Market Overview

The India Emergency and Disaster Response market is valued at USD ~ billion based on a recent historical assessment. The growth is primarily driven by government investments in disaster preparedness, the rising frequency of natural disasters, and advancements in emergency response technologies. These factors have contributed to the increasing adoption of emergency management solutions in various sectors, particularly healthcare, military, and government organizations. As disaster management needs become more complex, the demand for efficient, real-time solutions has surged, driving market expansion.

Dominant cities in the India Emergency and Disaster Response market include New Delhi, Mumbai, and Bengaluru, where infrastructure and government support are most robust. These cities serve as hubs for emergency management operations due to their strategic importance in logistics, access to technological resources, and central coordination of disaster response efforts. With rapid urbanization, the need for modern disaster response solutions has become urgent in these regions. Furthermore, the significant presence of government agencies and NGOs in these cities further enhances their dominance in the sector.

Market Segmentation

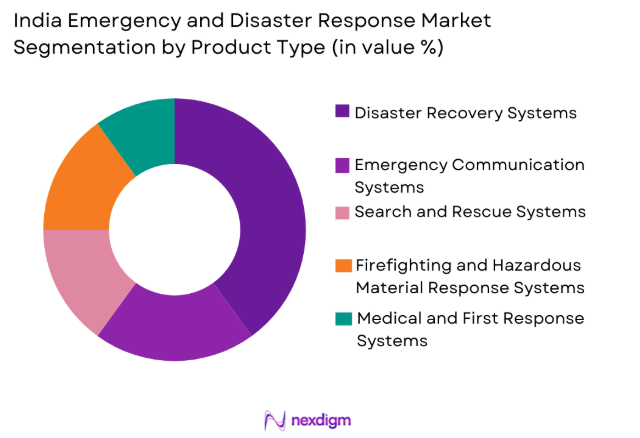

By Product Type:

India Emergency and Disaster Response market is segmented by product type into disaster recovery systems, emergency communication systems, search and rescue systems, firefighting and hazardous material response systems, and medical and first response systems. Recently, emergency communication systems have a dominant market share due to increasing demand for rapid, reliable communication technologies during critical disaster events. The growth of mobile and satellite communication networks, supported by the government’s push for modernization in disaster management, has driven the widespread adoption of these systems. Their ability to provide real-time updates and coordination during emergencies ensures their continued dominance in the market.

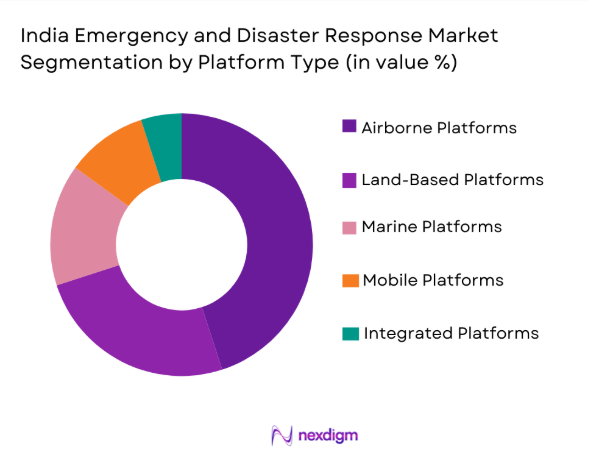

By Platform Type:

India Emergency and Disaster Response market is segmented by platform type into land-based platforms, airborne platforms, marine platforms, integrated platforms, and mobile platforms. Recently, land-based platforms have a dominant market share due to factors such as increased infrastructure development and the widespread use of land-based vehicles in rapid disaster response. These platforms are cost-effective, offer high mobility, and are supported by India’s vast road network, enabling faster deployment of resources during emergencies. Additionally, the growth of smart city initiatives has spurred the demand for land-based disaster response systems that can integrate with urban infrastructure.

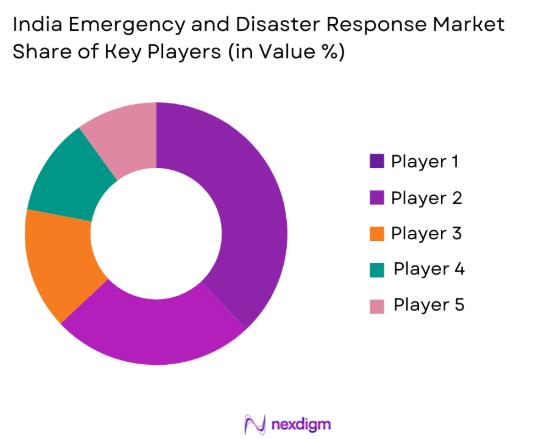

Competitive Landscape

The competitive landscape of the India Emergency and Disaster Response market is marked by a growing consolidation trend, with major players vying for a larger share through mergers, acquisitions, and partnerships. The market is influenced by key players who are shaping innovation through technological advancements in real-time communication systems, AI-driven analytics, and robotics. Companies with a strong presence in both hardware and software development are gaining significant market traction by offering end-to-end solutions for disaster management.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | R&D Investment |

