Market Overview

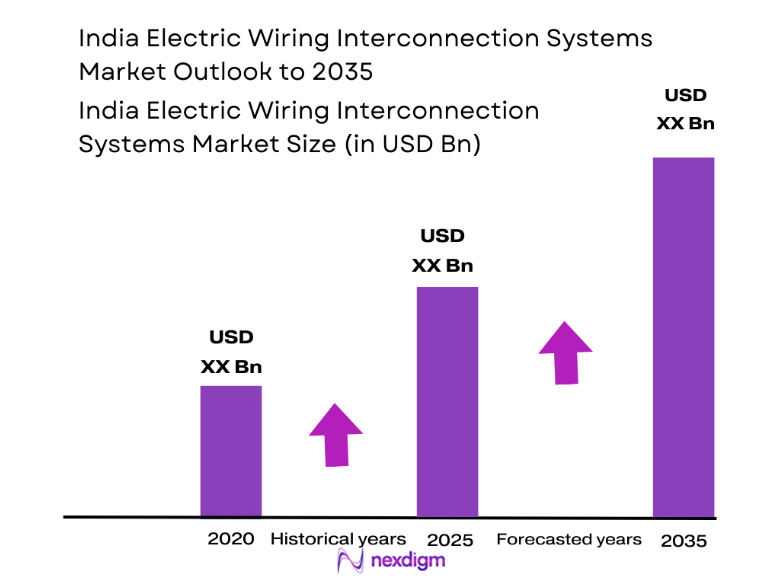

The India Electric Wiring Interconnection Systems Market is valued at approximately USD ~ billion based on a recent historical assessment. The market is primarily driven by the rapid growth of the automotive sector, particularly electric vehicles, and the increasing demand for energy-efficient solutions in various industries. Technological advancements in wiring and interconnection systems, alongside government initiatives promoting sustainable energy, further propel market expansion. With advancements in connectivity and automation, India’s infrastructure sector is also significantly contributing to the market’s development.

The dominant cities in India include Delhi, Mumbai, and Bengaluru, with their strong industrial base and technological infrastructure. These cities have become key hubs due to the concentration of automotive and industrial manufacturers, which demand high-quality interconnection systems. The presence of global players and domestic suppliers further fuels market dominance in these regions. Additionally, favorable government policies and investments in infrastructure, including electric vehicles, have led to increased demand for advanced wiring solutions in these cities.

Market Segmentation

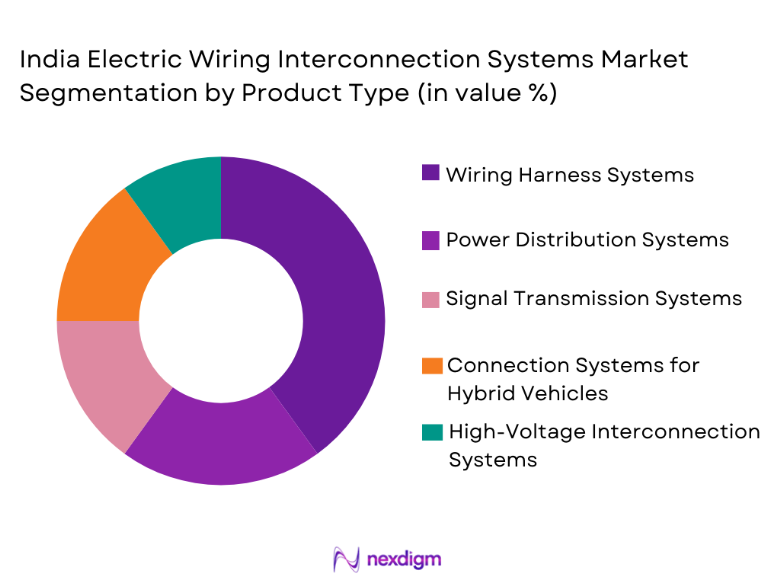

By Product Type

India Electric Wiring Interconnection Systems market is segmented by product type into wiring harness systems, power distribution systems, signal transmission systems, connection systems for hybrid vehicles, and high-voltage interconnection systems. Recently, wiring harness systems have a dominant market share due to factors such as widespread demand in the automotive industry and the shift towards electric vehicles. Wiring harnesses are crucial for ensuring proper electrical connectivity, which is central to the operation of electric vehicles and other industrial equipment. As automotive manufacturers increasingly prioritize wiring efficiency and reliability in their vehicles, the demand for wiring harness systems continues to grow.

