Market Overview

The India Fashion Retail Market is valued at USD 60.12 billion in 2024, following continuous expansion driven by rising disposable incomes, urbanization, and a young, fashion-conscious population. Growth is further propelled by increased smartphone usage and internet penetration—which expanded India’s e-commerce sales to USD 107.7 billion—and government support via “Make in India” and textile sector schemes.

Major metros like Mumbai, Delhi-NCR, Bengaluru, and Chennai dominate due to their affluent consumer base, high retail real estate activity, and stronger brand presence. These cities serve as trend incubators thanks to their large working-age population and brand-savvy culture. Equally, Tier-II and Tier-III cities (e.g., Chandigarh, Ahmedabad, Pune) are fast-growing hubs as rising incomes and digital access enable brands to expand their footprint beyond Metro regions.

Market Segmentation

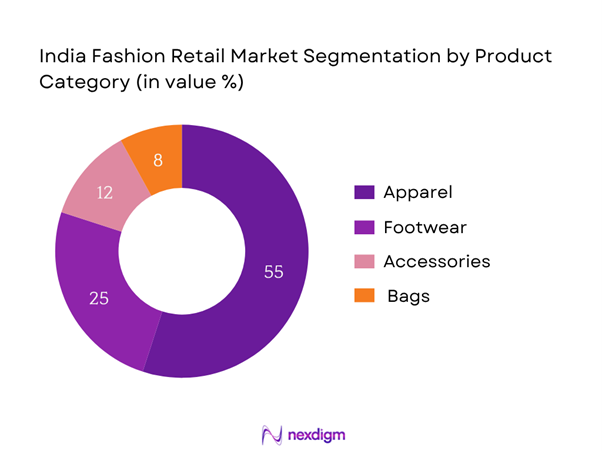

By Product Category

India’s fashion retail market is fragmented across apparel, footwear, accessories, and bags. Apparel leads the pack with approximately 55% share, owing to its wide range—from daily wear to ethnic and performance outfits. The dominance comes from established Indian fashion preferences, strong domestic manufacturing, and frequent wardrobe renewals. Leading brands such as W, Allen Solly, and Pantaloons reinforce apparel’s dominance through expansive inventories and mass reach.

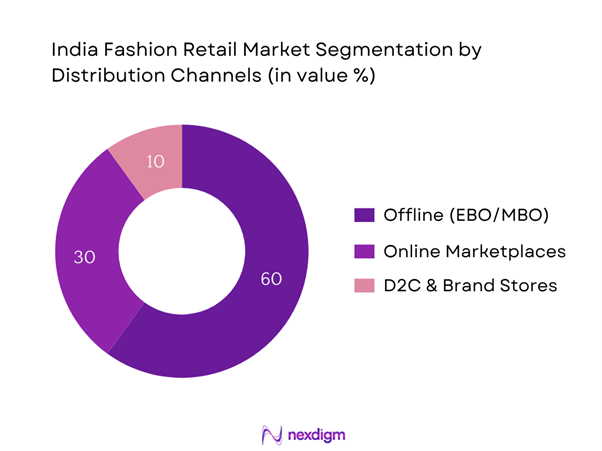

By Distribution Channel

Offline retail remains dominant with 60% share, due to Indian consumers’ preference for physical try-ons, immediate purchase, and retail experience. Nonetheless, Online Marketplaces hold about 30%, growing rapidly—especially among Millennials and Gen Z—for convenience, extensive choice, and competitive pricing. On the rise is D2C & Brand Stores (~10%), as emerging labels like Liva, Libas, and Bewakoof drive omnichannel strategies targeting niche consumer needs.

