Market Overview

The India epilators market is valued at approximately USD 190.56 million in 2024 with an approximated compound annual growth rate (CAGR) of 6.55% from 2024-2030, showcasing significant growth attributed to rising consumer preferences for convenient hair removal solutions and increasing awareness about personal grooming. The demand for epilators is primarily driven by the expanding beauty and personal care sector, combined with shifting consumer attitudes toward self-care and grooming. Furthermore, innovative product advancements and the availability of a wide range of options have contributed to the market’s robust expansion in recent years.

Key cities such as Mumbai, Delhi, and Bangalore dominate the epilators market due to their urban population dynamics and higher disposable income levels. These metropolitan areas demonstrate a higher inclination toward beauty products and grooming solutions, supported by expanding retail infrastructure and increased online shopping channels. Additionally, the growing influence of social media and beauty influencers has fostered greater awareness and consumption of epilators in these cities, further solidifying their market leadership.

The Indian e-commerce market plays a crucial role in expanding the reach of beauty and personal care products, including epilators. An increasing number of consumers are turning to online platforms to purchase grooming solutions due to convenience, wide selection, and competitive pricing. In 2023 alone, e-commerce sales were valued at approximately USD 46 billion, driven by accelerated digital adoption during the pandemic.

Market Segmentation

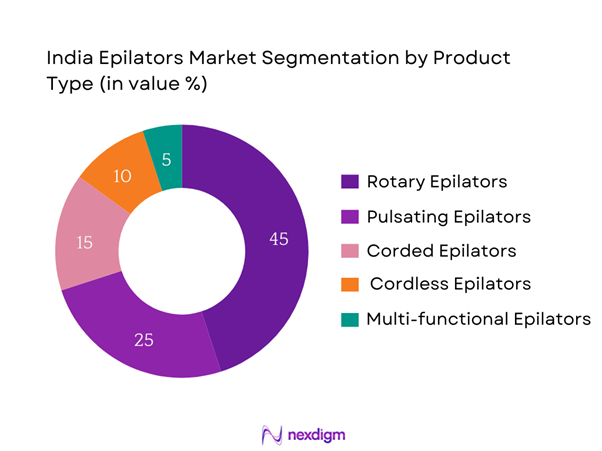

By Product Type

The India epilators market is segmented by product type into rotary epilators, pulsating epilators, corded epilators, cordless epilators, and multi-functional epilators. Currently, rotary epilators command a dominant market share within this segmentation due to their long-standing reputation for effectiveness and reliability in hair removal. Consumer trust in established brands that offer rotary models solidifies their market presence. Furthermore, advancements in technology have enhanced their performance and user experience, contributing to a sustained preference for rotary epilators over other alternatives.

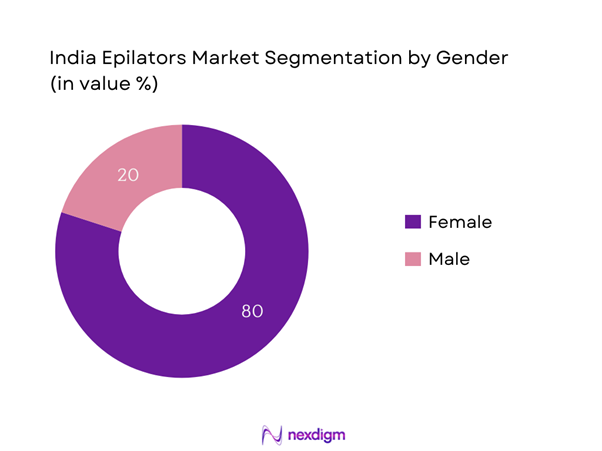

By Gender

The market is also segmented by gender into female and male epilators. The female segment significantly dominates the market share, primarily due to the higher demand for personal grooming products among women. As societal norms continue to evolve, women are increasingly seeking efficient and convenient hair removal solutions, leading to a focus on specialized products designed for their specific needs. Brands have tailored their offerings to cater to these preferences, thus reinforcing the female segment’s leadership within the India epilators market.

