Market Overview

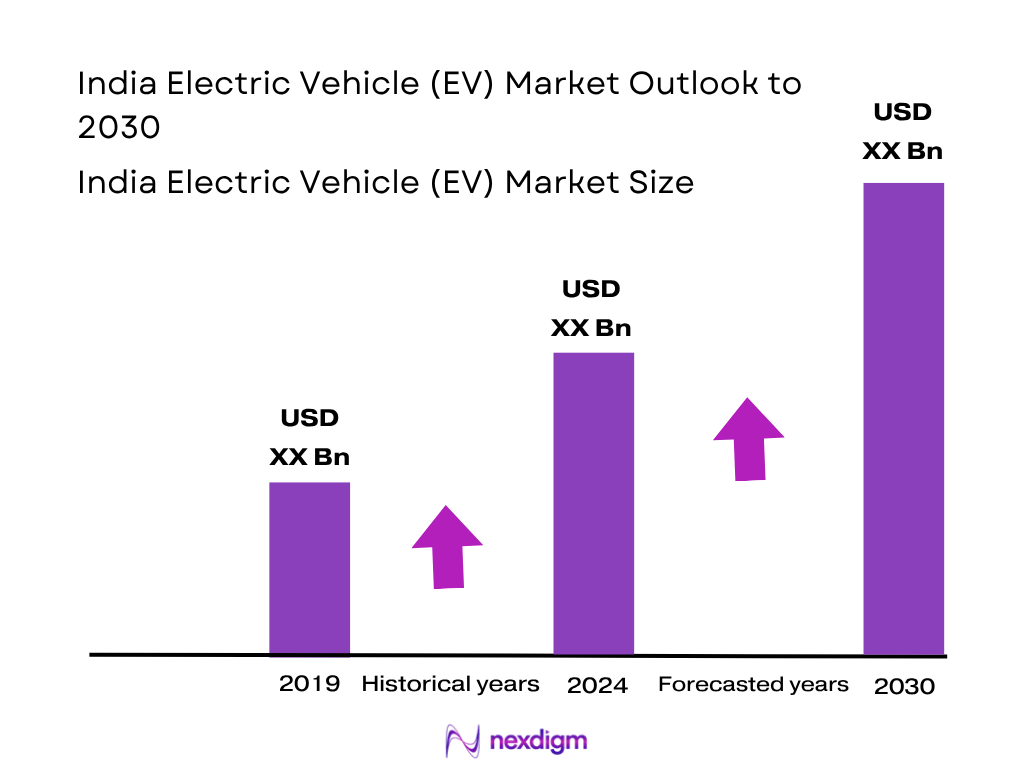

The India Electric Vehicle market is valued at USD 23.38 billion in 2024. This growth from USD 8.03 billion in 2023 underscores a robust uptrend. The surge is underpinned by aggressive government subsidies (FAME‑II, PLI), expanding charging infrastructure, rising fuel costs, and consumer inclination toward sustainable mobility solutions

Southern states such as Tamil Nadu and Karnataka are at the forefront of EV adoption, thanks to proactive manufacturing policies, PLI-backed infrastructure, and industrial ecosystems. Additionally, Uttar Pradesh dominates three‑wheeler EV demand and charging infrastructure rollout, driven by strategic state‑level incentives and aggressive capacity development.