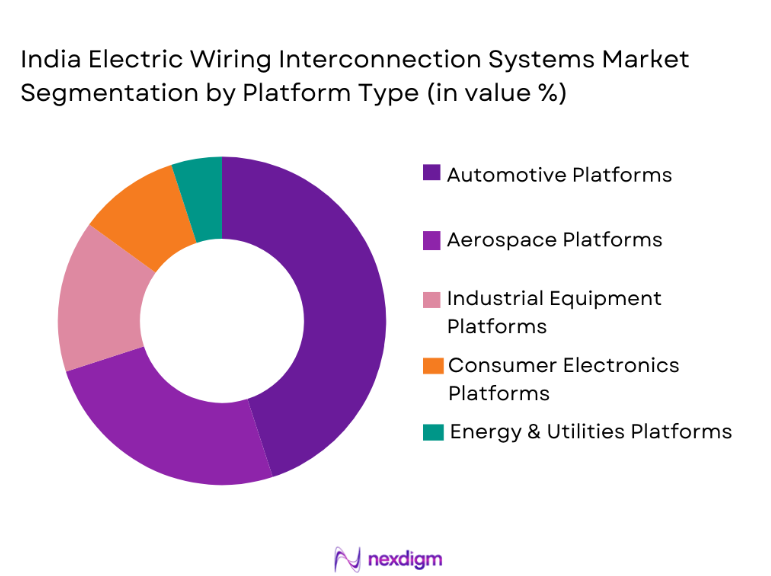

By Platform Type

India Electric Wiring Interconnection Systems market is segmented by platform type into automotive platforms, aerospace platforms, industrial equipment platforms, consumer electronics platforms, and energy & utilities platforms. The automotive platform holds the dominant market share, driven by the increasing production and adoption of electric vehicles. The automotive sector is undergoing a significant transformation, with manufacturers focusing on incorporating advanced wiring and interconnection systems to accommodate electric drivetrains and enhance vehicle safety and performance. This shift is largely influenced by government regulations and consumer preference for eco-friendly vehicles, leading to higher demand for reliable, efficient wiring solutions.

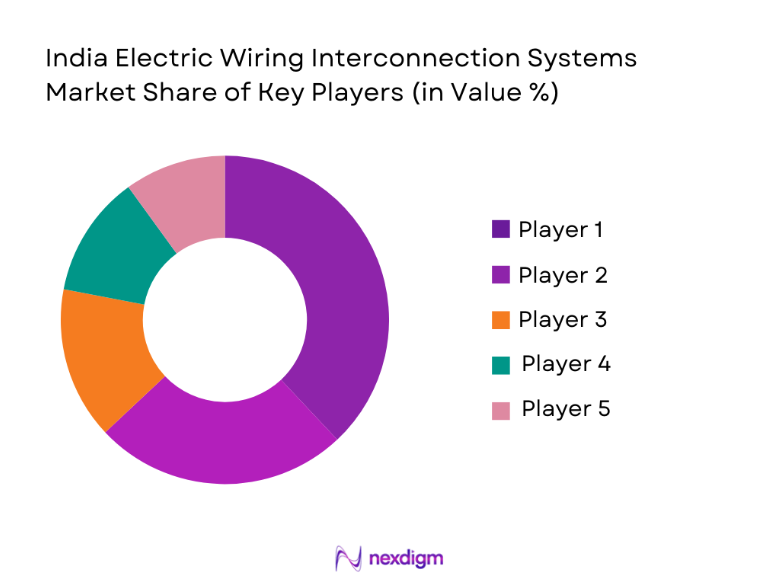

Competitive Landscape

The competitive landscape of the India Electric Wiring Interconnection Systems market is marked by significant consolidation and the presence of both established global players and emerging local manufacturers. The market is influenced by the technological capabilities of major players, who provide innovative and reliable solutions for various sectors such as automotive, aerospace, and industrial applications. These players are investing heavily in R&D and forming strategic alliances to maintain a competitive edge in the rapidly growing market.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Market-Specific Parameter |

