Market Overview

The India electric propulsion satellites market is growing significantly, driven by advancements in satellite propulsion technologies and increasing demand for low-cost, efficient solutions in space applications. Based on a recent historical assessment, the market size for this segment stands at approximately USD ~ billion, supported by government initiatives and private sector investments in space exploration and communication systems. The demand for electric propulsion systems is driven by the need for longer operational lifespans, fuel efficiency, and reduced costs in satellite missions, especially in the commercial and defense sectors.

India is emerging as a key player in the electric propulsion satellites market, particularly due to the rapid expansion of its space program and strong governmental support. Based on a recent historical assessment, the country benefits from its strategic location, robust space infrastructure, and investments in technology development. Cities such as Bengaluru and Hyderabad have become key hubs for space technology innovations, with a concentration of research institutions, satellite manufacturing facilities, and space agencies like ISRO, which is integral to the growth of this market.

Market Segmentation

By Product Type

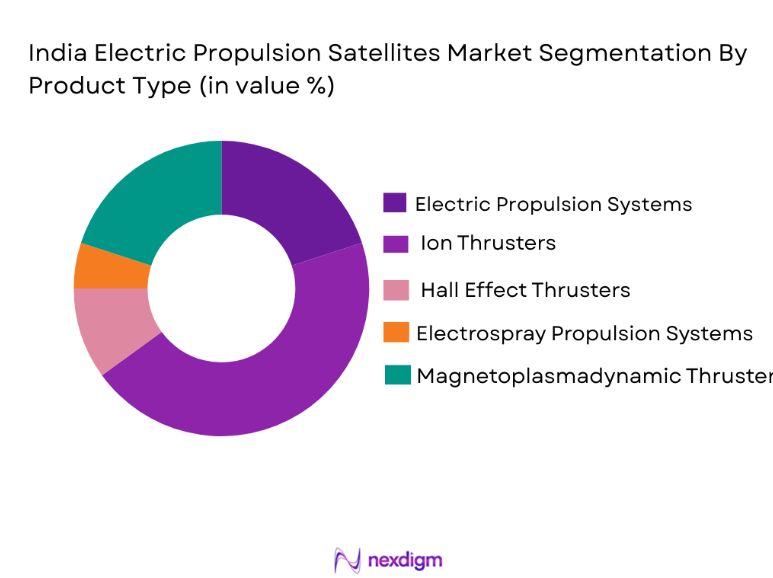

India electric propulsion satellites market is segmented by product type into electric propulsion systems, ion thrusters, Hall effect thrusters, electrospray propulsion systems, and magnetoplasmadynamic thrusters. Recently, ion thrusters had a dominant market share due to their efficiency in thrust generation for long-duration missions, ease of integration into satellites, and their growing adoption in both governmental and commercial space programs.

