Market Overview

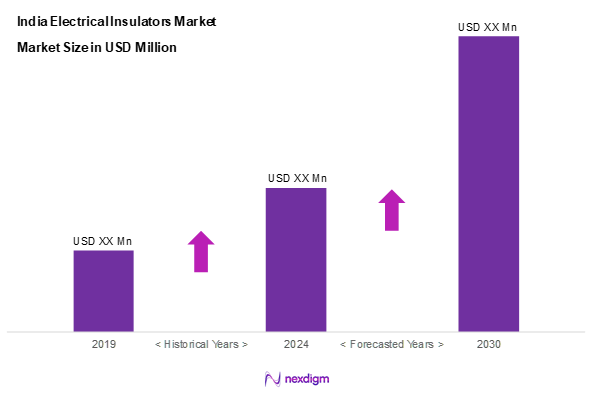

As of 2024, the India electrical insulators market is valued at USD 437.4 million with a CAGR of 6.5% from 2024 to 2030, influenced by the increasing demand for electricity and the expansion of transmission networks. Factors such as urbanization, government initiatives promoting electricity generation, and the necessity for improved power distribution solutions are driving this market. Moreover, a surge in renewable energy projects and an emphasis on infrastructure development are further fueling market growth, ensuring a robust outlook for the years ahead.

Several key cities dominate the market due to their strategic significance in the electrical infrastructure landscape. Cities such as Mumbai, Delhi, and Bangalore lead the charge, supported by their status as major economic hubs with substantial investments in power generation and grid upgrades. Additionally, the presence of established manufacturers and a growing population demanding consistent power supply further strengthen these cities’ importance in the electrical insulators market.

Market Segmentation

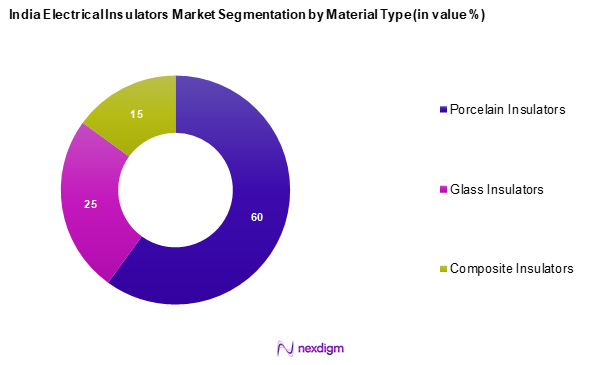

By Material Type

The India electrical insulators market is segmented into porcelain insulators, glass insulators, and composite insulators. Porcelain insulators dominate the market share due to their extensive use in both transmission and distribution applications. Their inherent durability and resistance to environmental factors make them a preferred choice for utility companies. Moreover, the well-established manufacturing base of porcelain insulators in India contributes to their availability and cost-effectiveness, further solidifying their leading position in the market.

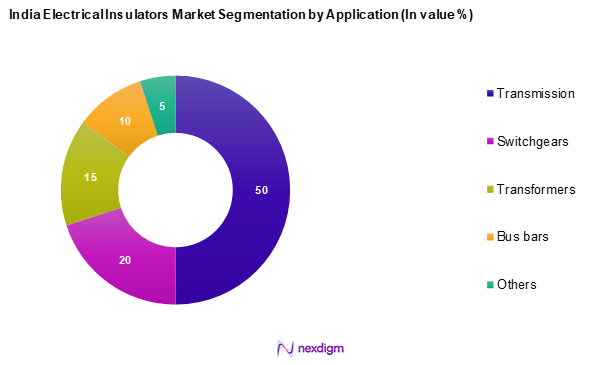

By Application

The India electrical insulators market is segmented into transmission, switchgears, transformers, bus bars, and others. The transmission application segment commands the largest share due to the robust expansion of transmission networks to support the burgeoning electricity demand across India. The need for high-performance insulators to enhance transmission efficiency and reduce losses plays a crucial role in this dominance. With ongoing government initiatives to strengthen India’s electrical infrastructure, investment in transmission lines and associated technology is on the rise, establishing its crucial role in the Electrical Insulators market.