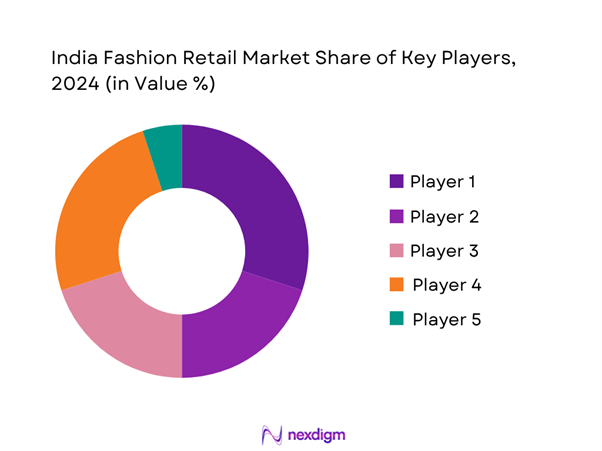

Competitive Landscape

India’s fashion retail arena is led by a mix of multi-category retail chains, e-commerce platforms, D2C labels, and specialty brands, marking a strong consolidation among top players. Large conglomerates (e.g., ABFRL, Reliance Retail, Trent) hold substantial offline presence via Exclusive and Multi-Brand Outlets. E-commerce leaders (Myntra, Amazon Fashion, Ajio) leverage digital convenience and technology-led personalization to challenge traditional retailers. Meanwhile, D2C and regional brands gain traction by focusing on sustainability, unique design, and niche differentiation.

| Company | Founded | HQ | Offline Stores | Online Share | Private Label % | Product Range | Premium Positioning | Sustainability Initiatives |

| Aditya Birla Fashion & Retail | 2010 | Mumbai | – | – | – | – | – | – |

| Reliance Retail ( Ajio) | 1975 | Mumbai | – | – | – | – | – | – |

| Shoppers Stop | 1991 | Mumbai | – | – | – | – | – | – |

| Metro Brands | 1977 | Mumbai | – | – | – | – | – | – |

| Myntra (Flipkart) | 2007 | Bengaluru | – | – | – | – | – | – |

India Fashion Retail Market Analysis

Growth Drivers

Rising Urban Middle Class

India’s urban population reached approximately 523 million in 2023, up from 511 million in 2022, demonstrating sustained urbanisation at an annual growth rate of 2.27%. Urban households tend to exhibit higher disposable income and lifestyle-oriented spending, driving demand for fashion and apparel. With nearly 131.9% urban teledensity and over 949 million broadband subscribers, urban consumers enjoy seamless exposure to digital fashion trends and platforms. This expanding urban base directly benefits fashion retail, pushing stores and brands to scale in metro and Tier‑1 cities.

Smartphone Penetration

According to MoSPI, 85.5% of Indian households now own at least one smartphone, supporting digital commerce and omni‑channel retail models. India recorded 290 million 5G subscriptions by end‑2024, representing 24% of all mobile connections, and an average data usage of 32 GB per user per month. Additionally, the gender gap in smartphone ownership narrowed from 40% to 32%, increasing access across all consumer segment. These trends lower barriers for online shopping and fashion discovery, boosting reach for D2C and e-commerce brands targeting all demographics.

Market Challenges

High Return Rates

The expansive e-commerce fashion segment in India faces persistent high return rates, largely attributed to ill-fitting apparel. While no definitive national-level number is available from sectoral bodies, industry feedback suggests returns of 35–50% in some product categories. This places significant pressure on inventory asset management, reverse logistics, and cost efficiency. Return volume exacerbates warehousing needs and labor costs for inspection, restocking, and repacking. Moreover, integration across physical and online channels magnifies complexity, demanding investments in IT systems and omnichannel fulfilment to reduce return burdens and maintain profitability.

Inventory Management

India’s fragmented retail ecosystem comprises both organised retailers and millions of unorganised shops. Organised players report 10–15% annual inventory obsolescence, driven by unpredictable demand, seasonal trends, and supply chain disruptions. The absence of standardised SKU coding and centralized data hampers accurate stocking. Urbanisation and digital proliferation are adding SKU diversification, further complicating inventory planning. Retailers must invest in RFID, demand forecasting tools, and distribution optimization to align stock with real-time demand across metro and smaller city outlets to avoid overstock or stockouts.

