Market Overview

The India firearm sight market is valued at USD ~ million in 2024, driven by increasing investments in defense and law enforcement sectors. The growth of advanced firearm sight technologies, such as red dot sights and holographic sights, has attracted considerable attention from both government and private entities. The demand is also fueled by the growing adoption of firearm sights among civilians for sports, hunting, and self-defense. The market’s expansion is further supported by a robust increase in security concerns and advancements in sighting technologies.

India is one of the dominant players in the firearm sight market, with major consumption centered in cities like Delhi, Mumbai, and Bengaluru. These cities are key due to their significant military presence, law enforcement activities, and civilian recreational shooting events. Moreover, India’s strategic location, coupled with heightened defense budgets and an increasing demand for high-tech firearm accessories, contributes to the market dominance in these regions.

Market Segmentation

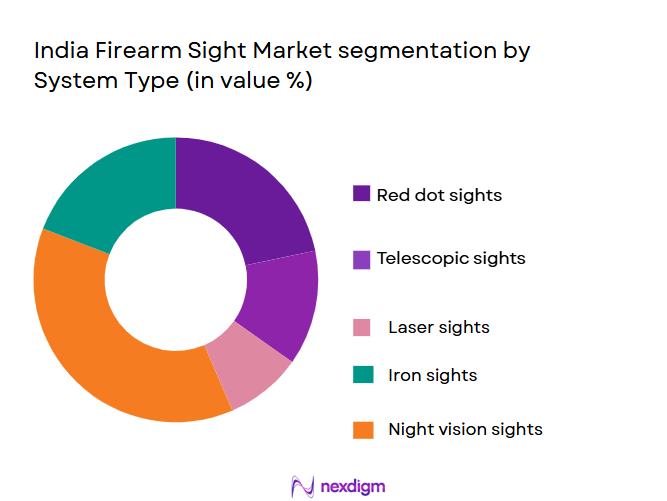

By System Type

The India firearm sight market is segmented by system type, with red dot sights holding a dominant share. The increasing adoption of red dot sights is attributed to their simplicity, ease of use, and rapid target acquisition capabilities. Red dot sights are highly favored by both law enforcement and civilian users due to their ability to provide quick aiming solutions in dynamic environments. These sights offer low-profile designs and a wide field of view, making them suitable for a variety of firearm types, including rifles and handguns.

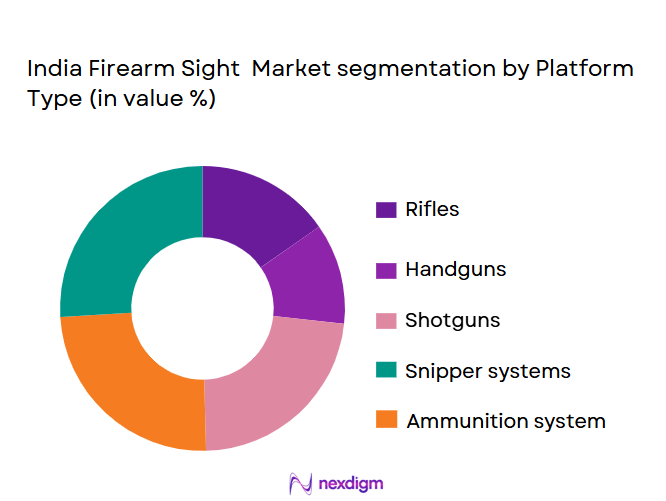

By Platform Type

The platform type segment of the India firearm sight market is largely dominated by rifles, which account for the highest share. Rifles are used extensively by both military and law enforcement agencies, which necessitates the use of advanced sights for precision and accuracy. Additionally, the growing trend of long-range shooting sports in India has increased the demand for high-quality sights in rifle platforms. The military’s preference for magnified optics and the civilian sector’s reliance on red dot sights for sport shooting further contributes to rifles’ dominance in the market.