Competitive Landscape

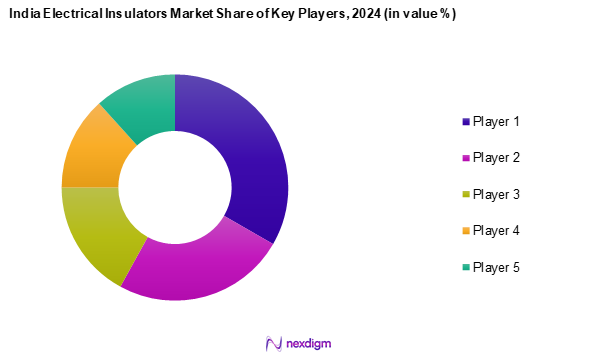

The India electrical insulators market is dominated by several major players, including established companies that have solidified their positions through innovation and market responsiveness. The competitive landscape features firms such as Siemens AG, GE Grid Solutions, and Lapp Insulators, all of which have robust material offerings and extensive distribution networks. This consolidation highlights the significant influence of these key companies in shaping market dynamics.

| Company | Establishment Year | Headquarters | Revenue (USD Mn) | Material Offerings | Market Presence |

| Siemens Energy | 1847 | Munich, Germany | – | – | – |

| GE Grid Solutions | 1892 | Boston, USA | – | – | – |

| Lapp Insulators | 1916 | Stuttgart, Germany | – | – | – |

| NGK Insulators | 1919 | Tokyo, Japan | – | – | – |

| Hubbell Power Systems | 1888 | Shelton, USA | – | – | – |

India electrical insulators market Analysis

Growth Drivers

Rising Demand for Electricity

The rising demand for electricity in India is a crucial driver of the electrical insulators market. Electricity consumption in India was estimated to reach 1,557 terawatt-hours (TWh) in 2024, reflecting robust growth due to ongoing industrial development and increasing population. The nation has witnessed a significant rise in per capita electricity consumption, reaching 1,254 kilowatt-hours (kWh) by 2024, emphasizing the growing reliance on electricity for residential, commercial, and industrial purposes. This escalated demand necessitates an expansion of electrical infrastructure, necessitating the deployment of high-quality electrical insulators to ensure efficient power distribution and reliability.

Expansion of Renewable Energy Sector

India’s commitment to increasing renewable energy capacity serves as a significant growth driver for the electrical insulators market. The total installed renewable energy capacity surpassed 170 gigawatts (GW) by 2023, and it aims to achieve 500 GW by 2030. This transition towards cleaner energy sources requires advanced electrical infrastructure, where electrical insulators play a pivotal role in integrating renewable projects into the grid effectively. The government has set ambitious targets under its National Renewable Energy Policy, advancing investments and technological innovations that will require robust insulators to handle diverse weather conditions and operational challenges.

Market Challenges

Fluctuating Raw Material Prices

A critical challenge facing the electrical insulators market in India arises from the fluctuating raw material prices crucial to insulator manufacturing. The variability in prices of materials such as glass, ceramics, and composites, which have experienced demand volatility due to global geopolitical tensions, impacts production costs significantly. As of early 2024, the price of ceramic raw materials has surged by approximately 30% over the past year due to price wars and increased demand from other sectors. These fluctuations create uncertainties for manufacturers in budgeting and pricing strategies, potentially affecting profitability and market stability.

Technological Obsolescence

The rapid pace of technological advancements poses a significant risk to manufacturers in the electrical insulators market. Companies must consistently innovate to keep pace with evolving standards and expectations. As of 2024, many manufacturers are grappling with the pressure to integrate smart technologies into their products, ensuring effective performance and enhancing safety measures in transmission networks. Companies that fail to adopt the latest manufacturing technologies or align with contemporary industry standards face the risk of obsolescence in a competitive market environment, impacting their market positioning considerably.

Opportunities

Technological Innovations

Technological innovations present significant growth opportunities for the electrical insulators market, with the shift towards smart and automated solutions. The integration of advanced materials and technologies, such as composite insulators and Nano-coatings, is gaining traction. With the current global trend towards enhanced durability and performance, manufacturers see increased investments directed toward research and development, leading to materials that can endure extreme weather conditions and reduce maintenance costs. Innovations also promise to improve the functionality and lifespan of electrical systems—enhancing delivery and reducing frequency disruptions—positioning companies embracing these advancements favourably in the evolving market.

Expansion of Grid Connectivity

The ongoing expansion of grid connectivity across India opens up numerous opportunities for the electrical insulators market. The government plans to enhance the existing grid structure to accommodate new energy sources, especially renewable energy. The total length of transmission lines in India is projected to reach over 450,000 circuit kilometres in the coming years, making it crucial to deploy quality electrical insulators. The increasing demand for inter-state and intra-state transmission solutions and the focus on reducing transmission losses will drive this demand further, reinforcing the need for high-performance insulators.

Future Outlook

Over the next several years, the India Electrical Insulators market is expected to exhibit robust growth driven by government initiatives and infrastructural development projects. Continuous investments in the modernization of the electrical grid and the push for renewable energy sources will foster demand for high-quality electrical insulators. Furthermore, technological advancements, coupled with increasing awareness of energy efficiency, are poised to propel market expansion, making it a significant contributor to India’s electrical landscape.

