Market Overview

The India Explosive Ordnance Disposal (EOD) market is expected to be valued at INR ~ crore in 2024, growing as defense forces and law enforcement agencies enhance their capabilities to deal with explosive threats. The key drivers include the increased need for counter‑IED operations, modernization of defense equipment, and security threats from terrorism. The Indian government’s ongoing investments in defense technology and procurement of advanced EOD systems are fueling this growth. With increased urbanization and rising threats of terror, the demand for advanced EOD solutions is expected to continue rising.

Cities like New Delhi, Mumbai, and Bengaluru are crucial players in the India EOD market, primarily due to their strategic importance and the concentration of military and paramilitary forces in these areas. These cities also host key defense establishments, government bodies, and a significant number of security contractors. Additionally, states like Jammu & Kashmir and the Northeastern regions, with their ongoing security challenges, also play an important role in the demand for EOD services. The presence of multiple defense research agencies and military training centers in these regions further strengthens their dominance in the market.

Market Segmentation

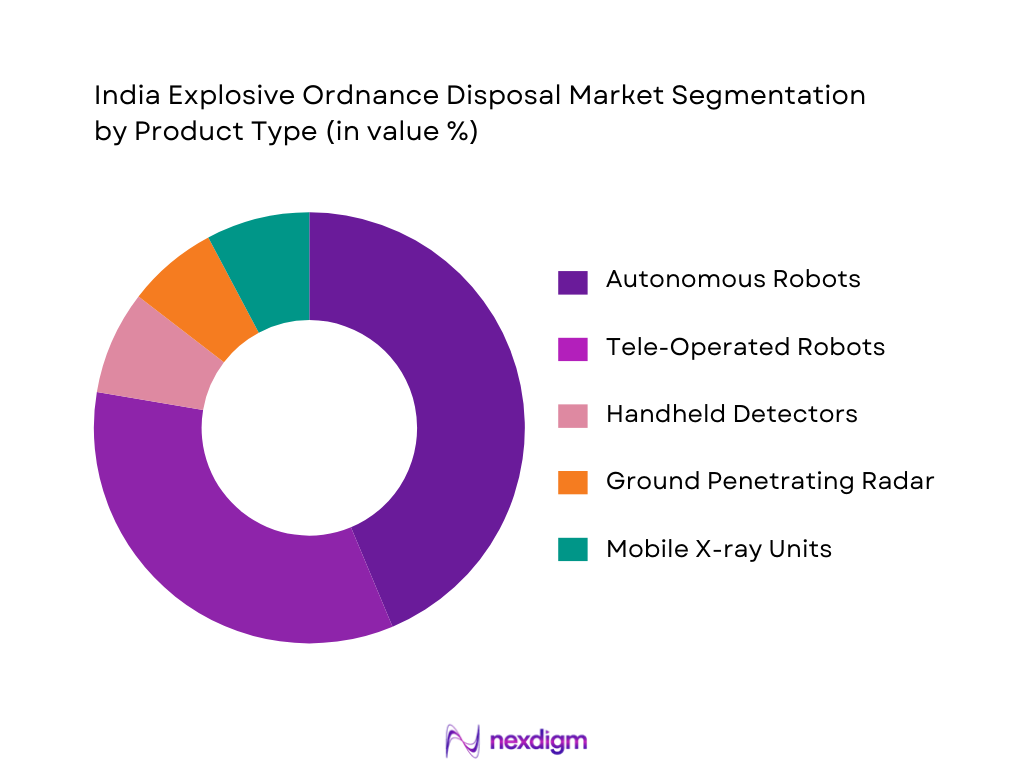

By Product Type

The India Explosive Ordnance Disposal market is segmented by product type into EOD robots, portable detection systems, X-ray systems, bomb suits, counter‑IED tools, and software/AI analytics. Among these, EOD robots, especially tele-operated and autonomous robots, dominate the market due to their increasing adoption in military and law enforcement operations. These robots are deployed for high-risk bomb disposal tasks, ensuring minimal human involvement in dangerous environments. With significant advancements in robotics and AI technologies, EOD robots are becoming more reliable and cost-effective, which fuels their market dominance.