| Bosch Security Systems | 1886 | Germany | ~ | ~ | ~ | ~ | ~ |

| Siemens AG | 1847 | Germany | ~ | ~ | ~ | ~ | ~ |

| Schneider Electric | 1836 | France | ~ | ~ | ~ | ~ | ~ |

| Honeywell International | 1906 | USA | ~ | ~ | ~ | ~ | ~ |

| Tata Consultancy Services | 1968 | India | ~ | ~ | ~ | ~ | ~ |

India Emergency and Disaster Response Market Analysis

Growth Drivers

Government Investment in Disaster Management Infrastructure:

Government initiatives have played a pivotal role in driving the growth of the India Emergency and Disaster Response market. The Indian government has consistently allocated funds for the modernization of emergency response systems, ensuring better coordination and quicker response times during disaster events. In recent years, India has increased its budgetary allocation for disaster risk management and preparedness, reflecting the growing importance of reducing vulnerability to natural and man-made disasters. Government support also includes investments in state-of-the-art technology for response systems, such as artificial intelligence (AI) and advanced analytics, improving predictive capabilities for disasters. This has encouraged both private and public sector entities to implement high-tech solutions, further fueling market expansion.

Technological Advancements in Disaster Response Systems:

The emergence of advanced technologies like drones, AI, machine learning, and robotics has significantly boosted the growth of the India Emergency and Disaster Response market. Drones, for instance, are increasingly being used for aerial surveillance during floods and other natural disasters, enabling rapid assessment of affected areas. AI-driven software is being adopted to optimize response strategies by predicting disaster scenarios and resource requirements. The integration of these technologies with existing infrastructure has enhanced the efficiency and accuracy of disaster management efforts, making it a critical driver of market growth. Furthermore, mobile applications designed for emergency response have gained widespread adoption, helping people stay informed and connected during disasters. These technological advancements are likely to continue influencing the market positively in the coming years.

Market Challenges

High Capital Expenditure for Disaster Management Systems:

A significant challenge faced by the India Emergency and Disaster Response market is the high capital expenditure required for the development and implementation of modern disaster response systems. The installation of advanced communication systems, surveillance equipment, and AI-powered platforms necessitates substantial investment, which can be a deterrent for smaller organizations or regions with limited budgets. Even though the government has allocated funds, there are still concerns about the timely distribution and utilization of resources. The cost of maintaining such infrastructure over the long term is another challenge, especially for areas that are frequently affected by disasters. Furthermore, the lack of adequate financial resources for rural and underserved regions hinders their ability to build resilient emergency response frameworks, leading to disparity in disaster management effectiveness across regions.

Lack of Skilled Workforce and Training:

Another critical challenge facing the market is the shortage of skilled personnel trained in the use of advanced disaster response systems. While there is an increasing reliance on technology, the effectiveness of these systems is largely contingent upon the ability of personnel to operate and manage them efficiently during emergencies. The current workforce lacks sufficient training in using high-tech equipment, limiting the efficiency and response times in critical situations. The gap in skills and training hampers the market’s growth potential, especially in rural and remote areas where trained personnel are even more scarce. Moreover, the adoption of new technologies often requires continuous education and upskilling, which adds an additional layer of complexity to the deployment of advanced systems. These challenges contribute to the delayed implementation and scaling of disaster response technologies across India.

Opportunities

Development of Smart Cities with Advanced Emergency Systems:

The rapid growth of urbanization in India presents significant opportunities for the Emergency and Disaster Response market, especially in the development of smart cities. As urban centers continue to expand, the need for more efficient, integrated disaster management systems becomes more pressing. Smart city initiatives that incorporate advanced sensors, real-time communication networks, and predictive analytics systems offer opportunities to develop more responsive disaster management infrastructures. These cities will serve as testing grounds for innovations in disaster response systems, from AI to robotics, providing valuable insights for wider applications across the country. Additionally, smart city projects often attract significant government and private sector investments, ensuring that the necessary resources and infrastructure are available to tackle urban disaster risks.