By Platform Type

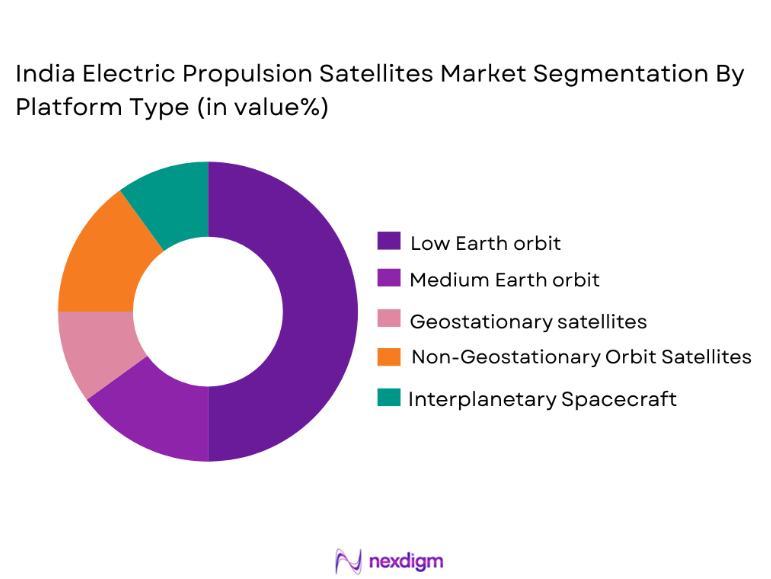

India electric propulsion satellites market is segmented by platform type into Low Earth Orbit (LEO) Satellites, Medium Earth Orbit (MEO) Satellites, Geostationary Orbit (GEO) Satellites, Non-Geostationary Orbit (NGSO) Satellites, and Interplanetary Spacecraft. Recently, LEO Satellites have the dominant market share due to their wide adoption in global communications, low latency, and the growth of satellite constellations for global internet coverage.

Competitive Landscape

The India electric propulsion satellites market is characterized by significant consolidation, with major players dominating the sector. A few leading companies influence the market due to their technological expertise, advanced propulsion systems, and strong government ties. The competition is driven by research and development efforts, partnerships between private firms and government agencies, and a constant focus on cost reduction and efficiency.

|

Company Name |

Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | R&D Investment (%) |

| Airbus | 1967 | Toulouse, France | ~ | ~ | ~ | ~ | ~ |

| SpaceX | 2002 | Hawthorne, USA | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | Falls Church, USA | ~ | ~ | ~ | ~ | ~ |

| ISRO | 1969 | Bengaluru, India | ~ | ~ | ~ | ~ | ~ |

India Electric Propulsion Satellites Market Analysis

Growth Drivers

Technological Advancements in Propulsion Systems

Recent advancements in electric propulsion systems, particularly in ion and Hall-effect thrusters, have propelled the India electric propulsion satellites market forward. These technologies offer higher fuel efficiency and longer operational life, significantly reducing operational costs for satellite missions. The growing demand for satellites with enhanced propulsion systems to carry out complex space exploration missions, including deep-space exploration and communication, further drives this trend. The continued development of high-performance materials and components, alongside improved power management systems, is enhancing the capabilities of electric propulsion systems. As these technologies continue to evolve, they are increasingly being integrated into both governmental and private sector space programs, ensuring sustained demand for satellite propulsion solutions. Governments and private companies are investing in expanding their space missions, which include deploying advanced electric propulsion systems for satellite constellations aimed at providing global internet access, weather monitoring, and telecommunications. This is creating a growing market for advanced propulsion systems, which are projected to witness further adoption across both geostationary and low-Earth orbit satellites.

Government Initiatives in Space Programs

The Indian government’s continued investment in space programs, particularly through ISRO, is a significant driver of the electric propulsion satellites market. The space agency’s ambitious goals, including the launch of satellites for communication, earth observation, and deep space exploration, are heavily reliant on advanced propulsion systems. The government’s initiatives, such as the establishment of space parks, incubators, and funding for research in electric propulsion technologies, are creating a favorable ecosystem for market growth. These investments are also encouraging collaborations between the public and private sectors, fostering innovation and accelerating the adoption of electric propulsion technologies in the satellite industry. Furthermore, government-driven missions, such as the Gagan Yaan crewed space mission, demand high-efficiency propulsion systems that extend satellite operational lifespans and enhance mission success rates. The government’s backing for the development and testing of new propulsion technologies in both defense and commercial space sectors contributes to market expansion.

Market Challenges

High Capital Expenditure in Space Programs

The capital required for developing and deploying electric propulsion systems in satellites is one of the major challenges facing the India electric propulsion satellites market. Electric propulsion systems, although cost-effective in the long term, involve significant upfront investments in research, manufacturing, and testing. This high capital expenditure is often a barrier for smaller companies and startups looking to enter the market, as they may lack the financial resources required for such investments. Governments and space agencies like ISRO may have access to funding, but even they face challenges in justifying the large expenditures involved in advanced satellite propulsion projects, particularly when budgets are tight and priorities shift. The cost of launching satellites with electric propulsion systems is also elevated by the necessity to invest in specialized infrastructure and launch vehicles. These costs could potentially deter new entrants and slow down the widespread adoption of electric propulsion in the satellite market, particularly among smaller entities that are hesitant to commit large sums to unproven technologies.