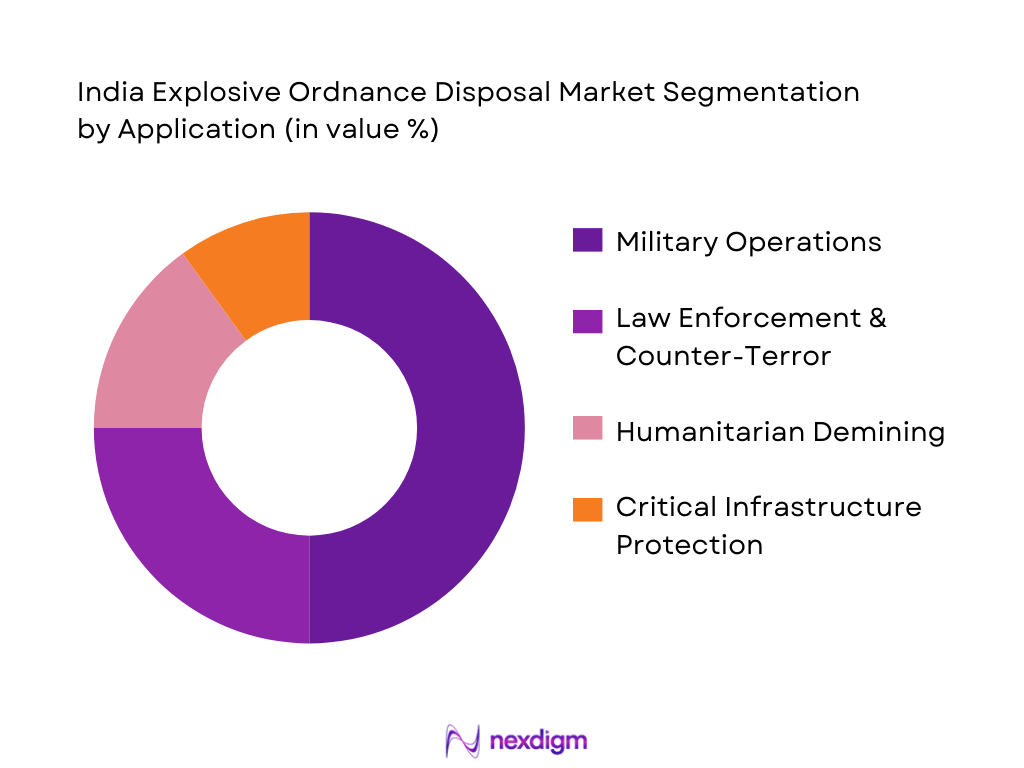

By Application

The market is segmented by application into military operations, law enforcement & counter-terrorism, humanitarian demining, and critical infrastructure protection. Military operations account for the largest share of the market due to the Indian armed forces’ continuous need for EOD solutions in conflict zones and their focus on modernizing defense technology. The importance of military EOD operations in protecting military personnel, vehicles, and assets is central to this dominance. Additionally, increased funding in defense modernization programs contributes significantly to the growth of military EOD solutions.

Competitive Landscape

The India Explosive Ordnance Disposal market is dominated by both international and local players. Global companies such as Northrop Grumman and Thales Group lead the market with advanced robotics and detection systems. Local manufacturers, including Premier Explosives and ElectroMech Material Handling, contribute significantly through indigenous production and technology integration with defense agencies.

| Company | Establishment Year | Headquarters | R&D Investment | Product Portfolio | Government Contracts | Technological Innovation | Market Reach |

| Northrop Grumman | 1939 | US | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | France | ~ | ~ | ~ | ~ | ~ |

| Premier Explosives | 1995 | India | ~ | ~ | ~ | ~ | ~ |

| ElectroMech Material Handling | 1980 | India | ~ | ~ | ~ | ~ | ~ |

| Rheinmetall AG | 1889 | Germany | ~ | ~ | ~ | ~ | ~ |

India Explosive Ordnance Disposal Market Analysis

Growth Drivers

Defense Modernization Budgets

India’s defense modernization strategy is a critical driver of the EOD market. The government has been consistently increasing its defense budget, which includes significant allocations for upgrading military technologies. This investment in modernizing defense equipment, including explosive ordnance disposal systems, is essential to improve the security of military personnel and civilians in conflict zones. The growing need for advanced EOD systems to counter new and evolving explosive threats, such as improvised explosive devices (IEDs) and landmines, is a key factor behind the increased demand for these solutions.

Counter-IED Imperatives

Counter-IED efforts have become a top priority in India, particularly due to the ongoing insurgency issues and the rising threat of terrorism in border regions and conflict zones. As the Indian government focuses on enhancing security along sensitive borders, the demand for EOD solutions that can effectively detect, neutralize, and dispose of explosive devices grows. Counter-IED operations, carried out by defense forces and law enforcement agencies, are crucial to ensure the safety of civilians and military personnel, making EOD technologies an indispensable part of national security infrastructure.