Market Opportunities

Tier‑II/III Penetration

With urbanisation projected to reach 40% of the population by 2036, translating into approximately 600 million urban dwellers, Tier-II and Tier-III cities represent vast untapped reservoirs of fashion consumption. These cities currently account for over 36% of India’s urban population, generating growing disposable incomes and opening new retail frontiers. Organised fashion retailers can capture this wave by adapting to local cultural nuances and pricing expectations. Franchise models, pop-up stores, and digital marketing tailored to regional languages are effective enablers to penetrate these geographies and convert aspirational consumers into loyal brand customers.

Sustainable Fashion

Over 949 million broadband internet users and rising youth engagement on digital platforms are fueling awareness around environmental sustainability and ethical fashion. Approximately 20% of Indian women engaged in informal or casual work segments are increasingly influencing demand for eco‑conscious clothing. Awareness campaigns around zero-waste, slow fashion, and circularity are gaining resonance via digital influencers and conscious consumer groups. Brands incorporating sustainable fabrics, recycling initiatives, and supply‑chain transparency are better positioned to retain loyalty among millennial and Gen Z consumers, making sustainability a future growth lever.

Future Outlook

Over the next six years, India’s Fashion Retail Market is expected to grow robustly at a CAGR of 12.87%, driven by rising discretionary spending, digital adoption, and urban penetration. Omnichannel integration will strengthen as retailers blend physical presence with online strategies. Sustainability will remain central, with eco-conscious consumers preferring ethical fashion. Furthermore, smaller cities present vast opportunities—particularly in value and mid-tier segments—as local tastes align with national brand strategies and premium product launches.

Major Players

- Aditya Birla Fashion & Retail

- Reliance Retail (including TRENT, Ajio)

- Shoppers Stop

- Myntra

- Amazon Fashion India

- ABFRL – Pantaloons

- Arvind Brands (Flying Machine, US Polo)

- Fabindia

- H&M India

- Zara India (Inditex)

- Decathlon India

- Biba Apparels

- Lifestyle (Landmark Group)

- Metro Brands

- Libas

Key Target Audience

- Brand & Retail CEOs/Founders

- Investors and Venture Capitalist Firms

- Private Equity Funds

- Strategic Business Units within Retail Conglomerates

- Fashion & E-commerce CFOs/COOs

- Real Estate Developers (Retail Leasing)

- Agricultural & Textiles Ministry & Directorate General of Foreign Trade

- Trade Associations (e.g., FICCI, CII)

Research Methodology

Step 1: Identification of Key Variables

Mapping of stakeholders (brands, manufacturers, retailers, platforms), supported by desk research leveraging government and industry databases. Objective: define variables like channel split, price tiers, urban penetration.

Step 2: Market Analytics & Estimation

Historical data (2019–2024) were quantified with channel-wise and product-wise revenue breakdowns. Unit volumes per consumer cohort and price tiers were back-calculated to cross-verify the overall market size.

Step 3: Expert Consultation

Quantitative hypotheses were tested through expert interviews across brands (Myntra, Ajio), retailers (Shoppers Stop, Fabindia), and manufacturers (Arvind, Metro). Insights refined assumptions in areas like growth projections and channel mix.

Step 4: Bottom-Up Validation

Primary data from brands, real estate leasing trends, and supplier procurement volumes validated the estimates. Cross-verification with e-commerce data from Flipkart and Amazon ensured alignment with industry-reported growth trajectories.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, In-depth Industry Interviews, Primary & Secondary Research, Limitations and Caveats)

