Market Overview

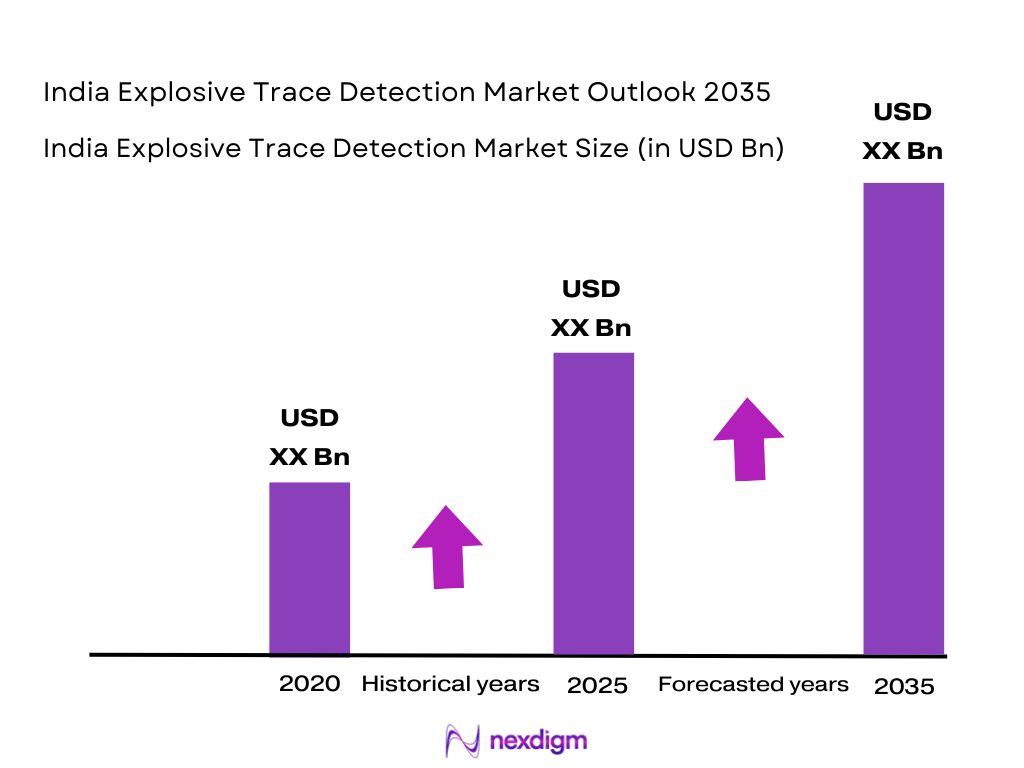

The Indian Explosive Trace Detection (ETD) market has been evolving significantly due to rising security concerns, particularly in the defense, aviation, and border security sectors. In 2025, the market was valued at approximately USD ~ million, with steady growth driven by the increasing demand for sophisticated security systems across transportation hubs, public spaces, and critical infrastructure. The integration of advanced technologies such as ion mobility spectrometry (IMS) and Raman spectroscopy has propelled market expansion, driven by enhanced detection capabilities. Additionally, India’s strategic security initiatives and modernization programs are fueling the market’s growth. As a result, the Indian ETD market is expected to maintain a healthy growth trajectory moving forward.

The market is dominated by key urban centers with high transportation activity and stringent security requirements, such as Delhi, Mumbai, and Bengaluru. These cities are leaders due to their critical infrastructure, which includes international airports, railway stations, and port security systems. Additionally, the proximity to international borders and heightened national security concerns further accelerate the adoption of ETD systems in these regions. Delhi’s status as a hub for defense and government agencies also contributes significantly to the market dominance in the region.

