Market Overview

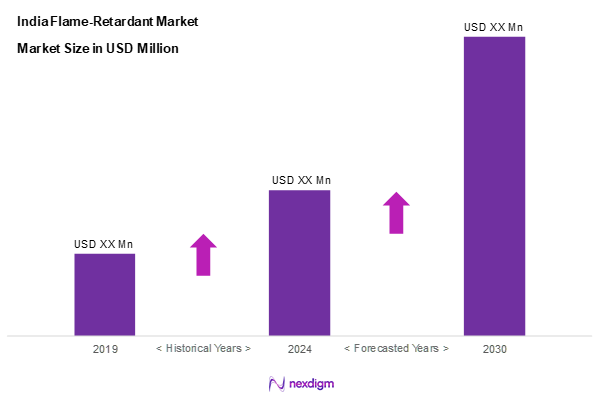

The India flame-retardant market is valued at USD 732.3 million, based on a thorough historical analysis. This growth is primarily driven by increased regulations on fire safety across various sectors, including construction and automotive industries. The heightened awareness of fire hazards and the subsequent demand for fire-resistant materials are fuelling market expansion. The rising construction activities and a growing manufacturing base further contribute to the market valuation.

Key cities dominating the India flame-retardant market include Mumbai, Delhi, and Bangalore, due to their status as industrial hubs and their rapid urban development. These cities are witnessing significant investments in infrastructure and construction, thereby spurring demand for flame-retardant materials. In addition, Mumbai serves as a financial centre, attracting businesses from various industries that prioritize safety regulations, while Bangalore is at the forefront of technological advancements, particularly in manufacturing and R&D sectors.

Market Segmentation

By Product Type

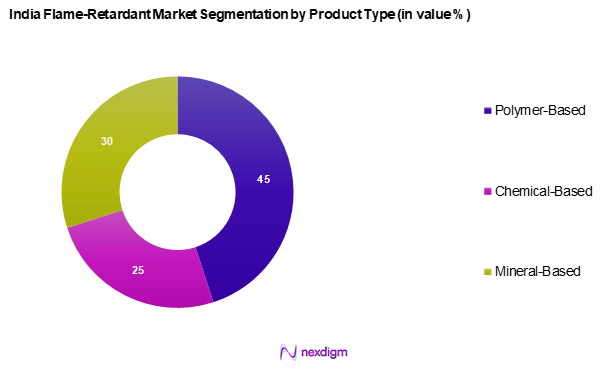

The India flame-retardant market is segmented into polymer-based, chemical-based, and mineral-based flame retardants. Polymer-based flame retardants hold a dominant market share due to their wide-ranging applications and superior performance characteristics. The versatility of polymer-based flame retardants in various products, from textiles to construction materials, further contributes to their prevalence. Their ability to blend with other materials seamlessly while providing effective fire protection makes them highly sought after by manufacturers seeking compliance with fire safety standards.

By Application

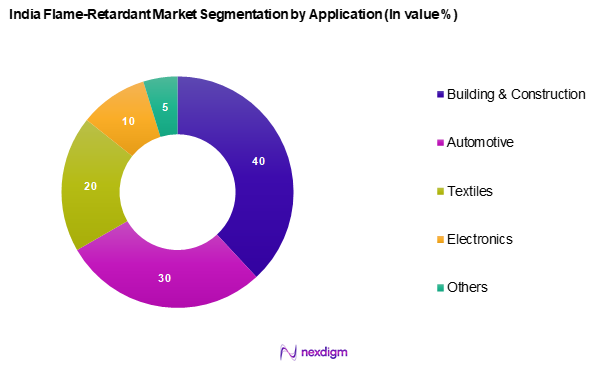

The India flame-retardant market is segmented into building & construction, automotive, textiles, electronics, and others. The building & construction sector accounts for the largest share, as stringent fire safety regulations mandate the use of flame retardants in various building materials. The growth in residential and commercial construction activities, alongside a rise in government initiatives promoting fire safety, ensures that the demand for flame retardants in this segment remains robust. Moreover, the increasing adoption of flame-retardant materials in infrastructure projects bolsters its market dominance.