Competitive Landscape

The competitive landscape of the India epilators market is characterized by several key players, including established brands and emerging companies. Notable competitors include Philips, Braun, Panasonic, and Remington, all of which have made significant inroads into the market. This consolidation is indicative of the competitive advantages possessed by these major players, such as established brand loyalty and a comprehensive distribution network. The combination of innovative product features and effective marketing strategies allows these companies to maintain their competitive edge in a rapidly evolving market.

| Company | Established Year | Headquarters | Market Type | Key Products | R&D Focus |

| Philips | 1891 | Amsterdam, Netherlands | – | – | – |

| Braun | 1921 | Kronberg, Germany | – | – | – |

| Panasonic | 1918 | Osaka, Japan | – | – | – |

| Remington | 1937 | Trenton, New Jersey, USA | – | – | – |

| Wahl | 1919 | Sterling, Illinois, USA | – | – | – |

India Epilators Market Analysis

Growth Drivers

Increasing Beauty and Personal Care Spending

The rising disposable income in India, which reached USD 3,200 billion in 2024 according to the World Bank, is fueling increased spending on beauty and personal care products. Consumers, particularly in urban areas, are becoming more willing to allocate a portion of their budget to grooming products such as epilators. Additionally, the Indian beauty and personal care market was valued at USD 13.1 billion in 2023 and is expanding rapidly, driven by young demographics and changing lifestyle preferences. This shift is solidifying grooming and personal care as essential components of consumer expenditure, further propelling the market for epilators.

Rise in Awareness of Hair Removal Solutions

As awareness regarding personal grooming and hygiene increases, particularly among younger generations, the demand for effective hair removal solutions, including epilators, is surging. Research indicates that approximately 71% of women in urban India are aware of various hair removal methods, reflecting a shift towards self-care practices. Additionally, the rise of digital media and social platforms is amplifying awareness of different hair removal technologies, thereby influencing consumer choices. The Indian government also promotes health awareness campaigns that highlight personal grooming’s significance, contributing to the rising demand in this segment.

Market Challenges

Intense Competition

The India epilators market faces aggressive competition, with numerous local and international brands vying for consumers’ attention, often leading to price wars. The beauty and personal care market in India is crowded, comprising over 1,000 companies, with several key brands dominating the segment. As a result, new entrants find it challenging to penetrate the market without significant investment in branding and marketing. This high level of competition is accompanied by evolving consumer preferences, necessitating companies to constantly innovate and improve their product offerings to maintain market relevance.

Price Sensitivity among Consumers

Price sensitivity is a significant challenge in the India epilators market. With approximately 253.6 million people living under the poverty line as per the World Bank data, affordability remains a crucial factor influencing purchasing decisions. Most consumers are inclined toward budget-friendly options, which directly impacts the pricing strategies of brands. Brands must balance product quality with competitive pricing to appeal to price-conscious consumers, making it imperative for companies to offer value propositions that reinforce the benefit of investing in epilators.

Opportunities

Rising Demand for At-home Hair Removal Solutions

The trend towards at-home beauty solutions is intensifying, with consumer preferences shifting to convenience and privacy. In 2023, the penetration rate of at-home beauty devices was estimated to be around 34% among urban households, highlighting an upward trajectory in self-grooming practices. This shift presents an opportunity for epilator manufacturers to capture market share by promoting the advantages of at-home hair removal solutions over conventional salon services. As consumers increasingly prioritize effective and convenient options, brands can expand their product lines to cater to these evolving needs.

Expansion of Men’s Grooming Products

Men’s grooming has emerged as a rapidly growing segment within the beauty market. Current statistics indicate that 40% of Indian men use some form of grooming products, illustrating growing acceptance of personal care among males. This shift not only opens pathways for brands to introduce epilators targeted at men, but it also allows them to diversify their product offerings and marketing strategies to appeal to this demographic, thus tapping into a previously underserved market segment.

