, such as lower maintenance costs and the absence of fuel expenses, leading to slower adoption rates. The Indian consumer finance market saw a loan uptake of over USD 5 billion in the gardening equipment sector last year, indicating a market willing to invest, but often limited by upfront costs.

Competition from Gas-powered Equipment

Though the shift towards electric lawn mowers is encouraged, resistance persists due to the entrenched presence of gas-powered equipment in the market. Gas mowers hold a significant market share for practical reasons; their ability to deliver powerful performance for larger yards makes them appealing to many consumers. With an estimated 15 million gas lawn mowers sold annually in India, the gas-powered segment remains robust. The reluctance to switch can be attributed to existing consumer relationships with gas mowers and perceptions regarding performance reliability and availability of service support.

Opportunities

Growing Gardening Trends

The trend towards gardening and outdoor landscaping is becoming increasingly popular, particularly among urban residents and millennials. According to a report, about 50% of urban households in India have adopted some form of gardening due to rising disposable incomes and a growing interest in home aesthetics. The number of urban gardens is expected to grow significantly as people seek to enhance their living spaces. This growing inclination towards home gardening serves as an excellent opportunity for electric lawn mower companies to capture and expand their market share. The gardening market value currently stands at USD 20 billion and is likely to grow further.

Expansion of E-commerce Platforms

The expansion of e-commerce platforms across India presents a unique opportunity for electric lawn mower sales. With approximately 500 million internet users in the country, online shopping is becoming a preferred purchasing avenue for many consumers, especially during the pandemic. E-commerce platforms can make electric lawn mowers more accessible by offering detailed product comparisons, user reviews, and competitive pricing. Recent reports highlight that e-commerce sales in the gardening segment have seen a sharp 25% increase, signalling ongoing growth potential for the electric lawn mower market as retail continues to shift online.

Future Outlook

Over the next six years, the India Electric Lawn Mower market is expected to demonstrate remarkable growth, driven by continuous advancements in battery technology, increased consumer awareness regarding sustainable gardening practices, and a favourable regulatory environment promoting the use of electric equipment. This growth trajectory indicates a shift in consumer preferences towards greener and more efficient gardening solutions, solidifying the market’s potential for expansion.

Major Players

- Honda Power Equipment

- MTD Products Ltd.

- The Toro Company

- Deere & Company

- Stanley Black & Decker

- Robert Bosch GmbH

- Husqvarna Group

- Stiga S.p.A.

- Emak S.p.A.

- Makita Corporation

- Ariens Company

- AL-KO Kober Group

- Greenworks Tools

- Einhell Germany AG

- Positec Tool Corporation

Key Target Audience

- Homeowners interested in landscaping

- Garden maintenance professionals

- Landscaping companies

- Investments and venture capitalist firms Government and regulatory bodies (Ministry of Environment, Forest and Climate Change)

- Environmental NGOs

- Retailers and distributors of gardening equipment

- Landscape architects and designers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing a comprehensive ecosystem map that encompasses all major stakeholders within the India Electric Lawn Mower market. This step is backed by extensive desk research, using a combination of secondary and proprietary databases to gather pertinent industry-level information. The objective here is to identify and define the critical variables that influence market dynamics, such as consumer behaviour, pricing strategies, and product innovation.

Step 2: Market Analysis and Construction

In this phase, historical data pertaining to the India electric lawn mower market is compiled and analysed. This includes assessing market penetration, the ratio of electric to traditional mowers, and the resultant revenue generation from both segments. An evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates, thereby framing a solid understanding of current market conditions.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and validated through direct consultations with industry experts representing a diverse array of companies involved in the electric lawn mower market. These consultations provide invaluable operational and financial insights from industry practitioners, which are instrumental in refining and corroborating the market data obtained in previous phases.

Step 4: Research Synthesis and Final Output

The final phase encompasses direct engagement with multiple electric lawn mower manufacturers to gather detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction is vital for verifying and complementing the statistics derived from the bottom-up approach, thus ensuring a comprehensive, accurate, and validated analysis of the India electric lawn mower market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Urbanization

Rising Environmental Awareness - Market Challenges

High Initial Investment

Competition from Gas-powered Equipment - Opportunities

Growing Gardening Trends

Expansion of E-commerce Platforms - Trends

Shift towards Automated and Smart Mowers - Government Regulation

Environmental Policies

Subsidies for Electric Appliances - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Corded Electric Lawn Mowers

– Push-Type Corded Mowers

– Self-Propelled Corded Mowers

– Adjustable Height Corded Mowers

Battery-Powered Lawn Mowers

– Lithium-Ion Battery Mowers

– Lead-Acid Battery Mowers

– Removable Battery Pack Models

Cordless Electric Lawn Mowers

– Push-Type Cordless Mowers

– Self-Propelled Cordless Mowers

– Foldable and Lightweight Models

Robotic Lawn Mowers

– GPS-Enabled Models

– App-Controlled Robotic Mowers

– Boundary Wire & Sensor-Based Mowers - By Power Rating (In Value %)

Below 1000W

1000W – 1500W

Above 1500W - By End User (In Value %)

Residential

– Independent Houses and Villas

– Gated Communities & Apartment Complexes

Commercial

– Landscaping Service Providers

– Corporate Office Parks & Campuses

Sports Complexes

– Golf Courses

– Cricket Grounds

– Athletic Fields & Parks - By Region (In Value %)

North India

South India

East India

West India - By Distribution Channel (In Value %)

Online Sales

– Brand E-commerce Stores

– Online Marketplaces

– Specialty Tools & Hardware Portals

Offline Retail

– Hardware and Garden Equipment Stores

– Power Tool Dealerships

– Multi-Brand Home Improvement Stores

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Product Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Distribution Channels, Unique Product Features, Service Offerings)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Honda Power Equipment

MTD Products Ltd.

The Toro Company

Deere & Company

Stanley Black & Decker

Robert Bosch GmbH

Husqvarna Group

Stiga S.p.A.

Emak S.p.A.

Makita Corporation

Ariens Company

AL-KO Kober Group

Greenworks Tools

Einhell Germany AG

Positec Tool Corporation

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030