Market Restraints

High CapEx of EOD Systems

One of the major challenges faced by the India EOD market is the high capital expenditure (CapEx) associated with acquiring advanced EOD systems. These systems often involve sophisticated technology, such as robotics, detection sensors, and protective gear, which require significant investment from both government agencies and private contractors. The high upfront costs can limit the adoption of cutting-edge EOD equipment, especially in smaller, budget-constrained military or law enforcement units. As a result, while there is a pressing need for these systems, their cost remains a significant barrier to widespread adoption.

Skill Shortages for Operators

EOD operations require highly specialized personnel who are trained to handle potentially dangerous explosive devices. However, there is a significant shortage of qualified EOD operators in India. The complex nature of EOD tasks, including the detection and safe disposal of explosives, requires expert knowledge and hands-on training. As the demand for more sophisticated EOD systems grows, the shortage of skilled operators poses a significant challenge to the effective deployment and operation of these systems. Addressing this skills gap through training and certification programs is crucial for the future success of the EOD market in India.

Market Opportunities

Indigenization under Aatmanirbhar Bharat

The “Aatmanirbhar Bharat” (Self-Reliant India) initiative has opened up significant opportunities for the Indian EOD market. The Indian government has been focusing on fostering local manufacturing and innovation in defense technology to reduce dependency on foreign suppliers. This shift towards indigenous development of EOD systems presents a unique opportunity for local manufacturers to create cost-effective, customized solutions tailored to the specific needs of the Indian military and law enforcement agencies. By encouraging domestic production, India can enhance its defense capabilities while also stimulating the growth of its defense manufacturing sector.

Robotics & AI Integration

The integration of robotics and artificial intelligence (AI) into EOD systems is revolutionizing the market. Autonomous and tele-operated EOD robots, equipped with advanced AI capabilities, are becoming increasingly popular due to their ability to safely and efficiently detect and neutralize explosive threats with minimal human intervention. Robotics and AI offer enhanced precision, faster response times, and a reduction in human risk, all of which are critical for improving the effectiveness of EOD operations. As technology advances, the demand for more sophisticated, AI-driven EOD solutions is expected to grow significantly, presenting a major opportunity for innovation and market expansion.

Future Outlook

Over the next 5 years, the India Explosive Ordnance Disposal market is expected to exhibit substantial growth, driven by increasing defense modernization programs, heightened security concerns, and a shift toward indigenous manufacturing under the Aatmanirbhar Bharat initiative. With advances in robotics, AI, and detection technologies, the market is set to witness a transformation, where autonomous and AI-enabled EOD systems will dominate. Additionally, as the Indian government increases its defense budget and focuses on border security and counter-terrorism, the demand for high-quality, efficient, and cost-effective EOD solutions will rise. The growing threat from terror organizations and insurgency, particularly in border states, will ensure sustained demand for EOD products and services.

Major Players

- Northrop Grumman

- Thales Group

- Premier Explosives

- ElectroMech Material Handling

- Rheinmetall AG

- L3Harris Technologies

- BAE Systems

- QinetiQ Group

- Safran

- Textron

- General Dynamics

- Leonardo DRS

- Kongsberg Gruppen

- Raytheon Technologies

- Lockheed Martin

Key Target Audience

- Indian Army

- Paramilitary Forces (Border Security Force, Central Reserve Police Force)

- Ministry of Defence (MOD)

- Ministry of Home Affairs (MHA)

- Border Security Agencies

- Airports Authority of India

- State Law Enforcement Agencies

- Investments and Venture Capitalist Firms

Research Methodology

Step 1: Identification of Key Variables

The research will begin with identifying critical variables that influence the India EOD market. This involves conducting thorough desk research, combining secondary data sources, and gathering insights from government publications, industry reports, and military procurement documents.

Step 2: Market Analysis and Construction

In this phase, historical data on defense budgets, EOD procurement trends, and the deployment of EOD solutions by Indian armed forces and law enforcement will be compiled. The segmentation of the market by product type, application, region, and technology adoption will be assessed to determine the contribution of each sub-segment to the overall market size.

Step 3: Hypothesis Validation and Expert Consultation

The hypotheses derived from secondary research will be validated through consultations with experts from defense contractors, government agencies, and military personnel. These expert insights will help refine assumptions and ensure data accuracy, especially in areas related to government procurement cycles and the operational effectiveness of EOD technologies.