Market Segmentation

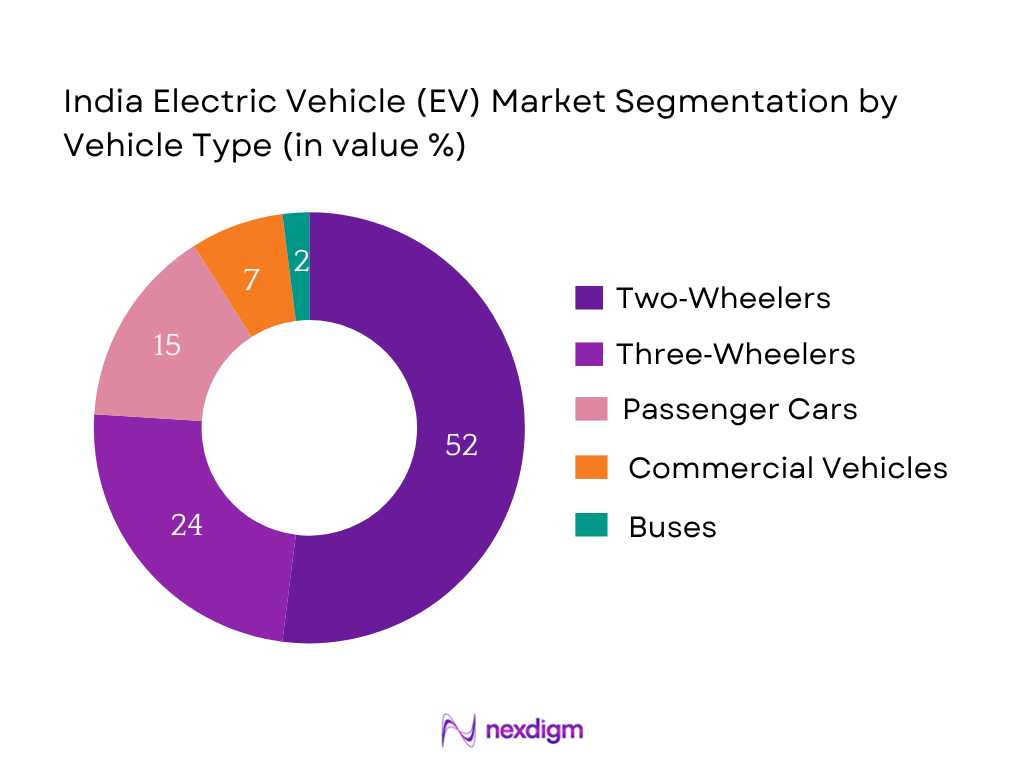

By Vehicle Type

India’s EV vehicle‑type segment is led by two‑wheelers — powered by their affordability, shorter range needs, and effective city‑wide penetration. Two‑wheelers have lower total cost of ownership, fit daily commute patterns, and benefit heavily from subsidies, making them the fastest-growing and largest-value contributor among vehicle segments.