- Definition and Scope

- Historical Evolution and Market Genesis

- Fashion Retail Lifecycle and Maturity Curve

- Value Chain and Retail Supply Chain Mapping

- Timeline of Key Market Developments and Brand Expansions

- Growth Drivers

Rising Urban Middle-Class

Smartphone Penetration

Working Women Population

D2C Brands Growth - Market Challenges

High Return Rates

Inventory Management

Unstructured Unorganized Market Share - Market Opportunities

Tier-II/III Penetration

Sustainable Fashion

Tech-driven Retail Personalization - Market Trends

Rental & Thrift Fashion

AI-Based Styling

Experiential Retail - Government Regulations

FDI Policy

Textile & Apparel Schemes

GST Impact on Apparel - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Ticket Size, 2019-2024

- By Units Sold, 2019-2024

- By Product Category (In Value %)

Casualwear

– T-Shirts & Tops

– Jeans & Trousers

– Dresses & Skirts

– Casual Shirts

– Sweatshirts & Hoodies

Formalwear

– Business Suits & Blazers

– Formal Shirts & Trousers

– Office Dresses & Skirts

– Ethnic Formal (Kurta Sets, Sarees)

– Uniforms

Sportswear

– Activewear Sets

– Track Pants & Joggers

– Yoga & Gym Apparel

– Sports Footwear

– Athleisure (Fusion of Sports & Casual)

Footwear

– Formal Shoes

– Casual Shoes & Sneakers

– Ethnic Footwear

– Flip-Flops & Slippers

– Sports & Running Shoes

Fashion Accessories

– Bags & Wallets

– Watches & Jewellery

– Belts, Scarves & Ties

– Sunglasses

– Caps, Hats & Socks - By Gender (In Value %)

Menswear

Womenswear

Kidswear

Unisex - By Distribution Channel (In Value %)

Exclusive Brand Outlets (EBOs)

– Single-brand Stores

– Franchise vs. Company-Owned Outlets

Multi-Brand Outlets (MBOs)

– Large Format Retail

– Local/Regional Retail Chains

Department Stores

– Premium Department Stores

– Discount Chains

Online Marketplaces

– E-commerce Giants

– Fashion Aggregators

Direct-to-Consumer (D2C)

– Brand-Owned Websites/Apps

– Instagram/WhatsApp Storefronts

– Subscription-Based Fashion Services - By City Tier (In Value %)

Metro Cities

Tier I Cities

Tier II Cities

Tier III Cities & Rural - By Price Segment (In Value %)

Luxury / Premium

– International Brands

– Designer Labels & Limited Editions

Mid-Range

– Branded but Affordable

– Urban Professionals, Young Adults

Value for Money

– Mass Appeal Brands

– Fashion-Conscious Budget Buyers

Economy/Budget

– Local Labels & Unbranded Apparel

– Kirana + Apparel Mix, Weekly Bazaars, Tier 3/Rural Market73

- Market Share Analysis by Product Category and Channel (Apparel, Footwear, Accessories)

- Cross Comparison Parameters (Company Overview, Channel Strategy, Distribution Network & Franchise Penetration, Digital Adoption & E-commerce Contribution, Private Label Contribution, Number of Physical Stores, Brand Collaborations and Endorsements, Exclusive Brand Outlet Count, SKU Breadth and Collection Refresh Rate)

- SWOT Analysis of Major Players

- SKU-Level Pricing Analysis across Key Brands

- Detailed Company Profiles

Reliance Retail (Trends, Azorte)

Aditya Birla Fashion and Retail Ltd (Pantaloons, Allen Solly, Van Heusen)

Tata Trent (Westside, Zudio)

Future Lifestyle Fashion (Central, Brand Factory)

Arvind Fashions (U.S. Polo Assn., Flying Machine)

Shoppers Stop

Myntra (Walmart/Flipkart Group)

Amazon Fashion India

Nykaa Fashion

Fabindia

H&M India

Zara India (Inditex)

Decathlon India

Biba Apparels

Lifestyle (Landmark Group)

- Purchase Motivation and Frequency

- Gender-Specific Shopping Trends

- Decision-Making Drivers (Style, Price, Sustainability, Brand)

- Omnichannel Journey and Preferences

- Value Perception by Income Group

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Ticket Size, 2025-2030

- By Units Sold, 2025-2030