Market Segmentation

By Product Type

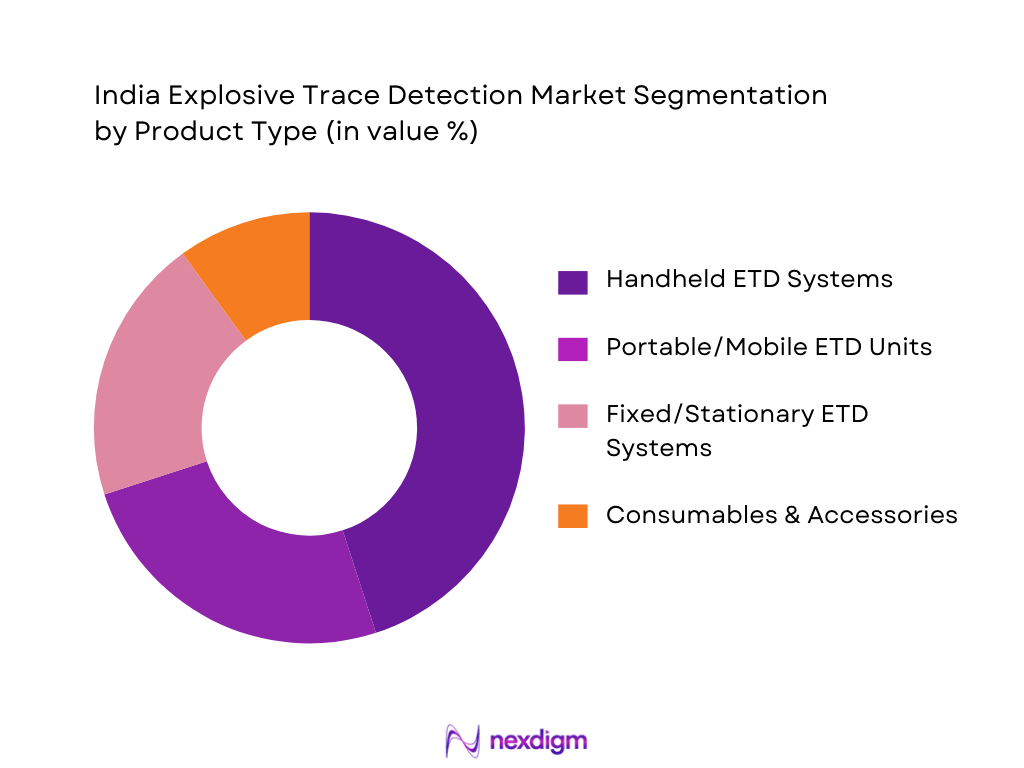

The Indian Explosive Trace Detection market is segmented by product type into handheld ETD systems, portable/mobile ETD units, fixed/stationary ETD systems, and consumables & accessories. Among these, handheld ETD systems dominate the market due to their versatility, ease of deployment, and ability to provide on-the-spot detection. These systems are highly favored by law enforcement agencies and airport security personnel for quick screening in high-risk environments. Additionally, the growing emphasis on enhancing the portability of detection devices has led to a surge in demand for handheld models in various public safety and defense operations. Fixed systems, though crucial in permanent installations at critical infrastructures, have a smaller share compared to handheld units, which offer flexibility in deployment.