| Bharat Wiring Systems | 1985 | New Delhi, India | ~

|

~

|

~

|

~

|

~

|

| Aptiv PLC | 1999 | Dublin, Ireland | ~ | ~

|

~

|

~

|

~

|

| Sumitomo Electric Industries | 1897 | Tokyo, Japan | ~ | ~

|

~

|

~

|

~

|

| Leoni AG | 1917 | Nuremberg, Germany | ~ | ~

|

~

|

~

|

~

|

| Yazaki Corporation | 1941 | Tokyo, Japan | ~ | ~

|

~

|

~

|

~

|

India Electric Wiring Interconnection Systems Market Analysis

Growth Drivers

Government Initiatives for Electric Vehicles

The increasing focus on electric vehicles (EVs) within India is one of the key growth drivers for the electric wiring interconnection systems market. In response to growing environmental concerns and the push for energy efficiency, the Indian government has introduced several initiatives such as the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme. These programs incentivize both manufacturers and consumers to adopt EVs, which in turn fuels demand for advanced wiring systems to accommodate electric drivetrains and ensure safety and performance. These efforts also attract significant investments from both domestic and foreign players in the automotive industry, spurring market growth. This initiative has accelerated the production of electric vehicles and created a robust demand for high-quality wiring solutions that support electric power systems, charging stations, and other EV-related infrastructure.

Technological Advancements in Automotive Manufacturing

Another significant growth driver is the continuous technological advancement in automotive manufacturing, particularly the integration of electric and hybrid vehicle technologies. The automotive sector is undergoing a major shift, with manufacturers focusing on the development of smarter, more efficient, and eco-friendly vehicles. Wiring systems are essential to these advancements, as they provide the electrical connectivity necessary for the operation of advanced vehicle features such as autonomous driving, energy storage systems, and infotainment systems. As carmakers strive to offer safer, more technologically advanced vehicles, the demand for sophisticated wiring systems is increasing. This trend is driven by consumer preference for cutting-edge automotive features and government regulations that promote the adoption of sustainable vehicle technologies.

Market Challenges

High Raw Material Costs

One of the significant challenges facing the India Electric Wiring Interconnection Systems market is the rising cost of raw materials. The market depends heavily on copper, aluminum, and other metals for the production of wiring systems, and fluctuations in the prices of these materials directly affect the overall cost structure. The prices of copper and aluminum have been particularly volatile, driven by global supply chain issues, geopolitical tensions, and environmental policies. As a result, manufacturers are forced to pass on these costs to consumers, potentially limiting market growth. Additionally, the high costs of raw materials make it challenging for smaller manufacturers to compete, leading to further market consolidation.

Regulatory Compliance and Standardization

Another challenge in the market is the complex and ever-evolving regulatory landscape. Manufacturers of wiring interconnection systems must comply with stringent regulations related to safety standards, environmental impact, and product certifications. These regulations vary across regions and industries, further complicating compliance efforts for manufacturers that operate on a global scale. Additionally, the Indian market is facing increasing pressure to align with international standards, which requires substantial investment in upgrading production facilities and technology. Non-compliance with these standards can lead to legal and financial repercussions, which may affect profitability and market penetration.

Opportunities

Expansion in Electric Vehicle Infrastructure

The continued expansion of electric vehicle (EV) infrastructure in India presents a major opportunity for the electric wiring interconnection systems market. With increasing government support for EV charging stations, battery swapping stations, and related infrastructure, the demand for high-quality interconnection systems is expected to rise. As more urban and rural areas adopt EV infrastructure, manufacturers of electric wiring systems will have a chance to provide innovative solutions that enhance connectivity, efficiency, and performance. This infrastructure expansion will be crucial in supporting the growing adoption of EVs across India, which is projected to increase in the coming years, thereby presenting a significant growth opportunity for the market.

Emerging Demand in Aerospace and Defense

The growing demand for advanced interconnection systems in aerospace and defense applications represents another opportunity for the market. As India strengthens its defense capabilities and seeks to enhance its aerospace industry, the need for reliable, high-performance wiring solutions is increasing. Aerospace and defense manufacturers require sophisticated interconnection systems for aircraft, satellites, and defense communication systems. These systems must meet stringent safety and performance standards, which creates an opportunity for manufacturers to innovate and provide tailored solutions. Additionally, as India’s defense budget grows and it continues to invest in cutting-edge technologies, this sector offers significant growth potential for the electric wiring interconnection systems market.