Competitive Landscape

The India firearm sight market is dominated by a mix of global and local manufacturers, with significant contributions from companies like Aimpoint, Trijicon, and Vortex Optics. These companies provide a wide range of sighting systems for military, law enforcement, and civilian users. Their competitive edge lies in product innovation, brand reputation, and technological advancements that cater to various needs in the market. The competition is intensified by the rapid development of new technologies such as smart and electronic sights, which provide superior performance over traditional sights.

| Company | Establishment Year | Headquarters | Product Range | Technology Focus | Key Markets | Strategic Initiatives |

| Aimpoint | 1975 | Sweden | ~ | ~ | ~ | ~ |

| Trijicon | 1981 | USA | ~ | ~ | ~ | ~ |

| Leupold | 1907 | USA | ~ | ~ | ~ | ~ |

| Vortex Optics | 2004 | USA | ~ | ~ | ~ | ~ |

| Holosun | 1980 | USA | ~ | ~ | ~ | ~ |

India firearm sight Market Dynamics

Growth Drivers

Rising demand for precision and accuracy in firearm systems

The growing emphasis on enhancing the precision and accuracy of firearms is driving the demand for advanced sighting systems in India. Both military and law enforcement agencies are adopting cutting-edge optical technologies to ensure that their personnel can perform effectively in high-pressure environments. With India’s defense budget increasing, more resources are being allocated for the modernization of weapons, including firearm sights. These precision technologies are crucial for military operations, law enforcement activities, and civilian sporting purposes, further propelling market growth.

Increasing investment in defense and law enforcement sectors

India’s commitment to strengthening its defense infrastructure is reflected in the rising investments in defense and law enforcement sectors. The Indian government’s focus on modernization, including upgrading weaponry with advanced sights, has led to a greater demand for such systems. A surge in defense budgets and initiatives for the expansion of police forces and their equipment ensures that firearm sights remain a priority for Indian security agencies. The increasing awareness of the need for high-quality weapon accessories to improve operational effectiveness further enhances the growth prospects of the firearm sight market.

Market Challenges

Stringent firearm regulations

The regulatory landscape surrounding firearms in India remains a challenge for the firearm sight market. The strict laws governing firearm ownership, which are aimed at controlling the spread of firearms among civilians, limit the potential market size for sights in the private sector. This regulatory environment, with its lengthy processes for obtaining firearm licenses, restricts the widespread adoption of firearm accessories like sights. While law enforcement and military sectors continue to contribute significantly to market growth, the civilian market is constrained by these regulations, which impedes broader market expansion.

High initial costs for advanced systems

One of the significant challenges facing the firearm sight market in India is the high upfront cost of advanced sighting systems. With prices for high-end sights, such as holographic and magnified sights, ranging from INR ~to INR ~ many potential buyers, particularly in the civilian market, are deterred by the price. While the military and law enforcement agencies may have the budget to afford such systems, the high cost remains a barrier for widespread adoption across lower-budget consumer segments. Additionally, taxes and import duties on foreign-made sights make them even more expensive, further limiting their reach.

Opportunities

Growing civilian interest in recreational shooting

The increasing popularity of shooting sports in India presents a significant opportunity for the firearm sight market. With a growing number of recreational shooters and the establishment of shooting ranges across urban areas, the demand for high-quality firearm sights is rising. As more Indians engage in shooting sports, especially in states like Delhi and Maharashtra, the need for precision sights, particularly red-dot and reflex sights, will continue to grow. The increasing disposable income of the urban middle class and the rising interest in professional shooting competitions also contribute to this expanding market.

Technological innovations in smart and electronic sights

Technological advancements in firearm sight systems, particularly in smart and electronic sights, present new opportunities for market growth. Innovations such as augmented reality-based optics and sensor-integrated sights, which enhance targeting precision in low-light and complex environments, are gaining traction. The increasing demand for smart optics in military and law enforcement applications, combined with the growing adoption of high-tech sights in civilian shooting sports, creates significant opportunities for manufacturers. As India modernizes its defense infrastructure and embraces cutting-edge technologies, the market for these advanced sighting systems is expected to expand.