By Detection Technology

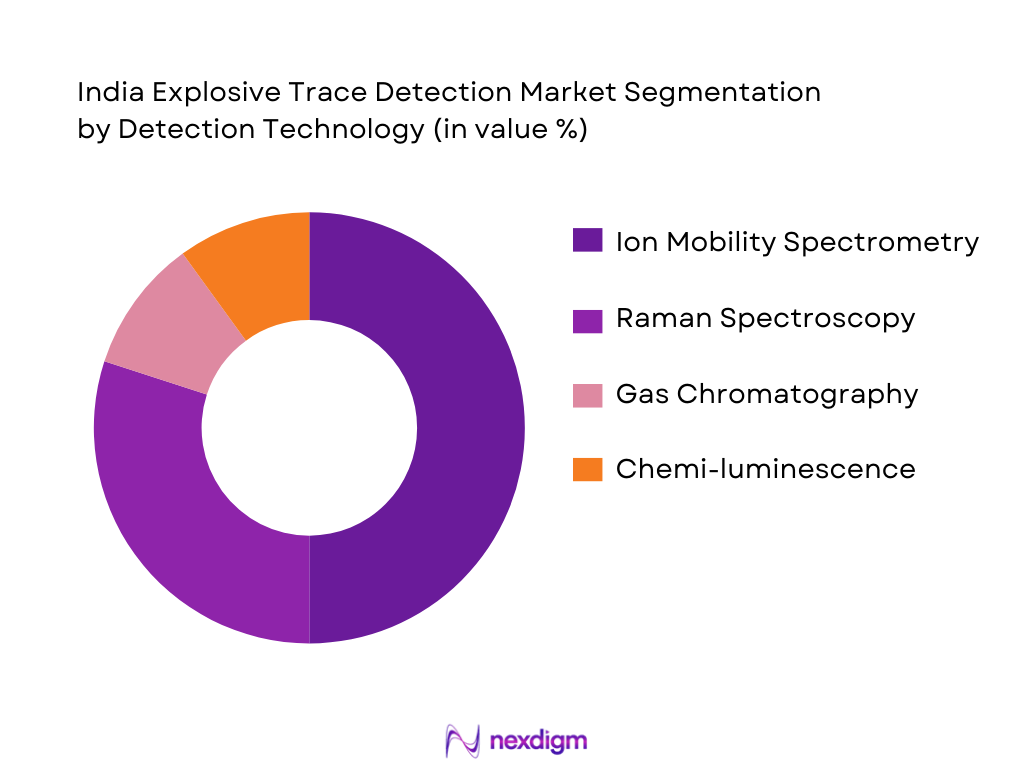

The market is further segmented based on detection technology, including ion mobility spectrometry (IMS), Raman spectroscopy, gas chromatography-based ETD, and chemi-luminescence/biosensor-based ETD. The IMS technology currently holds the dominant position in the Indian market due to its proven reliability and accuracy in detecting explosive traces. It is widely adopted in airports, government buildings, and military installations because of its ability to detect a broad range of substances at minute concentrations. However, newer technologies such as Raman spectroscopy are gaining traction for their ability to analyze solid, liquid, and vapor samples without direct contact. These technologies are seen as complementary to IMS, especially in areas where diverse explosive materials need to be detected.