Competitive Landscape

The India flame-retardant market is characterized by a competitive landscape comprising both local and global players. Major participants include established firms such as BASF, LANXESS, and Dow. These companies have a significant influence in the market due to their extensive product portfolios and established distribution networks. The consolidation among these key players highlights their dominant roles in innovation and market share.

| Company | Establishment Year | Headquarters | Revenue (USD Bn) | Product Range | Market Share (%) |

| BASF | 1865 | Ludwigshafen, Germany | – | – | – |

| LANXESS | 2004 | Cologne, Germany | – | – | – |

| Dow | 1897 | Midland, Michigan, USA | – | – | – |

| CLARIANT | 1995 | Muttenz, Switzerland | – | – | – |

| ICL | 1999 | Tel Aviv, Israel | – | – | – |

India Flame-Retardant Market Analysis

Growth Drivers

Increasing Safety Regulations

The push for enhanced safety regulations in India is driven by a growing awareness of the risks associated with fire hazards. The National Building Code, established by the Bureau of Indian Standards, outlines stringent safety measures for construction materials. In 2024, the Indian Government allocated INR 8,500.0 crore for the implementation of fire safety standards in buildings, ensuring the integration of flame-retardant materials. These regulations are informed by a significant increase in fire incidents, which have risen to over 1,200 reported cases across major metropolitan areas. The government’s focus on regulatory frameworks incentivizes industries to adopt flame-retardant solutions, thus promoting safer environments.

Growing Construction Sector

The expansion of the construction sector in India is further fuelling demand for flame-retardant materials. According to the Ministry of Housing and Urban Affairs, the construction industry grew to INR 57.8 lakh crore in 2022, with expectations of continued growth driven by urbanization and infrastructure development. Government initiatives like the Pradhan Mantri Awas Yojana aim to build over 12 million affordable housing units, contributing to the demand for compliant building materials, including flame retardants. Moreover, the sector’s projected contribution to the country’s GDP is set to reach 9% by 2025, aligning economic growth with safety standards.

Market Challenges

Volatility in Raw Material Prices

One of the notable challenges in the India flame-retardant market is the volatility of raw material prices, which affects production costs significantly. The price of key raw materials like phosphorus and bromine has fluctuated widely due to supply chain disruptions and geopolitical tensions. In 2023, bromine prices saw a spike of approximately 18% due to interruptions in global supply chains impacted by both the pandemic recovery and the Russia-Ukraine conflict. This has consequential effects on manufacturers as they grapple with increased production costs, which may affect pricing strategies and overall profit margins in a competitive market environment.

Regulatory Compliance Issues

Navigating through stringent regulatory compliance poses another challenge for producers of flame-retardants in India. Compliance with evolving safety standards set by various regulatory bodies, including the Central Pollution Control Board (CPCB) and the Ministry of Environment, Forest and Climate Change, is critical. In 2023, over 250 manufacturers faced scrutiny for failing to adhere to updated environmental regulations pertaining to hazardous substances in flame-retardants, leading to potential fines and shutdowns. This regulatory landscape creates additional hurdles for companies, particularly smaller firms struggling to meet compliance costs alongside production expenses.

Opportunities

Development of Eco-Friendly Products

The current shift towards sustainable practices presents considerable opportunities for the development of eco-friendly flame retardants, especially bio-based solutions. With consumer awareness increasing regarding environmental impacts, manufacturers are incentivized to innovate and introduce safer alternatives. As of 2023, investments in green chemistry have surged, with a reported 25% uptick in funding for projects developing non-toxic flame retardants. Indian manufacturers can capitalize on this trend, as the global market for eco-friendly flame retardants is expected to reach USD 35.0 billion by 2025. This shift towards sustainability allows companies to not only meet regulatory requirements but also address consumer preferences for environmentally responsible products, thereby enhancing competitive advantage. With the commitment to greener products, manufacturers can strengthen their market positions by aligning with global sustainability goals and attracting eco-conscious consumers.

Technological Innovations

The pace of technological innovations in the flame-retardant sector provides significant growth opportunities. Recent advancements in polymer chemistry and composite materials are enhancing the performance and efficacy of flame retardants. For example, the integration of nanotechnology in product formulations has drastically improved fire resistance while reducing environmental impact. In 2023, around INR 1,000.0 crore was invested in R&D for developing advanced flame-retardant materials in India. Such innovations can propel the competitive landscape, allowing manufacturers to offer superior products, comply with safety regulations, and cater to an increasingly knowledgeable consumer market seeking advanced fire protection solutions.

Future Outlook

Over the next five years, the India flame-retardant market is anticipated to experience substantial growth driven by continuous government support for fire safety regulations, technological advancements in flame-retardant manufacturing, and increasing consumer demand for safety in construction and automotive applications. An uptick in infrastructure projects and heightened awareness regarding fire hazards are expected to further boost market momentum. The trend towards sustainable and environmentally friendly products will also play a crucial role in shaping the market landscape.