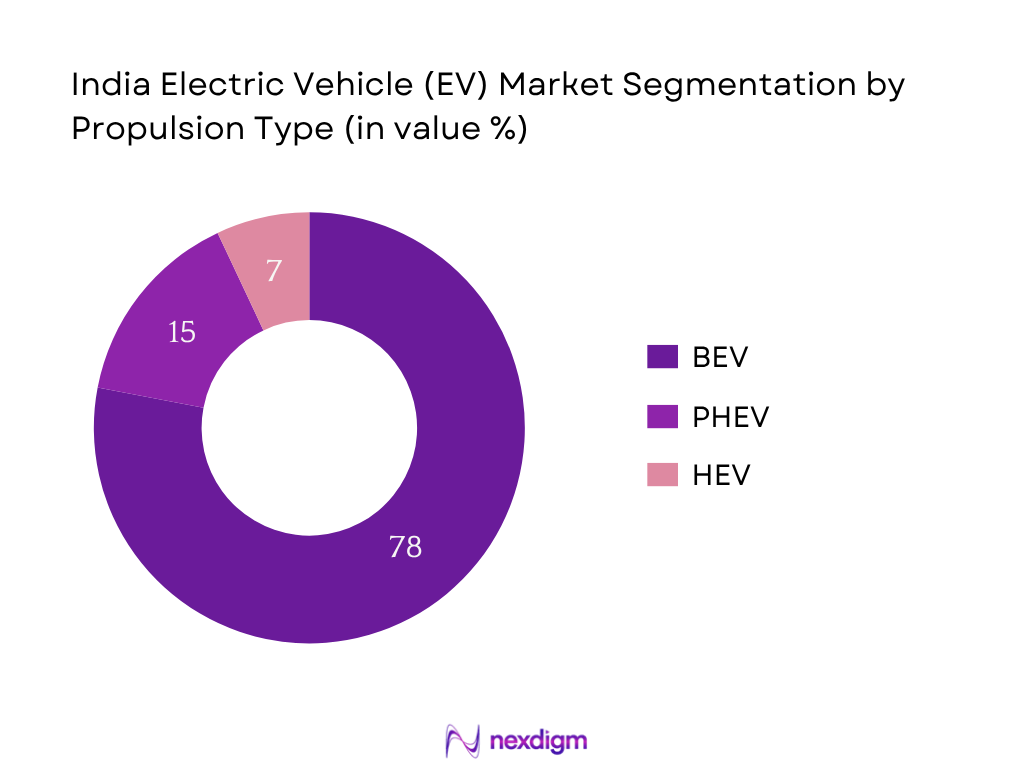

By Propulsion Type

BEVs command the propulsion type market, driven by strengthening charging networks, zero-emission policies, and the government’s push for pure-electric mandates. With falling battery prices and long-term operational savings, BEVs have gained significant consumer trust and policy support, overshadowing hybrids and plug‑ins in terms of revenue and volume.

Competitive Landscape

The India EV market is characterized by a few dominant players driving innovation and adoption. Their influence underlines the market’s competitive consolidation.

| Company | Year Established | Headquarters | Vehicle Portfolio Breadth | Local Manufacturing Capability | Battery Strategy | Charging Ecosystem Initiatives | Pricing Strategy | After‑Sales Network |

| Tata Motors | 1945 | Mumbai | – | – | – | – | – | – |

| Mahindra Electric | 1945 | Mumbai | – | – | – | – | – | – |

| Ather Energy | 2013 | Bengaluru | – | – | – | – | – | – |

| Ola Electric | 2017 | Bengaluru | – | – | – | – | – | – |

| JSW‑MG Motor India | 2019 (MG lineage) | Mumbai (Jamshedpur) | – | – | – | – | – | – |

India Electric Vehicle Market Analysis

Growth Drivers

FAME II and State‑Level Subsidies

India’s unified current GDP stood at USD 3.91 trillion in 2024, indicating robust economic capacity to channel subsidies toward electric vehicle incentives. For instance, Uttar Pradesh has tapped FAME II to enable over 400,000 EV registrations, especially e‑rickshaws, supported by capital influx of INR 30,000 crore and a targeted rollout of 300 charging stations across 16 municipalities. These subsidy programs are catalyzing adoption by easing cost barriers and enhancing access—especially where administrative backing and policy frameworks are strong. The alignment with India’s evolving fiscal health amplifies the efficacy of these incentives in accelerating EV adoption.

Rising Oil Prices and Import Dependency

India’s reliance on energy imports is clear—import values reached USD 101.75 billion from certain countries in 2024–25, significantly impacting trade deficits. Though global energy prices are set to fall by approximately 6 percent in 2025, the prior high levels elevated retail fuel costs, creating sustained consumer impetus toward EVs. With inflation (CPI) moderating to 5 percent in 2024 and unemployment low at 4.2 percent, consumers are financially primed to consider EVs as hedge against volatile fuel costs. Thus, macroeconomic stress from oil dependency continues to drive EV preference.

Market Challenges

High Upfront Cost vs ICE Vehicles

Though macroeconomic indicators (like 6.5 percent GDP growth) signal consumer capacity for EV adoption, the initial purchase cost of EVs remains a deterrent given higher vehicle loan interest environments. With India’s CPI inflation at 5 percent—indicative of moderate cost pressures—and unemployment stable at 4.2 percent, consumers may prioritize affordability. Without aggressive subsidy deployment or financing options, the upfront premium of EVs compared to ICE vehicles continues to delay widespread adoption, especially in price-sensitive demographics.