Competitive Landscape

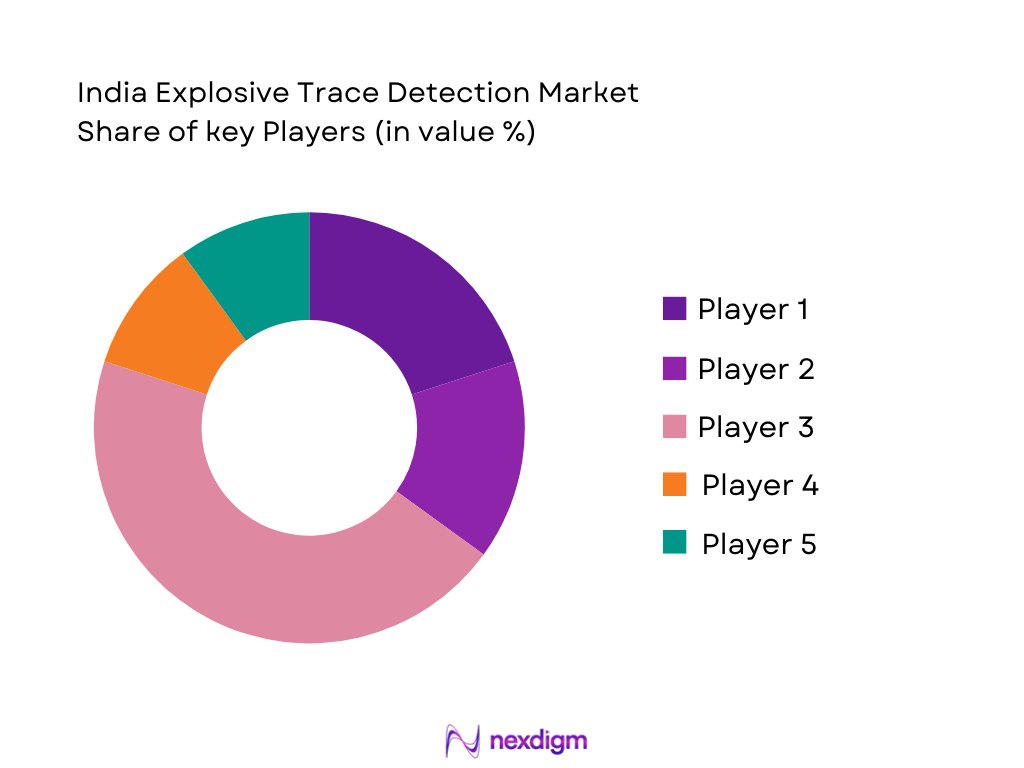

The Indian Explosive Trace Detection market is dominated by a few major global and local players, each contributing significantly to the market’s growth through advanced product offerings, technological innovations, and strategic collaborations. Major players such as Smiths Detection, Rapiscan Systems, and Leidos Holdings lead the market by providing high-quality and reliable ETD systems across sectors like aviation, defense, and public safety. These companies enjoy strong market penetration and have well-established distribution networks across India. Their competitive edge lies in their ability to provide cutting-edge technologies, including ion mobility spectrometry and Raman spectroscopy, and their strong focus on meeting regulatory compliance standards.

| Company | Establishment Year | Headquarters | Detection Technology | Revenue | India Operations | Strategic Partnerships | Technological Advancements |

| Smiths Detection | 1987 | UK | ~ | ~ | ~ | ~ | ~ |

| Rapiscan Systems | 1993 | USA | ~ | ~ | ~ | ~ | ~ |

| Leidos Holdings | 1969 | USA | ~ | ~ | ~ | ~ | ~ |

| Teledyne FLIR | 1975 | USA | ~ | ~ | ~ | ~ | ~ |

| Analogic/AS&E | 1968 | USA | ~ | ~ | ~ | ~ | ~ |

India Explosive Trace Detection Market Analysis

Growth Drivers

Government regulatory mandates on ETD at civil aviation checkpoint

The India Explosive Trace Detection (ETD) market is significantly driven by government regulatory mandates that require enhanced security measures at civil aviation checkpoints. These regulations stipulate the mandatory use of advanced security technologies such as ETD systems to ensure passenger safety and mitigate the risk of terrorist activities. As India continues to modernize its aviation sector, the demand for ETD systems has escalated, as airports must comply with international standards and provide effective screening for explosive materials at critical transportation hubs.

Defense Modernization & Counter-IED Capabilities:

The modernization of India’s defense infrastructure, coupled with the need to combat the growing threat of improvised explosive devices (IEDs), further fuels the demand for ETD systems. As the Indian military enhances its counter-terrorism and counter-IED capabilities, there is an increasing need for advanced detection solutions that can efficiently identify explosives in varied environments. This includes the use of ETD systems in military bases, defense installations, and border security checkpoints, contributing to the broader adoption of this technology in the defense sector.

Market Challenges

False Positive Rate & Interoperability Issues

A significant challenge in the India ETD market is the high false positive rate that some detection systems exhibit. False alarms can cause delays, disrupt operations, and reduce the credibility of security checks, especially in high-traffic environments like airports. The interoperability of different detection systems also presents challenges, as seamless integration between various technologies is often difficult. This can lead to inefficiencies, making it harder for security agencies to implement comprehensive solutions that utilize multiple detection methods for increased reliability.

High Initial CAPEX & Lifecycle Maintenance Cost

The high initial capital expenditure (CAPEX) required to procure advanced ETD systems remains a major challenge, particularly for smaller and regional security agencies. The complexity of the systems and the need for ongoing maintenance add to the overall cost, which can hinder the adoption of ETD systems in certain sectors. Additionally, the lifecycle maintenance costs, including calibration, servicing, and software upgrades, are ongoing financial burdens for organizations. These high costs can deter some potential buyers, limiting the market’s broader penetration.