Technological Integration and Compatibility Issues

Integrating electric propulsion systems with existing satellite architectures poses a significant challenge. Many satellites currently in operation were not designed to accommodate electric propulsion systems, making the retrofitting process complex and expensive. The challenges of ensuring compatibility between propulsion systems and the satellite’s power, control, and communication systems are significant. The integration of these systems often requires redesigning key components to meet specific mission requirements, which can lead to delays and additional costs. In addition, electric propulsion systems are still a relatively new technology, which means there may be unforeseen technical issues that arise during integration. The lack of standardization in satellite propulsion systems also creates challenges for the industry, as manufacturers may have to deal with varying design specifications and requirements from different satellite operators. The complexity involved in integrating electric propulsion systems with satellites can increase time-to-market and reduce the cost-effectiveness of these systems, which can deter potential buyers and slow market growth.

Opportunities

Expansion of Low-Cost Satellite Constellations

One of the most significant opportunities in the India electric propulsion satellites market is the rapid expansion of low-cost satellite constellations. With the growing demand for global internet coverage, especially in underserved regions, satellite constellations are becoming an essential component of communication infrastructure. Electric propulsion systems are increasingly being utilized in these constellations due to their efficiency and lower cost of maintenance compared to traditional chemical propulsion systems. As private companies, such as SpaceX and OneWeb, continue to invest heavily in satellite constellation projects, there is an increasing need for propulsion systems that can provide sustained thrust over long periods without depleting resources. Electric propulsion systems are ideal for these applications because they allow satellites to maintain their orbits over longer periods, making them cost-effective in large-scale deployments. This trend will likely continue to gain momentum as both private and public sector entities look to expand their satellite networks to support emerging technologies such as 5G, the internet of things (IoT), and next-generation data networks. The shift towards constellations offers significant growth potential for electric propulsion technologies, as they play a critical role in the deployment and maintenance of these large, interconnected networks of satellites.

Development of Small and Medium Satellites

Another opportunity lies in the increasing demand for small and medium satellites (SMALLSATS) across various industries, including telecommunications, remote sensing, and scientific research. Electric propulsion systems are particularly well-suited for small satellites due to their compact size, high efficiency, and ability to operate over extended periods. The rise in small satellite deployments presents a substantial opportunity for the adoption of electric propulsion, as these systems are well-aligned with the need for efficient and cost-effective propulsion solutions. The demand for SMALLSATS is expected to increase significantly in the coming years, driven by their versatility in various applications, from disaster monitoring to earth observation and communication services. The adoption of electric propulsion systems will enhance the performance and cost-effectiveness of SMALLSATS, helping to support the growing market for these compact, low-cost satellites. This segment is expected to experience strong growth as the cost of manufacturing small satellites continues to decrease, and the need for efficient propulsion systems becomes more pronounced in the commercial space sector.

Future Outlook

The future outlook of the India electric propulsion satellites market is positive, with expectations of steady growth driven by technological advancements and government support for space exploration. The market is poised to benefit from increased demand for satellite constellations, space exploration missions, and commercial applications. Technological innovations, such as the development of more efficient and cost-effective propulsion systems, are expected to enhance market dynamics. Additionally, strong governmental support and private-sector investment are likely to accelerate the adoption of electric propulsion in space programs. Regulatory policies encouraging the use of sustainable technologies and efficient satellite propulsion will further bolster market expansion, making electric propulsion systems a critical component of India’s space agenda in the coming years.