Major Players

- BASF

- LANXESS

- Dow

- Phillips 66 Company

- SABIC

- DuPont

- CLARIANT

- Albemarle Corporation

- Shin-Etsu Chemical Co., Ltd.

- Arkema

- ICL

- Elementis PLC

- R.T. Vanderbilt Company, Inc.

- Huber Engineered Materials

- GFK Chemical

Key Target Audience

- Manufacturers of Flame-Retardant Products

- Construction and Infrastructure Developers

- Automotive Suppliers and Manufacturers

- Textile Industries

- Electronics Manufacturers

- Government and Regulatory Bodies (Bureau of Indian Standards, Ministry of Housing and Urban Affairs)

- Investments and Venture Capitalist Firms

- Fire Safety Equipment Manufacturers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves creating an ecosystem map that includes all major stakeholders within the India flame-retardant market. This step utilizes extensive desk research and a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define critical variables that influence market dynamics, such as regulatory influences, technological advancements, and sector-specific demands.

Step 2: Market Analysis and Construction

In this phase, we compile and analyse historical data regarding the India flame-retardant market. This includes assessing market penetration across various applications and industries and evaluating the ratio of suppliers to demand. Additionally, service quality statistics will be assessed to ensure that revenue generation estimates are accurate and reliable, informing how trends evolve in the marketplace.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through Computer-Assisted Telephone Interviews (CATIs) with industry experts across diverse companies within the flame-retardant sector. These consultations provide invaluable operational insights and financial data directly from practitioners, which are crucial for refining and corroborating the market data, ensuring authenticity and reliability.

Step 4: Research Synthesis and Final Output

The final phase encompasses direct engagement with several flame-retardant product manufacturers to acquire detailed insights regarding product segments, sales performance, and consumer preferences. This interaction serves to verify and complement the statistics derived from a bottom-up approach and ensures a comprehensive, accurate analysis of the India Flame-Retardant Market, leading to a refined report.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain & Value Chain Analysis

- Growth Drivers

Increasing Safety Regulations

Growing Construction Sector - Market Challenges

Volatility in Raw Material Prices

Regulatory Compliance Issues - Opportunities

Development of Eco-Friendly Products

Technological Innovations - Trends

Increasing Usage of Bio-Based Flame Retardants

Growth in the E-commerce Sector - Government Regulation

Fire Safety Standards

Environmental Policies - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Type (In Value %)

Polymer-Based

– Polypropylene (PP) Flame Retardants

– Polyvinyl Chloride (PVC) Flame Retardants

– Polyethylene (PE) Flame Retardants

– Polyamide (PA) Flame Retardants

Chemical-Based

– Organophosphorus Compounds

– Nitrogen-Based Flame Retardants

– Brominated Compounds

Mineral-Based

– Aluminium Hydroxide (ATH)

– Magnesium Hydroxide (MDH)

– Zinc Borates

– Ammonium Polyphosphate (APP) - By Application (In Value %)

Building & Construction

– Insulation Materials

– Cables & Wires

– Pipes and Panels

– Roofing and Ceiling Products

Automotive

– Interior Components (Dashboards, Seats)

– Under-the-Hood Applications

– Wiring Harness

Textiles

– Upholstery

– Protective Wear (Industrial Garments)

– Curtains & Carpets

Electronics

– Printed Circuit Boards (PCBs)

– Consumer Electronics Housings

– Electrical Enclosures

Others

– Transportation (Railways, Marine)

– Packaging Materials

– Furniture - By End-User Industry (In Value %)

Manufacturing

– Electrical Equipment

– Construction Materials

– Industrial Machinery

Aerospace

– Cabin Interiors

– Wiring Systems

– Structural Panels

Oil & Gas

– Protective Clothing

– Fireproof Insulation

– Flame-Resistant Coatings - By Region (In Value %)

North India

South India

East India

West India

Central India - By Material Type (In Value %)

Halogenated Flame Retardants

– Brominated Flame Retardants (BFRs)

– Chlorinated Flame Retardants (CFRs)

Non-Halogenated Flame Retardants

– Phosphorus-Based

– Nitrogen-Based

– Mineral Fillers (ATH, MDH)

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Revenues by Type, Distribution Channels, Number of Dealers and Distributors, Margins, Production Plant, Capacity, Unique Value offering and others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

BASF

LANXESS

Dow

Phillips 66 Company

SABIC

DuPont

CLARIANT

Albemarle Corporation

Shin-Etsu Chemical Co., Ltd.

Arkema

ICL

Elementis PLC

R.T. Vanderbilt Company, Inc.

Huber Engineered Materials

GFK Chemical

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030