Range Anxiety and Charging Infrastructure Gaps

India’s EV-to-public-charger ratio stands at approximately 135 EVs per charger, exceeding the global ideal of 6–20 EVs per charger. Delhi’s dominance in EV charging consumption (over 40 percent) underscores regional disparities. Although investments are underway, pervasive range anxiety persists due to infrastructure gaps in non-metro and rural areas, diluting consumer confidence. Despite macroeconomic resilience, spatial mismatch in charging readiness restrains potential adoption across broader geographies.

Opportunities

EV Financing and Leasing Models

Revfin, an EV-focused lending platform, has disbursed INR 1,000 crore in loans to over 75,000 customers by 2024, including financing for 14,000 women in Bihar and Uttar Pradesh. Supported by macroeconomic stability—India’s GDP of USD 3.91 trillion, 6.5 percent growth, and 5 percent inflation —such models make EV ownership accessible to underserved segments. These inclusive financing frameworks, especially in tier‑2 and 3 markets, open broader market reach without requiring consumer cost burdens to be borne upfront.

Battery‑as‑a‑Service (BaaS) and Subscription Models

Innovative models like Revfin’s partnership with Sun Mobility to roll out battery swapping options demonstrate emerging infrastructure-led consumer models. By decoupling battery cost from vehicle cost and offering subscription-based usage, these models align with consumer financing ability and reduce upfront expenditure. This fits well within India’s macroeconomic landscape—growing economy, stable inflation—making access-based models particularly scalable and likely to bridge adoption gaps across varied income segments.

Future Outlook

India’s electric vehicle market is poised for dramatic expansion, driven by supportive government schemes, capacity ramp-ups, and shifting consumer preferences. As production scales and battery ecosystems mature, India is likely to emerge as a significant global EV hub. State-forward momentum, rural penetration, and mass-market models will further accelerate adoption. The combination of infrastructure growth, manufacturing investments, and evolving business models (like BaaS) points to a multifold increase in overall market value and adoption.

Major Players

- Tata Motors

- Mahindra Electric

- Ather Energy

- Ola Electric

- JSW‑MG Motor India

- Hero Electric

- TVS Motor Company

- Hyundai Motor India

- BYD India

- MG (JSW‑SAIC JV)

- BluSmart Mobility

- Revolt Motors

- Ampere Vehicles

- Olectra Greentech

- Ashok Leyland

Key Target Audience

- Institutional Investors and Venture Capital Firms

- Government and Regulatory Bodies (e.g., NITI Aayog, Ministry of Heavy Industries)

- State EV Policy Departments (e.g., Karnataka EV Cell, Uttar Pradesh EV Mission)

- OEM Strategy Teams

- Automotive Supply Chain Executives

- Battery Manufacturing and Gigafactory Planners

- Charging Infrastructure Developers

- Fleet Operators and Ride-sharing Platform Owners

Research Methodology

Step 1: Identification of Key Variables

The process began with mapping the EV ecosystem in India, identifying stakeholders across OEMs, suppliers, policymakers, and infrastructure players — underpinned by desk research and secondary industry databases to capture critical market variables.

Step 2: Market Analysis and Construction

We compiled and analyzed historical demand and revenue data, breaking it down by vehicle type and propulsion, leveraging bottom-up sales and registration data, ensuring a robust foundation for sizing accuracy.

Step 3: Hypothesis Validation and Expert Consultation

Key hypotheses regarding adoption drivers and constraints were validated via interviews with industry professionals across OEMs, policy think tanks, and EV infrastructure firms to refine the market model.