Opportunities

AI-Driven Analytics for False Alarm Reduction

The integration of artificial intelligence (AI) into ETD systems presents a promising opportunity for the India market. By utilizing machine learning algorithms and advanced analytics, AI can significantly reduce false alarm rates and improve the overall efficiency of explosive detection systems. AI-powered ETD systems can identify patterns, analyze large datasets in real-time, and learn from past detections to enhance accuracy. This technology promises to optimize operational efficiency and reduce disruptions, making ETD systems more reliable and cost-effective in high-security environments.

Indigenous Manufacturing & Technology Development (DRDO, Startups)

Another opportunity lies in the push for indigenous manufacturing and technology development within India. Government initiatives to boost local production of defense and security technologies, such as those supported by the Defence Research and Development Organisation (DRDO), provide a strong foundation for the development of cost-effective and India-specific ETD solutions. Collaborations with local startups and research institutions can foster innovation and reduce reliance on imported technologies. This also has the potential to lower production and procurement costs, making ETD systems more accessible for a wider range of security agencies and industries in India.

Future Outlook

The Indian Explosive Trace Detection market is poised for significant growth over the next few years. With increasing terrorist threats, national security concerns, and the expansion of critical infrastructure, the demand for ETD systems is expected to rise substantially. Furthermore, the government’s focus on modernizing defense and security mechanisms will provide a conducive environment for ETD systems. Technological advancements, including AI-based detection, mobile units, and the integration of multispectral sensors, will drive the market forward. By 2030, the market is projected to show consistent growth, with the penetration of advanced technologies such as Raman spectroscopy and hybrid detection systems.

Major Players

- Smiths Detection

- Rapiscan Systems

- Leidos Holdings

- Teledyne FLIR

- Analogic/AS&E

- Chemring Group

- L3Harris Technologies

- OSI Systems

- Honeywell International

- Bruker Corporation

- Kromek Group

- Detection Technologies

- Selex ES (Leonardo)

- SAAB

- Unisys Corporation

Key Target Audience

- Defense Agencies (Ministry of Defense, Indian Army)

- Aviation Authorities (Directorate General of Civil Aviation, Airports Authority of India)

- Border Security Forces (Border Security Force, Indo-Tibetan Border Police)

- Law Enforcement Agencies (Central Bureau of Investigation, Indian Police Forces)

- Private Security Providers (G4S, SIS)

- Airport Operators (Delhi International Airport Limited, Chhatrapati Shivaji Maharaj International Airport)

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Home Affairs, Bureau of Civil Aviation Security)

Research Methodology

Step 1: Identification of Key Variables

The research begins with constructing an ecosystem map of stakeholders involved in the Indian Explosive Trace Detection market. This step relies on secondary research, gathering data from proprietary databases, industry reports, and official government publications to identify key variables affecting market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data about market trends, regional adoption rates, and the impact of government initiatives are analyzed. We assess revenue generation from different sectors like airports, defense, and public safety, ensuring the accuracy of revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated by conducting expert interviews with industry professionals and key players. This helps in refining our analysis and gaining first-hand insights into the operational aspects of ETD systems.

Step 4: Research Synthesis and Final Output

The final analysis integrates insights from direct consultations with technology manufacturers and end-users. This final phase ensures the accuracy of the report by cross-referencing data from primary and secondary sources.