Future Outlook

The India epilators market is poised for substantial growth in the coming years, driven by rising consumer standards of personal grooming and increased awareness of home grooming solutions. With the growing availability of innovative products and advancements in technology, companies are likely to invest heavily in research and development. The shift towards eco-friendly products and sustainable practices in manufacturing will also likely drive market dynamics. Overall, the market is set to flourish as consumers continue to prioritize convenience and efficiency in their grooming routines.

Major Players

- Philips

- Braun

- Panasonic

- Remington

- Wahl

- VEGA

- Havells

- SYSKA

- BBLUNT

- Nova

- Trimmer

- EpiLADY

- Lilac

- Conair

- Toppik

Key Target Audience

- Retailers and Distributors

- E-commerce Platforms

- Beauty and Personal Care Brands

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Bureau of Indian Standards, Ministry of Consumer Affairs)

- Beauty Salons and Spas

- Cosmetic Manufacturers

- Wholesalers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map that encompasses all major stakeholders within the India epilators market. This is underpinned by extensive desk research and analysis of industry reports, statistical databases, and market publications. The primary objective is to identify and define the critical variables that significantly influence market dynamics, including consumer preferences, technological advancements, and competitive landscape.

Step 2: Market Analysis and Construction

In this phase, historical data related to the India epilators market will be compiled and analyzed. This includes assessing market penetration rates, growth trends, and the ratio of consumers to product variety, resulting in a detailed revenue generation overview. Additionally, evaluations of consumer satisfaction statistics and service quality will be carried out to ensure the reliability of the data collected.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed based on initial findings and subsequently validated through structured interviews with industry experts. These interviews will incorporate insights from diverse stakeholders, including manufacturers, retailers, and market analysts. Such consultations will provide operational and financial insights directly from practitioners, refining the accuracy of the data and addressing any discrepancies.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing all data points and insights from various stakeholders to develop a cohesive understanding of the India epilators market. This includes validating findings through engagement with industry leaders and collecting information on product segments, sales performance, consumer preferences, and market projections. The thorough analysis will culminate in a comprehensive report that accurately reflects the current state and future potential of the market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Beauty and Personal Care Spending

Rise in Awareness of Hair Removal Solutions

Growth of E-commerce Platforms - Market Challenges

Intense Competition

Price Sensitivity among Consumers - Opportunities

Rising Demand for At-home Hair Removal Solutions

Expansion of Men’s Grooming Products - Trends

Adoption of Smart and Multi-functional Devices

Increasing Preference for Sustainable Practices - Government Regulation

Consumer Product Safety Standards

Compliance with Import Regulations - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Rotary Epilators

– Single-Head Rotary

– Dual-Head Rotary

Pulsating Epilators

– Sonic Pulsation Epilators

– Vibrating Tweezer Technology

Corded Epilators

– Standard Plug-in Models

– Ergonomic Designs for Long Use

Cordless Epilators

– Battery-Operated

– Rechargeable (USB/Charging Dock)

Multi-functional Epilators

– Epilation + Shaving Head

– Epilation + Massage + Exfoliation Attachments - By Gender (In Value %)

Female

Male - By Distribution Channel (In Value %)

Online Retail

– E-commerce Marketplaces

– Brand Websites

Hypermarkets/Supermarkets

– Big Bazaar

– Reliance Smart

– Spencer’s Retail

Specialty Stores

– Electronics Chains

– Personal Care Retailers - By Region (In Value %)

North India

South India

East India

West India - By Pricing Range (In Value %)

Economy Range

Mid-Range

Premium Range

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Epilator Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Revenues by Type of Epilator, Number of Touchpoints, Distribution Channels, Number of Dealers and Distributors, Margins, Production Plant, Capacity, Unique Value Offering and others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Philips

Braun

Panasonic

Remington

Wahl

VEGA

Havells

SYSKA

BBLUNT

Nova

Trimmer

EpiLADY

Lilac

Conair

Toppik

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030