Future Outlook

The future of the India Electric Wiring Interconnection Systems market looks promising as demand for advanced interconnection solutions continues to rise across various industries, including automotive, aerospace, and industrial equipment. The market is expected to witness steady growth driven by technological advancements, such as the integration of electric and hybrid vehicles, the growth of EV infrastructure, and the increasing reliance on automation and smart systems. Regulatory support from the Indian government, aimed at promoting energy efficiency and sustainable transportation, will further bolster market growth. Additionally, the increasing demand for high-quality, reliable interconnection systems in defense and aerospace sectors will provide additional avenues for market expansion over the next five years.

Major Players

- Bharat Wiring Systems

- Aptiv PLC

- Sumitomo Electric Industries

- Leoni AG

- Yazaki Corporation

- Motherson Sumi Systems

- Delphi Technologies

- TE Connectivity

- Furukawa Electric Co.

- Lear Corporation

- Kostal Group

- AVX Corporation

- Robert Bosch GmbH

- Amphenol Corporation

- Parker Hannifin Corporation

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Automotive manufacturers

- Aerospace and defense contractors

- Electric vehicle infrastructure developers

- Industrial equipment manufacturers

- Energy and utility companies

- Original equipment manufacturers (OEMs)

Research Methodology

Step 1: Identification of Key Variables

Key variables such as product types, platform types, and industry applications were identified to frame the market scope.

Step 2: Market Analysis and Construction

Detailed analysis of market drivers, challenges, and opportunities were conducted through primary and secondary research to estimate market size.

Step 3: Hypothesis Validation and Expert Consultation

Expert consultations were conducted to validate assumptions and ensure the reliability of market trends and forecasts.

Step 4: Research Synthesis and Final Output

The final research output was synthesized, incorporating expert opinions, market data, and segmentation insights to create a comprehensive market report.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increase in demand for electric vehicles

Technological advancements in automotive wiring systems

Growing demand for energy-efficient systems in industries - Market Challenges

High costs of raw materials

Regulatory constraints and compliance issues

Complexities in integration with existing systems - Market Opportunities

Growth in electric vehicle infrastructure

Emerging demand in aerospace sector

Innovative solutions for high-power applications - Trends

Shift toward smart and connected interconnection systems

Rising adoption of automation in manufacturing processes

Focus on sustainability and eco-friendly materials - Government Regulations

Revised automotive wiring standards

Environmental compliance for manufacturing processes

Government incentives for electric vehicle infrastructure

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Wiring Harness Systems

Power Distribution Systems

Signal Transmission Systems

Connection Systems for Hybrid Vehicles

High-Voltage Interconnection Systems - By Platform Type (In Value%)

Automotive Platforms

Aerospace Platforms

Industrial Equipment Platforms

Consumer Electronics Platforms

Energy & Utilities Platforms - By Fitment Type (In Value%)

OEM Fitment

Aftermarket Fitment

Custom Fitment

Modular Fitment

Integrated Fitment - By EndUser Segment (In Value%)

Automotive Manufacturers

Aerospace & Defense

Industrial Equipment Manufacturers

Consumer Electronics Companies

Energy & Utility Providers - By Procurement Channel (In Value%)

Direct Procurement

Online Procurement Platforms

Distributors and Resellers

Third-party Logistics Providers

OEM-Approved Suppliers

- Market Share Analysis

- CrossComparison Parameters (System Type, Platform Type, EndUser Segment, Procurement Channel, Fitment Type, Technology Adoption, Material/Technology, Product Innovation, Cost Leadership, Customer Service, Market Reach)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Bharat Wiring Systems

Aptiv PLC

Sumitomo Electric Industries

Leoni AG

Yazaki Corporation

Motherson Sumi Systems

Delphi Technologies

TE Connectivity

Furukawa Electric Co.

Lear Corporation

Kostal Group

AVX Corporation

Robert Bosch GmbH

Amphenol Corporation

Parker Hannifin Corporation

- Automotive manufacturers’ shift to electric vehicle production

- Aerospace sector’s push for lightweight interconnection systems

- Industrial sector’s demand for high-performance wiring solutions

- Energy sector’s investment in sustainable infrastructure

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035