Major Players

- GE Grid Solutions

- Lapp Insulators

- ABB

- Aditya Birla Insulators

- Adpro Pvt. Ltd.

- Bharat Heavy Electricals

- General Electric

- GR Enterprises

- Grasim Industries Limited

- Honeywell

- Hubbell Power Systems

- Incap Limited

- Insulators and Electricals Company

- Modern Insulators Ltd

- NGK Insulators

- Olectra Greentech Limited

- Power telecom Enterprises

- C. Electric Company

- Seves Group

- Siemens Energy

- Spark insulators

- Toshiba

Key Target Audience

- Electrical Utilities

- Infrastructure Development Firms

- Power Transmission Companies

- Construction Companies

- Investment and Venture Capitalist Firms

- Government and Regulatory Bodies (Central Electricity Authority, Ministry of Power)

- Manufacturers of Electrical Equipment

- Renewable Energy Companies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map that encompasses all major stakeholders within the India electrical insulators market. This process relies on extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary aim is to identify and define the critical variables that influence market dynamics, including regulatory factors, technological advancements, and market trends.

Step 2: Market Analysis and Construction

In this phase, we compile and analyse historical data pertaining to the India Electrical Insulators Market. This includes assessing market penetration, scrutinizing the revenue generated by various material types and applications, and evaluating the overall market size. Furthermore, a review of service quality metrics will be conducted to ensure the reliability and accuracy of the revenue estimates, allowing us to create a robust market framework.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and validated through Computer-Assisted Telephone Interviews (CATIs) and structured questionnaires directed at industry experts. This diverse range of participants from various sectors, including manufacturing, grid management, and policy-making, will provide valuable operational and financial insights directly from industry practitioners. Such consultations are instrumental in refining and corroborating the market data obtained in previous steps.

Step 4: Research Synthesis and Final Output

The final phase incorporates direct engagement with numerous electrical insulator manufacturers and suppliers to obtain detailed insights concerning material segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the India Electrical Insulators market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain & Value Chain Analysis

- Growth Drivers

Rising Demand for Electricity

Expansion of Renewable Energy Sector - Market Challenges

Fluctuating Raw Material Prices

Technological Obsolescence - Opportunities

Technological Innovations

Expansion of Grid Connectivity - Trends

Adoption of Smart Grid Technologies

Increasing Use of Composite Insulators

Focus on Sustainability - Government Regulation

National Electric Policy

Standards for Electrical Insulation Materials - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Material Type (In Value %)

Porcelain Insulators

– Pin Type Insulators

– Suspension Type Insulators

– Post Insulators

– Shackle Insulators

Glass Insulators

– Toughened Glass Disc Insulators

– Hollow Glass Insulators

– Cap and Pin Type

Composite Insulators

– Long Rod Insulators

– Line Post Insulators

– Station Post Insulators

– Horizontal and Vertical Mounting Types - By Application (In Value %)

Transmission

– Overhead Power Lines

– Substation Transmission

– Long-Distance Grid Transmission

Switchgears

– Medium Voltage Switchgear Insulators

– High Voltage Gas-Insulated Switchgear (GIS)

– Arc Interruption and Contact Support

Transformers

– Bushing Insulators

– Transformer Terminal Insulators

Busbars

– Support Insulators

– Busbar Trunking Systems

Others

– Rail Electrification Systems

– Renewable Energy Installations (e.g., Wind and Solar Power)

– Distribution Panels - By Voltage Range (In Value %)

Low Voltage

Medium Voltage

High Voltage - By End-User Industry (In Value %)

Residential

– Distribution Panels

– Home Electrical Systems

Commercial

– Commercial Buildings

– Data Centers

– Shopping Malls

Industrial

– Manufacturing Facilities

– Heavy Equipment and Power Plants

– Chemical and Metallurgical Industries

Utilities

– Power Transmission & Distribution (T&D) Companies

– Renewable Energy Utilities

– Railways and Metro Utilities - By Region (In Value %)

North India

South India

East India

West India

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Material Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Revenues by Type of Material, Distribution Channels, Number of Dealers and Distributors, Margins, Production Plant, Capacity, Unique Value offering and others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

GE Grid Solutions

Lapp Insulators

ABB

Aditya Birla Insulators

Adpro Pvt. Ltd.

Bharat Heavy Electricals

General Electric

GR Enterprises

Grasim Industries Limited

Honeywell

Hubbell Power Systems

Incap Limited

Insulators and Electricals Company

Modern Insulators Ltd

NGK Insulators

Olectra Greentech Limited

Power telecom Enterprises

Electric Company

Seves Group

Siemens Energy

Spark insulators

Toshiba

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030