Major Players

- Airbus

- SpaceX

- Lockheed Martin

- Northrop Grumman

- ISRO

- Boeing

- Thales Group

- Rocket Lab

- Maxar Technologies

- Honeywell Aerospace

- Ball Aerospace

- Skyroot Aerospace

- Blue Origin

- Sierra Nevada Corporation

- Space Systems Loral

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Satellite manufacturers

- Aerospace technology developers

- Space exploration agencies

- Telecommunications providers

- Military and defense contractors

- Satellite service operators

Research Methodology

Step 1: Identification of Key Variables

This step involves recognizing critical variables influencing the India electric propulsion satellites market, such as technological advancements, government policies, and market demand.

Step 2: Market Analysis and Construction

In this phase, a comprehensive analysis is conducted to construct the market’s structure, evaluating existing players, technologies, and growth trends.

Step 3: Hypothesis Validation and Expert Consultation

The hypotheses developed during the market analysis are validated by consulting with experts and stakeholders to ensure accurate conclusions.

Step 4: Research Synthesis and Final Output

The final output synthesizes all collected data into a coherent report, providing an in-depth understanding of the market dynamics, trends, and forecasts.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Demand for Communication Satellites

Growing Space Exploration Initiatives

Advancements in Electric Propulsion Technology

Cost-Effective Solutions for Satellite Launch

Regulatory Support for Sustainable Space Technologies - Market Challenges

High Initial Capital Investment for Electric Propulsion Systems

Limited Availability of Advanced Materials for Propulsion

Complexity in Integrating Electric Propulsion with Satellites

Challenges in Propulsion System Lifespan and Efficiency

Environmental Impact and Sustainability Regulations - Market Opportunities

Partnerships Between Government and Private Sector

Expansion of Satellite Constellations for Global Connectivity

Development of Electric Propulsion Systems for Deep Space Missions - Trends

Rising Adoption of Green and Sustainable Space Technologies

Miniaturization of Electric Propulsion Systems

Integration of AI in Propulsion Control Systems

Increased Investment in Space-Based Internet Infrastructure

Shift Toward Non-Geostationary Satellite Constellations - Government Regulations & Defense Policy

Regulatory Framework for Sustainable Space Technologies

International Cooperation in Space Missions and Standards

Funding for Research & Development in Electric Propulsion - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Electric Propulsion Subsystems

Ion Thrusters

Hall Effect Thrusters

Electrospray Propulsion Systems

Magnetoplasmadynamic Thrusters

Gridded Ion Engines - By Platform Type (In Value%)

Low Earth Orbit (LEO) Satellites

Medium Earth Orbit (MEO) Satellites

Geostationary Orbit (GEO) Satellites

Non-Geostationary Orbit (NGSO) Satellites

Interplanetary Spacecraft - By Fitment Type (In Value%)

Standalone Electric Propulsion Systems

Hybrid Electric Propulsion Systems

Integrated Electric Propulsion Systems

Modular Propulsion Systems

Multi-mode Propulsion Systems - By End User Segment (In Value%)

Satellite Manufacturers

Space Agencies

Private Space Companies

Telecommunications Providers

Government & Military Agencies - By Procurement Channel (In Value%)

Direct Procurement from Manufacturers

Government Tenders

Private Sector Procurement

OEM (Original Equipment Manufacturer) Partnerships

Third-party Distributors - By Material / Technology (in Value%)

Electric Propulsion Materials

Plasma Propulsion Technology

Thrust Vector Control Technology

Power Generation Systems

Propellant Management Systems

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, End User Segment, Fitment Type)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Airbus

SpaceX

Lockheed Martin

Northrop Grumman

Thales Group

Boeing

ISRO (Indian Space Research Organization)

Sierra Nevada Corporation

Rocket Lab

Maxar Technologies

Honeywell Aerospace

Ball Aerospace

SSL (Space Systems Loral)

Sky root Aerospace

Blue Origin

- Growing Demand from Space Agencies for Advanced Propulsion Systems

- Private Sector’s Focus on Low-Cost Satellite Launches

- Telecommunications Providers Investing in Satellite Constellations

- Military and Defense Applications in Advanced Propulsion Technology

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035