Step 4: Research Synthesis and Final Output

A top-down validation was conducted through engagement with EV manufacturers and charging network providers, cross-verifying production volumes, consumer behavior, and infrastructure data to ensure alignment with bottom-up figures.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Multi-Pronged Research Approach, Expert Interviews, Primary and Secondary Data Sources, Forecast Methodology, Limitations)

- Definition and Scope

- Market Genesis and Evolution

- EV Industry Ecosystem Overview

- Timeline of Key Regulatory Milestones (FAME, PLI, State Policies)

- Supply Chain & Value Chain Analysis (Battery Cells, Motor Components, Assembly Units, Charging Network)

- Growth Drivers

FAME II and State-Level Subsidies

Rising Oil Prices and Import Dependency

OEM Investments and Domestic Manufacturing Push (PLI Scheme)

Urban Pollution Control and EV Mandates

Expanding Charging Infrastructure by DISCOMs and Private Players - Market Challenges

High Upfront Cost vs ICE Vehicles

Range Anxiety and Charging Infrastructure Gaps

Battery Supply Chain Dependence on Imports

Low EV Penetration in Rural & Tier-3 Cities

Recycling and Disposal Challenges for EV Batteries - Opportunities

EV Financing and Leasing Models

Battery-as-a-Service (BaaS) and Subscription Models

Rural EV Adoption with Low-Cost 2W & 3W

E-Mobility Integration in Government Fleet - Market Trends

Shift Toward LFP Batteries in Indian Conditions

Growth of EV Aggregators and Shared E-Mobility

Local Manufacturing of Advanced Powertrain Components - Government Regulation

GST Rate Reduction on EVs

EV Incentives – FAME II, PLI Schemes

State EV Policies & Mandates

RTO and Road Tax Exemptions - SWOT Analysis

- Stakeholder Ecosystem Mapping

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2091-2024

- By EV Type Contribution, 2019-2024

- By Battery Type Contribution, 2019-2024

- By Region Contribution, 2019-2024

- By Vehicle Type (In Value %)

Two-Wheelers

Three-Wheelers

Passenger Cars

Commercial Vehicles

Buses - By Battery Type (In Value %)

Lithium-ion (Li-ion)

Nickel Metal Hydride (NiMH)

Lead Acid

Solid-State Batteries

Others - By Propulsion Type (In Value %)

Battery Electric Vehicle (BEV)

Plug-in Hybrid Electric Vehicle (PHEV)

Hybrid Electric Vehicle (HEV)

Fuel Cell Electric Vehicle (FCEV) - By Charging Infrastructure (In Value %)

Home Charging

Public Charging

Battery Swapping

Fast Charging Stations

Fleet/Depot Charging - By Region (In Value %)

Northern India

Southern India

Western India

Eastern India

Central India

- Market Share of Major Players (By Vehicle Type, Battery Type, Charging Infrastructure)

- Cross Comparison Parameters (Company Overview, Vehicle Portfolio and Innovation Capabilities, Battery Sourcing Partnerships, Charging Infrastructure Collaborations, Revenue Streams (EV Sales, Battery Sales, Services), Manufacturing Footprint & Localisation Levels, Sales Channels and Distribution, Production Capacities, Number of Service Centers, Range of Models & Price Bandwidth, Financial Performance, Policy Incentive Utilisation, Smart Tech Integration (IoT, Telematics),

- SWOT Analysis of Major Players

- Pricing Analysis by Top Models (2W, 3W, Passenger EVs, Buses)

- Detailed Company Profiles

Tata Motors

Mahindra Electric

Ather Energy

Ola Electric

TVS Motor Company

Hero Electric

Bajaj Auto

Hyundai India

MG Motor India

BYD India

Greaves Electric Mobility

Ashok Leyland

BluSmart Mobility

Revolt Motors

Ampere Vehicles

- Fleet Operators & Logistics Providers

- Private EV Owners – Cars and 2W Buyers

- Government Institutions & Public Sector Fleet

- Ride-Hailing Platforms (Ola, Uber, BluSmart)

- B2B Use-Cases (E-commerce, Food Delivery, Last-Mile Logistics)

- By Value, 2025-2030

- By Volume, 2025-2030

- By EV Type Contribution, 2025-2030

- By Battery Type Contribution, 2025-2030

- By Region Contribution, 2025-2030