Step 4: Research Synthesis and Final Output

Finally, the gathered data will be synthesized into a cohesive report. The analysis will be cross-checked against real-time inputs from industry experts, ensuring all market data is both reliable and comprehensive. Additionally, the growth opportunities for local EOD product manufacturers will be identified.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions (EOD Definitions, UXO vs IED vs Bomb Disposal), Data Collection Framework (Primary–Defense Forces, Law Enforcement, OEMs; Secondary–Govt. Sources), Market Sizing Approach (Top‑Down & Bottom‑Up), Modeling Assumptions (Procurement Cycles, Defense Budget Allocations), Limitations and Future Scope)

- Definition and Scope of EOD Market

- Industry Genesis and Evolution

- Global vs India EOD Landscape (Regional Strategic Context)

- Defense & Security Value Chain (Detection → Identification → Neutralization → Disposal)

- Supply Chain Mapping

- Regulatory Framework and Compliance

- Growth Drivers

Defense Modernization Budgets

Counter-IED Imperatives

Public Safety Mandates - Market Restraints

High CapEx of EOD Systems

Skill Shortages for Operators

Regulatory Bottlenecks - Market Opportunities

Indigenization under Aatmanirbhar Bharat

Robotics & AI Integration

After-Sales Service Ecosystem - Market Trends

Shift to Autonomous EOD Robotics

Miniaturized Detection Systems

Remote Explosive Neutralization

Modular Systems - Industry Policy & Regulation

Defense Procurement Procedures (DPP, OEM Qualification

Quality & Safety Standards (National & International Norms

Import Controls, Offsets & Technology Transfer Incentives (e.g., DRDO collaboration on ordnance disposal robot)

- Market Value, 2020-2025

- Volume Consumption Across Subsegments, 2020-2025

- Composite Adoption Intensity, 2020-2025

- By Product and Technology (In Value %)

EOD Robots

Autonomous Robots

Tele-Operated Robots

Portable Detection Systems

X-Ray Systems

Bomb Suits

Counter-IED Tools

Software/AI Analytics - By Application (In Value %)

Military Operations

Law Enforcement & Counter-Terror

Humanitarian Demining

Critical Infrastructure Protection - By End User (In Value %)

Indian Army

Paramilitary Forces

Police Forces

Private Security Contractors

UN/Peacekeeping - By Deployment Environment (In Value %)

Urban

Rural/Conflict Zones

Minefields

Coastal/Marine Areas - By Procurement Type (In Value %)

Direct Government Contracts

FMS/Imports

Indigenous Development

- Market Share Analysis (Value & Volume by Supplier)

- Cross‑Comparison Parameters (Company Overview, Product Portfolio Breadth (Robots, Detection, Protection), Technology Maturity Index (AI, Autonomy), R&D Intensity (% Revenue), After‑Sales & Training Services Network, Defense Procurement Certifications (ISO, DGQA), indigenous Content Levels (Make‑in‑India %), Strategic Partnerships (Govt., DRDO, OEMs))

- SWOT Profiles of Key Players (Strengths, Weaknesses, Market Position)

- Pricing Landscape & Benchmarking (SKU‑Level Pricing & TCO – Total Cost of Ownership)

- Company Profiles

Northrop Grumman Corporation (EOD Robotics & Detection)

L3Harris Technologies, Inc. (Defense Systems)

BAE Systems plc (EOD Solutions)

Textron Inc. (Bomb Disposal Robots)

QinetiQ Group plc (Advanced EOD Tech)

Safran S.A (Detection Systems)

Rheinmetall AG (Robotics & Defense)

Thales Group (Sensor & EOD Tech)

General Dynamics Corporation (Defense Platforms)

Premier Explosives Ltd (Defense Manufacturing, EOD Materials)

Electronic & Engineering Co (I) Pvt Ltd (X‑Ray & Detection)

CDET Explosive Industries Pvt Ltd (EOD Initiation Systems)

ElectroMech Material Handling Systems (Explosion‑Proof Equipment)

SBL Energy Limited (Explosives & Consultancy)

Andor Tech (Defense Support Systems)

- Procurement Cycle Analysis (Defense, Paramilitary, Police)

- Operational Readiness & Utilization Frequency

- Training & Skill Gap Analysis (Certification Levels & Operators)

- Decision Making & Budget Allocation Behavior

- Forecast by Value & Growth Scenarios, 2026-2035

- Forecast by Volume & Composite Penetration, 2026-2035

- Future Demand by Aircraft Segment, 2026-2035