Future Outlook

Over the next decade, the India firearm sight market is expected to exhibit substantial growth, driven by increased defense spending, technological advancements in sighting systems, and growing adoption among civilians. The market will benefit from the rising security concerns, particularly in urban areas, along with the modernization of military equipment. The proliferation of advanced sighting technologies, such as smart optics and night vision systems, is expected to drive the demand across various user segments, including law enforcement, military, and recreational users. Additionally, the increasing popularity of shooting sports in India is set to further boost the market, as more consumers invest in high-performance firearm sights.

Major Players

- Aimpoint

- Trijicon

- Leupold

- Vortex Optics

- Holosun

- Bushnell

- Sig Sauer

- ATN Corporation

- Meprolight

- Primary Arms

- Burris Optics

- Nikon

- EOTech

- Delta Optical

- Sightmark

Key Target Audience

- Government and Regulatory Bodies

- Defense Contractors and OEM Manufacturers

- Law Enforcement Agencies (e.g., Indian Police Forces, Border Security Force)

- Military Organizations (e.g., Indian Army, Navy, Air Force)

- Shooting and Hunting Associations

- Civilian Sporting Enthusiasts

- Security and Surveillance Companies

- Investments and Venture Capitalist Firms

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map that identifies all significant stakeholders within the India firearm sight market. This step is backed by comprehensive desk research, using both secondary and proprietary databases to gather essential industry-level data. The primary goal is to define and analyze the critical factors affecting market dynamics.

Step 2: Market Analysis and Construction

In this stage, historical data is collected and analyzed to assess market penetration, the balance of marketplace actors, and revenue generation patterns. We will evaluate the level of service quality across different sectors to ensure accurate revenue estimates and a clear understanding of market growth.

Step 3: Hypothesis Validation and Expert Consultation

We will validate our hypotheses through expert consultations, using computer-assisted telephone interviews (CATIs) with professionals representing a range of companies. These consultations will offer valuable operational and financial insights that will help refine and confirm the gathered market data.

Step 4: Research Synthesis and Final Output

This phase involves direct engagement with various manufacturers to obtain detailed information regarding product segments, sales performance, and customer preferences. These insights will be combined with data from earlier research phases to ensure a comprehensive and validated market analysis.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising demand for precision and accuracy in firearm systems

Increasing investment in defense and law enforcement sectors

Technological advancements in sighting systems - Market Challenges

Stringent firearm regulations

High initial costs for advanced systems

Complexity of integration with various firearm platforms - Market Opportunities

Growing civilian interest in recreational shooting

Technological innovations in smart and electronic sights

Expansion of defense budgets in India - Trends

Increasing adoption of compact and lightweight sighting systems

Integration of advanced electronics for enhanced targeting

Rising demand for customized firearm sight systems

- Government Regulations & Defense Policy

FDI Rules

Offset Obligations

Export Licenses - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

- Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Red Dot Sights

Reflex Sights

Holographic Sights

Magnified Sights

Laser Sights - By Platform Type (In Value%)

Rifles

Handguns

Shotguns

Machine Guns

Sniper Rifles - By Fitment Type (In Value%)

Integrated

Rail-mounted

Clip-on

Side-mounted

Universal Fit - By EndUser Segment (In Value%)

Military

Law Enforcement

Sports & Recreation

Civilian Self-Defense

Hunting - By Procurement Channel (In Value%)

Direct Sales

Distributors

Online Retail

Government Contracts

OEM Partnerships

- Market Share Analysis

- Cross Comparison Parameters

(Price, System Type, Platform Compatibility, Fitment Type, End-User Segment Market Penetration, Technology Integration, R&D Investment, Operational Efficiency, Customer Retention, Regulatory Compliance, Product Portfolio Diversity) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Aimpoint

Trijicon

Leupold

EOTech

Bushnell

Vortex Optics

Nikon

Meprolight

Sig Sauer

ATN Corporation

Primary Arms

Holosun Technologies

Burris Optics

Sightmark

Delta Optical

- Growing adoption of firearm sights in the military sector

- Rising use of sights in law enforcement operations

- Surge in civilian demand for advanced optics in shooting sports

- Increased interest in high-quality sights for hunting

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035