Collaboration with Private Tech Firms for Enhanced Response Systems:

A growing opportunity within the India Emergency and Disaster Response market lies in fostering collaborations between the government, private sector, and tech firms to create more innovative and efficient disaster management solutions. Technology companies specializing in AI, cloud computing, and IoT have the potential to revolutionize disaster response efforts through the development of intelligent systems capable of real-time data processing, resource allocation, and communication. By partnering with these companies, government agencies and NGOs can leverage cutting-edge technology to create more robust disaster management frameworks. These collaborations are expected to lead to more cost-effective, scalable, and sustainable solutions, enhancing overall preparedness for a range of natural and man-made disasters.

Future Outlook

The India Emergency and Disaster Response market is set to experience significant growth over the next five years, driven by technological advancements, government initiatives, and the increasing frequency of natural disasters. Technological innovations, such as AI and machine learning, are expected to enhance predictive capabilities and streamline response times. The government’s continued investment in disaster management infrastructure will provide additional support for market growth, with a particular focus on expanding capabilities in rural and remote areas. Regulatory frameworks will likely evolve to incorporate new disaster management technologies, ensuring their integration into national preparedness strategies.

Major Players

- Bosch Security Systems

- Siemens AG

- Schneider Electric

- Honeywell International

- Tata Consultancy Services

- GE Healthcare

- Air Force Systems

- IBM

- Rockwell Automation

- ABB

- Honeywell Aerospace

- L3 Technologies

- Thales Group

- Emerson Electric

- BAE Systems

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- NGOs and disaster relief organizations

- Military and defense agencies

- Emergency management agencies

- Urban development authorities

- Infrastructure developers

- Public safety departments

Research Methodology

Step 1: Identification of Key Variables

The key variables for market analysis, such as product types, platform types, and regional segmentation, were identified to structure the report.

Step 2: Market Analysis and Construction

Data was collected through primary and secondary research, including interviews with industry experts and reviewing credible sources.

Step 3: Hypothesis Validation and Expert Consultation

The collected data was validated through discussions with market participants, ensuring accuracy in the model.

Step 4: Research Synthesis and Final Output

The findings were synthesized into a comprehensive market report, which includes market size, trends, and forecasts.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Frequency of Natural Disasters

Government Initiatives for Disaster Management and Relief

Advancements in Emergency Response Technology

Rise in Public-Private Partnerships for Disaster Management

Growing Awareness and Preparedness Among Communities - Market Challenges

High Capital Expenditure for Emergency Systems

Lack of Infrastructure in Rural and Remote Areas

Coordination Challenges Among Response Agencies

Technological Integration and Interoperability Issues

Political and Bureaucratic Barriers - Market Opportunities

Development of Smart Cities with Advanced Emergency Systems

Emerging Market for Robotics and Drone-Based Emergency Services

Integration of AI and Big Data in Disaster Response Management - Trends

Integration of AI and Big Data in Disaster Preparedness

Increase in Use of Drones and Autonomous Systems

Development of Mobile Disaster Response Units

Rising Demand for Green and Sustainable Emergency Systems

Government Focus on Real-Time Communication and Data Sharing - Government Regulations & Defense Policy

Strengthening of National Disaster Management Policies

Introduction of New Safety Standards and Guidelines

Government Funding and Grants for Emergency Response Systems - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Disaster Recovery Systems

Emergency Communication Systems

Search and Rescue Systems

Firefighting and Hazardous Material Response Systems

Medical and First Response Systems - By Platform Type (In Value%)

Land-Based Platforms

Airborne Platforms

Marine Platforms

Integrated Platforms

Mobile Platforms - By Fitment Type (In Value%)

On-premise Solutions

Cloud-based Solutions

Hybrid Solutions

Modular Solutions

Integrated Solutions - By EndUser Segment (In Value%)

Government Agencies

Non-Governmental Organizations (NGOs)

Private Sector / Technology Firms

Military and Defense

Public Safety and Emergency Services - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors - By Material / Technology (In Value%)

AI and Machine Learning Technologies

IoT-Based Emergency Response Systems

Satellite Communication Systems

Robotics and Drones

Renewable Energy Systems for Emergency Power

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (System Type, Platform Type, Procurement Channel, EndUser Segment, Fitment Type)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Tata Consultancy Services

Larsen & Toubro Limited

Bosch Security Systems

Honeywell International Inc.

Samsung Electronics

Siemens AG

GE Healthcare

Schneider Electric

BAE Systems

Airbus Group

Thales Group

Lockheed Martin

Northrop Grumman

Harris Corporation

Raytheon Technologies

- Government Agencies Increasing Investment in Response Systems

- NGOs Expanding Operations for Global Disaster Relief

- Private Sector’s Growing Interest in Emergency Technology

- Military Forces Enhancing Response Systems for Civilian Disasters

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035