- Executive Summary

- Research Methodology (Market Definitions, Scope of India ETD Market, Abbreviation Glossary, Data Triangulation (Primary + Secondary), Sample Design (Govt & Private agencies), Assumptions, Limitations, Forecast Modelling Techniques (CAGR, TAM, SAM, SOM))

- Definition and Scope of ETD Systems in India & Border Security

- Origin & Evolution of ETD Deployment in India

- Historical Policy & Regulatory Timeline (Aviation, Border, Critical Infrastructure)

- Security Threat Landscape (Terrorism, IED Risks, Public Safety)

- National Security Procurement Framework & Funding Paths

- Growth Drivers

Government regulatory mandates on ETD at civil aviation checkpoint

Defense modernization & counter‑IED capabilities

Border security upgradation and international treaties

- Market Challenges

False positive rate & interoperability issues

High initial CAPEX & lifecycle maintenance cost

Skill shortage & training needs for ETD operators

- Opportunities

AI‑driven analytics for false alarm reduction

Indigenous manufacturing & technology development (DRDO, startups)

Integration with multi‑sensor screening platforms

- Trends

Shift to dual‑mode detection

Miniaturized, ruggedized portable ETD deployment

Cloud & mobile connectivity for real‑time threat alerts

- Regulatory & Policy Landscape

ICAO/TSA aligned standards for aviation security

India C‑MET/BCAS / Ministry of Home Affairs compliance

Data privacy & ETD analytics usage norms

- Market Value, 2020-2025

- Volume Consumption Across Subsegments, 2020-2025

- Composite Adoption Intensity, 2020-2025

- By Product Type (In Value %)

Handheld ETD Systems (Operational Mobility Index)

Portable/Mobile ETD Units (Deployment Flexibility Score)

Fixed/Stationary ETD Systems (Infrastructure Integration Metric)

Consumables & Accessories (Reagent & Swab Usage Volume)

ETD Software & Analytics Solutions (False Alarm Reduction Factor)

- By Detection Technology (In Value %)

Ion Mobility Spectrometry (IMS) (Detection Sensitivity %)

Raman Spectroscopy (Material Specificity Index)

Gas Chromatography‑based ETD (Resolution & Throughput Score)

Chemi‑luminescence & Biosensor Based ETD (Environmental Robustness Index)

Hybrid / Dual‑Mode Systems (Adoption Growth Rate)

- By Deployment Mode (In Value %)

Installed Security Checkpoints (Airports, Railway Stations)

Border Entry Points (Land/Sea Crossings)

Defense Bases & Strategic Sites (Threat Coverage Metric)

Event Security & Public Gatherings (Rapid Deployment Index)

Logistics & Cargo Screening (Throughput Efficiency %)

- By End‑Use Sector (In Value %)

Aviation & Airport Security (Regulatory Mandate Level)

Defence & Military (Operational Demand Score)

Public Safety / Homeland Security (Incident Response Index)

Critical Infrastructure Protection (Risk Exposure Score)

Commercial & Industrial (Insurance & Compliance Index)

- Market Share (Value & Unit) – Vendor & Product Class

- Cross‑Comparison Parameters (Product Technology Mix & Detection Efficacy, Installed Base & Renewal Rates, Distribution & Service Footprint, Government Contracts & Approval Status, R&D Investment & Localisation Strategy (indigenous tech factor), After‑sales Support &, Training Programs)

- Pricing Architecture & Value Per Device

- Compliance Certification Scores

- Detailed Company Profiles

Smiths Detection (UK/Global)

Rapiscan Systems (US/Global)

Leidos Holdings (US)

Teledyne FLIR (US)

Thermo Fisher Scientific (US)

Analogic/AS&E (US)

Chemring Group (UK)

L3Harris Technologies (US)

OSI Systems (US)

Elbit Systems (Israel)

Honeywell International (US)

Nomadics/FLIR Fido Series (US Tech)

Kromek Group (UK Tech)

Analog Devices / GC‑MS suppliers (US/EU Tech)

Indian Domestic ETD Innovators

- Adoption patterns by agency (Aviation Security, Central Armed Police Forces, Defence)

- Procurement cycle & budget allocation practices

- Operational pain points & technology preference

- Decision criteria for ETD acquisition

- Forecast by Value & Growth Scenarios, 2026-2035

- Forecast by Volume & Composite Penetration, 2026-2035

- Future Demand by Aircraft Segment, 2026-2035